- by New Deal democrat

Last week I “pre-debunked” the idea that a lack of reporting in Texas skewed the big decline in claims, concluding that “being very generous, the ‘real’ seasonally adjusted number of initial claims at worst probably would have been only about 30,000 higher - I.e., 760,000 - but for Texas issues.”

That observation was validated this week, as last week’s 730,000 number was only revised higher by 6,000 to 736,000. And the *relatively* good news continued.

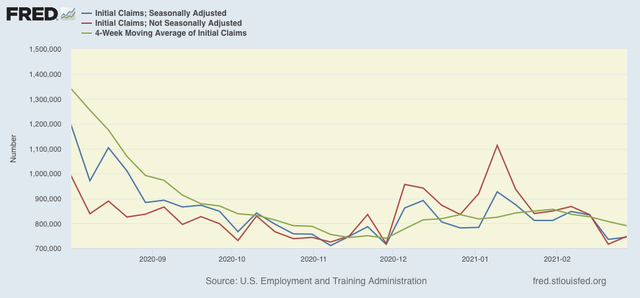

This week, on a unadjusted basis, new jobless claims increased by 31,519 to 748,078. Seasonally adjusted claims increased by 9,000 to 745,000. The 4 week moving average declined by 17,250 to 790,750.

Here is the close up since the end of July (these numbers were in the range of 5 to 7 million at their worst in early April):

The recent increase in claims appears to have subsided. Nevertheless both adjusted and unadjusted claims remain above their worst levels at the depths of the Great Recession.

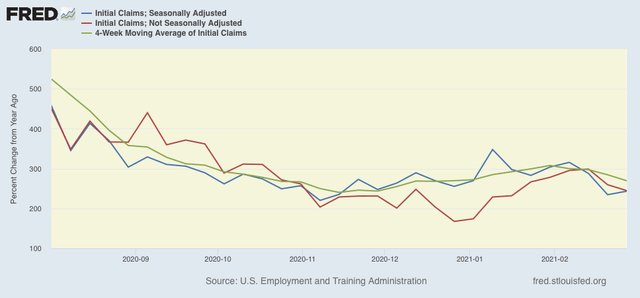

Because of the huge swings caused by the scale of the pandemic - typically claims only vary by 20,000 or less from week to week, but since the start of the pandemic, swings of 50,000 or 100,000 per week have happened as often as not, recently I began posting the YoY% change in the numbers as well, since they will be much less affected by scale. As a result, there is less noise in the numbers, and the trend can be seen more clearly:

This confirms the observation that the recent elevation in new claims is reversing.

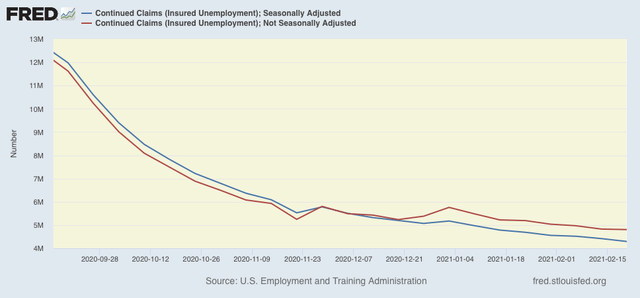

Meanwhile continuing claims, which historically lag initial claims typically by a few weeks to several months, made new pandemic lows yet again this week. Seasonally adjusted continuing claims declined by 124,000 to 4,295,000, while the unadjusted number declined by 22,355 to 4,806,269: