- by New Deal democrat

Still no important economic news yet this week, so let’s take a look at something I haven’t updated in awhile: the Quick and Dirty economic indicator of stock prices vs. new jobless claims.

Both metrics are short leading indicators, although historically stock prices have been more leading (3-9 months) than jobless claims (roughly 2-3 months). Both have the advantage of being updated daily or weekly, so we don’t have to wait a month for each update. If they are both going in the same direction (i.e., positive or negative) it’s a pretty good proxy for the overall direction of the economy in the months to come.

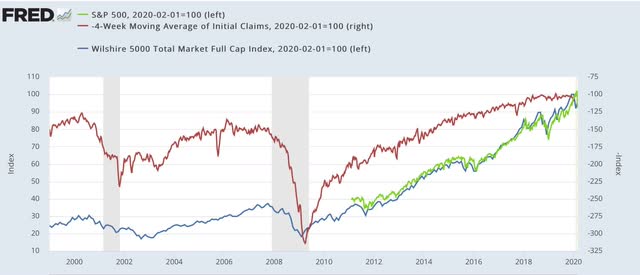

Here is the historical view of the actual readings of two stock market indexes - the Wilshire 5000 Total Market Index (blue) and the S&P 500 (green), plus the inverted reading of new jobless claims (red) for the past 20 years up until the pandemic hit:

Viewed this way, they aren’t too much help aside from noting that they appear to turn down in tandem prior to both of the past 2 recessions before the pandemic.

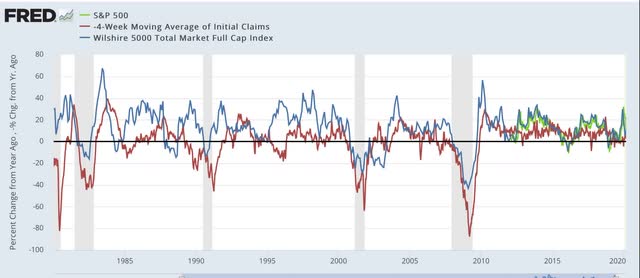

A better way to get information from them is to compare the YoY% changes, again with initial jobless claims inverted (because fewer is better):

They don’t always move in tandem, and usually - but by no means always! - stocks move first. This is because traders evaluate stocks based on anticipated *future* returns, whereas jobless claims react to present consumer demand situations.

In general, when both are better by less than 10% YoY, and decelerating sharply towards 0, the economy has a problem. When they are both negative, the economy is almost always about to enter a recession.

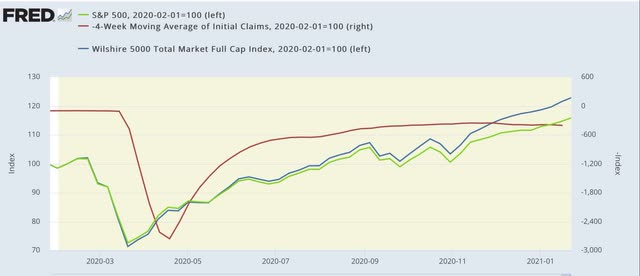

Here’s what the absolute index values look like for the past 12 months:

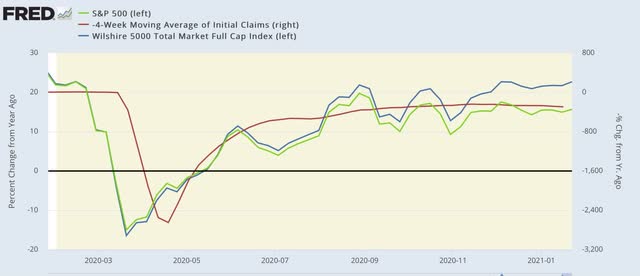

And here’s what the YoY% readings are:

After slowing during the summer and pausing in fall, stock prices have taken off again in the past few months. They have been consistently up over 10% YoY.

In other words, the Quick and Dirty economic indicator is not giving a recession signal, and is suggesting that with the end of winter (resumption of meaningful outdoor dining and other activities) and vaccine approvals and distribution, the economy is going to resume further growth in springtime.

One more reason why “Here Comes the Sun” is the theme song of 2021.