- by New Deal democrat

First, an update on jobless claims: neither initial jobless claims nor continuing claims met either of my thresholds for concern this week. Both are below their levels a year ago, and the four week average of initial claims is less than 5% above its lows for this expansion.

I have thought that on the producer side, the first indication we would have of an impact of the coronavirus on the supply chain or production would come via railroad loads and/or steel production. While steel production was up +1.2% YoY last week, railroad loads - and specifically intermodal units, by which most imports are shipped from Asia - are another story.

Intermodal rail loads were down -12.5% YoY last week. Except for two weeks right after Thanksgiving, at least one of which was clearly due to seasonality, this was the first time that intermodal transport by rail was down -10% or more since its initial decline 12 months ago. In other words, the ongoing decline didn’t just continue - it intensified.

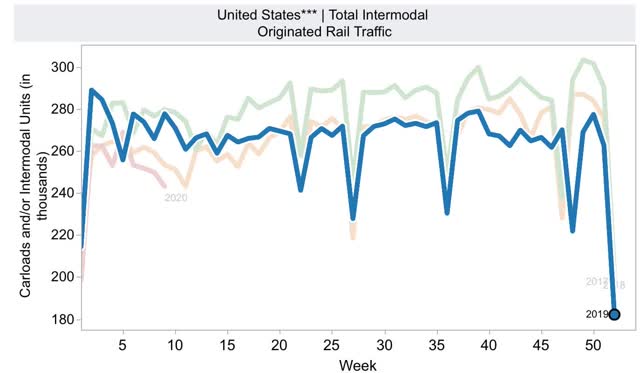

Here’s a look at a multi-year graph of intermodal traffic from the AAR site. I’ve highlighted 2019 data. For YoY comparisons, 2018 is the faded green line; 2020 so far the faded red line:

It’s not unusual seasonally for rail traffic to decline w/w this time of year, but this does not affect the YoY comparisons.

While correlation does not mean causation, in this case it is clearly entitled to the first pass. Coronavirus has infected the producer supply chain in a significant way.