- by New Deal democrat

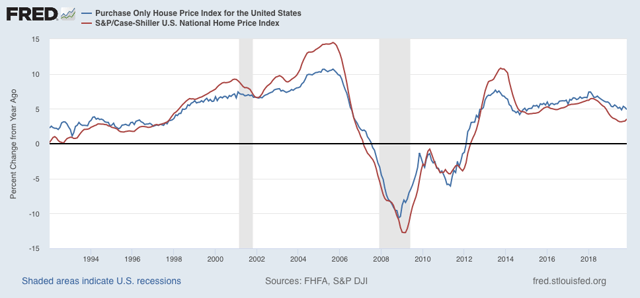

The Case Shiller housing indexes for the three month period ending in November were reported this morning. The YoY% change in the national index increased to 3.5% from 3.2% last month (red in graph below). This is in line with the FHFA purchase price index (blue), and continues the slight acceleration in each from a trough in August:

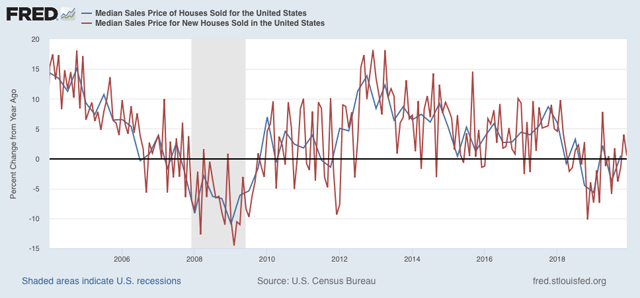

As I mentioned yesterday, the YoY% change in new home prices has also started to rebound (red in the graph below), as does the change in total home prices (blue):

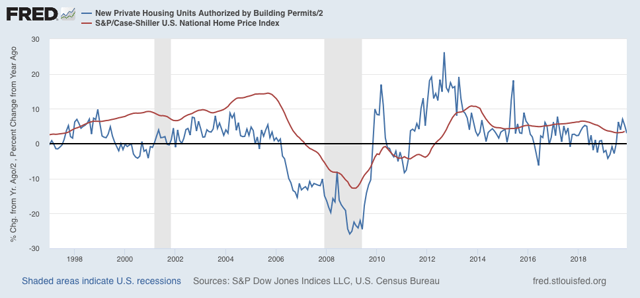

That price appreciation has begun to rebound is not a surprise, as they follow permits (blue in the graph below) with a lag:

So long as permits, sales, and starts continue to increase, we can expect further acceleration in price growth - which is already running ahead of wage growth.

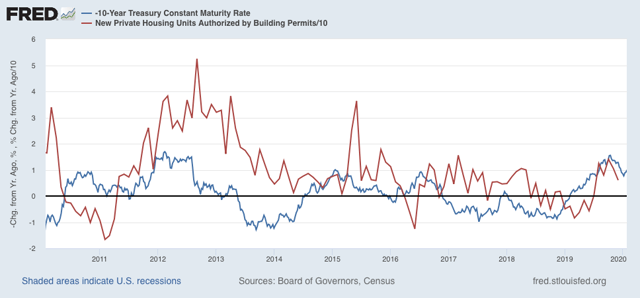

Permits, in turn, follow interest rates. Since interest rates are lower than they were a year ago (inverted, blue, in the graph below), it looks like permits will continue to increase for awhile:

Permits, in turn, follow interest rates. Since interest rates are lower than they were a year ago (inverted, blue, in the graph below), it looks like permits will continue to increase for awhile: