- by New Deal democrat

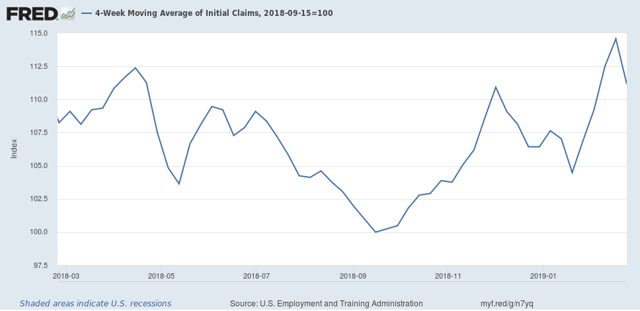

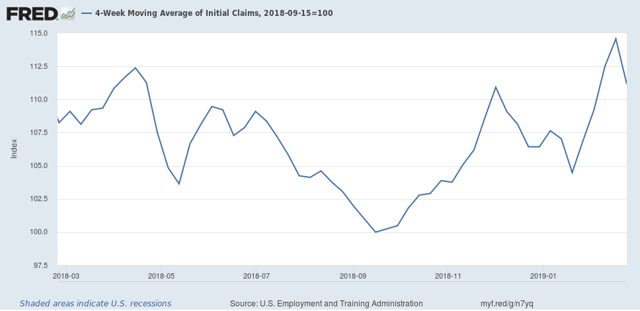

Initial jobless claims are an important short leading indicator, typically turning up 3-9 months before a recession. A problem is the necessity of filtering out signal from noise.There are two ways I measure claims in order to do so: (1) how much has the less noisy four week average risen from its low? And (2) have initial claims, averaged monthly, turned higher YoY?

Let’s start with the first measure. A 10% increase off of an interim low in claims is not unusual, and has happened every year or two for the entire 50+ year period that records have been kept. By the time they are up 15% from their bottom, not only is it almost always a signal of recession, but frequently the recession is imminent.

To distill signal and still give reasonable warning, the caution signal I employ is a rise of over 12% from a low. Measuring so, we see that initial claims as of this week are up about +11.5% off their lows:

Note that I am discounting the previous few weeks because they were distorted by layoffs due to the government shutdown. The four week average now does not appear to have any special factors.

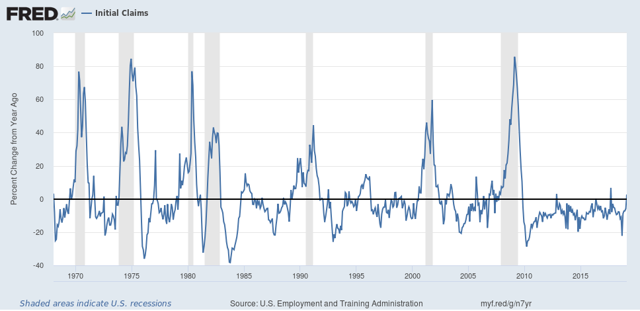

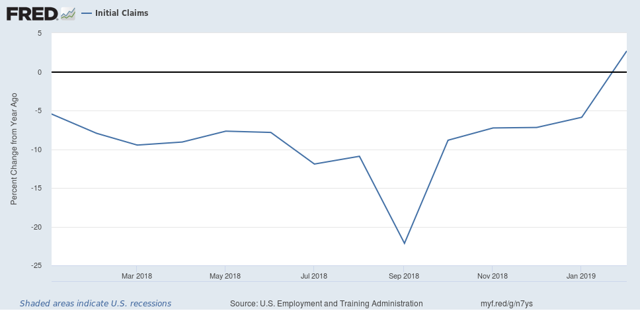

Next, here is the long view of initial claims YoY measured monthly:

In any given expansion, there is usually at least one month where claims are higher YoY. But if that happens for two months in a row, more often than not it has signaled that a recession is approaching.

Note that the big distortion in claims happened at the end of January. Even so, on average January 2019 was lower than January 2018. But February saw more initial claims being filed on average than one year ago. Still, we won’t have a caution signal unless March also sees higher claims than March of last year.

The bottom line is that, while initial claims are close to the levels at which they would give a warning, they aren’t quite there at this point.