- by New Deal democrat

So, after a nearly empty week until now, there were four economic reports this morning. Three of them were good.

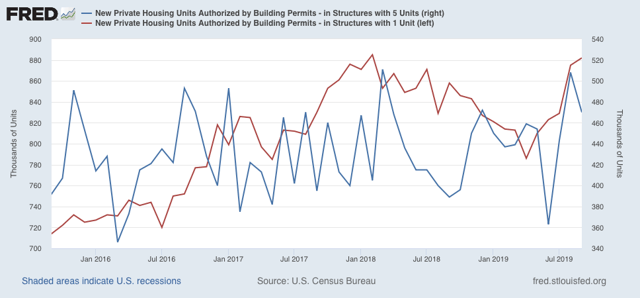

First, although overall housing starts and permits declined, single family permits, the most forward looking and least volatile of the metrics, were only 3000 off a new expansion high (red in the graph below, vs. multi-family permits):

Housing’s rebound is the biggest single argument against a recession later next year.

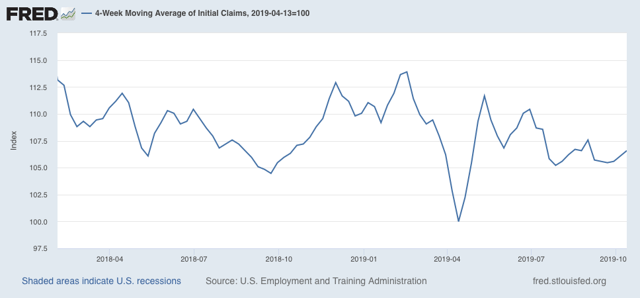

Second, initial jobless claims continued at only 6.6% off their lowest level of the expansion:

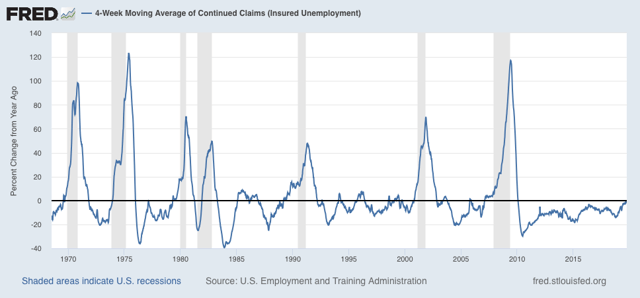

The one significant fly in the ointment is that the 4 week average of continuing claims, which is less volatile if less leading, was unchanged YoY:

This has happened 15 times in the past 50+ years. Seven times it was a prelude to a recession; eight times it was a false positive, but signaled a slowdown.

Third, the Philadelphia region’s production continued to expand, and the new orders index actually improved further to +26.2. That’s *really* good, with the caveat that this series has been very volatile in the past.

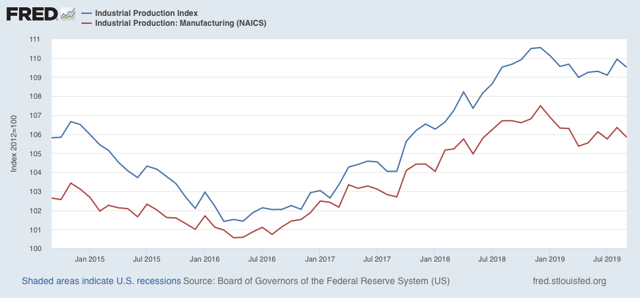

Finally, industrial production declined, but the special factor here was the GM strike:

Still, both measures (overall and manufacturing) are significantly below their December peaks - but above their lows from earlier this year.

It is safe to say that in 2019 the US has been having another shallow industrial recession, but the consumer continues to power through.