- by New Deal democrat

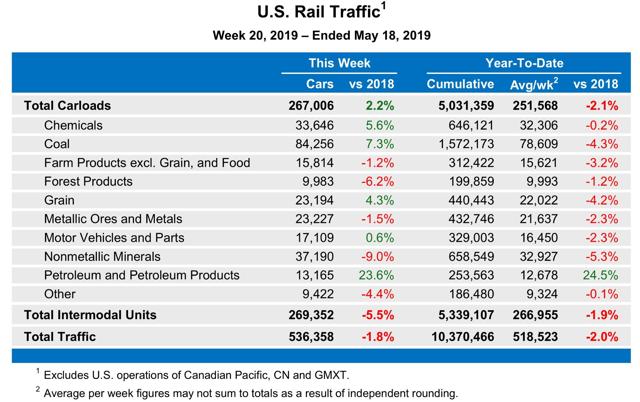

Since the beginning of this year, weekly rail volumes have usually been negative. The full year to date volumes have also been negative YoY:

Since all manufactured goods have to be transported to market, if this is something confirmed in other transportation readings, it would clearly be recessionary - as in, a recession has already started.

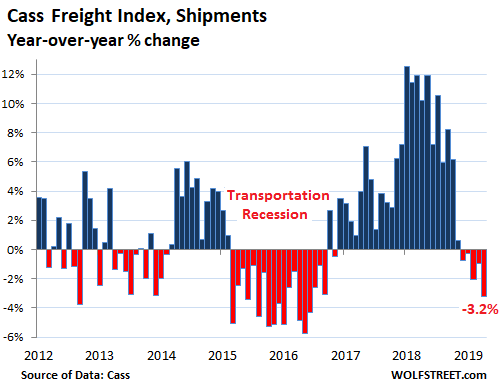

One alternative measure of the transportation sector is the Cass Freight Index.

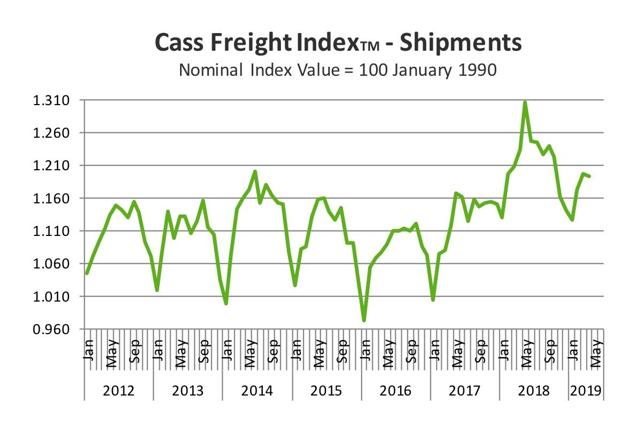

Although, interestingly, the primary reason for the downturn seems to be an anomalous surge that happened in late 2017 (due primarily to the hurricanes?) and went out of the YoY comparisons in late 2018, as shown in this next graph:

Note the seasonal downturn that typically starts to happen in about October, but never happened in 2017. As a result, on a 2 year basis, the Cass Index is up 7.0%.

Another issue with the Cass Index, however, is that it also measures international air and ocean shipping volumes for the U.S. So at least some of the downturn may be changes in international freight, perhaps due to Trump’s trade wars.

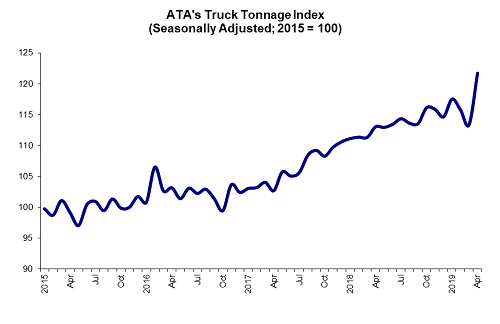

So I have been waiting for the April American Trucking Association Index. If domestic trucking is down as well as rail, that clearly looks recessionary. But if trucking is up while rail is down, that looks like a substitution, possibly due to competing costs, and/or possibly due to changed transportation patterns as western railroads suffer due to the widened Panama Canal increasing shipments directly to East and Gulf Coast ports.

And, late last week, the April trucking index was released.

Here’s what it shows:

According to the ATA:

[the] seasonally adjusted (SA) For-Hire Truck Tonnage Index surged 7.4% in April after decreasing 2% in March. In April, the index equaled 121.8 (2015=100) compared with 113.4 in March.

“The surge in truck tonnage in April is obviously good for trucking, but it is important to examine it in the context of the broader economy,” said ATA Chief Economist Bob Costello. “February and March were particularly weak months, as evidenced by the 3.5% dip in tonnage due to weather and other factors, so some of the gain was a catch-up effect. In addition, the Easter holiday was later than usual, likely pushing freight that would ordinarily be moved in March into April.”

“I do not think the fundamentals underlying truck tonnage are as strong as April’s figure would indicate, but this may signal that any fears of a looming freight recession may have been overblown,” he said.

Even averaging April with March, however, the trucking index remains positive.

The bottom line is that the downturn in rail has not been confirmed by trucking, which continues in an uptrend. This is real time evidence that while the economy may be softening, it’s not in an outright downturn.