- by New Deal democrat

Because the long leading indicators turned down in 2018, over the last few months, I have repeatedly looked at the leading employment sectors of temporary jobs, manufacturing, and construction, to check for that weakness feeding through. Today I am taking a closer look at construction jobs.

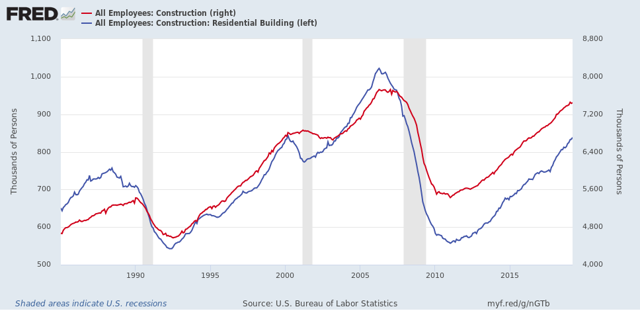

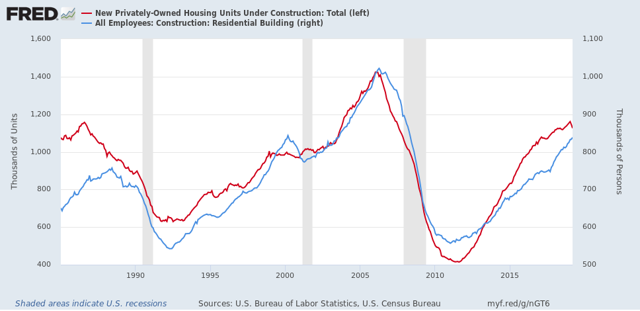

To begin with, while construction jobs as a whole do lead, residential construction jobs have been the most leading sector of construction jobs, as shown in the graph below:

Although, interestingly, construction employment is down slightly from January, while residential employment has continued to increase.

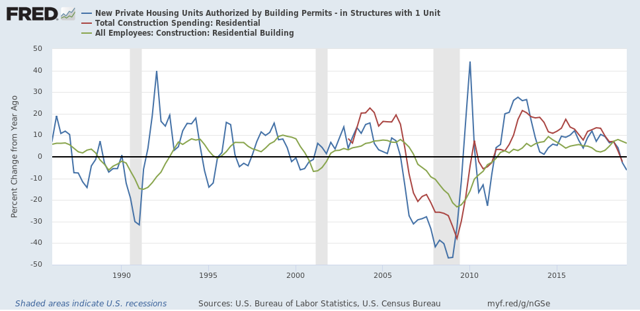

Next, here’s a comparison of the YoY% change in single family permits (blue), residential construction spending (red), and residential construction employment (green), averaged quarterly to cut down on noise:

To cut to the chase, the peak in YoY construction spending follows permits with usually a one quarter lag. Residential construction employment, in turn, follows spending with one more quarter lag. Both permits and spending are down YoY as of the most recent data. Employment is merely decelerating.

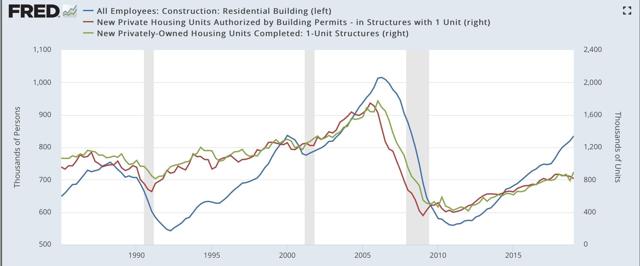

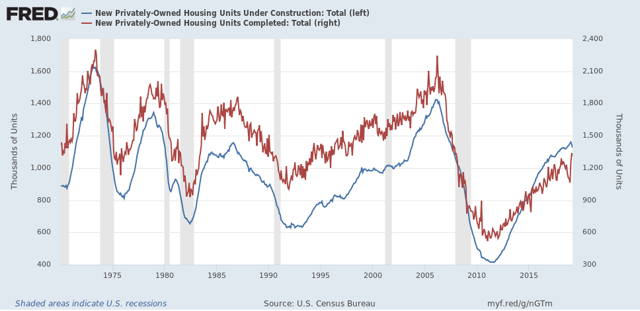

So when might we expect residential construction employment to turn down meaningfully? I next broke out permits vs. housing completed, and compared both of those to residential construction employment. Here’s what I got.

Measured by single family units:

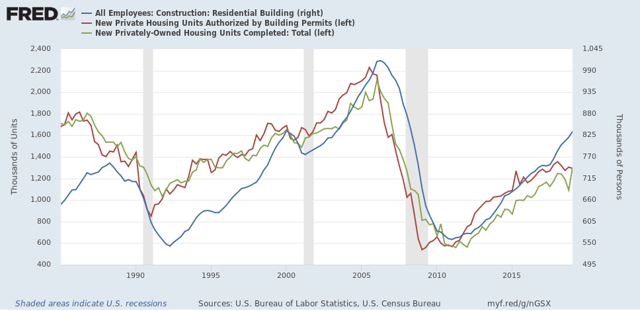

Measured by total units:

In both cases, residential construction employment coincided most closely with housing completions.

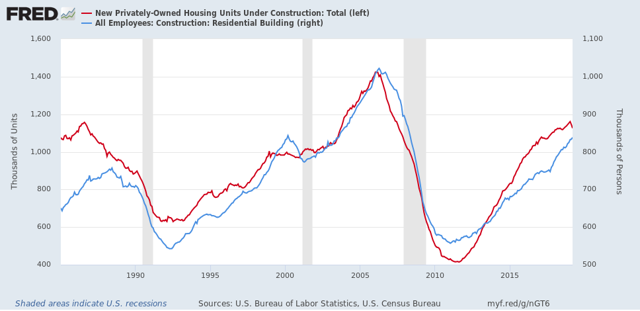

It appears that, usually, employers keep employees on the books even as units under construction begin to decline, until the decline goes all the way to completions:

It appears that, usually, employers keep employees on the books even as units under construction begin to decline, until the decline goes all the way to completions:

Note that in the 1980s, this most closely tracked single family homebuilding. It be tracking total units more closely now.

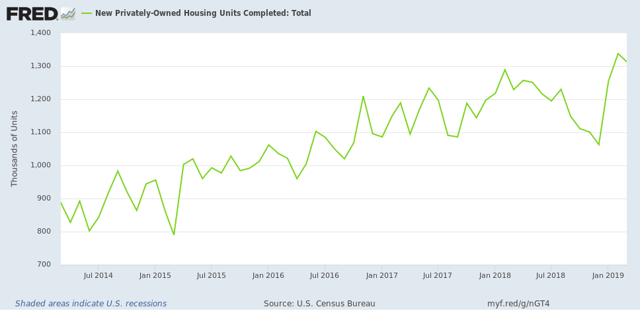

In any event, here is a close-up on total housing completions through March:

This may explain why residential construction employment has not turned down meaningfully yet.

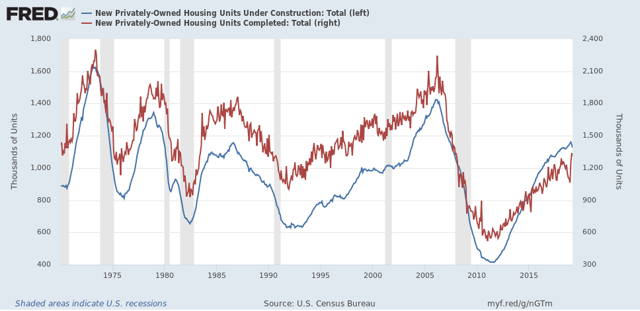

Finally, I looked at historically how long it took after units under construction peaked for completions to peak:

In the past 50 years, with the exception of one outlier - 1978, in which completions actually led by 4 months - the peak in units under construction has led the peak in completions by between 1 and 5 months.

Note that units under construction, for now, last peaked in January. Completions may have peaked in February.That means, if January was the peak for units under construction, we should expect completions, and residential construction employment, to turn down meaningfully no later than June.

Note that units under construction, for now, last peaked in January. Completions may have peaked in February.That means, if January was the peak for units under construction, we should expect completions, and residential construction employment, to turn down meaningfully no later than June.