- by New Deal democrat

Along with jobs and wages, household and personal income and spending are my main focus on how average Americans are doing in the economy.

We’ll get the next jobs report a week from now, but today we got - almost updated to the present - January personal income and February personal spending.

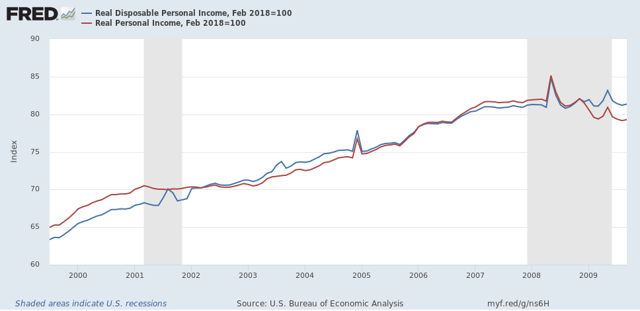

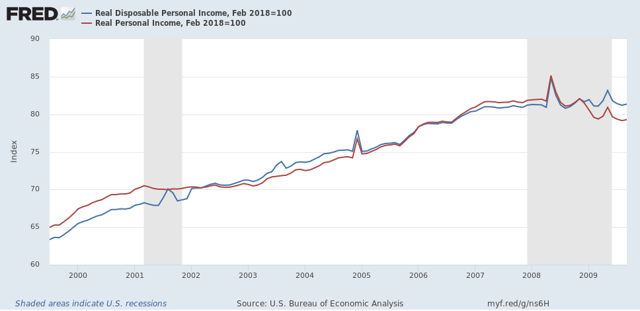

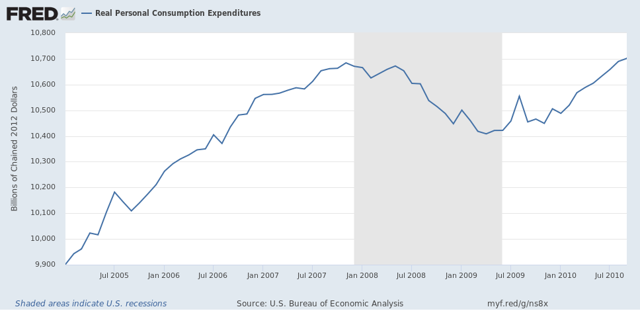

First of all, in my rubric of long leading, short leading, and coincident indicators, both of these are coincident. They tend to top out, or at least sharply decelerate, right when a recession begins. Here’s the performance of income including the last two recessions, and spending for the last one:

We’ll get the next jobs report a week from now, but today we got - almost updated to the present - January personal income and February personal spending.

First of all, in my rubric of long leading, short leading, and coincident indicators, both of these are coincident. They tend to top out, or at least sharply decelerate, right when a recession begins. Here’s the performance of income including the last two recessions, and spending for the last one:

So they really tell us nothing about the future of the economy.

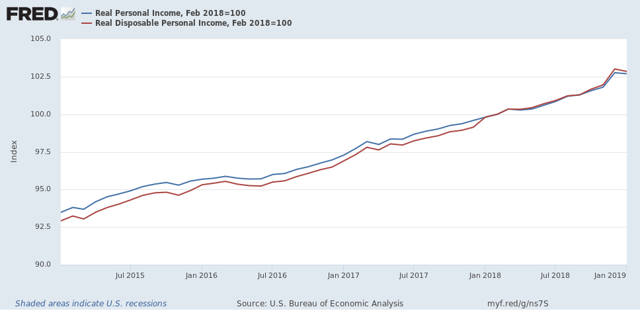

Now, to the data. Adjusted for inflation, incomes fell -0.2% in January

These have declined ever so slightly in the past two months, although they are up +2.7% and +3.0% since last February. Nominally incomes rose +0.2% in February, but we won’t have the inflation-adjusted figure until next month. If the deflator is in line with consumer inflation, which rose +0.2% in February, then real personal incomes will be flat.

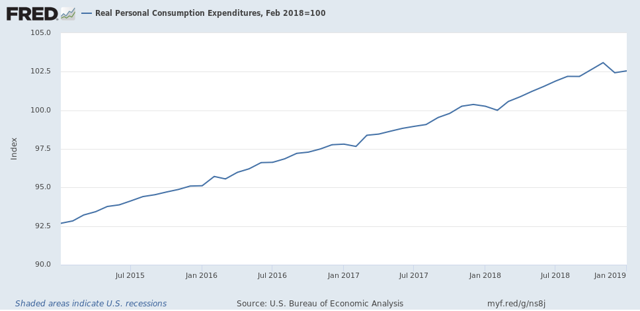

Personal spending declined -0.1% nominally in January, but rose +0.1% adjusted for inflation, after a decline in December:

These are weak reports, in line with the slowdown forecast I made last summer. Where they go from here will have a lot to do with whether the Fed lowers rates quickly or not, and whether or not there are more boneheaded economic moves from the Administration.