- by New Deal democrat

First, a quick site note. I am blogging from a new device, and since I am a fossil, that means the transition is far from smooth. In particular, posting of graphs is going to be minimal until I can get a new method working properly. Also, I’m going to be traveling later this week, so don’t be surprised if there is no content for a couple of days. Finally, because the “Blogger” platform is very 2000s, and not supported any more, don’t be shocked if the best way to deal with it turns out to be transitioning to a new website.

No new data economic today, but the Fed did publish data last week that allows me to update one of my “alternate” forecast methods, one that I first laid out over a decade ago: the consumer nowcast.

The way this works is to look at the economy from the viewpoint of the average American consumer. In order for the consumer economy to grow, at least one of the three below items must be happening:

1. Real income is growing.

2. A widely held asset class, in particular stocks or real estate, is appreciating (and thus available to be tapped into to free up cash.

3. Interest rates decline to new lows, allowing existing debt to be refinanced.

If none of these are happening, then a pullback in willingness to spend signals the onset of a recession.

If none of these are happening, then a pullback in willingness to spend signals the onset of a recession.

Let’s take these in reverse order.

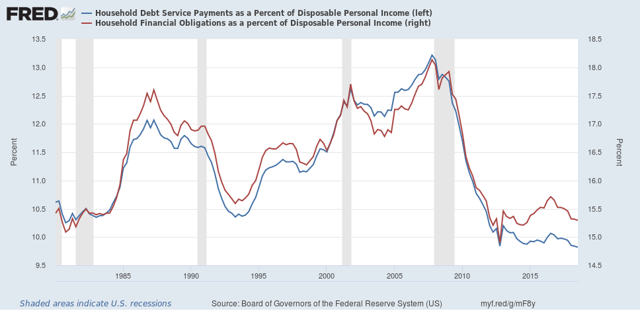

Last week the Fed released its household debt data, showing that household debt as a share of income peaked over two years ago. In Q3 2018 households became slightly more cautious compared with the quarter before:

Needless to say, stock prices last made a peak over 3 months ago. That source of cash has dried up.

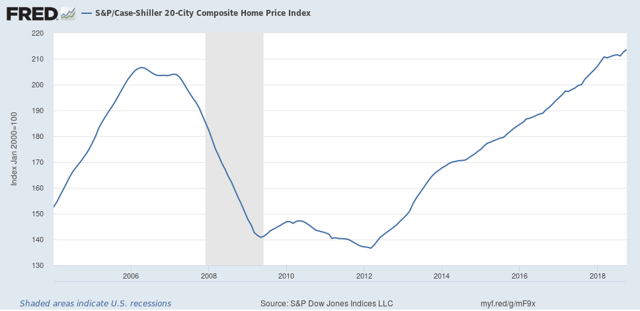

House prices, however, have continued to climb, according to the most recent Case-Shiller index, meaning that home equity withdrawal remains a potential source of spending money:

And perhaps most fundamentally, as I wrote about last week, real average and aggregate non-supervisory wages have continued to grow.

So the consumer nowcast is not signaling recession.

Meanwhile, as I wrote last week at Seeking Alpha, the short term forecast through mid-year is for no a slowdown but no recession, unless caused by poor public policy — like, say, a trade war, or maybe a government shutdown that causes businesses to postpone plans due to lack of transparency.

That sort of policy debacle isn’t going to first show up in the long leading indicators and take an entire year or more to filter through the economy. It will show up, more or less, all at once.

But I would still expect some warning from the short leading indicators, most notably from measures of manufacturing, temp hiring and layoffs.

As of now, neither temp hiring nor layoffs have backed off enough for any sort of warning. On the other hand, although it is just one data point of many, that the Empire State Manufacturing Index’s new orders measure fell to an 18 month low (although still positive at +4) at very least continues the trend of a big slowdown in the industrial sector.

Keep an eye on these three areas (new orders, temp hiring, and new jobless claims). If these turn outright negative, that will be a very strong sign that poor public policy is causing what otherwise would just be a slowdown to tip all the way into recession.