There is a fundamental point that I have made in nearly all of my economic writings over the last year. Because that point is frequently missed, as it has not been the focal point of my commentary, I wanted to place it front and center in this diary.

Both Bonddad and I called for the recession before it began. And both of us said it looked like the economy was bottoming a couple of months before it did. I went beyond that and spent a great deal of effort trying to determine when the jobs situation would turn around. Last September I said the bottom would be in November or December +/- one month -- an effort that turned out to be exactly correct. While others were -- wrongly -- mired in bearishness that was contradicted by almost all of the objective data around them, Bonddad and I chronicled the turnaround that has continued to the present.

What neither of us has said is that wage, income, employment or the unemployment rate, are anywhere near "good." Neither on of us is saying that "Happy Days are Here Again." In fact, Happy Days Aren't Here Again.

One of the frequent types of criticisms that Bonddad and I received last year after we said the economy was bottoming, was on the order of "It's not a recovery until jobs start to be added," or "It's not a recovery until unemployment starts to go down."

Well, we now know that the economy has been adding jobs since the beginning of this year -- 600,000 if you use the more common "establishment survey" which asks employers if they have been hiring or firing, and 1.6 million if you go by the less commonly reported "household survey" which asks consumers if they have been working during the last month. As of now, it still looks like last October was the peak for both the U3 and U6 calculations of the unemployment rate.

Yet we still receive complaints like "But you said the Recession was over, didn't you? The Recession is nowhere near over. Not with 10% unemployment." Criticisms like these highlight a fundamental disconnect between economic terms and common discourse.

While we both called for the reversal of the direction of the economy as a whole, and jobs in particular -- in other words the downward trend towards the abyss last spring reversed and became the continually improving upward trend that has continued until now -- neither one of us has said that the absolute level of economic activity, be it of household income, or jobs, or unemployment, or wages, are "good."

Thus while in economic terms the "Great Recession" ended late last year, I would agree with an amendment to the above criticism, that "The Hard Times are nowhere near over."

The problem arises from differing terms of frames of reference. For example, here is one good description of the business cycle:

In outline, the economic cycle is divided into 4 phases: (1) slowdown or a slowing economy, (2) recession, (3) [ ] improvement of the economic recovery and (4) expansion of the economic boom.

In the most straightforward economic sense, a recession is a period of declining economic activity. A recovery is a period of rising economic activity, that has not yet regained the peak GDP level before the recession. An economic expansion begins once the economy is expanding at a level that exceeds its highest GDP from before the recession.

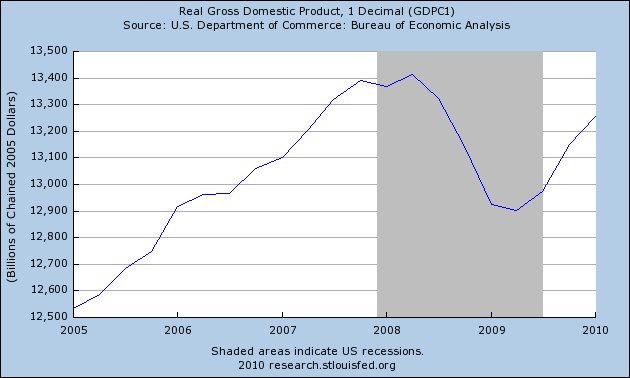

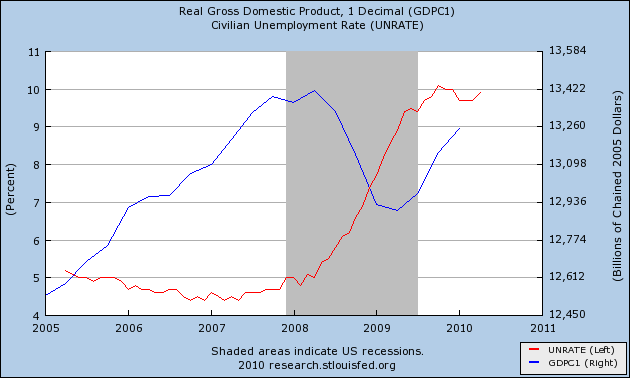

Thus in simple terms, we had a recession until sometime last summer. We are currently in a recovery because economic activity is expanding. We are not yet in an expansion because that positive economic activity as not yet exceeded its 2007 peak. Here's the relevant graph of real GDP that plainly makes that point:

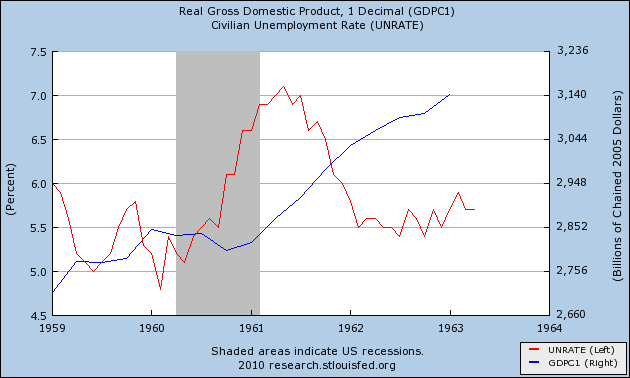

But there is a disconnect between the language of economic cycles and the language of Main Street distress in a time like this. In most weak recessions, unemployment and wages might both pick up again shortly after the bottom of economic activity, and we might return to a level of at least nearly full employment within a year or two, as for example, in the a classic post-WW2 recession like 1960:

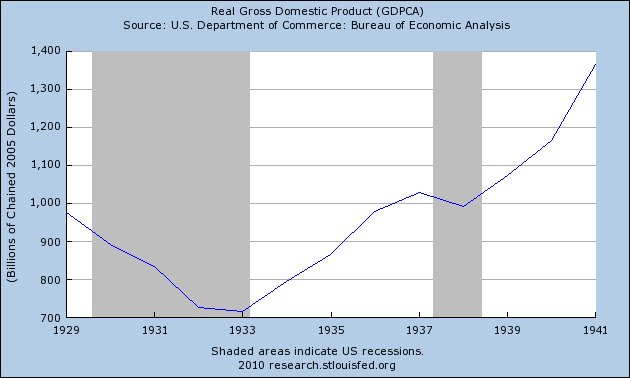

But after a severe recession, like the one that ended last summer, it can take literally years before economic conditions return to levels that are not full of distress. Thus, take for example this graph of GDP during the 1930s:

A business cycle economist might say that the Great Depression bottomed in 1933 and that thereafter until 1938, the economy was in recovery. But we call the entire 1930s "the Great Depression" because unemployment never dipped below 10%.

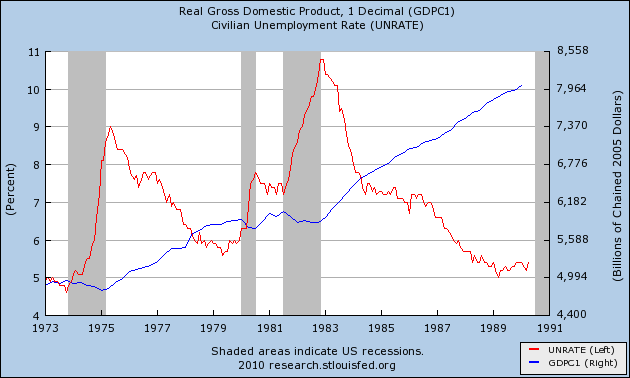

Similarly, in between 1974 and 1986 -- a period of over 10 years -- there was almost no period of time during which employment was anywhere near full (typically figured to be under 6% unemployment), even though there were recoveries and expansions after each of those recessions:

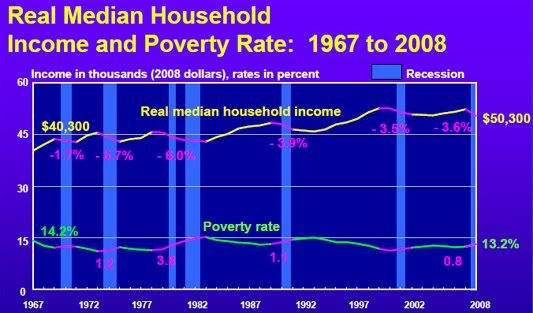

Further, since the year 2000 economic performance as a whole has been so poor that at no point has median household income of Americans ever exceeded the level attained in 1999:

One decade has already been lost, and it appears that another lost decade may be beginning, with no end to the structural problems of wage stagnation in sight. Now, like the 1930s and 1970s, the economy is growing again -- it is in recovery -- and thankfully since the beginning of this year jobs are being added, but unemployment remains intolerably high at nearly 10% in U3 terms:

Thus a year ago, when there was derision for the concept of "green shoots", and people spoke scornfully of the "second derivative", i.e., the downtrend was just slowing down, it was correct to highlight the fact that the Leading Indicators pointed to a change in the direction of the trend itself (i.e., the "the first derivative"). What has not happened, and most likely will not happen anytime soon, is that the upward trend will reach the absolute level where income, wages, or employment are sufficient for the long-term economic well-being for average Americans.

Last year when it seemed nearly everyone thought we were falling into the bottomless abyss of Great Depression 2, it was not just valuable or correct, but vital to point out that conditions were bottoming and a change in direction was upon us. That being said, "Happy Days are not here again," and nothing I have written should be taken to mean that I say they are. Hard Times are still here, and probably will be for a substantial time to come. Until there is sustained real wage growth for average Americans, it will be difficult for America to have sustained economic growth.

-------

From Bonddad:

NDD makes a good point here. Let me add my two cents.

1.) The recession is over -- meaning growth has returned. In fact, it has returned for the last three quarters. As an aside, I've seen the economic blogsphere expend a tremendous amount of energy trying to deny this argument. At first it was "it's only one quarter of growth." Then there wasn't enough information to say there was a trend." Then the numbers were cooked because the government lies. It's been incredibly funny watching people try to move the facts around their preconceptions.

2.) Expecting a quick resolution to any economic issue after an incredibly severe recession is at best unrealistic and at worst an indication that the commenter lacks an understanding of basic economics. Case is point: 10% unemployment is not going to drop to 5% in the period of a year -- it's just not going to happen. Curing that problem will take years.

Personally, I think what has happened over the Great Recession is jobs that would have disappeared by natural attrition over a period of say 5-10 years were accelerated out of existence by the recession. For example, a manufacturer was thinking, "I'll continue to move in the area of automation at a slow rate." But then the recession hit and he said, "no time like the present to at least start getting rid of people."

3.) The primary reason people argue we're not in a recovery is a high unemployment rate. However, as I documented here the issue of long-term unemployment -- the issue which many people argue prevents this from being a recovery -- is a multi-faceted problem that revolves around two issues: educational achievement and economic area. Simply put, a large percentage of the jobs lost fall in construction and manufacturing. These are areas that typically attract employees with less than a college education. Hence, we currently have a high rate of unemployment for people without a high school degree and for people who are a high school degree but no secondary education. Neither construction or manufacturing is going to start hiring in a big way anytime soon. As such, long-term unemployment is an issue going forward.

4.) Additionally, jobs that don't need higher level educational skills are nowhere near as plentiful as before -- and will continue to decrease in this country. As a result, something has to be done in this area. Any by something, I mean something more than lip-service. As an example, NDD and I have both called for a new WPA program. The reason is simple. First, there is a high rate of unemployment among manual/blue collar laborers. This would get them back to work. Secondly, the nation's infrastructure needs serious rebuilding. Thirdly, this would be a fantastic investment that would promote future growth. For example, assume there are two cities that don't have a highway between them but alone they both grow. However, create and enhance the transportation facilities between the cities and you get a long-term (as in 30+ years) growth enhancer. It's really not that complicated.

5.) A large amount of the "this is a recovery, this isn't a recovery" is an issue of schematics and motivation. From an economic perspective, two quarters of growth indicates a recession is over -- that is a standard, text book definition. To argue it's not means either a.) you don't know basic economics, or b.) you have other motivations which are usually political. There is nothing wrong with political motivations -- just state them upfront and don't argue you're making an economic argument, because you're not. I don't mind people trying to drive the debate or narrative because that is part of the process. BUT -- I can't stand when these same people try to argue they are making a purely economic statement.