- by New Deal democrat

In ordinary times, new home sales are important because while they are very noisy and heavily revised, they are the most leading of all housing metrics. They remain important even presently because they can tell us about the underlying upward or downward pressure on the economy going forward one year or more.

By way of background, remember that housing responds first and foremost to mortgage rates, and since those have been rangebound generally in the 6% - 7% range for 2.5 years, so have new home sales in the range of 611,000-741,000.

In March, new home sales increased 7.4% from a slightly downwardly revised February, to 724,000 units annualized, continuing the rangebound behavior. As per usual, the below graph compares with with single family permits (red, right scale), which lag slightly but are much less noisy:

.

Both demonstrate the recent range bound behavior.

Over the same 2.5 year period of time, prices at first stalled, and then began a very slow deflation. This continued last month, as on a non-seasonally adjusted basis, the median price of a new single family home declined -7,900 to 403,600, with the exception of last November the lowest price in three years:

Although I won’t bother with a graph this month, on a YoY basis, the median price of a new home is continued to decline, down -7.5%.

Builders are much more able to respond to market pressures, and - tariffs aside for the moment - this continues to make new homes relatively much more attractive than the constricted existing homes market, with its continuing upward price pressure.

Finally, recessions have in the past happened after not just sales decline, but the inventory of new homes for sale - which also consistently lag - also decline (as builders pull back:

So it is good news that last month’s slight downward tick was revised away, and the inventory of new homes for sale rose 3,000 to a new 17 year high of 503,000 annualized:

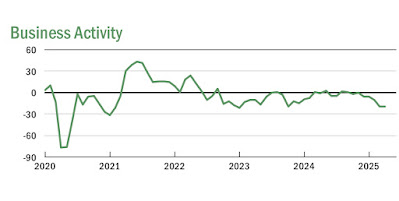

Because manufacturing has been flat to declining in the past three years, construction has been important in the continued expansion of the economy. This month’s report tells us that while new home construction is not increasing significantly, it is not meaningfully decreasing either, and is not showing any sign of any imminent recession.