Now, when did the sub-prime mess really start to blow-up? Although there were a few problems before the week of July 22, it was that week when Bear Stearns announced it's problems with two hedge funds. So, there was a period of a month 1/2 to month 3/4 when the consumer had some breathing room in terms of negative news.

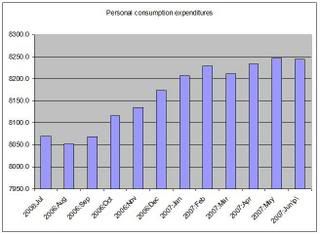

However, notice that June and July Personal Consumption expenditures were still weak on an inflation adjusted basis. In other words, the consumer is still reeling from high gas prices and the turmoil in the markets.

That leads to a question. What is the possibility that consumer spending increases? Probably not that high right now. There are a ton of reasons for the consumer to be fearful.