Saturday, May 18, 2019

Weekly Indicators for May 13 - 17 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

The stock market’s “tariff tantrum” is driving down interest rates in bonds. We are in a time when government policy decisions - sometimes just passing tweets - are driving winners and losers in economic activity. And these can have immediate impact, disrupting the scheme of long leading -> short leading -> coincident indicators of the economy.

As usual, clicking over and reading helps reward me a tiny little bit for my efforts.

Friday, May 17, 2019

Initial jobless claims lead the unemployment rate: May 2019 update

- by New Deal democrat

Let’s take a look at a relationship I haven’t updated in awhile: initial jobless claims vs. the unemployment rate.

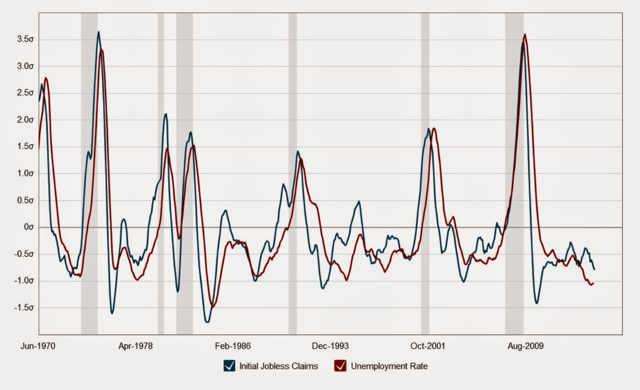

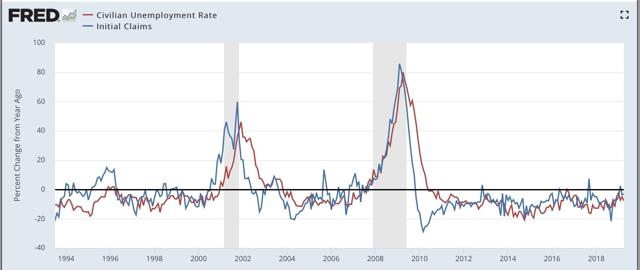

There used to be a site called “thumbcharts.com” that published a bunch of graphs, including one that showed that, measured on a 6 month rolling average basis, the change in initial jobless claims anticipated a similar move by the unemployment rate. Here’s one that I made use of about five years ago:

Certainly not perfect on a monthly basis, but over a longer timeframe, very persuasive.

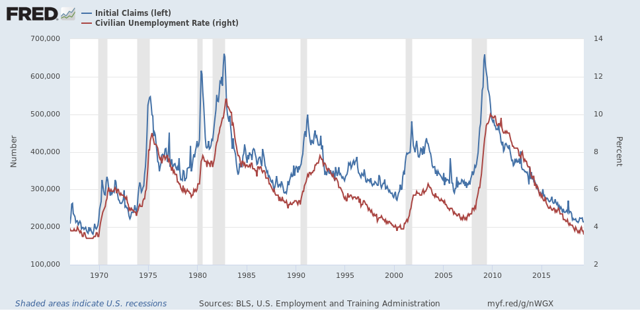

Here’s what this looks like over the past 50+ years measured by their absolute levels:

Again, it’s pretty clear that initial claims does lead the unemployment rate by several months with some variability.

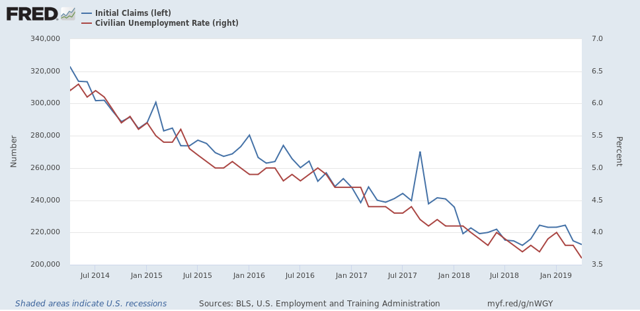

Here’s a close-up of that metric over the past five years (with initial claims averaged monthly for comparability):

Interestingly, in the past year, the unemployment rate has moved in tandem with claims without any appreciable delay.

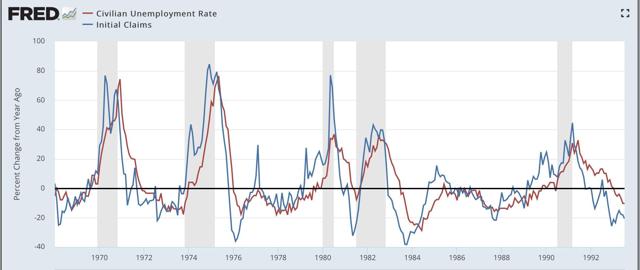

And here is the same data expressed as YoY% changes, first over the long term:

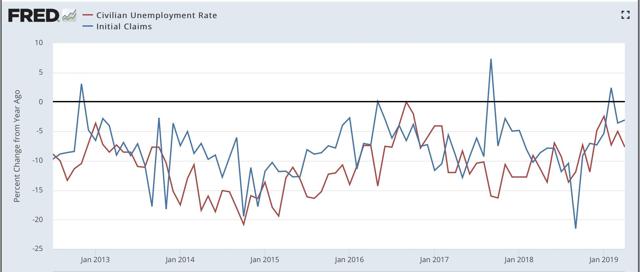

And now a close-up on the past six years:

Again, lots of noise in any single month’s comparison, but averaged over a longer period of time, the leading/lagging relationship is pretty clear, and it is also pretty clear that the trend in the YoY% change in initial claims has been rising (i.e., is less positive) since last September.

With the exception of the three weeks right before Easter, initial claims have not declined significantly since February 2018. Leaving those aside, the biggest YoY% decline on a two week average basis was -3.5%. That suggests that the unemployment rate ought to be converging on about 3.8% (.965 x 4.0 = 3.86; .965 x 3.9 = 3.76). In any event, since initial claims have risen significantly in the four weeks since Easter, I do not expect the 3.6% unemployment rate to last, although I am not expecting it to rise above 3.9% anytime soon.

Thursday, May 16, 2019

April housing permits and starts: not nearly so rosy under the headlines

- by New Deal democrat

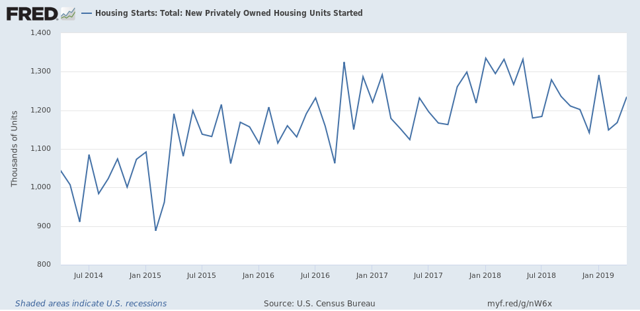

The headlines in this morning’s residential construction report were certainly positive: permits increased by 0.6% and starts by 5.7% m/m. I’ve been looking for a bottom in housing, based on lower mortgage rates, so this is good news because the bottom in overall permits and starts on a monthly basis may have been reached.

But the news was not nearly so positive underneath.

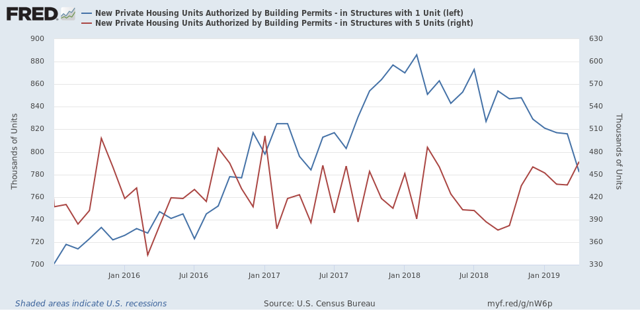

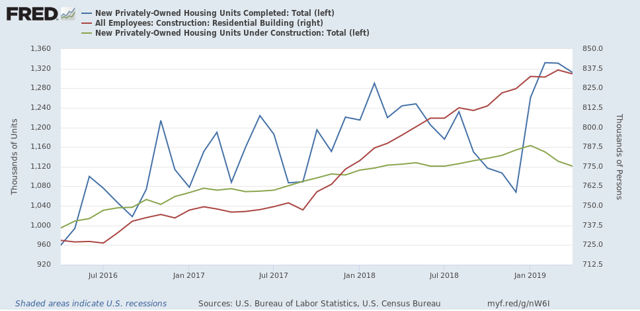

As I have repeated many times, single family permits are my favorite metric, because permits lead starts, and single family permits are the least volatile of any of the measures. Well, single family permits sank to a two and half year low, at 782,000. This is -11.7% off their February 2018 high:

The least that single family permits have fallen prior to a recession in the past 50+ years was prior to the 2001 recession, at -12.5%, so we are very close to that threshold.

The saving grace in this number is that permits for multi-family dwellings have increased at the same time. This is socially beneficial, because these are more affordable for households unable to afford single family housing, which had become very unaffordable up until a few months ago. It also ameliorates some of the negative economic impact of the decline in single family construction. By contrast, just prior to the 2001 recession, multi-unit construction declined by -34% as well.

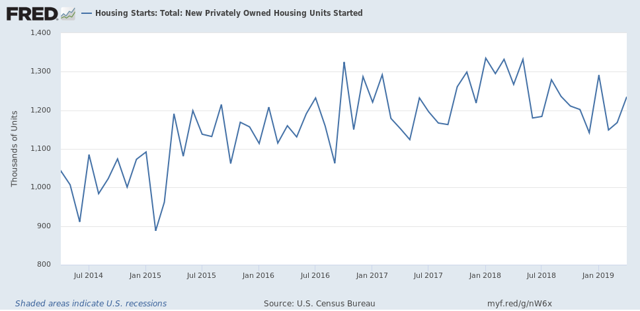

Next, housing starts are much more volatile than permits. And despite the great monthly improvement in starts, the three month moving average is also at a new 1+ year low:

Because starts represent actual economic activity, that this has continued to decline argues that the long leading effects of housing on the economy are going to continue to be negative for perhaps another year. And by the way, lest you think I am cherry-picking, the metrics above are the same ones I have been checking, month after month after month for years.

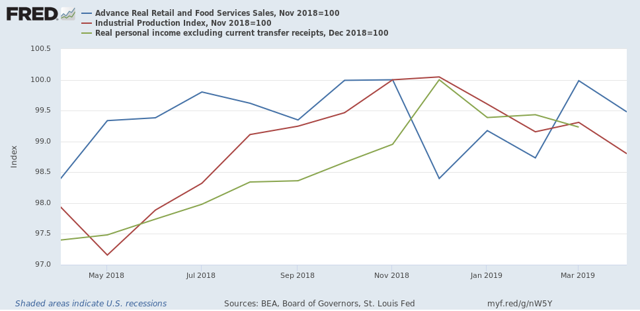

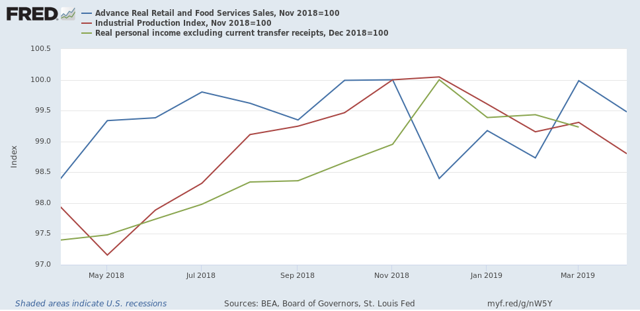

Finally, I’ve been watching construction employment as a leading sector of that metric. Employment has been the coincident indicator for the economy that has improved the most in the past half year. In fact, all three of the other four big coincident indicators remain below their highs of last November or December:

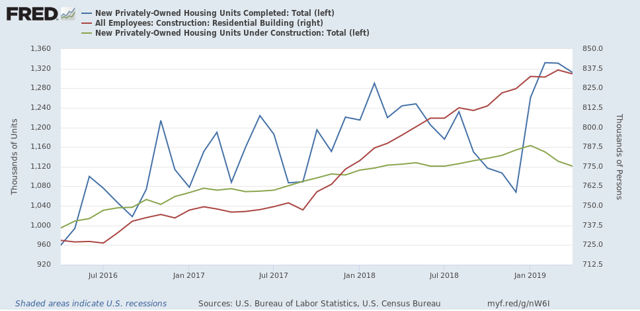

In the past, residential construction employment (red in the graph below) has usually started to decline within 6 months after the peak in the number of housing units under construction (green), and coincident with the peak in housing units completed (blue):

The number of units under construction peaked 4 months ago in January, and has declined ever since. Completed units peaked two months ago in March. Residential construction employment declined in April.

So this morning’s housing report is powerful evidence that we should expect to see continued declines in residential construction employment in jobs reports going forward.

Wednesday, May 15, 2019

April real retail sales turn negative, with both short and longer term implications

- by New Deal democrat

Retail sales are one of my favorite indicators, because in real terms they can tell us so much about the present, near term forecast, and longer term forecast for the economy.

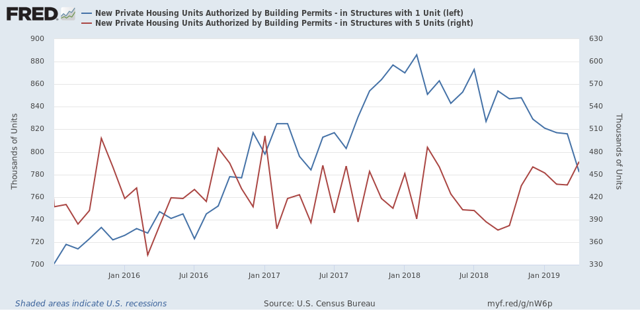

This morning retail sales for April were down, -0.2%. Since consumer inflation increased by +0.3%, real retail sales fell by -0.5%, a poor result that nevertheless did not reverse the extremely strong March showing of +1.3% in real terms. Last month I noted that sales were still slightly below their peak of five months prior, and YoY real sales remained in a downshift. Needless to say, April’s result did not help matters.

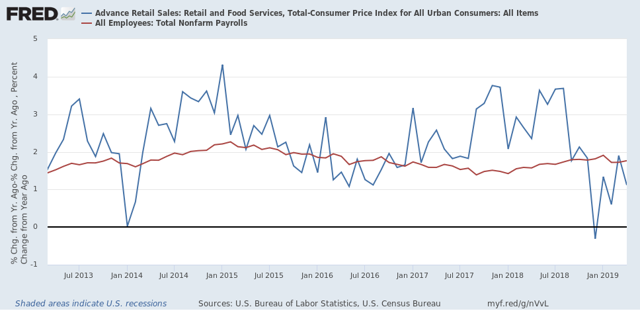

Below are both the long term and short term graph of real retails sales:

Note that real retail sales turned flat for about a year before both of the last two recessions. Since late last year we’ve hit the biggest soft patch since 2013. In fact, we’re only up about +0.2% total in the past 11 months. As revised, both of these last made new highs five months ago in last November.

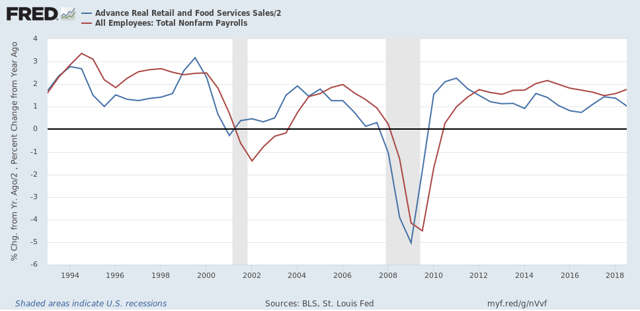

Next, although the relationship is noisy, because real retail sales measured YoY tend to lead employment (red in the graph below) by a number of months, here is that relationship for the past 25 years. Normally I show this quarterly, but this time I’d like to show it in 6 month intervals, that really shows the leading relationship:

Now here is the monthly close-up of the last six years. You can see that it is much noisier, but helps us pick out the turning points:

The lead times are somewhat variable, and notably most recently while sales roughed in mid-2016, employment did not similarly trough until a full 12 months later. We are currently 8 months into a big downshifting in YoY sales, so I still fully expect employment as measured in the monthly jobs report to slow down noticeably shortly.

The lead times are somewhat variable, and notably most recently while sales roughed in mid-2016, employment did not similarly trough until a full 12 months later. We are currently 8 months into a big downshifting in YoY sales, so I still fully expect employment as measured in the monthly jobs report to slow down noticeably shortly.

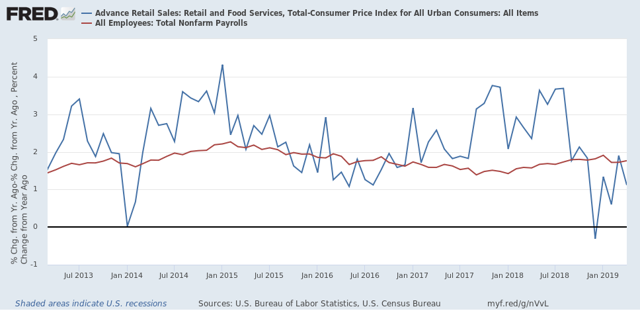

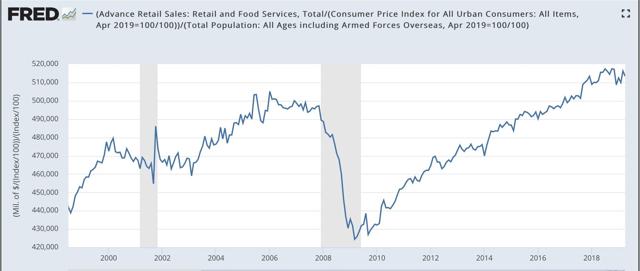

Finally, real retail sales per capita is a long leading indicator. In particular it has turned down a full year before either of the past two recessions:

Here is the close-up of the past 18 months:

Measured per capita, real retail sales peaked 6 months ago, and are down compared with 11 months ago. Unless there are substantial upward revisions, or a good report next month, this metric is going negative YoY.

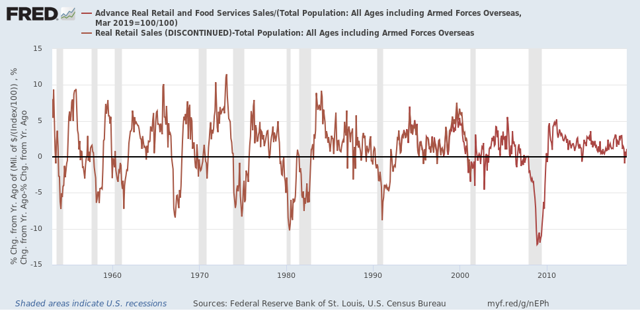

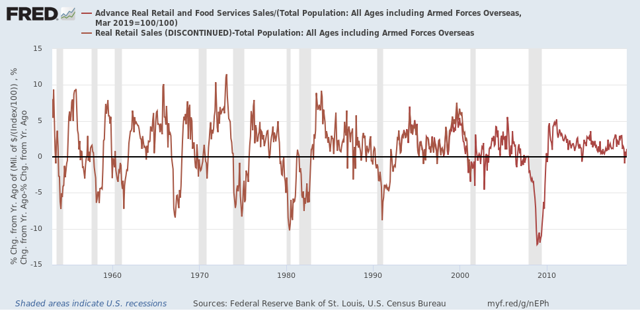

Why is that significant? Here are real retail sales per capita YoY, going all the way back to 1948:

In the last 70 years, this measure has always turned negative at least shortly before a recession has begun. There are no false negatives. While there are about a dozen false positives for a single negative month, there are only four false positives for consecutive negative readings — 1966, 1995, 2002, and early 2006. Recently there has only been one month - last December - where this was negative YoY, so this series bears close watching to see if it turns negative again, and for longer than one month.

To sum up, real retail sales for April weren’t just a weak coincident data point, bu they further point to weakness in the near term for employment gains, and are signaling negative for the long term depending on whether the poor readings remain durable for the next several months.

Tuesday, May 14, 2019

Consumer credit: both producer and consumer sides of the ledger show mortgage market OK, increasing stress for other loans

- by New Deal democrat

The New York Fed reported on household debt and credit this morning.

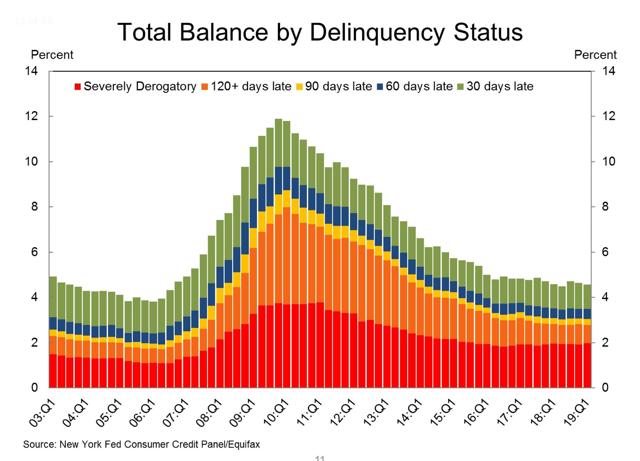

The good news is that there has been no increase in total delinquencies:

This is important because the amount of delinquencies would be expected to increase if we were close to getting into a recession.

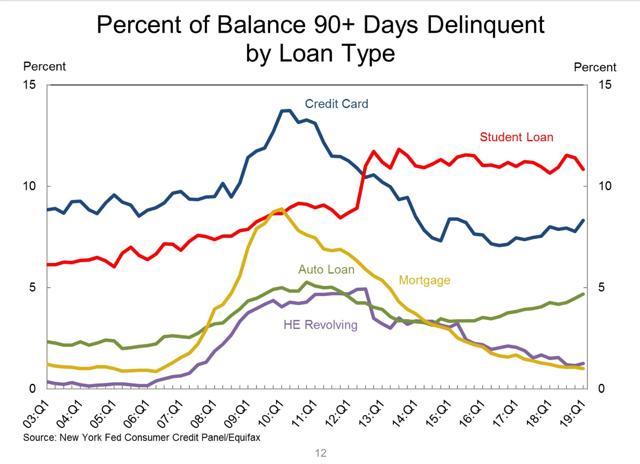

The somewhat more bad news is that, if the *amount* of delinquencies has not risen, the *percentage* of vehicle and credit card loans that are seriously delinquent has risen:

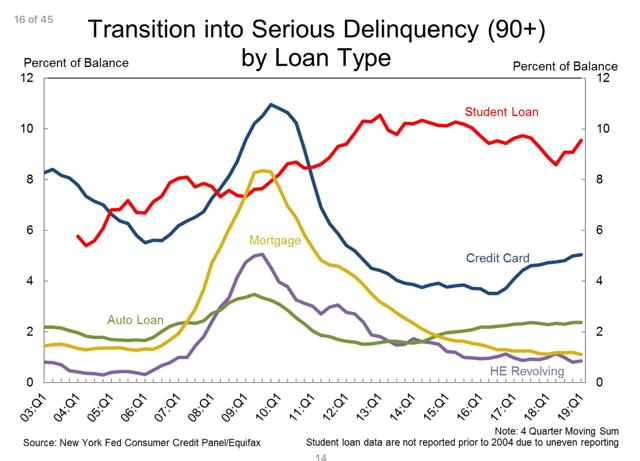

And the percent transitioning into serious delinquencies for credit card loans have also risen:

Note, however, that mortgage loan delinquencies remain at their lowest ever in the survey.

Meanwhile, last week the Fed issued its Senior Loan Officer Survey, which covers the creditor side of the ledger. That report showed that in Q1, mortgage lending got slightly looser, as did credit to firms, while outside of mortgages, banks tightened conditions for issuing consumer credit, and consumer demand for nearly all types of credit declined. My post on the Senior Loan Officer Survey is up at Seeking Alpha.

In short, from both the producer and consumer side of the ledger, the mortgage market is in good shape, with some signs of increasing stress, and tightening of conditions, for other types of loans.

Monday, May 13, 2019

We are probably close (~500,000) to “full employment”

- by New Deal democrat

From time to time over the past few years I have tried to estimate how far we were from “full employment,” by which I meant the average levels of the best year in each of the past two expansions. I also estimated how long it would take to get there given the then-current monthly gains in employment.

For example, two years ago I estimated that we needed to add another 2.5 million people, or 1.5% of the labor force, to the employment rolls in order to be at “full employment.” Last August, I updated the figure to a shortfall of about 0.8%, and estimated that, if employment trends held, we would get to “full employment” in about 9 to 12 months from then, which would be sometime between now and the end of summer.

Given the continuing very good jobs reports, I thought I’d take another look.

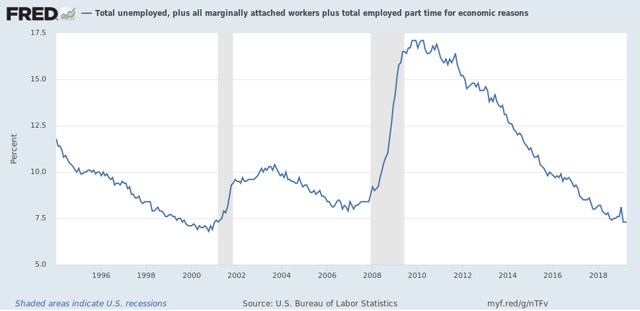

First, here is the U6 underemployment rate. This includes, most importantly, involuntary part-time workers. For us to be at full employment, this figure ought to be at its 1999-2000 and 2006-07 levels:

We have already surpassed the latter, and are only about 0.2% away from the former.

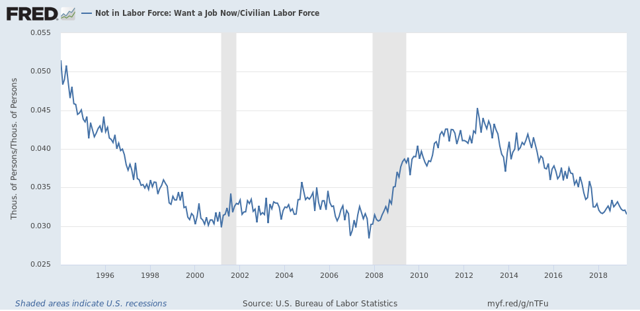

On top of that, there are also people who aren’t even in the labor force, because they haven’t looked for work, but tell the Census Bureau that they do want a job now. In the below graph, I’ve divided that by the civilian labor force to tell us what percentage over and above the labor force fit in that category:

Currently these are equivalent to a little under 3.2% of the total labor force. At its best average levels in the last two expansions, this number was 3.0%, in other words, we are also about 0.2% away.

Put these two together and they add up to between 0.2% and 0.4% of the 170 million labor force, or in other words 340,000 to 680,000. If monthly employment gains continue to run about 100,000 over the number needed just to accommodate an increasing prime age population, that puts us about 7 months away. Meaning we should reach “full employment” by the end of this year.

This, by the way, has implications for wages, because the closer we approach to “full employment,” the more employers will have to raise wages to entice people who aren’t currently in the labor force to decide to enter it.

———-

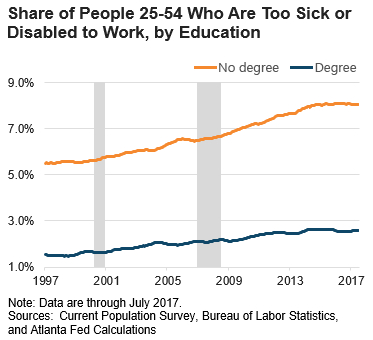

P.S. Yes I know it is more complicated than that. In particular people seem to come off disability rolls and find employment if it is plentiful enough at decent pay:

But at least some of that is probably reflected in the continuing elevated levels of underemployment and those who haven’t looked but have decided they now want a job. Also, I would expect that the prime age employment to population ratio will increase to over 80% as part of any further decrease in underemployment and job desirers who aren’t actively seeking employment.

Subscribe to:

Comments (Atom)