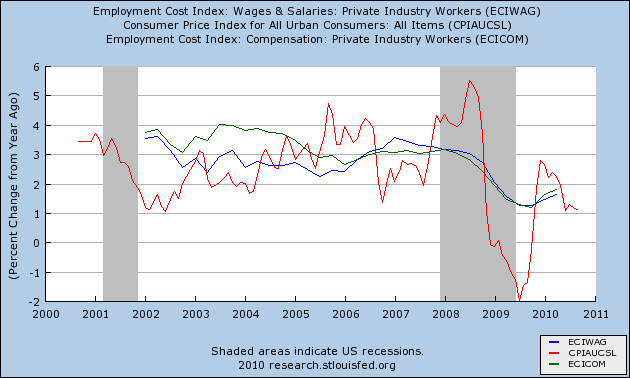

This week started out slow, with no significant data. Then yesterday and today we had a surprise negative initial jobless claims reading (more on that below), both producer and consumer prices surged (the PPI up 0.8%, the CPI up 0.5%), largely because of gasoline. Nomial Retail sales were strong at 0.6, but real, inflation adjusted retail sales were the weakest in 6 months, up only 0.1. Still, real retail sales are up 3.9% in that 6 month period, a very strong showing. Industrial production and capacity utilization both were also up strongly, with industrial production up 0.8, it's best showing in the last 6 months. Consumer sentiment about the present unexpectedly fell, but expectations about the future were up slightly (expectations are a small component of the LEI).

Now here is this week's high frequency data:

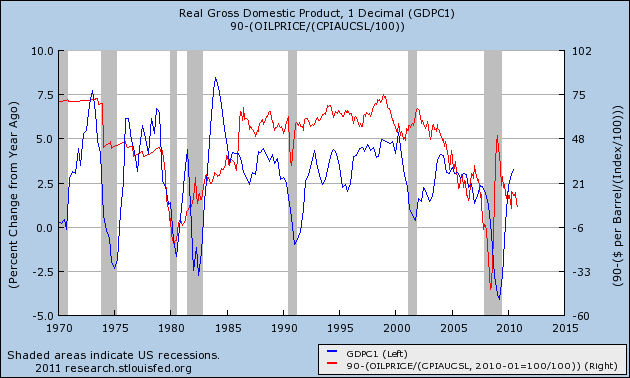

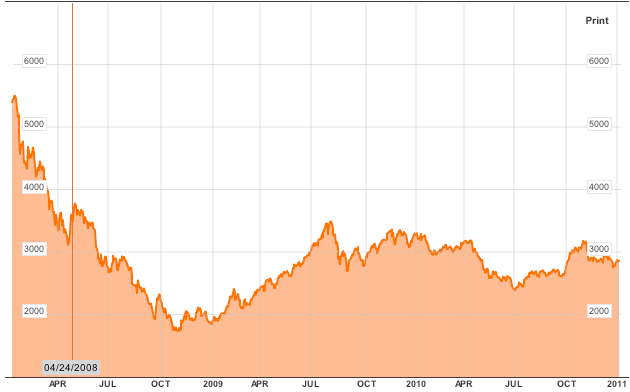

Gas at the pump went up 2 more cents to $3.09 a gallon last week, and Oil climbed back above the $90 a barrel mark to $90.21 Friday morning. Gasoline usage was slightly above (1%) last year's levels.

The Mortgage Bankers' Association reported a net decrease of -3.1% in seasonally adjusted mortgage applications. This number has declined slightly in the last month, but has been in a uptrend since bottoming in July, athough it is still -12.3% lower YoY . Refinancing increased about 4.1% but is still at low levels equal to many bottoms in the last 5 years. This is likely to impact consumer spending down the road. (btw, click on the link for a cool new interactive graph).

The ICSC reported that same store sales for the week ending January 8 increased 3.5% YoY, although they were down -3/2% week over week. Shoppertrak did not report for the week, but said that the 2010 holiday season as a whole was up 4.0% YoY. There was a negative spin place on this some quarters, with the opinion that high end stores did extremely well, midrange stores did OK, and low end stores did badly YoY, therefore we are Doomed. This is garbage analysis. Since Wal-Mart doesn't report, the truth is that we don't know how low end stores did. Were the poor sales across the board, or did Wal-Mart eat its direct competitors' lunch? Also, last year, when midrange stores did poorly compared with low end stores, we were told that was because midlevel shoppers were forced to trade down. In other words, those midrange shoppers may have moved back up the ladder this year - a good story! I don't know which it is, and neither do the Doomorons.

Railfax tells the same story as it has for over a month. It declined in all areas last week again, for seasonal reasons. It nevertheless remained steady in its comparative improvement over last year. Shipments of waste and scrap metal and auto shipments are no better than last year's levels.

The American Staffing Association Index fell 11.7% to 81 for the week ending January 2, entirely for seasonal reasons. This was still 17% above a year ago, but about a similar percentage below 2006 and 2007 levels. This index will probably bounce substantially next week, again for seasonal reasons, but it will be still one more week before it again gives reliable information.

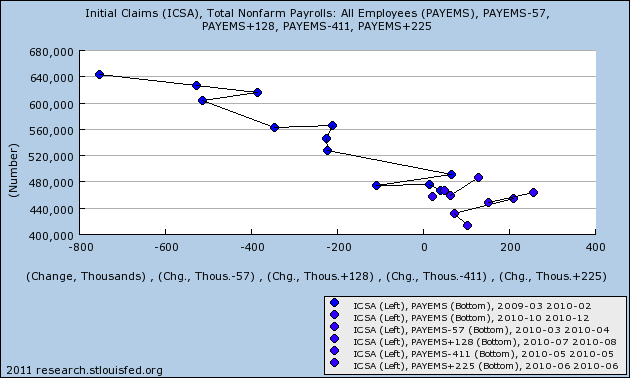

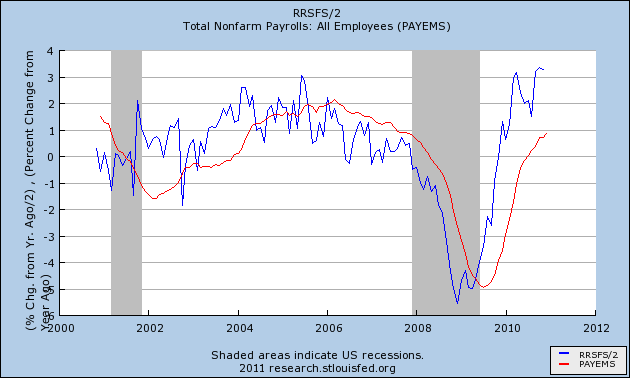

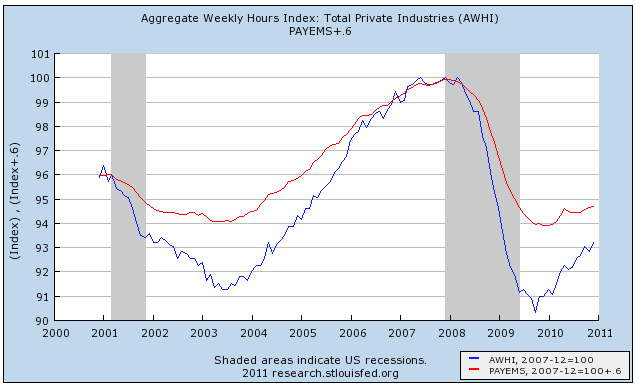

The BLS reported initial jobless claims of 445,000. The 4 week moving average rose to 415,000. It is important to note that the first full week in January is typically by far the highest number for NON-seasonally adjusted claims all year. Thus the seasonal adjustment is major, and it is easy - and common - for this adjustment to be "off." The best way to deal with this is to treat it as the mirror image of the positive 388,000 claims of several weeks ago. The average comes to about 420,000, which is probably the truer picture. Some of the new claims may be state and municipal layoffs (layoffs at the end of the year are more common for government employees where there are budget problems, and have shown up 1 or 2 years after the bottom of more severe recessions in the past). Bottom line: I won't be concerned unless we see 430,000+ continuing for a couple more weeks.

M1 was up 2% for the week, down -0.4% month over month, and up 7%+ yoY, meaning "Real M1" was up 6%. M2 was up +0.16% for the week, +0.24% month over month, and +3.2% YoY, meaning "Real M2" was up ~2.2%. These numbers have told the same story for months on end. Real M1 is up sharply, Real M2 can't seem to improve above the red zone of +2.5%.

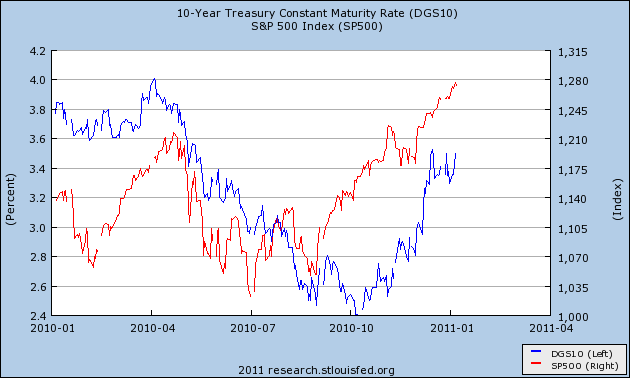

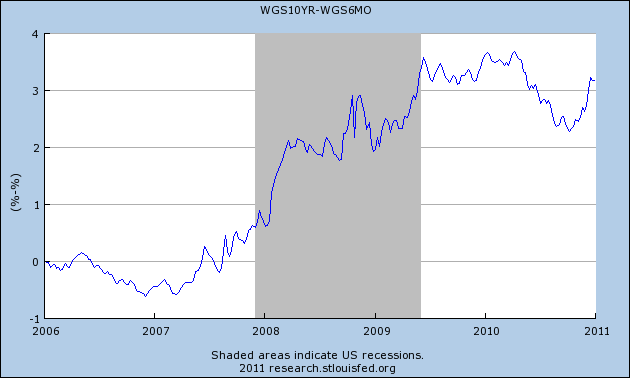

Weekly BAA commercial bond rates rose .02% to 6.09%. This was equal to the .02% increase in the yields of 10 year treasuries. There remains no sign of deflationary fear amound B grade corporate bonds.

Income tax withholding comparisons are going to be a mess this year, because of the tax cut in Social Security payments, and the simultaneous ending of the "make work pay" tax credit. Fortunately, Matt Trivisonno has already estimated the math. So, pending further refinements, I will add 1.07% to withholding data this year to compare with last year as a best estimate. With that in mind, the Daily Treasury Statement showed adjusted receipts in the first 8 reporting days of January of $66.8 B vs. $66.7 B a year ago, for a gain of $0.1 B. Over the last 20 reporting days, this year shows $160.0 B collected vs. $159.1 B one year ago. This is a very slight improvement - it may mark a slowdown, or it may be the adjustments for the tax credit are off the mark.

We have a similar mantra as we have had for several months now: almost all of the data is moving in the right direction, with the very conspicuous exception of commodities, especially Oil. There will be consequences.

In the meantime, have a nice weekend!