It's Saturday. Do anything except think about the markets or economics.

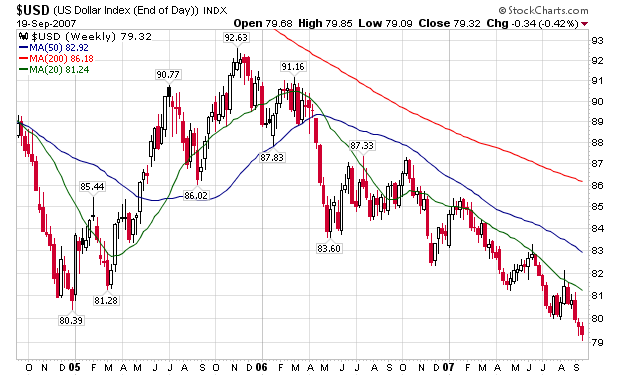

The Fed's move put more pressure on the dollar because it made returns on investment in other countries more valuable. The weak dollar also means that American goods are cheaper for overseas buyers, which can help manufacturing and producers, and can help companies with big foreign operations turn a larger profit by converting overseas profit into dollars.

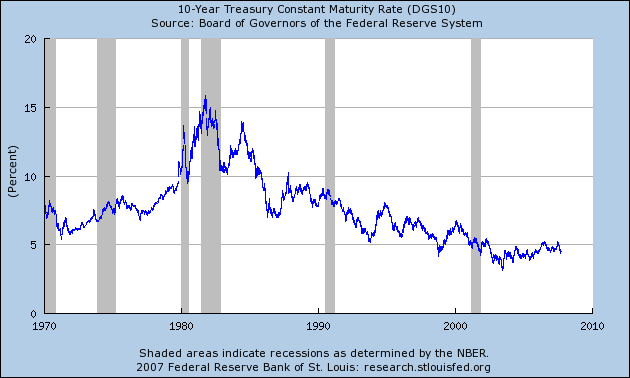

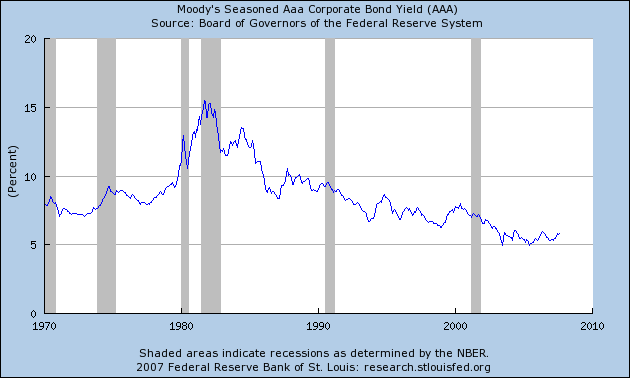

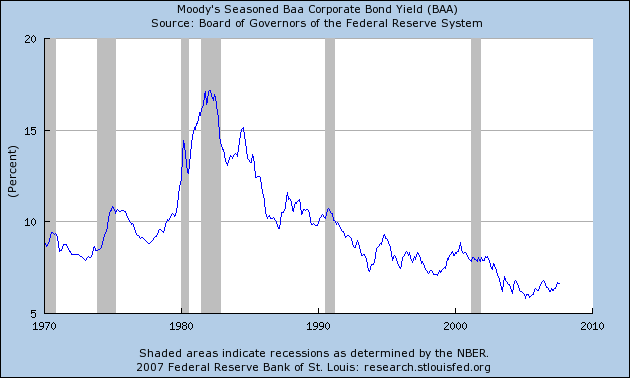

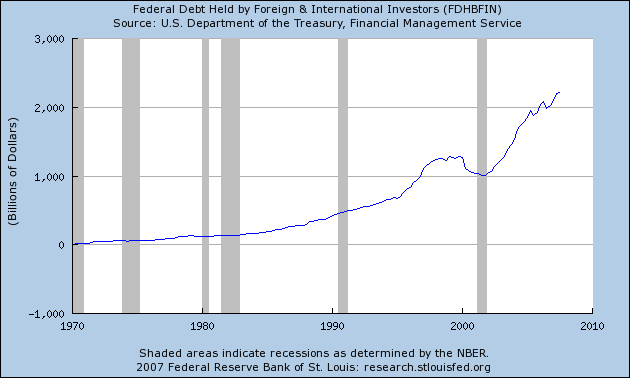

But it also could scare away foreign investors who help to finance the U.S.'s debt. As investment in U.S. Treasury securities dwindles, the government will have to pay higher rates at weekly auctions to find buyers for its bills, notes and bonds. That eventually could push up borrowing costs for all Americans.

The U.S. commercial paper market shrank for a sixth week, extending the biggest slump in at least seven years and signaling Federal Reserve interest rate cuts haven't yet drawn investors back to short-term debt.

Short-term debt maturing in 270 days or less fell $48.1 billion in the week ended yesterday to a seasonally adjusted $1.87 trillion, including a $32.1 billion decline in financial commercial paper. Asset-backed debt dropped $15.6 billion, according to the Fed in Washington.

Commercial paper outstanding has declined $354.5 billion, or almost 16 percent, since the week ended Aug. 8 as investors retreated to the safety of government debt. The slump that began in asset-backed paper spilled to financial companies, where the decline in issuance accelerated. The prospect of a slowing economy, which prompted the Fed to act this week, may have caused firms to reduce sales, said Tony Crescenzi, chief bond market strategist at Miller Tabak & Co. in New York.

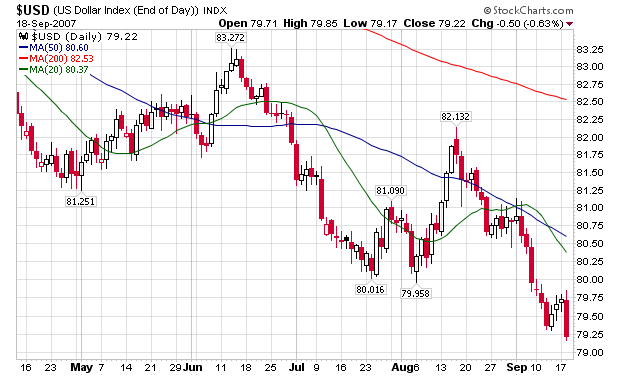

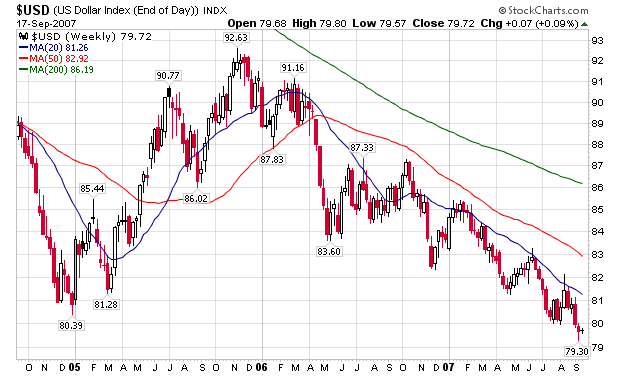

The dollar fell to the lowest versus the euro since the European currency's inception in 1999 on speculation the Federal Reserve will continue to reduce interest rates, dimming the allure of U.S. assets.

``It seems like the world is dumping the dollar,'' said John Taylor, chairman of FX Concepts Inc., a New York firm that manages $12.1 billion in currencies. ``The U.S. central bank is cutting its interest rate. We have sold the dollar and will continue to do so. My preference is to sell the dollar against European currencies.''

Gold rose to a 27-year high as the dollar fell to a record low against the euro and the spread between the two- and 10-year U.S. Treasuries widened, fueling demand for the metal as an inflation hedge. Silver also climbed.

Gold's gain today was the biggest in seven months, sending bullion up almost 17 percent for the year and heading for its seventh straight annual gain. The yield spread on Treasuries widened to the most since May 2005 on speculation a plunge in the U.S. currency and the Federal Reserve's first interest-rate cut in four years will spark inflation.

``When the bond markets and currency markets move, it is a shout rather than a whisper to the gold market,'' said Leonard Kaplan, president of Prospector Asset Management in Evanston, Illinois. ``The Fed has thrown in the towel in its fight against inflation.''

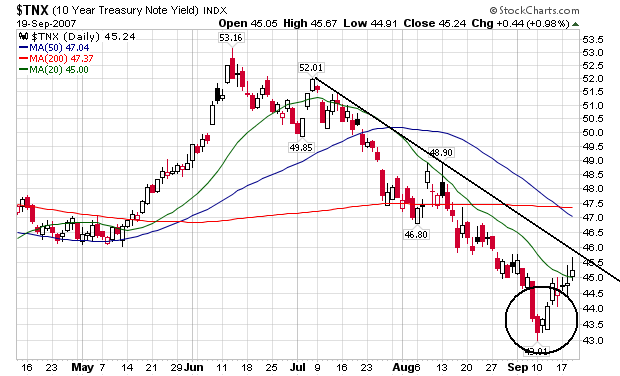

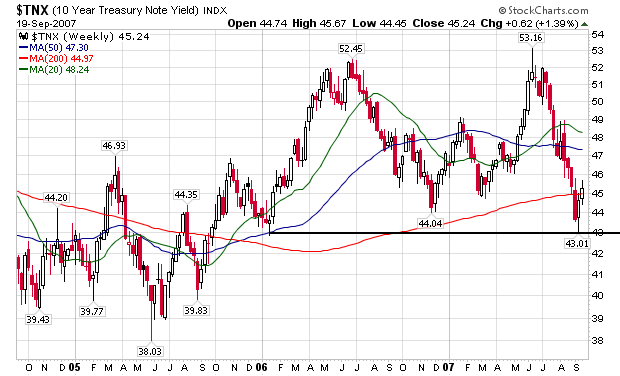

The difference between two- and 10- year Treasury note yields increased to the widest since May 2005 on speculation the tumbling dollar and the Federal Reserve's cut in borrowing costs will fuel inflation.

Yields on 10-year notes, more sensitive to inflation expectations than shorter-term securities, rose faster than those on two-year notes, steepening the so-called yield curve. A Fed report showed manufacturing in the Philadelphia region accelerated more than economists forecast this month.

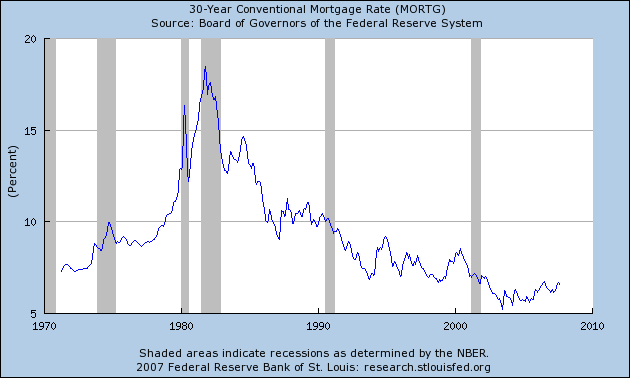

Mortgage delinquencies jumped again in August, according to new data from Equifax and Moody's Economy.com. The new data provide the first big-picture look at how the credit crunch is hitting homeowners.

Nationwide, 3.56% of mortgages were at least 30 days past due last month, up 0.31 percentage points from July. The delinquency rate has increased about 1.5 points since bottoming out at the end of 2005, with fully half of that increase coming in the last three months.

Delinquencies have climbed since August 2006 in all 50 states, and 10 states have posted an increase of more than one percentage point. The rise in bad loans is "broad based," says Mark Zandi, chief economist at Moody's Economy.com. "That signals that foreclosure problems are going to be widespread."

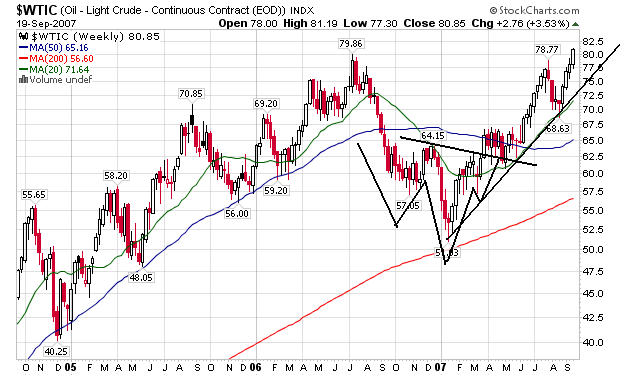

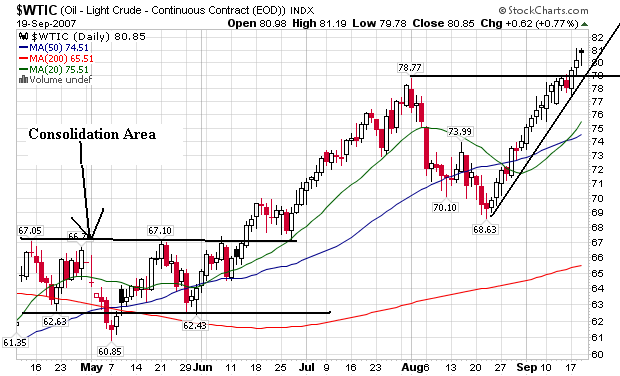

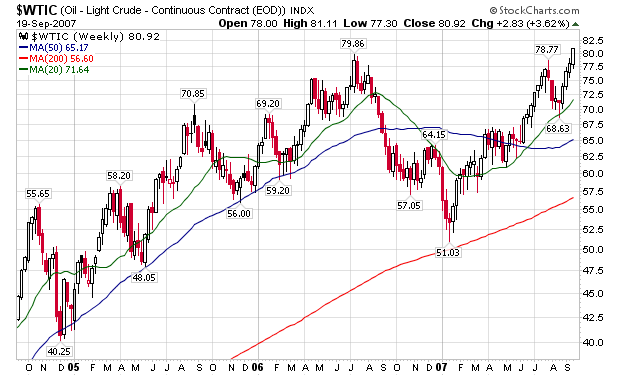

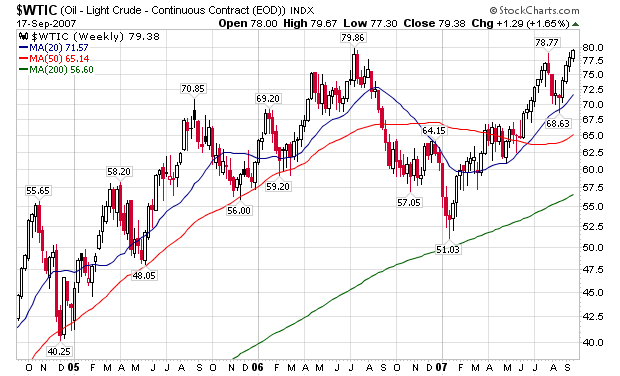

A weaker greenback gives oil producers an extra incentive to drive prices higher: Oil is denominated in dollars on the global market, so producers are being paid for their output in less-valuable currency.

Late yesterday in New York, one euro bought $1.3962, compared with $1.3201 at the start of the year, a 6% weakening of the dollar. One gauge used by the Federal Reserve shows the dollar at its weakest in a decade as measured against a broad range of currencies.

Oil reached an intraday New York Mercantile Exchange record of $82.51 a barrel yesterday before closing at $81.93, up 42 cents, or 0.5%, on the day and 34% higher for the year. That is still well off the high, in inflation-adjusted terms, above $100 in 1980. Since the start of 2003, when one euro bought just $1.05, crude's price has risen 163%.

Despite registering declines in each of the last three months, the index for energy increased at a 12.7 percent SAAR through August. Petroleum-based energy led the acceleration with a 22.7 percent increase at an annual rate. Last year the overall energy index rose 2.9 percent.

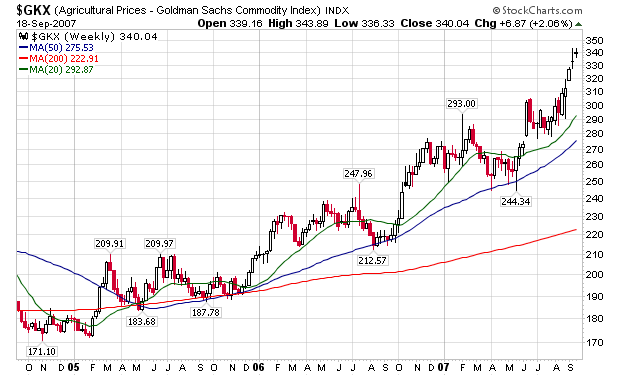

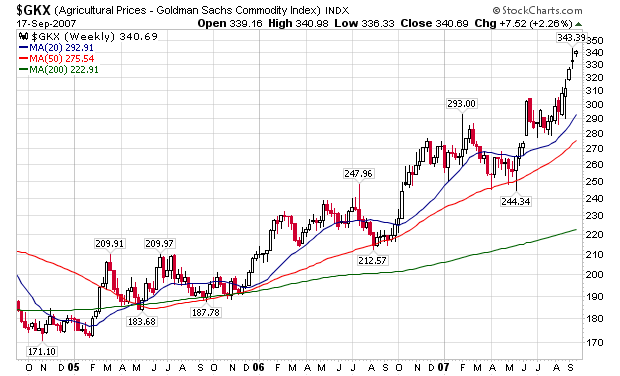

Not only oil is affected. Most commodities are denominated in dollars, and commodity producers are often paid for in dollars, so commodities prices in general have risen as the dollar becomes less valuable.

During the first eight months of 2007, the CPI-U rose at a 3.7 percent seasonally adjusted annual rate (SAAR). This compares with an increase of 2.5 percent for all of 2006.

The larger advance thus far this year was due to larger increases in the energy and food indexes. Despite registering declines in each of the last three months, the index for energy increased at a 12.7 percent SAAR through August. Petroleum-based energy led the acceleration with a 22.7 percent increase at an annual rate. Last year the overall energy index rose 2.9 percent. The food index also increased much more so far this year compared with last year, a 5.6 percent SAAR compared with a 2.1 percent rise for all of 2006. Excluding food and energy, the CPI-U advanced at a 2.3 percent SAAR in the first eight months, following a 2.6 percent rise for all of 2006

LONDON (Thomson Financial) - US crude oil stocks fell by a greater-than-expected 3.8 mln barrels in the week to Sept 14, while gasoline inventories rose by 400,000 barrels against expectations for a decline, the US Energy Information Administration said.

The report said, however, that at 318.8 mln barrels, US crude oil inventories remain at the upper end of the average range for this time of year.

The dollar sank against other major currencies in international trading Wednesday, as the Federal Reserve's sharp interest rate cut overnight eroded its yield advantage and fueled concern that the U.S. economy's outlook may be gloomier than expected.

The dollar dropped to a record low versus the euro, rising as high as $1.3987 in morning European trading before settling back to $1.3981, above the $1.3971 it bought in late New York trading the night before. The U.S. currency fell below $1.0100 against the Canadian dollar for the first time in nearly 30 years. The British pound rose higher against the dollar, too, reaching $2.0157, slightly above the $2.0131 it fetched late Tuesday in New York.

....

"Some players are wondering if the Fed's decision suggests that the U.S. economy will go from bad to worse in the near future," said Michiyoshi Kato, a senior trader at Mizuho Corporate Bank. "If that is the case, it's very difficult to buy the dollar now."

Readings on core inflation have improved modestly in recent months, and inflation pressures seem likely to moderate over time. However, the high level of resource utilization has the potential to sustain inflation pressures.

The Committee judges that some inflation risks remain. The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Recent readings on core inflation have been somewhat elevated. Although inflation pressures seem likely to moderate over time, the high level of resource utilization has the potential to sustain those pressures.

In these circumstances, the Committee's predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Core inflation remains somewhat elevated. Although inflation pressures seem likely to moderate over time, the high level of resource utilization has the potential to sustain those pressures.

In these circumstances, the Committee's predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Readings on core inflation have improved modestly in recent months. However, a sustained moderation in inflation pressures has yet to be convincingly demonstrated. Moreover, the high level of resource utilization has the potential to sustain those pressures.

In these circumstances, the Committee's predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Readings on core inflation have improved modestly in recent months. However, a sustained moderation in inflation pressures has yet to be convincingly demonstrated. Moreover, the high level of resource utilization has the potential to sustain those pressures.

Although the downside risks to growth have increased somewhat, the Committee's predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the outlook for both inflation and economic growth, as implied by incoming information.

Financial market conditions have deteriorated, and tighter credit conditions and increased uncertainty have the potential to restrain economic growth going forward. In these circumstances, although recent data suggest that the economy has continued to expand at a moderate pace, the Federal Open Market Committee judges that the downside risks to growth have increased appreciably. The Committee is monitoring the situation and is prepared to act as needed to mitigate the adverse effects on the economy arising from the disruptions in financial markets.

Readings on core inflation have improved modestly this year. However, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

Developments in financial markets since the Committee’s last regular meeting have increased the uncertainty surrounding the economic outlook. The Committee will continue to assess the effects of these and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

Economic growth was moderate during the first half of the year. Financial markets have been volatile in recent weeks, credit conditions have become tighter for some households and businesses, and the housing correction is ongoing. Nevertheless, the economy seems likely to continue to expand at a moderate pace over coming quarters, supported by solid growth in employment and incomes and a robust global economy.

Economic growth was moderate during the first half of the year, but the tightening of credit conditions has the potential to intensify the housing correction and to restrain economic growth more generally. Today’s action is intended to help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and to promote moderate growth over time.

Readings on core inflation have improved modestly this year. However, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

Developments in financial markets since the Committee’s last regular meeting have increased the uncertainty surrounding the economic outlook. The Committee will continue to assess the effects of these and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

Late summer brought no relief from soaring foreclosures. The number of homes in some stage of default jumped 36 percent month-over-month in August, according to a regular monthly survey.

Delinquencies and defaults more than doubled year over year to 243,947, according to August figures released Tuesday by RealtyTrac, a marketer of foreclosed properties. RealtyTrac's forecast is for total foreclosure filings to exceed 2 million this year.

Bankrate.com

"The jump in foreclosure filings this month might be the beginning of the next wave of increased foreclosure activity, as a large number of subprime adjustable rate loans are beginning to reset now," James Saccacio, chief executive of RealtyTrac, said in a statement.

The Producer Price Index for Finished Goods fell 1.4 percent in August, seasonally adjusted, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. This decrease followed a 0.6-percent increase in July and a 0.2-percent decline in June. At the earlier stages of processing, prices received by manufacturers of intermediate goods moved down 1.2 percent in August compared with a 0.6-percent advance in July, and the crude goods index dropped 3.0 percent after climbing 1.2 percent in the prior month. (See table A.)

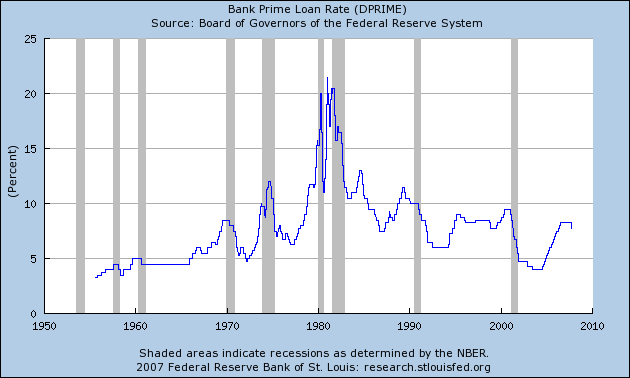

The Federal Reserve will probably cut its benchmark interest rate today for the first time in four years, seeking insurance against a recession. The main question is how big a policy Chairman Ben S. Bernanke is ready to buy.

While a quarter-point reduction in the federal funds rate may not be enough to bolster growth and investor confidence, a half-point cut might fan inflation and be perceived as giving in to pressure from Wall Street firms that made bad bets, especially in the market for securities backed by subprime mortgages.

Bernanke and fellow policy makers ``are really caught,'' said Robert Eisenbeis, a former research director at the Fed's bank in Atlanta who attended meetings of the rate-setting Federal Open Market Committee before retiring early this year. ``The Fed needs to avoid the perception of bailing out the markets, lenders or borrowers.''

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to improve in September, but at a slower pace than in the past few months. The general business conditions index fell to 14.7.

The new orders index dropped, while the shipments index declined sharply. The prices paid index, although elevated, held steady, as the prices received index rose several points. The number of employees index inched upward. Future indexes conveyed continued optimism, with the future shipments index increasing notably. The capital expenditures index fell for a second consecutive month.

Industrial production rose 0.2 percent in August after an increase of 0.5 percent in July. At 114.4 percent of its 2002 average, total industrial production in August was 1.7 percent above its year-earlier level. Manufacturing output fell 0.3 percent in August after five consecutive months of increases, mining output dropped 0.6 percent, but unusually hot weather contributed to an increase of 5.3 percent in the output of utilities.

....

The production of consumer goods edged up 0.1 percent in August. The production of durable consumer goods decreased 1.0 percent; the drop was due mainly to a reduction of 2.1 percent in the output of automotive products. Elsewhere, the output of home electronics declined 0.2 percent; the output of appliances, furniture, and carpeting fell 0.6 percent; but the index for miscellaneous durable goods rose 0.2 percent. The production of nondurable non-energy consumer goods fell 0.3 percent; decreases in the production of foods and tobacco, of clothing, and of paper products more than offset an increase in the production of consumer chemical products. Boosted by residential sales of electricity, the index for consumer energy goods rose 3.5 percent.

The index for business equipment fell 0.2 percent in August. The output of transit equipment declined 0.2 percent, as a reduction in motor vehicle assemblies more than offset an increase in the production of civilian aircraft. The index for industrial and other equipment decreased 0.6 percent; although farm machinery increased for the second month in a row, other machinery categories registered declines. The production of defense and space equipment fell 0.6 percent.

The index for construction supplies stayed flat in August. The index for business supplies rose 1.0 percent as a result of an increase in the commercial sales of electricity; the output of non-energy business supplies was unchanged.

The production of materials rose 0.2 percent in August. Within non-energy materials, the index for durable materials fell 0.2 percent, and the index for nondurable materials fell 0.1 percent. The decrease in durable materials reflected reduced output of motor vehicle parts as well as decreases in a variety of equipment parts. Among nondurable materials, declines in the output of textiles and of chemicals more than offset an increase in the production of paper. The output of energy materials climbed 1.5 percent.