We'll all be back on Monday

Gallup estimates that more than 1.5 million Americans who were underemployed became employed to full capacity over the last month. Gallup's 30-day average underemployment measure (not seasonally adjusted) declined to 19.2% on April 18 -- a sharp improvement from the 20.2% reported on March 21 -- and essentially matching its best level of the year.I point this out because one of this website's trolls has changed his economic indicators every time they turn positive. For example, he no longer quotes the BLS (which is rigged -- rigged I tell you!!!!!!) but instead relies on Gallup. However, now that this number reporting positive news, he'll have to find a more negative jobs number to claim is accurate.

Republicans are stepping up their criticism of the Securities and Exchange Commission following reports that senior agency staffers spent hours surfing pornographic websites on government-issued computers while they were supposed to be policing the nation's financial system. California Rep.

Darrell Issa, the top Republican on the House Oversight and Government Reform Committee, said it was "disturbing that high-ranking officials within the SEC were spending more time looking at porn than taking action to help stave off the events that put our nation's economy on the brink of collapse." He said in a statement Thursday that SEC officials "were preoccupied with other distractions" when they should have been overseeing the growing problems in the financial system.

The SEC's inspector general conducted 33 probes of employees looking at explicit images in the past five years, according to a memo obtained by The Associated Press. The memo says 31 of those probes occurred in the 2 1/2 years since the financial system teetered and nearly crashed.

The staffers' behavior violated government-wide ethics rules, it says. The memo provides fresh ammunition for Republicans who suspect the timing of the SEC's lawsuit last week against Wall Street powerhouse Goldman Sachs Group Inc. News of the suit came as the Senate prepared to take up a sweeping overhaul of the rules governing banks and other financial companies.

In 2004, well before the risks embedded in Wall Street’s bets on subprime mortgages became widely known, employees at Standard & Poor’s, the credit rating agency, were feeling pressure to expand the business.One employee warned in internal e-mail that the company would lose business if it failed to give high enough ratings to collateralized debt obligations, the investments that later emerged at the heart of the financial crisis.“We are meeting with your group this week to discuss adjusting criteria for rating C.D.O.s of real estate assets this week because of the ongoing threat of losing deals,” the e-mail said. “Lose the C.D.O. and lose the base business — a self reinforcing loop.”

.....

In June 2005, an S.& P. employee warned that tampering “with criteria to ‘get the deal’ is putting the entire S.& P. franchise at risk — it’s a bad idea.” A Senate panel will release 550 pages of exhibits on Friday — including these and other internal messages — at a hearing scrutinizing the role S.& P. and the ratings agency Moody’s Investors Service played in the 2008 financial crisis. The panel, the Permanent Subcommittee on Investigations, released excerpts of the messages Thursday.

The released documents will be very interesting to read.

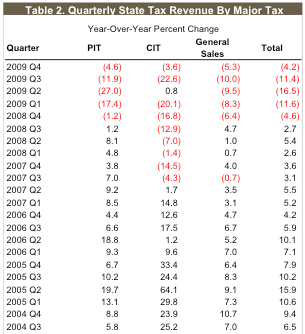

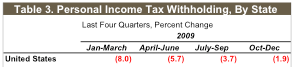

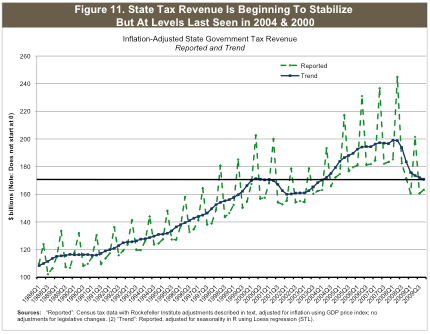

Total state tax revenues in the fourth quarter of 2009 declined by 4.2 percent relative to a year ago. The income tax was down by 4.6 percent, the sales tax was down by 5.3 percent, and the corporate income tax declined by 3.6 percent [vs. a year previously].Note that these are all year-over-year calculations. The Rockefeller Institute explains that while

....

Preliminary figures for January and Februrary for 45 early-reporting states show continued weakness, with personal income collections dropping 7.1 percent and overall tax collections dropping 2.2 percent from a year earlier.

....

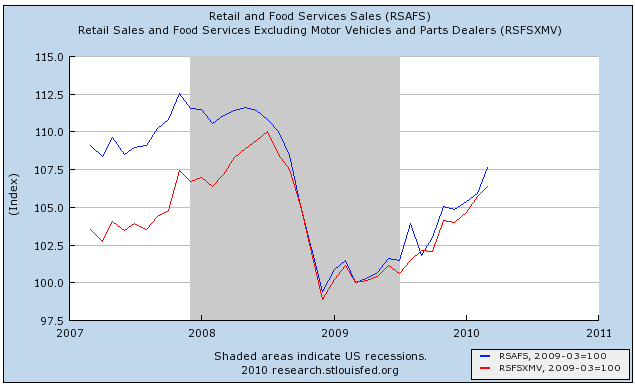

Preliminary figures for the 41 of 45 early reporting states with broad-based sales tax indicate that sales tax collections saw some trivial yet positive growth at 0.1 percent in January-February 2010 compared to the same period of 2009, but nonetheless the sales tax in the median state for these two months was down 4.2 percent. While March data could change the picture, the sales tax could see small positive growth in the January-March quarter as a result of stabilizing retail sales and consumption as well as legislated changes in several states

most economic time series have been adjusted to remove seasonality so that comparisons from one period to the next are meaningful[, g]overnment tax data, by contrast, rarely are adjusted to remove seasonal variations....Looking at revenues on an annualized basis also makes sense because states are interested in how revenues compare with their annual budgets.

[P]reliminary data on tax collections in January and February in 45 states show that year-over-year increases are few and far between. Tax revenue is continuing to decline in the median state, and at this point it appears as if the January-March quarter will have declines in the median state. … athough there is evidence of further slowing in the rate of decline. With preliminary data for January and February now available for 45 states, tax revenue for the two months combined has declined further by 2.2 percent versus the same period last year. About 84 percent of states reporting personal income tax data had a year-over-year decline, with a median decline of 7.1 percent, while 80 percent of states reporting sales-tax data had a year-over-year decline.As indicated above, the late breaking news is March. The Rockefeller Institute report itself noted that "March data could change this troubling picture" and there is reason to believe it indeed has. According to the March 30 edition of Business Week:

The two-year slide in tax collections that opened a $196 billion gap in U.S. state budgets has stopped, easing pressure on credit ratings and giving leeway to lawmakers as they craft spending plans for next year. The 15 largest states by population forecast a 3.9 percent gain in tax revenue in fiscal 2011, budget documents show. The 50 states on average may increase collections by about 3.5 percent, the first time in two years the figure is expected to grow, said Mark Zandi, chief economist at Moody’s Economy.com. California took in 3.9 percent more since December than projected in January, Controller John Chiang said this month. New York got $129 million above forecasts in its budget year through February, according to a report from Comptroller Thomas DiNapoli. In New Jersey, the second-wealthiest state per capita, January sales-tax collections were 1.9 percent higher than a year earlier, the first annual increase in 19 months, forecasters said in a report last month.In addition to California, New York, and New Jersey, I have been following about half a dozen other states to see when their sales tax revenues would increase YoY, ending any doubts about the upward turn in retail sales. Here are the results as of their latest reports:

while real retail sales have been rising from their lows for about the last year, they are still more than six percent below their prerecession peak. So even if sales taxes mirrored retail sales, they would be well below their recession peak. In fact, though, many state sales taxes exempt food and other necessities, and exempt or exclude many services, relying more heavily on non-necessities. Many of these taxable goods and services — such as cars, other durable goods and restaurant meals — are far easier to do without or postpone than are necessities and they tend to be more volatile and suffer greater declines in business downturns.

This fiscal year, the 15 largest states expect to collect 11 percent less taxes than in fiscal 2008, budget proposals show. It won’t be until 2013 that revenue returns to 2008 levels, said New Jersey’s Rosen and Barry Boardman, the North Carolina General Assembly’s chief economist.In the meantime, a continued Federal line of life support is necessary. Allowing fiscal assistance to the states to expire would be the worst kind of Hooverism (and actually, that's a slander on Herbert Hoover). The Federal government should extend low-interest grants to the states which do not have to be repaid until state budgets firmly reflect economic expansion.

A Senate panel is blaming credit rating agencies for helping banks disguise the risks of investments they marketed.The Permanent Subcommittee on Investigations says in a report that the rating agencies relied on hefty fees from banks, which wanted them to rate risky investments as safe.

Initial jobless claims fell back to trend in the April 17 week, coming in at a largely as-expected 456,000 and reversing two weeks of administrative delays that swelled claims to as high as 480,000 in the prior week (revised from 484,000). The 456,000 level compares with 445,000 in the March 20 period, offering a flat comparison at best to gauge monthly payroll change. Despite the distortions of the prior two weeks, the four-week average shows a similar comparison: at 460,250 vs. 454,000 at mid-March. Continuing claims for the April 10 week fell 40,000 to 4.646 million with the four-week average down slightly to 4.644 million.

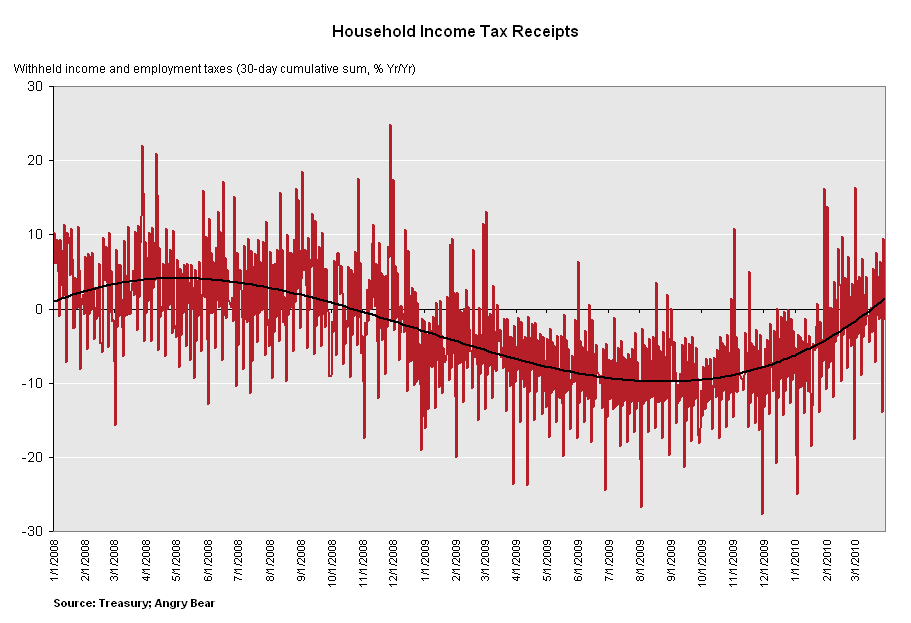

Rising tax receipts will likely reduce U.S. government borrowing needs in the rest of this fiscal year and fiscal 2011, Morgan Stanley said on Wednesday.Less supply may end up hurting bonds because it signals an improving U.S. economy -- which is typically negative for Treasuries, the U.S. investment bank's analysts said in a research note.

They predicted U.S. long-dated Treasury supply would fall by $52 billion for the remainder of fiscal 2010 and by $589 billion in fiscal 2011.

"While we are encouraged by this improvement it's hard to get too excited because it's like drowning in 75 feet of water instead of 100 feet of water," they wrote in the note.

Foreclosure activity of all types spiked in the first quarter of 2010 according to RealtyTrac. Activity is now at an all time record of 932,234 properties.[N.B.: Mish has been a reliable contrary indicator for the last year, unintentionally telegraphing turning points in data. Keep in mind below his contention that foreclosures "spiked" in the first quarter.]

| Month | YoY % change | actual foreclosures |

|---|---|---|

| 04/2009 | +32 | 342,038 |

| 05/2009 | +18 | 321,480 |

| 06/2009 | +33 | 336,173 |

| 07/2009 | +32 | 360,149 |

| 08/2009 | +18 | 358,471 |

| 09/2009 | +29 | 343,638 |

| 10/2009 | +19 | 332,292 |

| 11/2009 | +22 | 306,627 |

| 12/2009 | +15 | 349,519 |

| 01/2010 | +15 | 315,716 |

| 02/2010 | +6 | 308,524 |

| 03/2010 | +8 | 367,056 |

There is a growing risk that deflation will be seen as the gravest threat to the US economy by the end of the year, warns Nick Beecroft, senior FX consultant at Saxo Bank.

He notes that the minutes of last month’s Federal Reserve policy meeting show the US central bank becoming increasingly concerned with the fall in inflation.

And the latest consumer price data will have reinforced these worries, he says. “As the year progresses, the output gap – exemplified by the still chronically weak labour market and very low levels of capacity utilisation – will lead inflation inexorably towards zero.”

Meanwhile, a sizable increase in energy prices pushed up headline consumer price inflation in recent months; in contrast, core consumer price inflation was quite low.

.....

Although rising energy prices continued to boost overall consumer price inflation, consumer prices excluding food and energy were soft, as a wide variety of goods and services exhibited persistently low inflation or outright price declines. On a 12-month change basis, core personal consumption expenditures (PCE) price inflation slowed in January 2010 compared with a year earlier, as a marked and fairly widespread deceleration in market-based core PCE prices was partly offset by an acceleration in nonmarket prices. Survey expectations for near-term inflation were unchanged over the intermeeting period; median longer-term inflation expectations edged down to near the lower end of the narrow range that prevailed over the previous few years. With regard to labor costs, the revised data on wages and salaries showed that last year's deceleration in hourly compensation was even sharper than was evident at the January meeting.

.....

Headline consumer price inflation picked up around the world over the past two months, principally reflecting increases in food and energy prices. Excluding food and energy, consumer prices were generally more subdued.

.....

Reflecting these developments, inflation compensation--the difference between nominal yields and TIPS yields for a given term to maturity--declined over the period, a move that was supported by the somewhat weaker-than-expected economic data and the publication of lower-than-expected readings on consumer prices.

.....

Recent data on consumer prices and unit labor costs led the staff to revise down slightly its projection for core PCE price inflation for 2010 and 2011; as before, core inflation was projected to be quite subdued at rates below last year's pace. Although increased oil prices had boosted overall inflation over recent months, the staff anticipated that consumer prices for energy would increase more slowly going forward, consistent with quotes on oil futures contracts. Consequently, total PCE price inflation was projected to run a little above core inflation this year and then edge down to the same rate as core inflation in 2011.

.....

Participants saw recent inflation readings as suggesting a slightly greater deceleration in consumer prices than had been expected. In light of stable longer-term inflation expectations and the likely continuation of substantial resource slack, they generally anticipated that inflation would be subdued for some time.

.....

Participants referred to a wide array of evidence as indicating that underlying inflation trends remained subdued. The latest readings on core inflation--which exclude the relatively volatile prices of food and energy--were generally lower than they had anticipated, and with petroleum prices having leveled out, headline inflation was likely to come down to a rate close to that of core inflation over coming months. While the ongoing decline in the implicit rental cost for owner-occupied housing was weighing on core inflation, a number of participants observed that the moderation in price changes was widespread across many categories of spending. This moderation was evident in the appreciable slowing of inflation measures such as trimmed means and medians, which exclude the most extreme price movements in each period.

In discussing the inflation outlook, participants took note of signs that inflation expectations were reasonably well anchored, and most agreed that substantial resource slack was continuing to restrain cost pressures. Measures of gains in nominal compensation had slowed, and sharp increases in productivity had pushed down producers' unit labor costs. Anecdotal information indicated that planned wage increases were small or nonexistent and suggested that large margins of underutilized capital and labor and a highly competitive pricing environment were exerting considerable downward pressure on price adjustments. Survey readings and financial market data pointed to a modest decline in longer-term inflation expectations over recent months. While all participants anticipated that inflation would be subdued over the near term, a few noted that the risks to inflation expectations and the medium-term inflation outlook might be tilted to the upside in light of the large fiscal deficits and the extraordinarily accommodative stance of monetary policy.

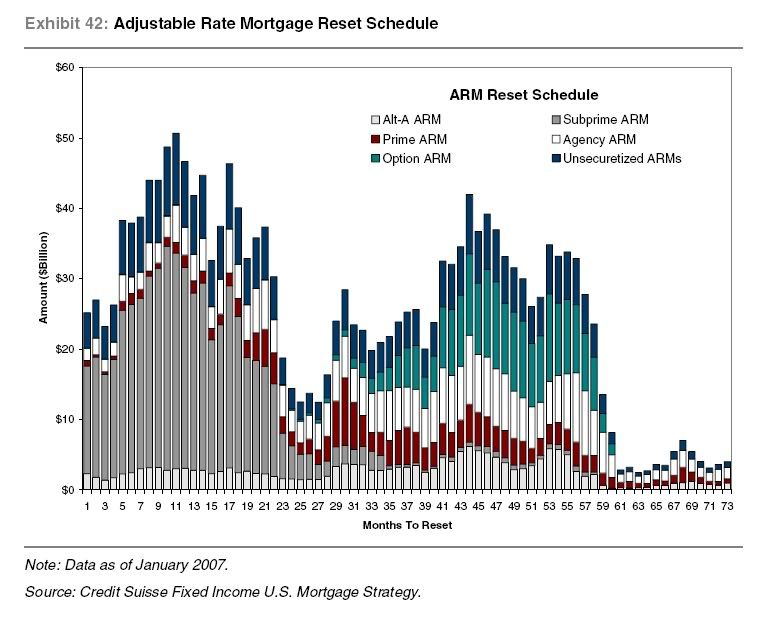

Housing related prices have stalled for nearly two years. Given the current state of the housing market, this is to be expected (see the discussion on the housing market here). But housing accounts for 41.960% of the overall CPI index, leading to a conclusion that these prices are having an incredibly negative impact on overall CPI.

Housing related prices have stalled for nearly two years. Given the current state of the housing market, this is to be expected (see the discussion on the housing market here). But housing accounts for 41.960% of the overall CPI index, leading to a conclusion that these prices are having an incredibly negative impact on overall CPI.