- by New Deal democrat

No economic news today. So, now that we have the September inflation read, let’s take a look at a couple of important consumer indicators: real average wages, and real aggregate payrolls for non-supervisory workers.

Real average hourly wages for non-supervisory employees have declined almost relentlessly since last September, only broken during months where gas prices were steady or declined:

The total decline since then is -2.5% YoY:

Frequently - but not always, this level has been associated with recessions:

The only way to keep up consumer spending in the face of such a decline is either to cash out an asset (e.g., a cash out refinance of a house) or to dig into savings (in the 1980s, it was assisted by women’s entry into the workforce, which boosted *household* income). And as I’ve written the past couple of months, the personal saving rate, at 3.5% in August (after a 15 year low of 3.0% in June), is near all-time lows, equivalent to the 2005-07 period:

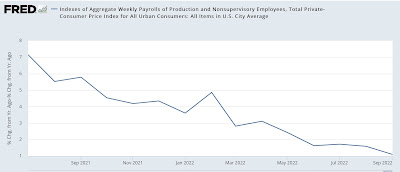

Meanwhile, as I suggested they would several weeks ago, real aggregate payrolls for non-supervisory employees did improved in the 3rd Quarter:

As I wrote then, that pretty effectively kills the idea that a recession has already begun.

But they are only up 1.1% in the past year:

As I wrote recently, real aggregate non-supervisory payrolls are a good coincident to short leading indicator for a recession, because they tend not to be noisy, and with the notable but I believe irrelevant exception of the 2003 “jobless recovery,” whenever they have declined YoY (1967 and 1996 were close to zero, but no cigar), a recession has either begun or is going to start in less than a year:

In the past year, real aggregate payrolls have decelerated at a pace of 1% every 4 months. Which means that if that pace continues, they will turn negative in January or February of next year.

And remember: although I won’t bother with the graph, consumption leads employment, and real consumption has been essentially flat to slightly declining for over a year. So there is no reason to expect the pace of employment not to keep slowing down.

In fact, there are a couple of reasons to expect that it *will* keep declining.

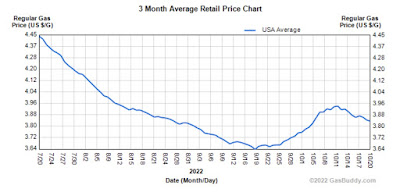

First, gas prices stopped declining with OPEC’s cutback in production:

One month ago the nationwide average gas price was $3.64/gallon. It rose as high as $3.95 before declining back to $3.85 today.

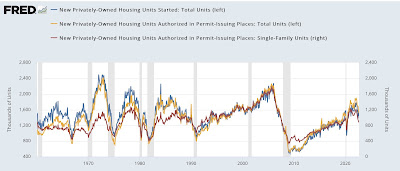

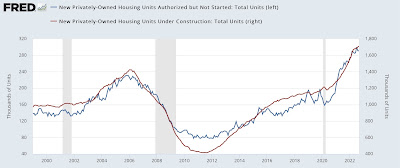

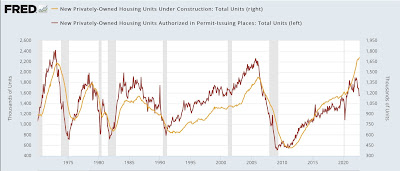

What is more serious is what has happened to mortgage payments. I last looked at this

back in April.

Here’s what has happened to mortgage rates in the past year:

They have risen from just over 3% last October to just over 7% now.

Back in April I calculated that house prices in real terms were almost identical to their 2006 highs. They got a little higher by summer, and have fallen back a little since, so they are about the same now as they were then.

That being the case, let’s compare a $250,000 mortgage at the peak of the housing bubble 15+ years ago and now at the prevailing mortgage rates in real terms. Here’s the monthly payment for each in today’s $$$:

April 2006: $1865.

July 2006: $1913.

October 2021: $1337.

October 2022 $1947.

That’s a new all-time record high. And an extra $600/month is going to price a lot of people out of the market. We’ll see what September housing permits and starts bring us Wednesday, existing home sales on Thursday, and new home sales next week. But it’s not likely to be good.

Finally, this brings to the fore my alternate, “consumer nowcast” model of recession. This states that when real wages decline, if consumers can’t cash in an appreciating asset like stocks (down almost 25% since their peak in January), or housing equity (which likely peaked over the summer), and they start to save more (possibly the 3.0% June saving rate was the low for this expansion), a recession is imminent. This model has now been triggered: it signals that a recession is likely, and very soon, as in Q1 2023. The only questionable component is whether the increase in the savings rate persists.

In summary, we have average Americans with very little more money in real terms to spend in total vs. one year ago, and less money per capita. This by itself should cause new hiring to flag somewhat more than it already has from last year’s blistering pace. And two very big, very important spending items aren’t getting any better and in one case has gotten much, much worse. This is, to say the least, not a recipe for expecting a turnaround to the downward pace.