Yesterday, the Federal Reserve issued the

Beige Book, which provides great anecdotal information on the economy. The previous link is to the entire piece, which I recommend for anyone. Here are the important excerpts (offset and in italics) with commentary and charts (what else).

Reports indicate that holiday sales were generally disappointing. Sales in the Atlanta, Boston, Chicago, Cleveland, Dallas, New York, Richmond, and San Francisco Districts were varyingly described as lackluster, weak, below year-ago levels, or mixed. Kansas City reported that spending was solid, but below expectations. Sales rose modestly according to Minneapolis, Philadelphia, and St. Louis reports. Atlanta and New York merchants noted that foreign buyers were a boost to holiday sales. Overall, the outlook for 2008 among retail merchants was cautious.

8 districts reported poor holiday sales. That's a clear majority and it is not a good sign. This information jibes with the latest retail economic data. The Census Bureau

recently reported:The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $382.9 billion, a decrease of 0.4 percent (±0.7%)* from the previous month, but 4.1 percent (±0.7%) above December 2006. Total sales for the 12 months of 2007 were up 4.2 percent (±0.4%) from 2006. Total sales for the October through December 2007 period were up 4.9 percent (±0.5%) from the same period a year ago. The October to November 2007 percent change was revised from +1.2 percent (±0.7%) to +1.0 percent (±0.2%).

Also note that traders have been dumping retail shares.

Notice the following with the retail ETF:

-- Prices are more than 10% below the 200 day SMA

-- All the SMAs are heading lower

-- The shorter SMAs are below the longer SMAs

-- Prices are below 3 of the SMAs and are just barely above the 10 day SMA.

In short -- traders are clearly selling the retail sector.

Most Districts reported that vehicle sales for late 2007 were below year-ago levels. However, the Minneapolis report noted strong demand from area farmers and Canadians purchasing vehicles across the border. The Atlanta and Kansas City Districts reported that sluggish vehicle demand has resulted in unexpected inventory accumulation. However, imports and fuel-efficient vehicles continued to sell well according to the Philadelphia, Kansas City, and Dallas reports. Atlanta noted that some foreign brands had turned to fleet sales to offset generally weaker retail demand. Dealers in Philadelphia and Cleveland anticipated that sales in 2008 would be flat to lower than in 2007.

All the auto markets -- even Toyota -- are taking a hit right now.

All three charts are pretty ugly. Notice:

-- Prices are below all the SMAs

-- All the SMAs are headed lower

-- Prices are below the 200 day SMA (yes, even Toyota).

Most reports cited robust demand in several nonfinancial service industries including health care, hospitality, legal, and insurance. According to Atlanta, the demand for engineers, particularly in petrochemical fields, was very strong. Reports on temporary staffing services were mixed. For instance, Dallas and Philadelphia noted that employment firms reported weaker demand for temporary workers, whereas New York and Richmond reported relatively strong demand.

Health care is pretty resistant to economic downturns, so this shouldn't be a surprise. In addition, as the US population gets older, the entire field of older person care will continue to grow. Health care employment was on of the continuing bright spots for this cycle.

And "leisure and hospitality" (think, "you want fries with that) has been doing well.

As has professional services:

I have to wonder about the long-term viability of professional services with the housing slowdown going.

Reports on manufacturing activity varied. Kansas City reported that manufacturing was expanding and that manufacturers were relatively upbeat. Cleveland reported that manufacturing output remained steady overall, whereas Dallas indicated that conditions continued to soften. New York reported that manufacturing activity appeared to weaken somewhat in early December, but noted some improvement later in the month. Among the positive reports, San Francisco noted that production and new orders for commercial aircraft and parts remained solid, while sales of information-technology products continued to increase moderately. Boston said that sales of aircraft equipment and pharmaceuticals continued to rise at a robust rate. Atlanta and Minneapolis noted that defense and energy-related manufacturers reported strong activity. St. Louis and San Francisco reported that the local food production industry was expanding.

I noted the industrials a few days ago. This sector is not looking good right now.

-- Prices have moved below the 200 day SMA

-- The shorter SMAs are below the longer SMAs

-- Prices are below all the SMAs, which will pull the overall trend lower

-- The shorter SMAs have crossed the 200 day SMA, adding downward pressure to the long-term trend.

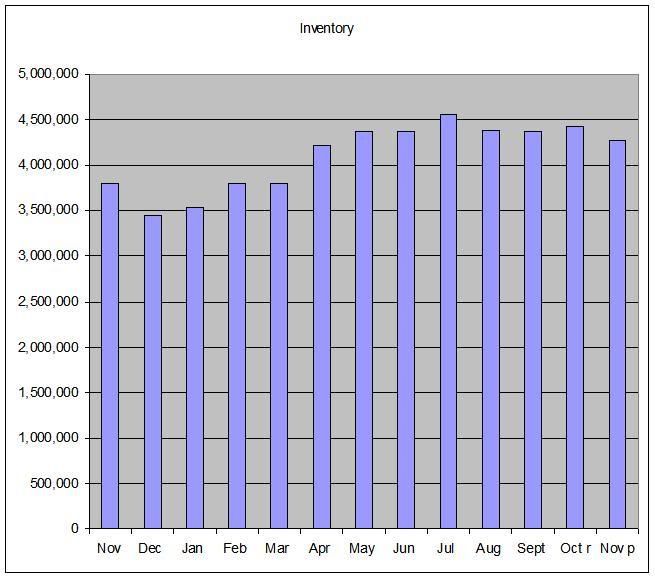

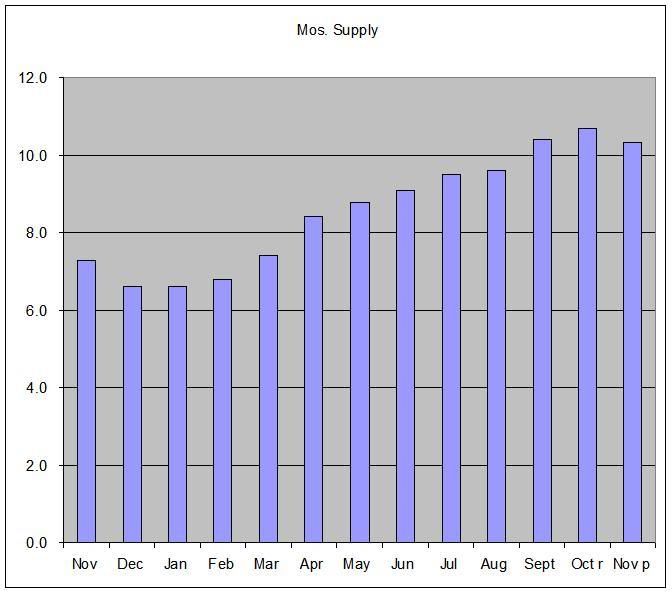

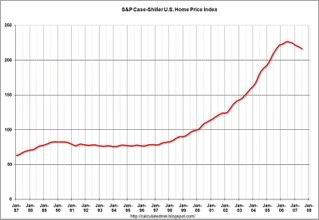

Conditions in most housing markets remained quite weak through year-end. The pace of sales continued to be sluggish, and inventories persisted at historically high levels according to most Districts. Home construction levels continued to decline according to Atlanta, Chicago, Dallas, Kansas City, and St. Louis reports. Reports on home prices varied. While Dallas observed that home prices were steady, Atlanta, Cleveland, Kansas City, New York, and Richmond reported that prices declined; the Boston and San Francisco Districts said that changes in home prices were mixed. Overall, contacts anticipate that housing markets will remain weak during the first part of 2008.

Gee -- housing's a wreck. Who would have thought that?

The real estate and homebuilders ETF are both very bearish. Notice the following:

-- Prices are below the 200 day SMA

-- The shorter SMAs are below the longer SMAs

-- All the SMAs are headed lower

-- Prices are below all the SMAs

Reports suggest that both business and consumer lending activity slowed in most Districts from mid-November through December. Residential mortgage lending continued to contract in all Districts while refinancing activity varied. For instance, Chicago and Richmond noted increased refinancing activity, but New York cited widespread declines in refinancing. Reports on commercial real estate loan demand were also mixed, although Dallas and Cleveland noted relatively healthy demand. Most reports indicated that credit standards for most loan categories had tightened over the period. Downward pressure on deposits was noted by Chicago, New York, Philadelphia, St Louis, Kansas City, and Dallas. Several Districts reported declines in loan quality and increased delinquencies.

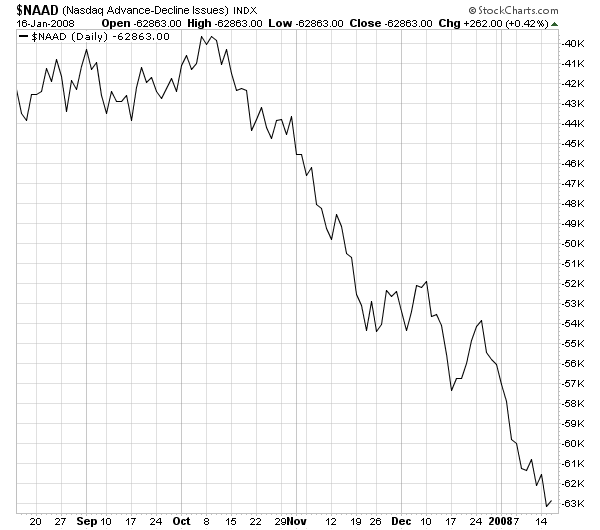

The US financial system is a wreck right now.

Notice the following:

-- Prices are below the 200 day SMA

-- The shorter SMAs are below the longer SMAs

-- All the SMAs are headed lower

-- Prices are below all the SMAs

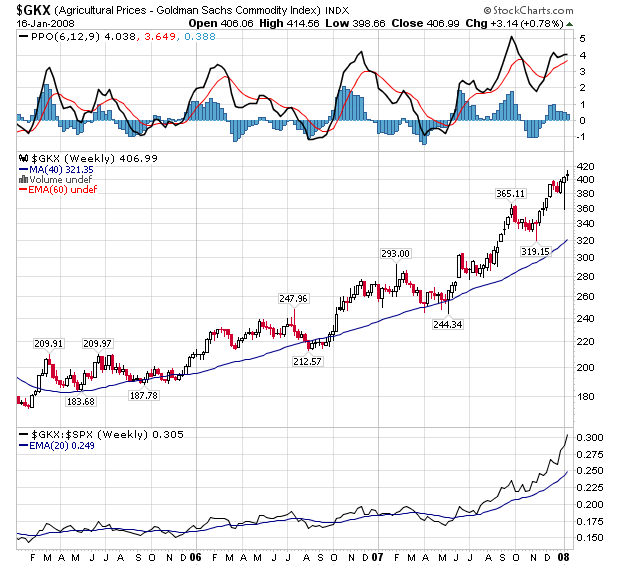

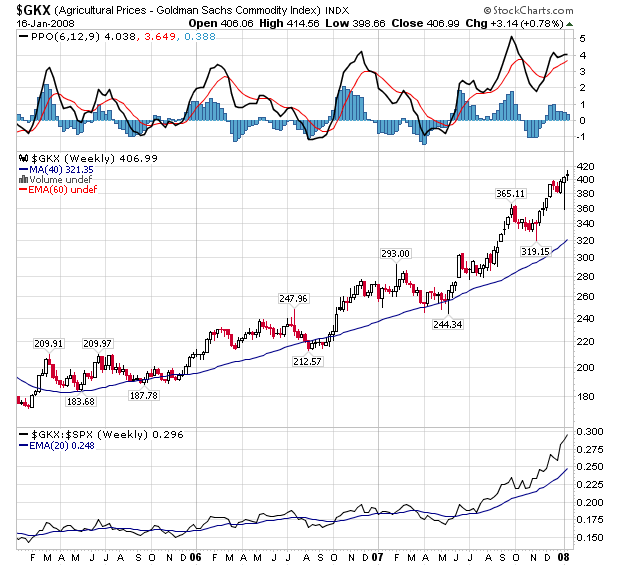

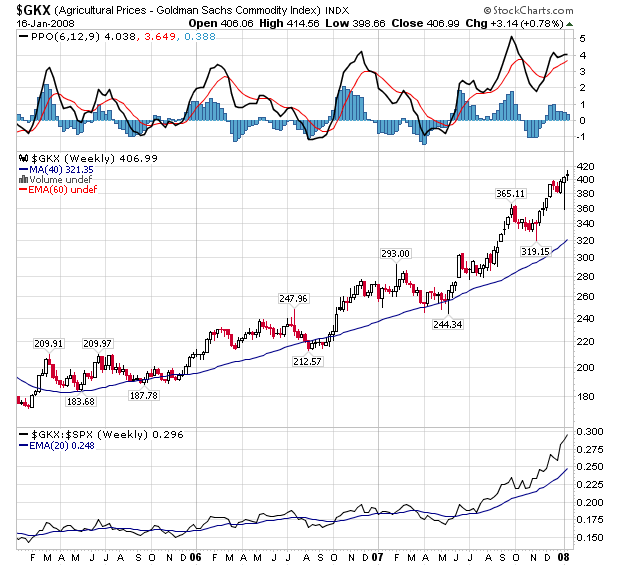

The performance of the agricultural sector across Districts was generally favorable. Upbeat conditions in Chicago, Minneapolis, and San Francisco were attributed to a combination of higher crop prices and favorable weather. Dallas and San Francisco reported strong domestic and global demand for their products. Kansas City reported that strong demand and low inventories boosted prices and income for crop producers. However, despite recent rains, conditions for drought-stricken areas in the Atlanta and Richmond Districts remained generally poor.

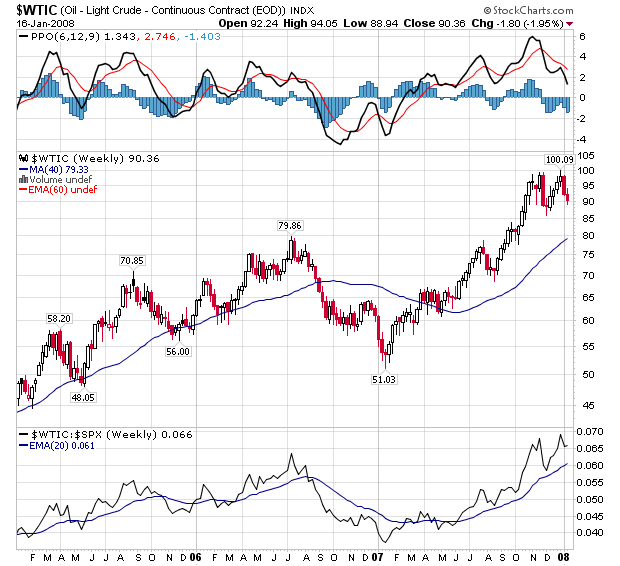

Activity in the energy sector increased according to the Atlanta, Dallas, Kansas City, and Minneapolis Districts. Dallas noted a sharp rise in the Texas rig count while Kansas City cited strong drilling activity in Oklahoma and Colorado. However, seasonal factors dampened drilling activity in the Cleveland District, and reports on coal production in the region were mixed. Atlanta indicated that Gulf Coast crude inventories were low, but new offshore platforms should help boost production in 2008.

Agricultural prices are in the middle of a three year bull run. There are strong fundamental reasons for this: India's and China's increased living standards, the use of agricultural additives to the fuel suppply and drought issues in some parts of the world.

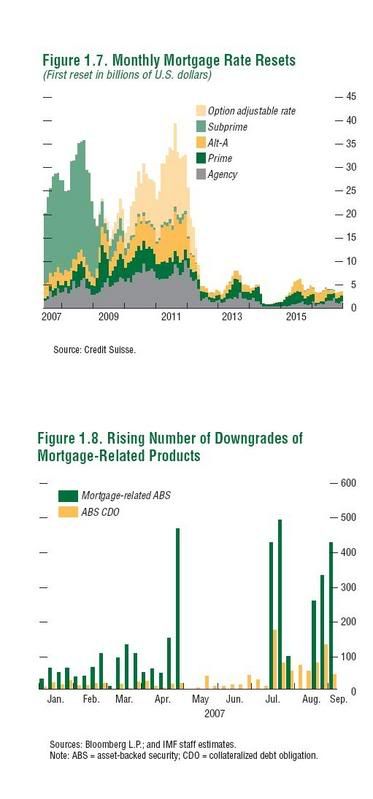

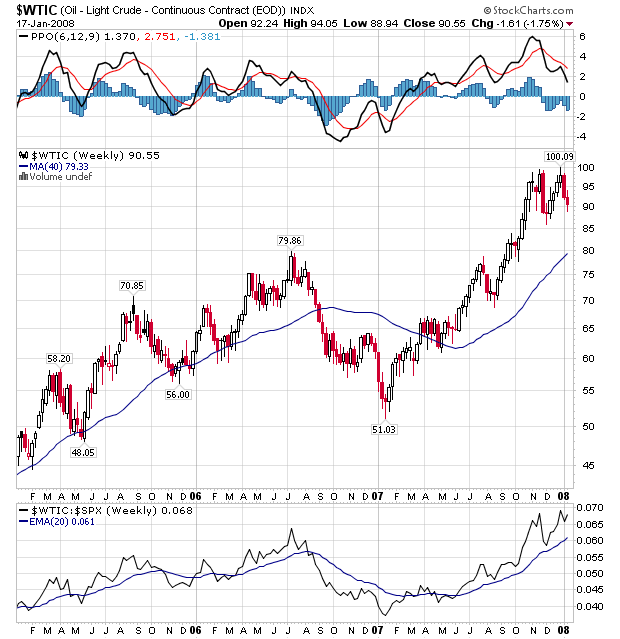

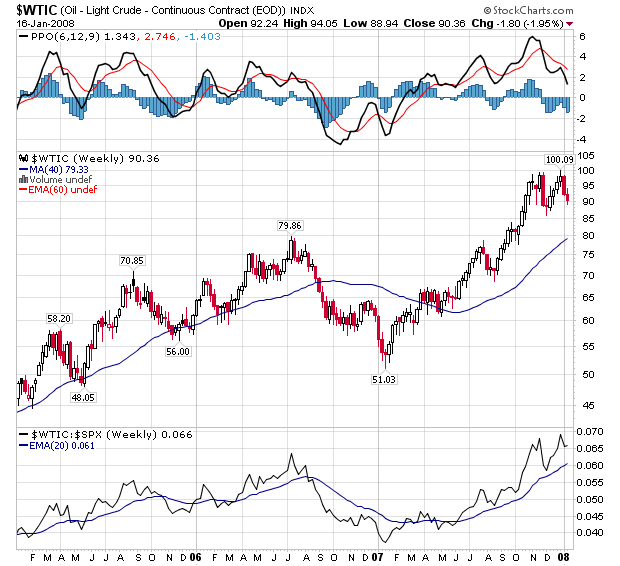

Yesterday I speculated that oil may be forming a double top. Something I will add to that analysis is the continuing decline of

US stockpiles.

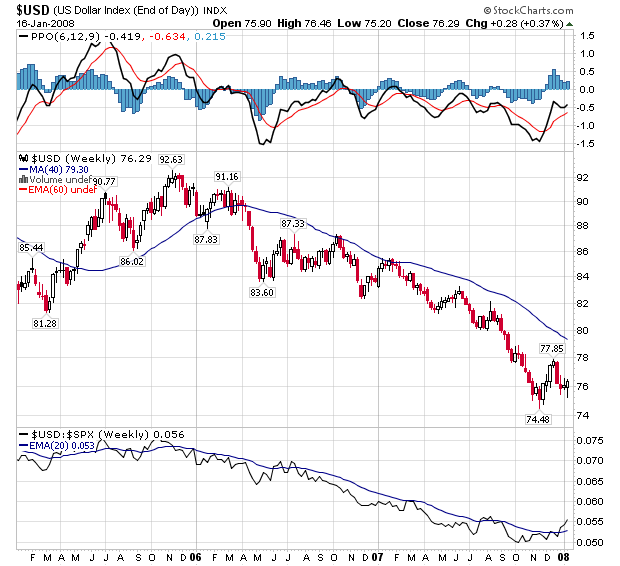

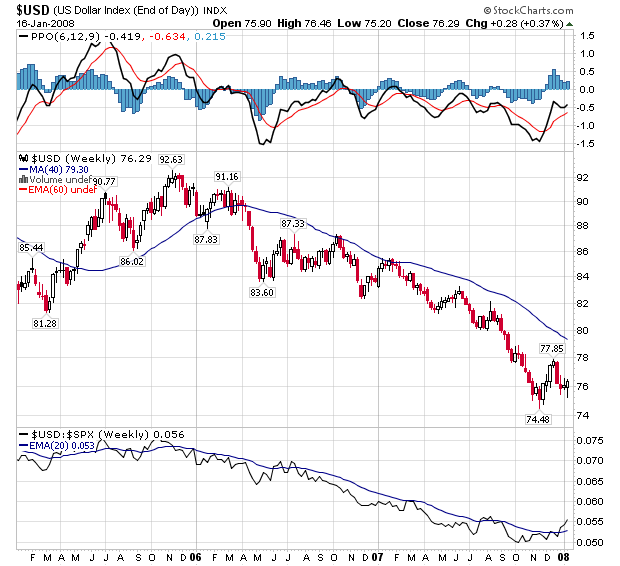

And the continuing move lower by the US dollar:

Because oil is priced in dollars, a drop in the dollar is a de facto increase in oil's price.

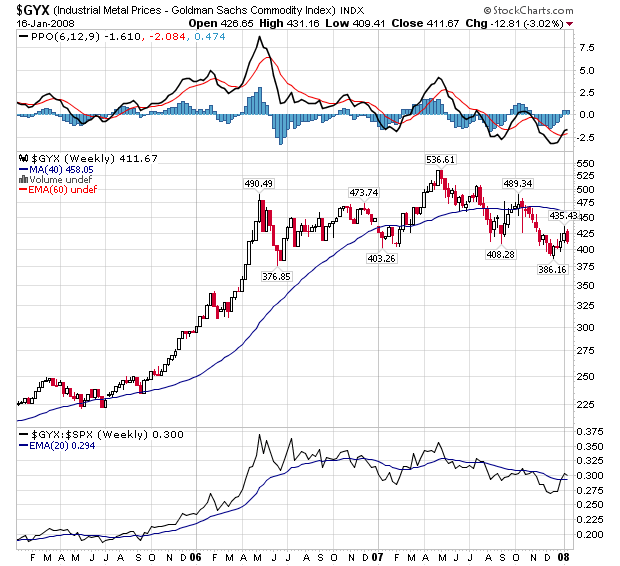

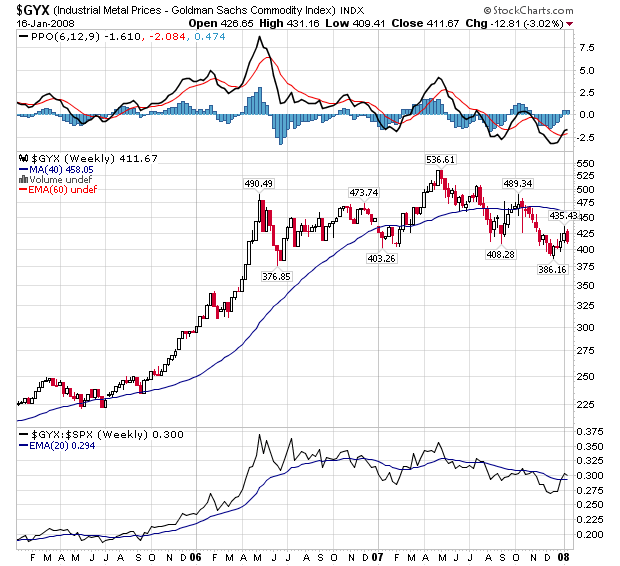

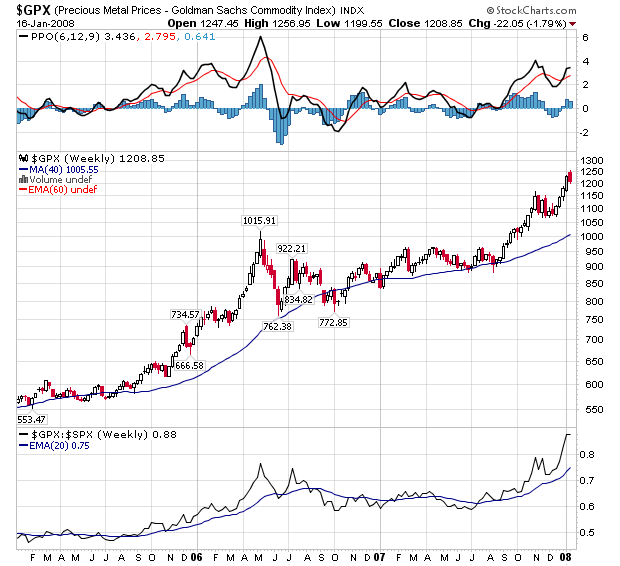

Industrial metals have been in a trading range/consolidation pattern for the last two years. However,

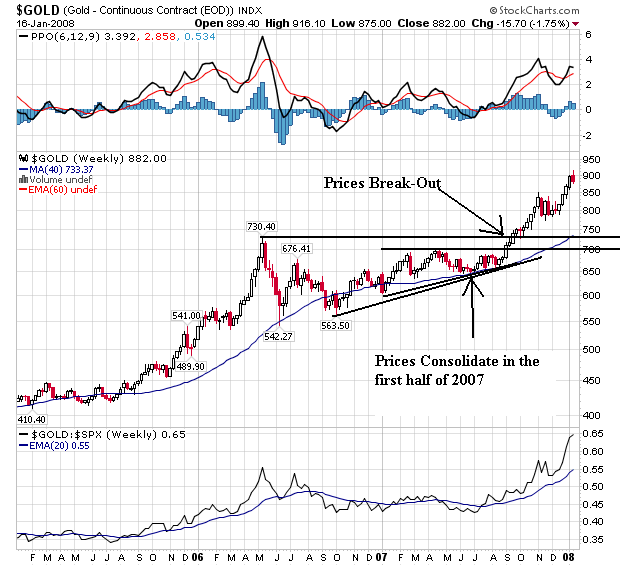

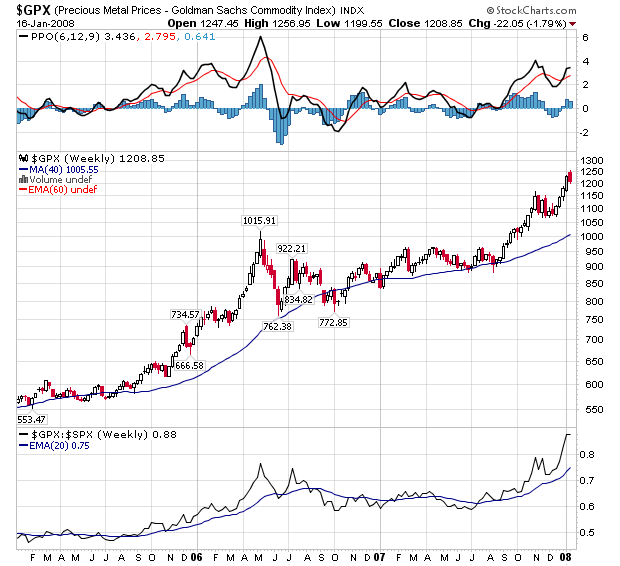

Precious metals are increasing, largely as an inflation hedge.

There really isn't that much good news in the report. Outside of agricultural prices and exports everything else is in questionable territory.