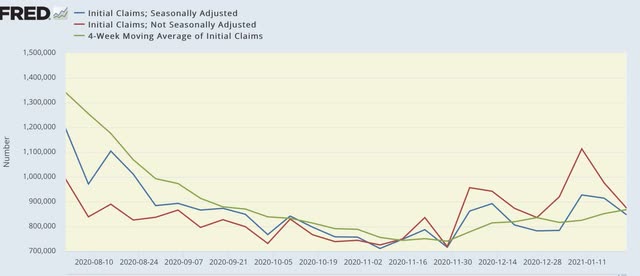

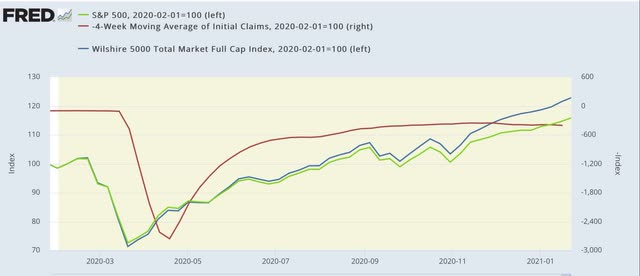

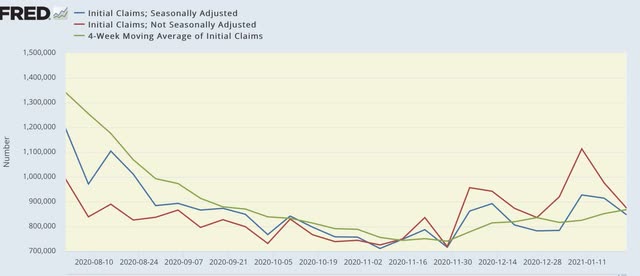

On a unadjusted basis, new jobless claims declined by 101,498 to 873,966. Seasonally adjusted claims also declined by 67,000 to 847,000. The 4 week moving average, however, rose by 16,250 to 868,000. Since the 4 week average has risen above 850,000, and weekly claims were above 900,000 for several weeks in a row, jobless claims have finally met my criteria confirming a change to an upward trend.

Here is the close up since the end of July (these numbers were in the range of 5 to 7 million at their worst in early April):

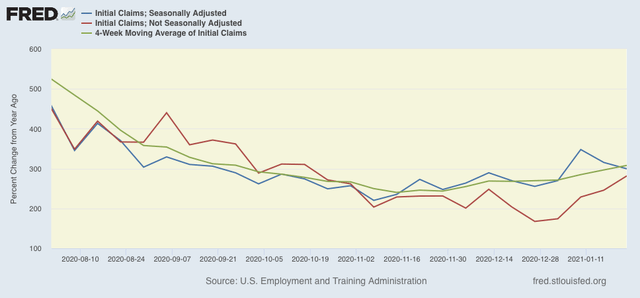

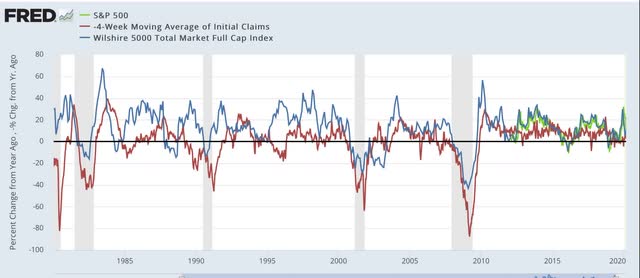

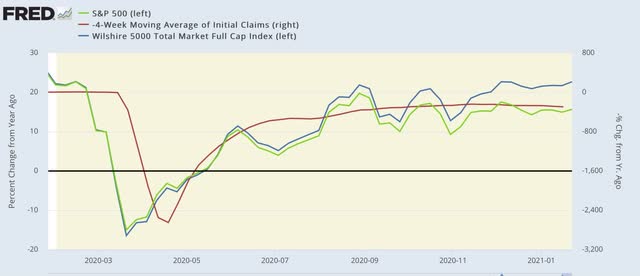

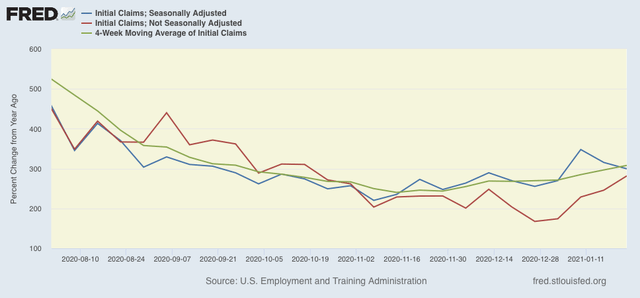

Because of the huge swings caused by the scale of the pandemic - typically claims only vary by 20,000 or less from week to week, but since the start of the pandemic, swings of 50,000 or 100,000 per week have happened as often as not - and because the holiday season even in ordinary years plays havoc with seasonal adjustments, I have been posting the YoY% change in the numbers as well, since they will be much less affected by scale.

Here’s what that looks like:

There is much less noise in the numbers, and while the change is more muted, the trend is now clearer. Both seasonally adjusted metrics are more than 300% higher YoY vs. 200-225% in November, while unadjusted claims are close to 300% vs. just over 200% higher YoY in early November.

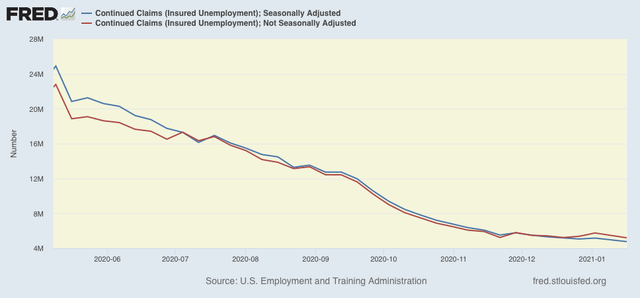

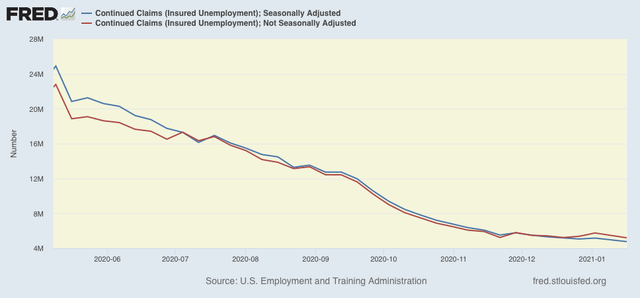

The story remains different with continuing claims, which historically lag initial claims typically by a few weeks to several months. Seasonally adjusted continuing claims declined by 203,000 to 4,771,000, while the unadjusted number declined by 274,055 to 5,208,719, both yet another pandemic low:

Because these lag initial claims, I have suspected that we would see an upward reversal, but obviously that hasn’t happened yet.

As I usually note, a reminder that both initial and continued claims remain at or above their worst levels from the Great Recession.

Finally, because for the past three weeks new claims have averaged about 40,000 higher than the comparable weeks in December, it appears more likely than not that we will see another slightly negative jobs report for January when it is reported next week.

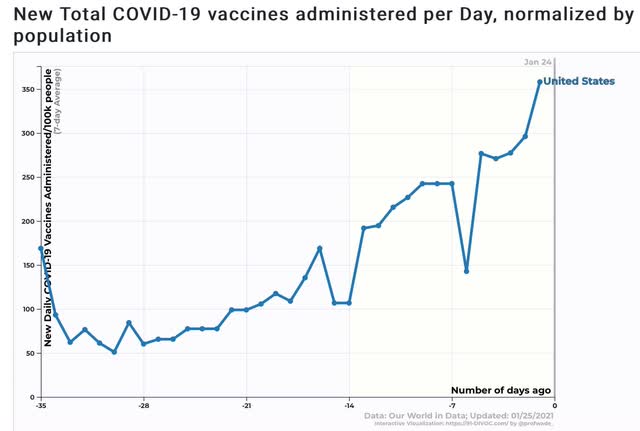

Winter is going to give way to spring from south to north over the next 10 weeks, and already we have seen a much more coherent, comprehensive, and forceful approach to the pandemic from the new Biden Administration. For both of those reasons, I am expecting the trend in claims to peak and to reverse again by the beginning of April - hopefully for good.