- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

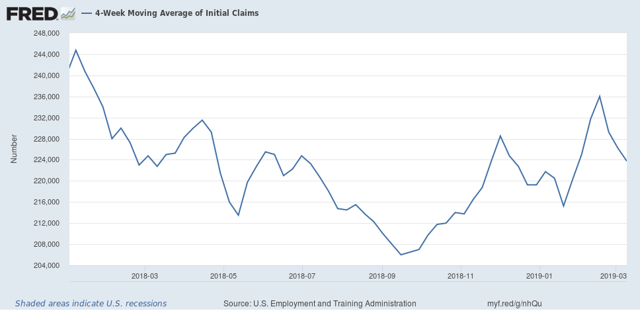

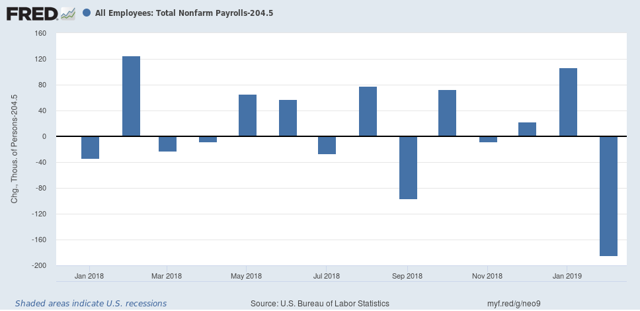

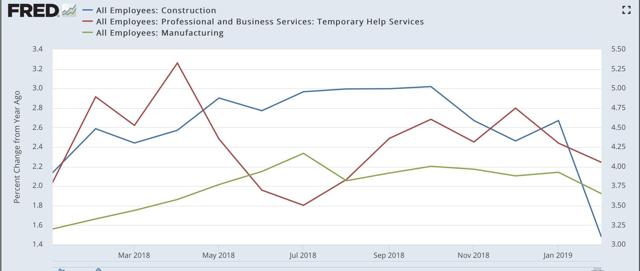

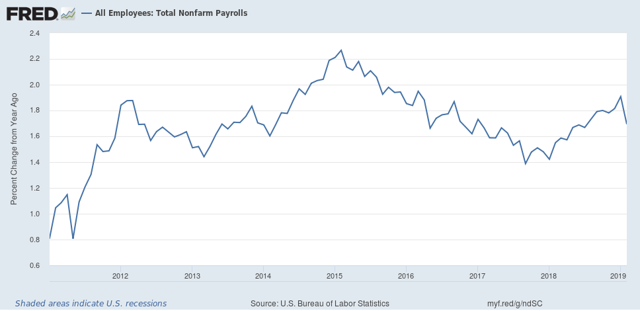

The rebound after the government shutdown has lifted the nowcast into slightly positive territory. Still, it seems clear at this point that the shutdown caused the already-weakening economy to skirt with recession during December and January.

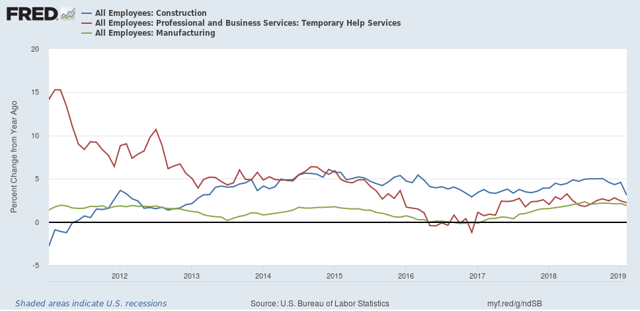

In my opinion Dean Baker is correct. Recessions aren’t as sneaky as Austin Goolsbee claims in his NYT article yesterday. What the *possible* “mini-recession” of December and January has in common with the very shallow 2001 recession is that both feature a weakening economy that is then hit with exogenous events, including poor government policy (the “China shock,” Trump’s trade wars, the government shutdown) and also in 2001, the September 11 terrorist attacks.

But as Baker points out, 2001 highlighted the bursting of a stock market bubble, apparent in the long leading indicator of corporate profits. Other long leading indicators had also flashed warning signals:

- Housing had also declined over -10%, as measured by the long leading indicator of single family housing permits.

- Long term interest rates had climbed over 2% from their 1998 lows.

- Real M1 had fallen by almost -7%

- The yield curve had inverted.

- Bank lending had gotten tighter.

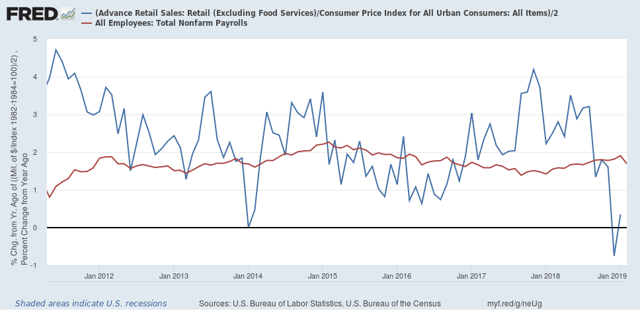

- Real retail sales per capita had peaked a year before.

UPDATE: If you don’t want to go behind the NYT’s paywall, here is what Goolsbee said, via the trusty commenter Anne at Economist’s View. Goolsbee’s position is actually pretty close to what I’ve written above. Small shocks like poor government decisions can take a weak economy and tip it into recession, although Goolsbee focuses on consumer confidence.