Grill cleaning time:

I'll be back on Monday; NDD will be here over the weekend.

Friday, August 30, 2013

Australian Economy Continues to "Moderate"

From the latest central bank minutes:

Indicators of household consumption had suggested continued

moderate conditions overall. Motor vehicle sales grew

in the June quarter, but had fallen in July. Retail

sales data showed that spending was flat in real terms

in the June quarter and liaison pointed to only modest

growth more recently. Consumer sentiment had declined

since earlier in the year to be close to average levels.

Overall, the softer run of recent indicators of consumption

was consistent with the somewhat subdued conditions

in the labour market. The unemployment rate rose a

bit further in June, to 5.7 per cent, while trend employment

growth had declined a little over the past few months.

Retail sales have been soft the last few months:

And the unemployment rate has been ticking up:

In contrast, conditions in the housing sector had continued to improve. Auction clearance rates remained high and dwelling prices had increased further in recent months. A number of indicators were pointing to a further recovery in dwelling investment, consistent with the low level of interest rates. Residential building approvals, especially for detached housing, had increased in the June quarter and loan approvals were at their highest level in over three years.

The total number of dwelling unit commitments is increasing

Members did, nevertheless, note that dwelling investment had thus far experienced a muted recovery relative to past cyclical upturns.

Survey measures of business conditions had remained below average and members noted an apparent reluctance on the part of businesses to take on new risks. Non-mining business investment remained subdued and a range of indicators suggested that this was likely to persist in the near term. Mining investment had been at a high level although it looked set to decline over coming years. Consistent with this, imports of capital goods had declined from the high levels in the previous year.

Conclusion: overall, this is an economy that is clearly slowing. There are no signs of a hard landing, but instead continued weak growth.

Let's take a look at the Australian ETF

At the beginning of March, we see a sell-off that takes prices all the way down to the 61.8% Fib level, or a loss of about 20% from peak to trough. Since then, prices have rebounded, trading between the 61.8% and 38.2% Fib level. Also note the upward resistance provided by the 200 day EMA, indicating we're probably in a bear market.

But the weekly chart shows the most recent sell-off has not made a significant dent in the long-term trend of the ETF, which is still up. This tells us that traders (at least so far) see a slowdown and overall economic re-balancing rather than an outright contraction.

The Australian dollar started to drop in April as the Reserve Bank of Australia started to cut rates. Overall, the currency has fallen about 15% from peak to trough. Prices have fallen through two key support areas (one an ~94 and the second at ~91) and are now consolidating losses by trading between ~89 and ~93.

Members noted that the news received on domestic activity

over the month was consistent with Australian economic

growth being below trend in the June quarter.

Retail sales have been soft the last few months:

And the unemployment rate has been ticking up:

In contrast, conditions in the housing sector had continued to improve. Auction clearance rates remained high and dwelling prices had increased further in recent months. A number of indicators were pointing to a further recovery in dwelling investment, consistent with the low level of interest rates. Residential building approvals, especially for detached housing, had increased in the June quarter and loan approvals were at their highest level in over three years.

The total number of dwelling unit commitments is increasing

Members did, nevertheless, note that dwelling investment had thus far experienced a muted recovery relative to past cyclical upturns.

Survey measures of business conditions had remained below average and members noted an apparent reluctance on the part of businesses to take on new risks. Non-mining business investment remained subdued and a range of indicators suggested that this was likely to persist in the near term. Mining investment had been at a high level although it looked set to decline over coming years. Consistent with this, imports of capital goods had declined from the high levels in the previous year.

Conclusion: overall, this is an economy that is clearly slowing. There are no signs of a hard landing, but instead continued weak growth.

Let's take a look at the Australian ETF

At the beginning of March, we see a sell-off that takes prices all the way down to the 61.8% Fib level, or a loss of about 20% from peak to trough. Since then, prices have rebounded, trading between the 61.8% and 38.2% Fib level. Also note the upward resistance provided by the 200 day EMA, indicating we're probably in a bear market.

But the weekly chart shows the most recent sell-off has not made a significant dent in the long-term trend of the ETF, which is still up. This tells us that traders (at least so far) see a slowdown and overall economic re-balancing rather than an outright contraction.

The Australian dollar started to drop in April as the Reserve Bank of Australia started to cut rates. Overall, the currency has fallen about 15% from peak to trough. Prices have fallen through two key support areas (one an ~94 and the second at ~91) and are now consolidating losses by trading between ~89 and ~93.

Coincident indicators stalled in July

- by New Deal democrat

With the release of personal income and spending this morning, we now have all four primary coincident indicators of the economy through July. With the exception of payrolls, they all stalled, with industrial production, real retail sales, and real personal income coming in at zero (actually, within +/-0.05% of 0%).

Below is a graph of all four of the above coincident indicators for the last year. I have presented it at a scale so that the biggest monthly change of each indicator is set to 1.0 (and I've deleted December and January personal income entirely, which featured an increase and then a decrease of over 5% due to moving income forward into 2012 due to the "fiscal cliff"):

You can see that there has been a distinct tapering off of positive readings in the last three months, and the trend is in decline.

That isn't to say that I expect the decline to continue. If anything, this may be the bottom, if all of the Leading Indices are to be believed. On the other hand, this again shows the negative impact of the Sequester, and certainly suggests that this would be a particularly bad time for fiscal shenanigans in Washington. Of course, that is asking way too much . . . .

Yen Devaluation Starting to Pay Dividends With Increased Exports

Despite having a very weak economy, the yen actually strengthened over the duration of this expansion because of Japan's safe haven status. In fact, from the yen's ETF's lows in 2008 to its highs in 2011, it gained a little over 32%. However, since the end of last year and the introduction of "Abenomics" (which includes yen devaluation to increase the competitiveness of Japan's exports) the yen's ETF has dropped almost 26%. The end result is an increase in exports, as shown in this excerpt from the latest BOJ Central Bank Meeting Minutes:

Exports had been picking up. Real exports had turned upward in the January-March quarter of 2013 and kept increasing in the April-May period relative to that quarter, after having continued to decline in the July-September and October-December quarters of 2012. Exports of motor vehicles and their related goods -- due in part to the effects of developments in foreign exchange rates -- had resumed an uptrend, assisted by a pick-up in those to China -- which had seen a significant drop -- while those to the United States and other regions had been steady. Exports of capital goods and parts as a whole had recently started to bottom out, with upward movements observed in exports to the United States and East Asia, disregarding the fluctuations in ships. Exports of IT-related goods as a whole appeared to be heading for a bottom, with the effects of the downshift in demand for parts for final products of smartphones -- which had taken place since the end of 2012 -- easing. Exports were expected to increase moderately, mainly against the background of the pick-up in overseas economies.

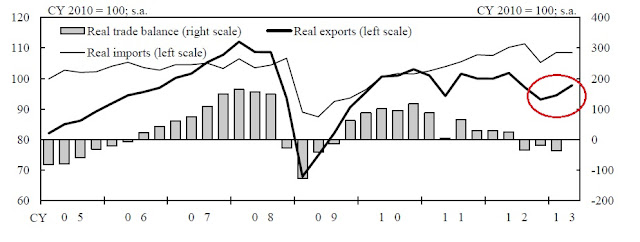

The latest exports release shows a 12% year over year increase. Here's a chart of total exports from the latest BOJ monthly economic report:

Exports are still weak, as they are in line with the numbers reported over the last 3-4 years. However, we do see the uptick that is mentioned in the BOJ minutes.

Exports had been picking up. Real exports had turned upward in the January-March quarter of 2013 and kept increasing in the April-May period relative to that quarter, after having continued to decline in the July-September and October-December quarters of 2012. Exports of motor vehicles and their related goods -- due in part to the effects of developments in foreign exchange rates -- had resumed an uptrend, assisted by a pick-up in those to China -- which had seen a significant drop -- while those to the United States and other regions had been steady. Exports of capital goods and parts as a whole had recently started to bottom out, with upward movements observed in exports to the United States and East Asia, disregarding the fluctuations in ships. Exports of IT-related goods as a whole appeared to be heading for a bottom, with the effects of the downshift in demand for parts for final products of smartphones -- which had taken place since the end of 2012 -- easing. Exports were expected to increase moderately, mainly against the background of the pick-up in overseas economies.

The latest exports release shows a 12% year over year increase. Here's a chart of total exports from the latest BOJ monthly economic report:

Exports are still weak, as they are in line with the numbers reported over the last 3-4 years. However, we do see the uptick that is mentioned in the BOJ minutes.

Thursday, August 29, 2013

Brazil Raises Rates 50 Basis Points

From Bloomberg:

Brazil’s central bank raised the key rate by half a percentage point for a third straight meeting, as a plunge in the currency undermines efforts to slow inflation in the world’s second-largest emerging market.

The bank’s board, led by President Alexandre Tombini, today unanimously voted to raise the benchmark Selic rate to 9 percent from 8.5 percent, as forecast by 50 of 52 economists surveyed by Bloomberg. One economist expected a 75 basis-point increase, while one forecast a 25 basis-point boost.

“The committee considers that this decision will contribute to put inflation on a decline and assure that this trend will persist next year,” policy makers said, according to their statement posted on the central bank’s website. The statement was virtually identical to their July 10 communique.

The central bank is in a very unenviable spot: growth is slowing but inflation is still at uncomfortable levels. This indicates that the real's drop and the accompanying rise in inflation is seen as the larger threat to the economy.

For more on Brazil, see links here, here and here.

Brazil’s central bank raised the key rate by half a percentage point for a third straight meeting, as a plunge in the currency undermines efforts to slow inflation in the world’s second-largest emerging market.

The bank’s board, led by President Alexandre Tombini, today unanimously voted to raise the benchmark Selic rate to 9 percent from 8.5 percent, as forecast by 50 of 52 economists surveyed by Bloomberg. One economist expected a 75 basis-point increase, while one forecast a 25 basis-point boost.

“The committee considers that this decision will contribute to put inflation on a decline and assure that this trend will persist next year,” policy makers said, according to their statement posted on the central bank’s website. The statement was virtually identical to their July 10 communique.

The central bank is in a very unenviable spot: growth is slowing but inflation is still at uncomfortable levels. This indicates that the real's drop and the accompanying rise in inflation is seen as the larger threat to the economy.

For more on Brazil, see links here, here and here.

Consumers Finally Realize CNBC (and Larry Kudlow) Are Worthless

From the New York Post

Tv viewers continued to trade out of CNBC in August.

The business news cable network posted some of its worst ratings in 20 years this month — attracting an average of just 37,000 viewers aged 25 to 54 over a 24-hour period, according to just-released ratings data.

That’s down 35 percent from a year ago, according to Nielsen, and the Comcast-owned network’s worst performance in the key advertiser demo since April 1993.

CNBC hit a peak of 162,000 viewers an hour in the key demo in January 2002.

.......

Larry Kudlow’s 7 p.m. show fell the most, recording just 20,000 viewers in the key advertiser demographic, a 53 percent decline

I stopped watching CNBC over 10 years ago and haven't missed it. If I was going to watch financial TV again, it's be Bloomberg. But, frankly, I'm not really impressed with any financial TV, instead finding the written news to be far more comprehensive.

And I have to admit that Kudlow's fall is more than welcome. I never could stand the idiot. It now appears that others have been catching on as well.

Tv viewers continued to trade out of CNBC in August.

The business news cable network posted some of its worst ratings in 20 years this month — attracting an average of just 37,000 viewers aged 25 to 54 over a 24-hour period, according to just-released ratings data.

That’s down 35 percent from a year ago, according to Nielsen, and the Comcast-owned network’s worst performance in the key advertiser demo since April 1993.

CNBC hit a peak of 162,000 viewers an hour in the key demo in January 2002.

.......

Larry Kudlow’s 7 p.m. show fell the most, recording just 20,000 viewers in the key advertiser demographic, a 53 percent decline

I stopped watching CNBC over 10 years ago and haven't missed it. If I was going to watch financial TV again, it's be Bloomberg. But, frankly, I'm not really impressed with any financial TV, instead finding the written news to be far more comprehensive.

And I have to admit that Kudlow's fall is more than welcome. I never could stand the idiot. It now appears that others have been catching on as well.

Three Four Important Points From Revised 2d Quarter GDP

- by New Deal democrat

The release of revisions to second quarter GDP this morning give us our first look at Gross Domestic Income and Corporate Profits after Taxes.

Gross Domestic Income is important because it is the other side of the ledger of GDP. Theoretically, the two should always be equal, but because they are calculated from separate data, there usually is a discrepancy. But more importantly, if there is a divergence between the two, it is more likely for GDP to move towards GDI than the other way around. This morning we learned that 2nd quarter 2013 GDI was up 2.5% at an annualized rate, compared with +2.4% in the first quarter. Here is the most current graph through the first quarter:

Although this hardly shows strong growth, it also confirms that the economy is still growing, and unlike the initial GDP estimate (also revised upward to +2.5%), it does not show any sign of stalling over the last three quarters.

This morning's release also included corporate profits after taxes and inventory adjustments. This is a long leading indicator. It tends to peak at least a year before the onset of any recession. Although profits declined slightly in the first quarter, as shown in the graph below:

they rebounded strongly in the second quarter to a new record of $1863 billion. Of course, while that may negative recession, it also does nothing to address the glaring inequality between capital and labor's share of income in this country.

The final point is that, while it is welcome that 2nd quarter GDP was revised higher, once again state and federal contributions to GDP were revised lower, and both were outright negative. Federal spending subtracted -1.6% in the second quarter while state and local spending decreased -0.5%. The total subtraction from all government expenditioures was -0.9%. Sequestration and austerity are having a real and negative impact on the economy.

Bonddad here:

Consider the following chart, culled from the latest GDP report, that shows the percentage change in exports from the previous quarter:

I've drawn an arrow about the latest quarters numbers. Total exports increase 8.6%; shipment of goods increase 10.1% -- the strongest jump since 4Q210. And the export of services increase 5.2%. The increase in exports were a primary reason for the upward revision in US GDP:

The acceleration in real GDP in the second quarter primarily reflected upturns in exports and in nonresidential fixed investment and a smaller decrease in federal government spending that were partly offset by an acceleration in imports and decelerations in private inventory investment and in PCE.

Recent Census data shows there was a drop in exports at the beginning of the 2Q, but that most categories of exports have increased since April:

A Long-Term View of the Japanese ETF

The are two points I wanted to make about this chart:

1.) We see the Abenomics rally that started in 4Q12 and extended to 2Q13. Prices rallied about 44%.

2.) Since the rally prices have been consolidating in a symmetrical triangle pattern. This is to be expected after such a strong move as traders take profits and assess the effectiveness of the new programs.

Wednesday, August 28, 2013

Will Emerging Market's Sliding Currency Become an International Crisis?

Over the last few months, India's problems have come home to roost. Their growth has dropped as the result of a bloated domestic government and rather draconian foreign investment rules. Their current account relative to GDP is large with little sign of getting smaller and inflation is still at uncomfortable levels, thereby boxing in the central bank. For more information, see here and here.

And the currency continues to slide:

Here's a chart of the rupee ETF that shows two recent breaks of support (see the blue arrow):

Also note the weak momentum and volume reading and very bearish EMA orientation.

And India is not alone in it's problems. The latest news out of Brazil is not encouraging.

First, we see the manufacturing sector's reading fell below 50, indicating a contraction:

Reflective of lower foreign business and total new orders, Brazilian manufacturers reduced their output in July. Subsequently, the PMI fell to a 13-month low, and indicated that the country’s manufacturing economy

deteriorated for the first time since September 2012. Meanwhile, the depreciation of the real reportedly resulted in higher prices paid for inputs, with the rate of cost inflation accelerating to the fastest in over three years and charge inflation picking up to the sharpest in five years.

The seasonally adjusted HSBC Brazil Purchasing Managers’ Index™ (PMI™) fell to its lowest reading in 13 months, posting 48.5 in July, down from 50.4 in the previous month. The latest reading indicated the first deterioration in manufacturing operating conditions across the country since September 2012. Four of the five PMI sub-indices negatively affected the

Here's a chart of the data:

The service sector output continues to fall, although it is currently on this side of an expansion:

The seasonally adjusted Services Business Activity Index fell from 51.0 in June to 50.3 in July. The latest reading was indicative of a marginal increase in

services output, and the joint-weakest in the current 11-month expansionary sequence. Slower rises in business activity were linked by panellists to weaker

gains in new work, an increasingly fragile economy and national protests.

And the country continues to have currency problems, which I first noted last week. In fact, their central banker had to forgo an appearance at the Fed's Jackson Hole retreat in order to implement a currency plan:

But with Brazil’s currency, the real, sinking rapidly against the dollar, he chose to stay at home, and on Thursday night launched one of the world’s most ambitious responses yet to the present market volatility – a $60bn currency intervention programme.

Let's take a look at the Brazilian real ETF:

The real has been dropping all summer. It fell through two key support levels in mid-June and again in mid-August (see blue arrows). Momentum has been weak for three months, the volume flow has been negative, volatility is high and the moving average picture is very weak.

Here's a chart comparing Brazil's currency ETF with India's; both show a similar recent slide.

And the currency continues to slide:

India’s

battered rupee was on track for its worst one-day fall in more than two

decades on Wednesday, plunging 3.4 per cent in morning trading to

breach Rs68 to the US dollar for the first time in a downbeat reaction

to a government plan to rescue the floundering economy.

Palaniappan Chidambaram, finance minister, on Tuesday outlined a

10-point scheme to reduce the nation’s current account deficit and

restore economic growth, responding to another day of sharp stock market

losses and currency decline. Here's a chart of the rupee ETF that shows two recent breaks of support (see the blue arrow):

Also note the weak momentum and volume reading and very bearish EMA orientation.

And India is not alone in it's problems. The latest news out of Brazil is not encouraging.

First, we see the manufacturing sector's reading fell below 50, indicating a contraction:

Reflective of lower foreign business and total new orders, Brazilian manufacturers reduced their output in July. Subsequently, the PMI fell to a 13-month low, and indicated that the country’s manufacturing economy

deteriorated for the first time since September 2012. Meanwhile, the depreciation of the real reportedly resulted in higher prices paid for inputs, with the rate of cost inflation accelerating to the fastest in over three years and charge inflation picking up to the sharpest in five years.

The seasonally adjusted HSBC Brazil Purchasing Managers’ Index™ (PMI™) fell to its lowest reading in 13 months, posting 48.5 in July, down from 50.4 in the previous month. The latest reading indicated the first deterioration in manufacturing operating conditions across the country since September 2012. Four of the five PMI sub-indices negatively affected the

Here's a chart of the data:

The service sector output continues to fall, although it is currently on this side of an expansion:

The seasonally adjusted Services Business Activity Index fell from 51.0 in June to 50.3 in July. The latest reading was indicative of a marginal increase in

services output, and the joint-weakest in the current 11-month expansionary sequence. Slower rises in business activity were linked by panellists to weaker

gains in new work, an increasingly fragile economy and national protests.

And the country continues to have currency problems, which I first noted last week. In fact, their central banker had to forgo an appearance at the Fed's Jackson Hole retreat in order to implement a currency plan:

But with Brazil’s currency, the real, sinking rapidly against the dollar, he chose to stay at home, and on Thursday night launched one of the world’s most ambitious responses yet to the present market volatility – a $60bn currency intervention programme.

Let's take a look at the Brazilian real ETF:

The real has been dropping all summer. It fell through two key support levels in mid-June and again in mid-August (see blue arrows). Momentum has been weak for three months, the volume flow has been negative, volatility is high and the moving average picture is very weak.

Here's a chart comparing Brazil's currency ETF with India's; both show a similar recent slide.

Fundamental And Technical Events Leading To Potential Oil Price Spike

Consider the daily and weekly charts of oil:

Prices were consolidating between 104 and 108. Now they have broken through upside resistance at the 108 by printing a very strong bar. Also note the declining momentum reading may act as a wound coil, giving prices strong upside rallying potential.

On the weekly chart, we see rising momentum and rising volume inflow along with a technical break through resistance.

More succinctly: the daily and weekly charts are lining up for a potential bullish run in oil prices.

And now we have two fundamental events adding fuel to the fire. The first is the Syrian situation. The US is considering limited military strikes and the UK is proposing a UN resolution. Secondly, inventories have been dropping:

More bluntly: technical and fundamental events may lead to a nasty oil price spike, tightening the oil choke collar and potentially slowing growth. This is another factor that I would add to my list of economic data points concerning me right now.

Prices were consolidating between 104 and 108. Now they have broken through upside resistance at the 108 by printing a very strong bar. Also note the declining momentum reading may act as a wound coil, giving prices strong upside rallying potential.

On the weekly chart, we see rising momentum and rising volume inflow along with a technical break through resistance.

More succinctly: the daily and weekly charts are lining up for a potential bullish run in oil prices.

And now we have two fundamental events adding fuel to the fire. The first is the Syrian situation. The US is considering limited military strikes and the UK is proposing a UN resolution. Secondly, inventories have been dropping:

More bluntly: technical and fundamental events may lead to a nasty oil price spike, tightening the oil choke collar and potentially slowing growth. This is another factor that I would add to my list of economic data points concerning me right now.

Mexican Economy Slowing

From Bloomberg:

Mexico’s economy grew less than forecast by any of the analysts surveyed by Bloomberg in the second quarter as industrial production declined on a sluggish U.S. recovery.

Gross domestic product expanded 1.5 percent from the year earlier, rebounding from a revised 0.6 percent growth rate in the previous three months, the National Statistics Institute said on its website today. The median estimate of 17 economists surveyed by Bloomberg was for growth of 2.3 percent. The economy contracted 0.7 percent from the previous quarter.

The central bank cut its growth forecast for this year to between 2 percent and 3 percent this month from 3 percent to 4 percent on stagnant exports to the U.S. and muted public spending. Growth will accelerate in both the third and fourth quarters, rising to 4 percent next year as the U.S. recovery strengthens and the government passes key economic reforms, according to the median estimate in a Bloomberg survey.

Industrial production fell 0.6 percent in the second quarter from the year earlier, the statistics agency also said today. The construction sector contracted 4 percent over the same period amid a drop in government spending.

Here's a chart of the data:

And retail sales continue to show hit and miss year over year results:

And total production has stagnated for over a year -- although it is at higher levels than before the contraction:

Let's turn to the Mexican ETF, starting with the weekly chart:

The main feature of the chart is the rally from mid-2012 to the spring of 2013, when the market rallied about 45%. Since then, however, we've seen two waves of selling. The first in the mid-Spring, and the second that started three weeks ago. The logical price target for the second wave of selling is the 200 week EMA.

On the daily chart, the relief rally that took place starting in early July looks incredibly weak; it occurred on weak volume while the MACD was still in negative territory. Once prices got just above the 38.2% Fib level, they ran out of steam and started moving lower.

Mexico’s economy grew less than forecast by any of the analysts surveyed by Bloomberg in the second quarter as industrial production declined on a sluggish U.S. recovery.

Gross domestic product expanded 1.5 percent from the year earlier, rebounding from a revised 0.6 percent growth rate in the previous three months, the National Statistics Institute said on its website today. The median estimate of 17 economists surveyed by Bloomberg was for growth of 2.3 percent. The economy contracted 0.7 percent from the previous quarter.

The central bank cut its growth forecast for this year to between 2 percent and 3 percent this month from 3 percent to 4 percent on stagnant exports to the U.S. and muted public spending. Growth will accelerate in both the third and fourth quarters, rising to 4 percent next year as the U.S. recovery strengthens and the government passes key economic reforms, according to the median estimate in a Bloomberg survey.

Industrial production fell 0.6 percent in the second quarter from the year earlier, the statistics agency also said today. The construction sector contracted 4 percent over the same period amid a drop in government spending.

Here's a chart of the data:

And retail sales continue to show hit and miss year over year results:

And total production has stagnated for over a year -- although it is at higher levels than before the contraction:

Let's turn to the Mexican ETF, starting with the weekly chart:

The main feature of the chart is the rally from mid-2012 to the spring of 2013, when the market rallied about 45%. Since then, however, we've seen two waves of selling. The first in the mid-Spring, and the second that started three weeks ago. The logical price target for the second wave of selling is the 200 week EMA.

On the daily chart, the relief rally that took place starting in early July looks incredibly weak; it occurred on weak volume while the MACD was still in negative territory. Once prices got just above the 38.2% Fib level, they ran out of steam and started moving lower.

Tuesday, August 27, 2013

August consumer inflation rate probably +0.1%

- by New Deal democrat

As a corollary of the theme to my reporting that the Oil choke collar is an important factor in the economy, for the last few months I have been using the change in the price of a gallon of gas to forecast that month's CPI in advance. My point has been, that all you really need to know about inflation is the price of gasoline. So far each prediction has turned out to be within 0.1% of the actual number.

Yesterday the E.I.A. reported for the final week of August (next Monday will be September), so we can already estimate the inflation rate. My method is to take the change in the price of a gallon of gas and divide by ten, then add 0.1% to 0.2% to account for core inflation, or else divide by 16 to be more conservative, to arrive at the non-seasonally adjusted inflation rate.

In July the price of a gallon of gas was $3.59.1. This month it was $3.57.4. That is a -0.5% decline. Dividing by 10 gives us -0.05%, and adding 0.1% to 0.2% gives us +0.05% to +0.15%. Dividing by 16 gives us a -0.3% decline, and adding 0.1% to 0.2% gives us +0.07% to +1.7%.

The seasonal adjustment for August last year was -0.045%. This gives us a final seasonally adjusted inflation rate that rounds to +0.1% +/-0.1%.

That will replace last August's +0.5% inflation rate, so that the YoY inflation rate will be +1.6%. This inflation rate is subdued enough to suggest that real YoY wages have probably increased slightly in August.

I do not think these graphs are a coincidence

- by New Deal democrat

My intensive examination of real average and median wages and income has caused me to rethink a few other things. First of all, I do not think that the relationship in the graph below, which shows the employment to population ratio (blue) and real average wages (red), is a coincidence:

Notice that the employment to population ratio remained fairly steady from the immediate aftermath of World War 2 until the late 1960's, when women started entering the workforce in large numbers. By the 1990's, that trend had matured. So had Baby Boomers, the olders of whom hit age 55 in the year 2000. Research on this ratio has suggested that the decline from 2000 through 2007 was largely as a result of the beginning of the Boomer retirement tsunami. Since that time, of course, it has been augmentsd by the long term unemployed.

Meanwhile average wages for non-supervisory personnel (the series only began to be reported in the 1960's) peaked in the early 1970's and fell through the mid-1990's, and surprisingly, has increased since.

I am not suggesting that the mass entry of women into the workforce was in any way "wrong." I am merely pointing out that, as a simple matter of supply and demand, the mass entry of new laborers into the workforce should act to depress wages, and it certainly looks like that was the case. When the trend ended, so did the depression in real wages.

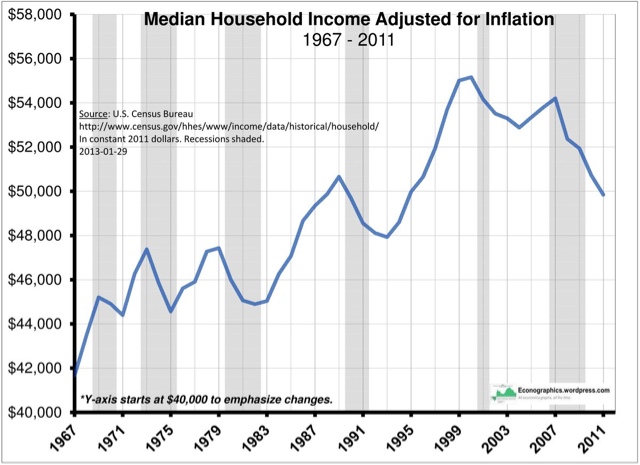

This has also caused me to rethink the graph below, showing that real median household income peaked in 1999:

As we have seen in other posts, real median wages rose slightly between 2000 and 2007, and even rose during the great recession, as the price of gas decreased. But real median household income declined. Just as we have seen that since the great recession, the continuing decline in real median household income is almost entirely a reflection of the decline in the employment to population ratio, the decline between 1999 and 2007 is probably really showing the same thing (recall that the median income of retirees is about half of that of working age households).

If this is true, then we should expect median household incomes to continue to decline for several more decades, as the entire Baby Boom generation retires and a majority of us have passed away.

By the way: those two spikes in the 1970's in the graph of real average wages? Here's a close-up of average wages (blue) and the inflation rate (red):

Back then, we had unions, and unions had power. They succeeded in writing automatic wage increases into contracts. These automatic increases were supposed to ensure that their wages did not erode due to inflation, and typically reflected the recent (higher) inflation rates. So although the spike in inflation receded (red line), the wage increases didn't (blue line), causing the echo-spike in real wages. That all ended with Reagan and Volcker.

Monday, August 26, 2013

Are We Closer to Recession Than We Think?

Over about the last month, a number of economic numbers have been released that are a bit concerning.

First, consider this point from Bloomberg:

Price gains of stocks in the Standard & Poor’s 500 Index (SPX) are outpacing profits by the fastest rate in 14 years as the bull market extends beyond the average length of rallies since Harry S. Truman was president.

The benchmark gauge for U.S. equities has risen 14 percent relative to income over the past 12 months to 16 times earnings, according to data compiled by Bloomberg. Valuations last climbed this fast in the final year of the 1990s technology bubble, just before the index began a 49 percent tumble. The rally that started in March 2009 has now outlasted the average gain since 1946, the data show.

For a contrary view, see this at Calafia Beach Pundit.

And then there was today's durable goods announcement (let's ignore the headline number which includes transportation bookings):

Core durable goods orders, excluding volatile transportation items, fell by a seasonally adjusted 0.6% last month, defying expectations for a 0.5% increase.

Core durable goods orders in June were revised to a 0.15 increase from a previously reported decline of 0.1%.

Orders for core capital goods, a key barometer of private-sector business investment, fell 3.3% in July, confounding expectations for a 0.5% gain and after rising 0.9% in June.

Continuing forward, let's look at a combination of economic numbers that started this line of thought.

While overall GDP growth has been weak this recovery, it's been very weak over the last three quarters. Consider the following three charts:

The year over year rate of change in real GDP has been below 2% for the last three quarters.

The compounded annual rate of change has been below 2.5% for the last three quarters, and

The percent change from the previous quarter has been below .5%.

No matter how you look at growth, it's been weak.

Also note this is occurring at a time when its obvious the sequester is hurting growth and we're hearing mumblings yet again that we'll have a budget showdown in Washington.

The last nine readings of industrial production have shown little forward progress and capacity utilization hasn't growth over the same time frame.

New home sales dropped 13.4% last month. Over at CR, Bill McBride notes (correctly) that this is only one month of data. This is always a good point to remember with economic numbers. However, the sharpness of the drop combined with its timing (during the summer buying season while interest rates are rising) is enough to give me pause.

Above is a table of the leading US indicators and their contribution to the last six months of readings. Notice that 33% of the data points have been negative over the last six months. Also note that ISM new orders printed four straight negative prints, as did average consumer expectations. Building permits printed three.

There is no magic ratio here, but 33% just does not seem like an overly bullish percentage.

Granted, there are some data points on the other side of the argument, with the latest ISM readings (see here and here) high on the list; retail sales are also still in good shape. But the sum total of the above points does give me reason to be a bit concerned right now, especially considering the close proximity of these data releases combined with the three straight quarters of weak GDP numbers.

Also -- consider the points made in NDDs recent post on the long leading indicators.

First, consider this point from Bloomberg:

Price gains of stocks in the Standard & Poor’s 500 Index (SPX) are outpacing profits by the fastest rate in 14 years as the bull market extends beyond the average length of rallies since Harry S. Truman was president.

The benchmark gauge for U.S. equities has risen 14 percent relative to income over the past 12 months to 16 times earnings, according to data compiled by Bloomberg. Valuations last climbed this fast in the final year of the 1990s technology bubble, just before the index began a 49 percent tumble. The rally that started in March 2009 has now outlasted the average gain since 1946, the data show.

For a contrary view, see this at Calafia Beach Pundit.

And then there was today's durable goods announcement (let's ignore the headline number which includes transportation bookings):

Core durable goods orders, excluding volatile transportation items, fell by a seasonally adjusted 0.6% last month, defying expectations for a 0.5% increase.

Core durable goods orders in June were revised to a 0.15 increase from a previously reported decline of 0.1%.

Orders for core capital goods, a key barometer of private-sector business investment, fell 3.3% in July, confounding expectations for a 0.5% gain and after rising 0.9% in June.

Continuing forward, let's look at a combination of economic numbers that started this line of thought.

While overall GDP growth has been weak this recovery, it's been very weak over the last three quarters. Consider the following three charts:

The year over year rate of change in real GDP has been below 2% for the last three quarters.

The compounded annual rate of change has been below 2.5% for the last three quarters, and

The percent change from the previous quarter has been below .5%.

No matter how you look at growth, it's been weak.

Also note this is occurring at a time when its obvious the sequester is hurting growth and we're hearing mumblings yet again that we'll have a budget showdown in Washington.

The last nine readings of industrial production have shown little forward progress and capacity utilization hasn't growth over the same time frame.

New home sales dropped 13.4% last month. Over at CR, Bill McBride notes (correctly) that this is only one month of data. This is always a good point to remember with economic numbers. However, the sharpness of the drop combined with its timing (during the summer buying season while interest rates are rising) is enough to give me pause.

Above is a table of the leading US indicators and their contribution to the last six months of readings. Notice that 33% of the data points have been negative over the last six months. Also note that ISM new orders printed four straight negative prints, as did average consumer expectations. Building permits printed three.

There is no magic ratio here, but 33% just does not seem like an overly bullish percentage.

Granted, there are some data points on the other side of the argument, with the latest ISM readings (see here and here) high on the list; retail sales are also still in good shape. But the sum total of the above points does give me reason to be a bit concerned right now, especially considering the close proximity of these data releases combined with the three straight quarters of weak GDP numbers.

Also -- consider the points made in NDDs recent post on the long leading indicators.

Market/Economic Analysis: US

Let's start by looking at last weeks news.

The Good

Existing home sales increased 6.5% and inventory increased to 5.1 months of supply. This is was good report for two reasons: sales increased, indicating that higher interest rates haven't deterred buyers yet, and inventory increased, which should lead to a decreasing of upward pricing pressures in the housing market.

The Neutral

The Chicago Fed National Activity Index (CFNAI) edged up to –0.15 in July from –0.23 in June. Three of the four broad categories of indicators that make up the index increased slightly from June, but only two of the four categories made positive contributions to the index in July.

I have the indicator in the neutral area because it indicates that the US economy is expanding at below the optimum rate and has for the duration of this expansion.

The Bad

New homes sales decreased 13.4%. In addition, the Census Bureau revised the new home sales figures lower, indicating the housing rebound hasn't been as strong as first thought.

Conclusion: the CFNAI number is simply telling us what we already know: this is a weak expansion and recovery. The real problem comes from the new homes sales numbers. While it is only one month of data, last week's number was a very negative print occurring in the summer when people are more likely to buy a house (this allows them to move into a new school district before the start of the the school year). This is the second week in a row when we've had pretty significant blips in the data. When this is combined with the weak GDP reading over the last three quarters, I think some caution is warranted.

The SPYs continue to correct in an orderly way. They hit a hight of 170.97, then started to drift lower. They moved through support at the 168.18 level and continued to drift lower until prices found support at the lower Fib fan. The MACD has given a sell signal and momentum continues to decrease. Volume flow is weak and volatility is increasing.

Both the belly of the curve (the IEFs) and the long end (TLTs) broke through support last week and moved lower. The IEFs broke through the 100 level, while the TLTs moved through the 105 area. Both have bearish chart attributes: declining shorter EMAs, negative momentum and weak volume flow.

The dollar did little last week, and continues its overall movement between the 21.5 and 23.2 levels.

The Good

Existing home sales increased 6.5% and inventory increased to 5.1 months of supply. This is was good report for two reasons: sales increased, indicating that higher interest rates haven't deterred buyers yet, and inventory increased, which should lead to a decreasing of upward pricing pressures in the housing market.

The Neutral

The Chicago Fed National Activity Index (CFNAI) edged up to –0.15 in July from –0.23 in June. Three of the four broad categories of indicators that make up the index increased slightly from June, but only two of the four categories made positive contributions to the index in July.

I have the indicator in the neutral area because it indicates that the US economy is expanding at below the optimum rate and has for the duration of this expansion.

The Bad

New homes sales decreased 13.4%. In addition, the Census Bureau revised the new home sales figures lower, indicating the housing rebound hasn't been as strong as first thought.

Conclusion: the CFNAI number is simply telling us what we already know: this is a weak expansion and recovery. The real problem comes from the new homes sales numbers. While it is only one month of data, last week's number was a very negative print occurring in the summer when people are more likely to buy a house (this allows them to move into a new school district before the start of the the school year). This is the second week in a row when we've had pretty significant blips in the data. When this is combined with the weak GDP reading over the last three quarters, I think some caution is warranted.

The SPYs continue to correct in an orderly way. They hit a hight of 170.97, then started to drift lower. They moved through support at the 168.18 level and continued to drift lower until prices found support at the lower Fib fan. The MACD has given a sell signal and momentum continues to decrease. Volume flow is weak and volatility is increasing.

Both the belly of the curve (the IEFs) and the long end (TLTs) broke through support last week and moved lower. The IEFs broke through the 100 level, while the TLTs moved through the 105 area. Both have bearish chart attributes: declining shorter EMAs, negative momentum and weak volume flow.

The dollar did little last week, and continues its overall movement between the 21.5 and 23.2 levels.

Subscribe to:

Comments (Atom)