Saturday, August 1, 2020

Weekly Indicators for July 27 - 31 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

The two most noteworthy short leading indicators, stock prices and initial jobless claims, have started to go in two different directions in the past several weeks.

As always, clicking over and reading should bring you right up to the moment, and put a little coin in my pocket as thanks.

Friday, July 31, 2020

Catching up with wages, income, and layoffs

- by New Deal democrat

Yesterday and today have seen several significant data releases. Let’s catch up.

Wages

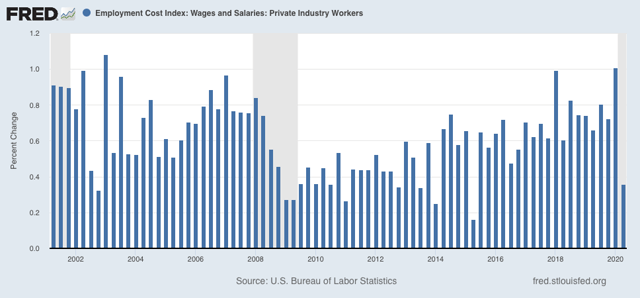

The Employment Cost Index was released for Q2 this morning. This is a particularly important release, because unlike the monthly “average hourly wages” number, this report normalizes by job category, e.g., it compares clerks’ wages in Q1 with clerks’ wages in Q2. So if clerks have experienced widespread wage cuts, it should show up here. Given the many anecdotes of wage cuts I have read and heard about since the pandemic began, I have been waiting to see what this number would be.

And the answer is . . . Wages did rise, albeit at one of the slowest rates in over 10 years, less than 0.4%, in Q2:

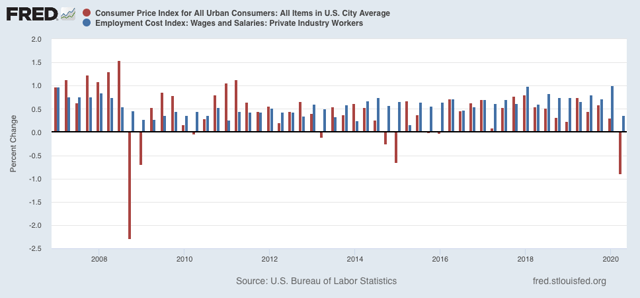

Because consumer prices fell close to -0.9% in Q2, in real inflation adjusted terms wages for equivalent jobs rose even more for the quarter:

I was expecting very bad news, so I will take this “less good” news with a sigh of relief.

Income

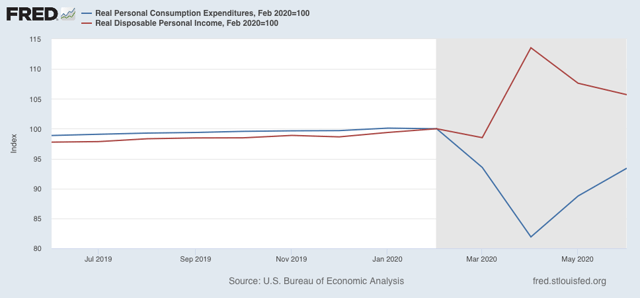

Personal income and spending for June were also released this morning. The bottom line is that income declined slightly, while spending rose:

Boosted by the $1200 relief check in April, and supplemental unemployment assistance of $600/month, income remains 5% higher than in February. Spending, meanwhile, has made up more than 1/2 of its April decline. This is also a positive - but for one month ago. Since the supplemental payments end as of today, this picture is likely to change in the high frequency data beginning in a week or two, although it won’t show up in the monthly data until August’s is released at the end of September.

Layoffs

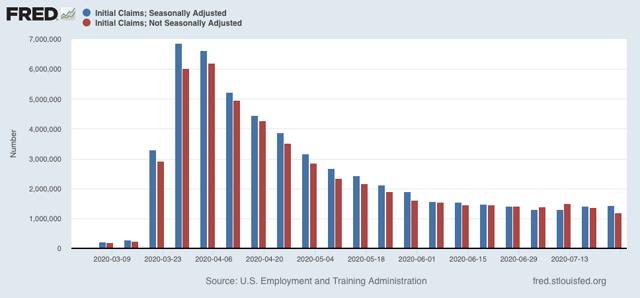

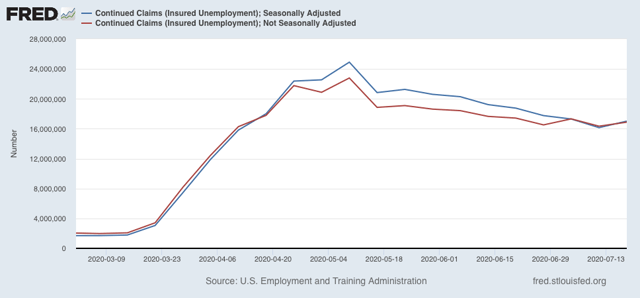

Yesterday’s initial and continuing claims continued the recent string of bad news. While the important non-seasonally adjusted initial claims did make a pandemic low, these were still over 1.2 million for last week. On an adjusted basis, initial claims rose again:

Continuing claims for two weeks ago also rose on both an adjusted and non-seasonally adjusted basis:

In other words, both layoffs and unemployment are likely increasing. We’ll find out next week with the July employment report whether new hires and rehires continued to outpace layoffs, as they have in the past two months, or not.

So the good news - at least for now - is that we do not appear to be in wage-deflationary spiral. The bad news is that the underpinnings of the good news has started to go away in the past few weeks.

Thursday, July 30, 2020

Q2 GDP does not bode well for early 2021

- by New Deal democrat

There are two components of quarterly GDP that are long leading indicators, giving us information about the economy 12 months from now. If you think, as I do, that it is likely there will be a new Administration in Washington next year, which will competently follow the science, then there is every reason to believe that by 12 months from now the pandemic will have been contained, and so the long leading indicators are more likely to be valid.

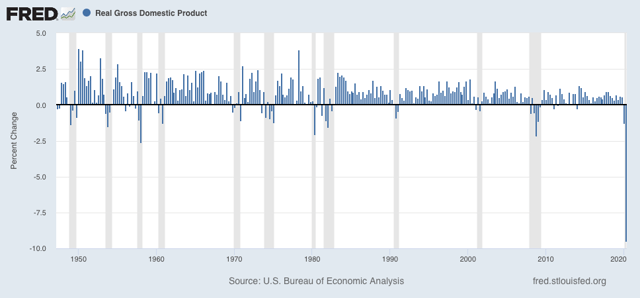

In that regard, this morning’s Q2 2020 GDP was not grounds for optimism.

As an initial matter, the GDP decline of -9.5% annualized was the biggest decline since the Great Depression:

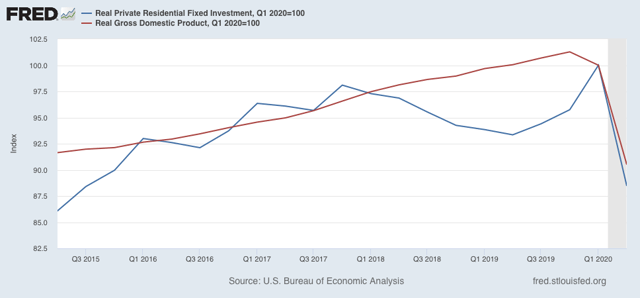

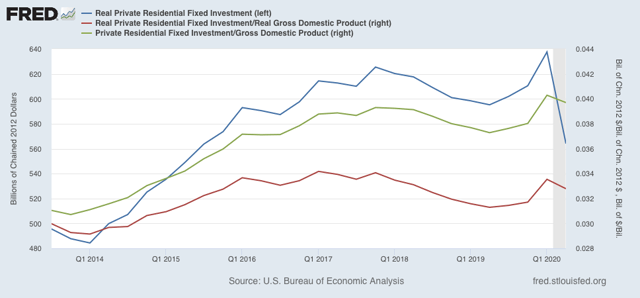

The two forward-looking components of GDP are (1) private fixed residential investment, and (2) corporate profits. Because corporate profits are delayed by one more month, I use proprietors income as a temporary proxy. Let’s look at each in turn.

Real private residential fixed investment decreased over 10% q/q. Real GDP decreased a little less than 10%:

Thus real private fixed residential investment as a share of GDP declined slightly (red in the graph below) as did nominal investment as a share of nominal GDP:

This is a negative.

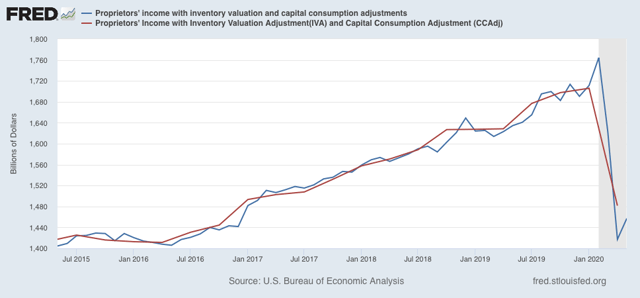

Meanwhile, proprietors income declined -13.2% in Q2:

Since the GDP implicit price deflator declined -2.1%, this was also a large negative.

In sum, both long leading indicators in the GDP report suggest that the economy will not be doing that well by summer 2021, even if the coronavirus is contained.

Wednesday, July 29, 2020

Three long-shot Senate races worth polling: Idaho, Nebraska, and South Dakota

- by New Deal democrat

On Sunday I wrote that it would be really helpful to have statewide polling in some Senate races that look on the surface like safe bets for the GOP, but might actually be worth contesting.

The reason for this is that, not only are the 4 Senate seats most likely to flip from GOP to Democrat — Colorado, Arizona, Maine, and North Carolina — all showing consistent leads for the democratic challenger in the past two months, but in several other States — most notably Iowa and Kansas — the democrat has *also* taken the lead, in the case of Iowa, a small but consistent one. In several other States — Alaska and South Carolina — the democrat has polled within striking distance in one or more recent polls.

Because there is no Senate polling available in other States, I have created the below spreadsheet showing the 2016 Presidential result, and 2020 Presidential and Senate polling both in the contested States that we know of, and the States where we are flying blind. The final column is the direction of change comparing 2016 vs. 2020 Presidential polling followed by 2016 Presidential result vs. 2020 Senate polling. Discussion follows below the chart (numbers are %-ages):

| State | 2016 Presidential Result | 2020 Presidential Polling | 2020 Senate Polling | 2020 Change from 2016 |

|---|---|---|---|---|

| Alaska | T+14.7 | T+3 | D-9 | D+11.7, D+5.7 |

| Iowa | T+9.4 | T+1 | D+2 | D+8.4, D+11.4 |

| Kansas | T+20.5 | T+12 | D+1 | D+8.5, D+22.5 |

| Montana | T+20.2 | T+9 | Even | D+11.2, D+20.2 |

| Nebraska-2^ | T+2 | B+7 | N/a | D+9, N/a |

| S. Carolina | T+14.3 | T+5 | D-4 | D+9.3, D+10.3 |

| Idaho | T+21.7 | N/a | N/a | N/a |

| Nebraska | T+25.0 | N/a | N/a | N/a |

| N. Dakota | T+45.7 | T+17*(*Mar) | N/a | D+28.7, N/a |

| S. Dakota | T+29.8 | N/a | N/a | N/a |

| West Virginia | T+42.1 | T+35*(*Jan) | N/a | D+7.1, N/a |

| Wyoming | T+46.3 | N/a | N/a | N/a |

^Congressional District

Generally speaking, note that in all States where available, there has been roughly a 10% swing in the Presidential vote from Trump to Biden +/-1.7%. The Senate results have been much more volatile, ranging from +5.7% to +22.5%, suggesting that they are much more candidate-specific.

While most other States are out of reach, Idaho’s Trump margin from 2016 is very close to that of Montana and Kansas, and Nebraska is not too far behind. South Dakota might even be at least worth a look. The other States look out of reach under almost any scenario.

Bottom line: based on the surprisingly positive result in one poll in Alaska, money has already flowed into that race to assist the Democrat getting on the air. At very least it would be worth polling in Idaho and Nebraska, and maybe even South Dakota to see if it would be worthwhile to take a long shot and make those candidates more viable as well.

Tuesday, July 28, 2020

Coronavirus dashboard for July 28: the “pain threshold” exists, and leads to a decline in new cases

- by New Deal democrat

Total US coronavirus cases: 4,275,188

Average daily cases last 7 days: 65,896

Total US coronavirus deaths: 140,309

Average daily deaths last 7 days: 1,004

(Source: COVID Tracking Project)

Several months ago I wrote:

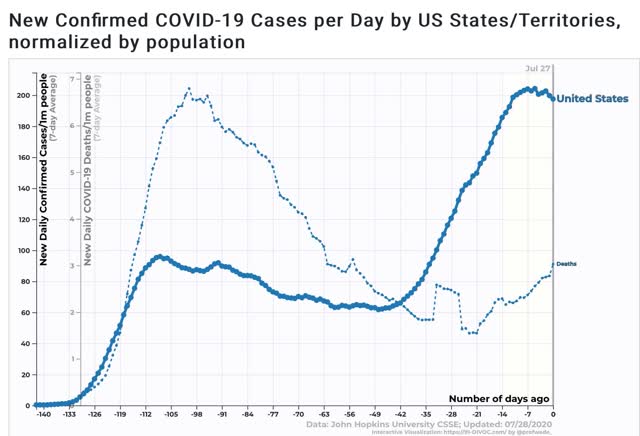

my forecast over the past month [has been] that the population of the US as a whole lacks the political and social will to beat the coronavirus. As a result, the outbreak will continue to wax and wane as complacency alternates with fear generated by big new outbreaks.The complacency of May gave rise to new outbreaks that showed up in June and deaths that have showed up in July. Case statistics over the past week show that the surge in cases and deaths in turn has caused the fear to kick back in, as shown in the below graph of the 7 days average in cases (solid line) and deaths (dotted line, separate scale) per capita for the US:

While deaths are still increasing, growth in new cases started to slow down about 12 days ago as the effects of new mask requirements in many States, the re-closing of bars and restaurants in others, and simple fear by people at first slowed the increase, followed by an apparent peak on July 22.

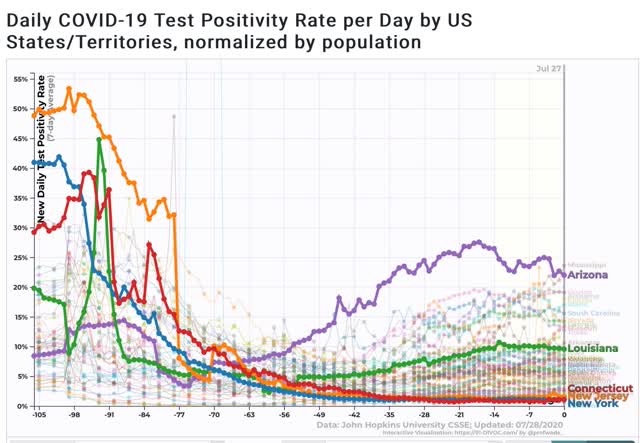

Josh Marshall has speculated, correctly I think, that an important reason why the “cases” and “deaths” scales trends look so different isn’t just demographics, but the fact that testing was so pitiful in March and April that a much larger percentage of cases were missed, citing the % of positive tests which was as high as 47% for NY in April. In other words is there had been more testing available, the trend line for cases would look much more similar to the trend line for deaths. The supporting graph makes the case quite compellingly:

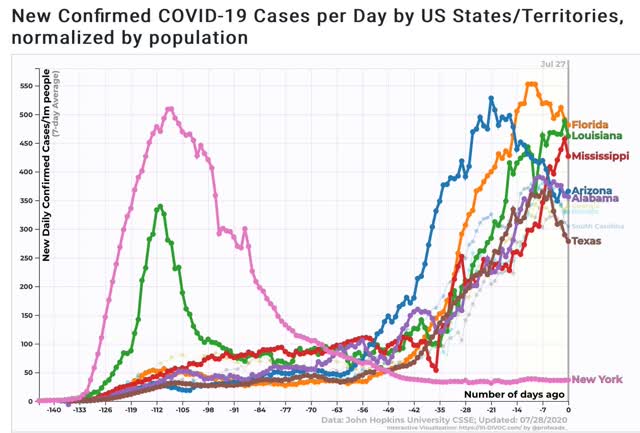

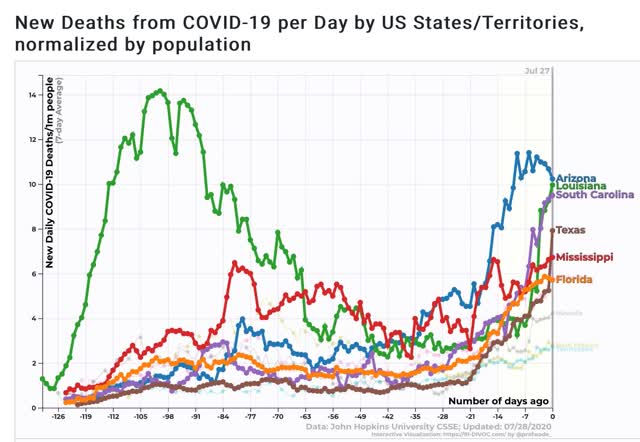

Next, here is the graph of the 10 worst States for new cases, highlighting the top 5 plus Texas, which has declined to #10, and plus NYS for comparison to the early outbreak:

Note that, as I speculated several months ago, once the outbreaks gets about as bad as it was in NY and NJ back in March and April, the “pain threshold” kicks in, and both the State and ordinary citizens take action to curb the outbreak.

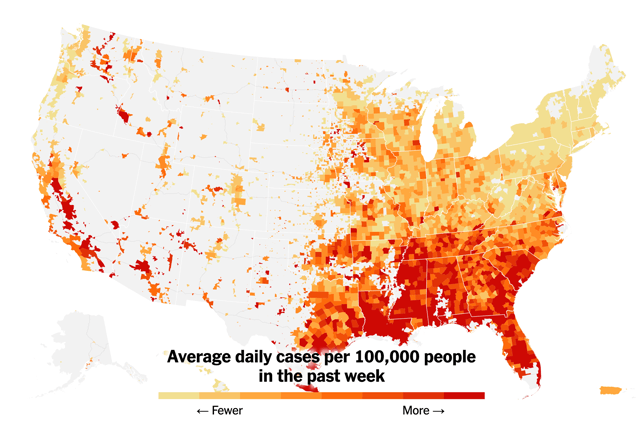

Here is the latest county by county map of cases per capita from the NYT:

It is manifest that those States which recklessly reopened and/or did not require masks at least in interior spaces have suffered far more in the renewed outbreak than States, like NY and NJ, which were more responsible.

As my German grandmother used to say, “Those who cannot see must feel.”

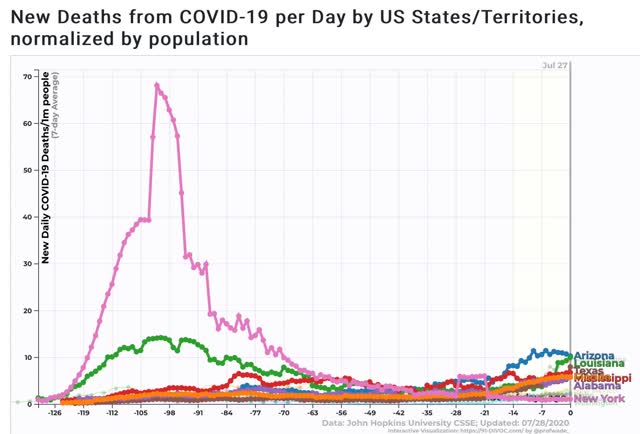

Finally, here is the graph of the 7 day average of deaths per capita, again highlighting the top 5 States, plus Florida, which is #6:

For perspective, here is the same graph plus NY for purposes of scale comparing the present per capita death rate in the current worst States vs. NY’s at its peak:

So there is some actual, if very slight and relative, “good news” in that the pain threshold has led to a decline in cases nationally and in some of the worst hit States. But because national leadership is the same, I expect that any period of waning will give rise to new complacency (vis. a party in Jackson NJ with 700 guests!) and new calls for forced reopening.

Monday, July 27, 2020

June durable goods orders continue rebound

- by New Deal democrat

Last week I wrote a synopsis of the short leading indicators and what they suggested about the ultimate Presidential election result in November. Basically they have improved over the last several months, and suggested the polls would tighten compared with the present.

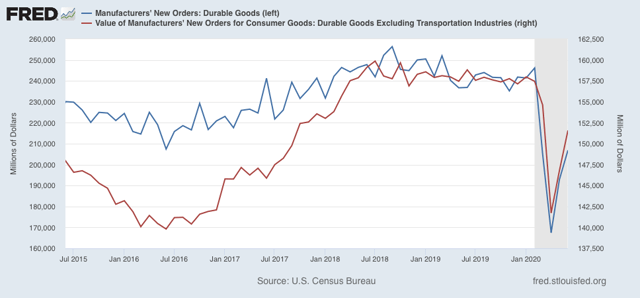

Among the missing June indicators were durable goods. They were reported this morning, and continued their sharp rebound from May, making up in total about half of their pandemic decline:

This adds to the evidence that the economy is likely to be better in November than it was in Q2, so adds incrementally to the idea that the race will tighten somewhat compared with recent polls.

Sunday, July 26, 2020

The 2020 Presidential and Senate polling nowcasts: we need more small State polling!

- by New Deal democrat

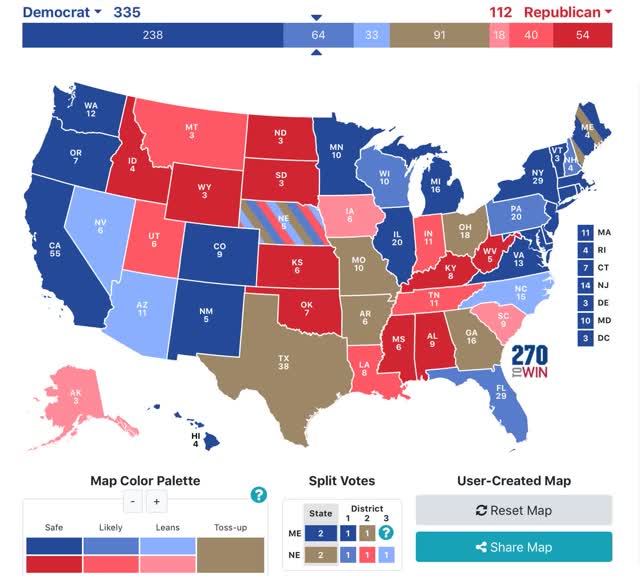

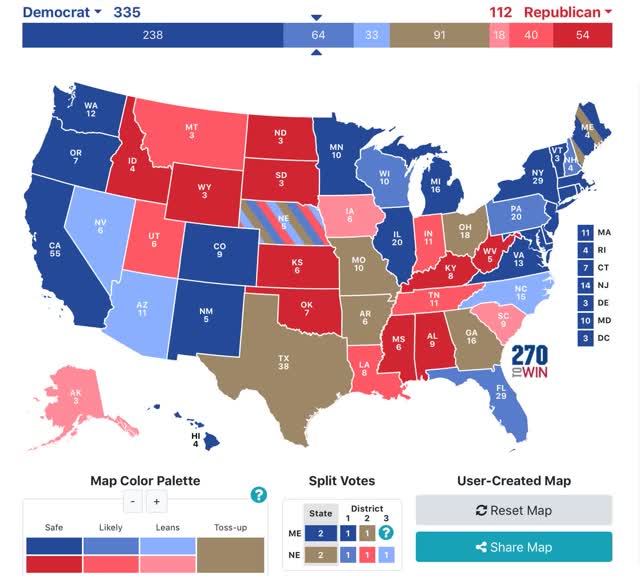

For the past five weeks I have posted a projection of the Electoral College vote based solely on State rather than national polls (since after all that is how the College operates) that have been reported in the last 30 days, using the following formula:

- States where the race is closer than 3% are shown as toss-ups.

- States where the range is between 3% to 5% are light colors.

- States where the range is between 5% and 10% are medium colors.

- States where the candidate is leading by 10% plus are dark colors.

As I emphasized last week, polls are really just nowcasts, snapshots in time that will change as circumstances change.

To cut to the chase, there are no changes this week compared with last week. Biden is leading comfortably in the Electoral College vote, not even counting States that are only “leaning” in his direction:

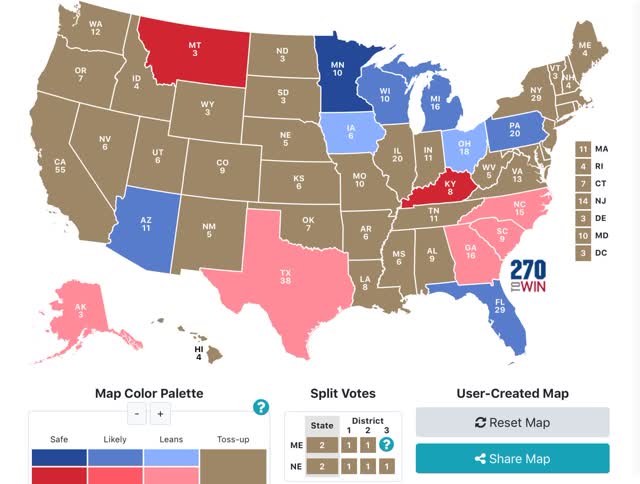

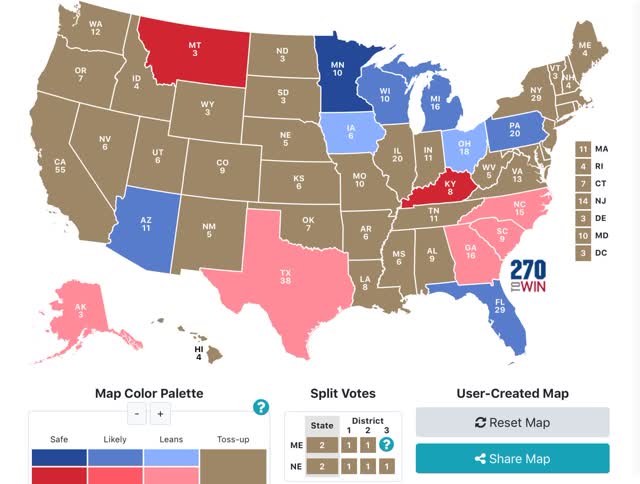

But there has been a fair amount of polling in the past week or so. The below map shows only those States that have been polled in the last 10 days. The only change in the color coding is that any “lean” of even less than 1% is shown in the appropriate color (to differentiate polled from non-polled States):

As I’ve been anticipating, it looks like there is a small “reversion to the mean” particularly occurring in the States of the Confederacy, but also note Ohio, which was just polled for the first time in several months, and showed a slight Biden lean.

Next, last week I wrote that I would very much like to see more State polling in the red States, because there are GOP Senators who should be targeted that we don’t even know are vulnerable as of this point.

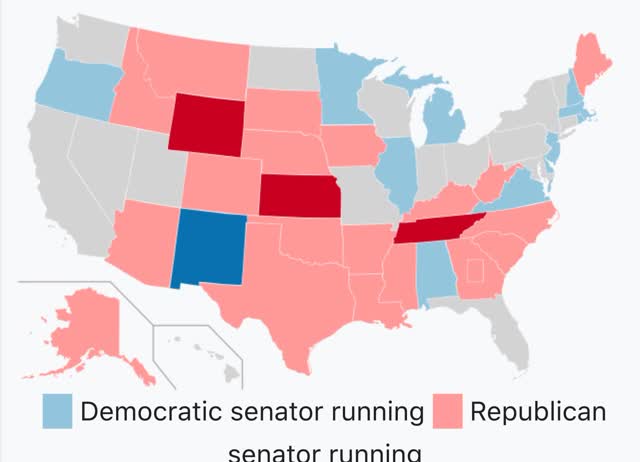

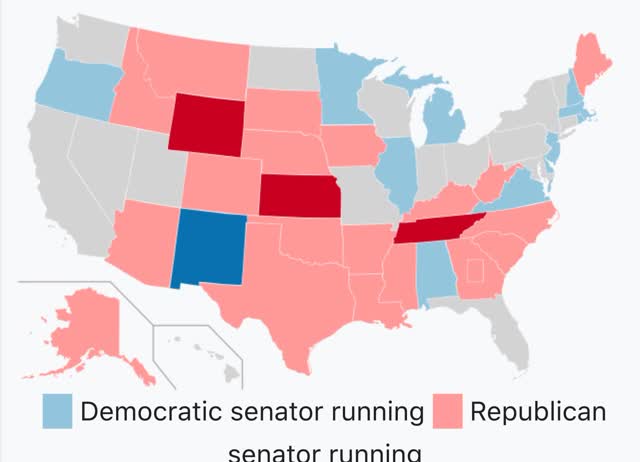

To demonstrate that, below are two maps. The first shows those Senate seats that are up for elections in 2020:

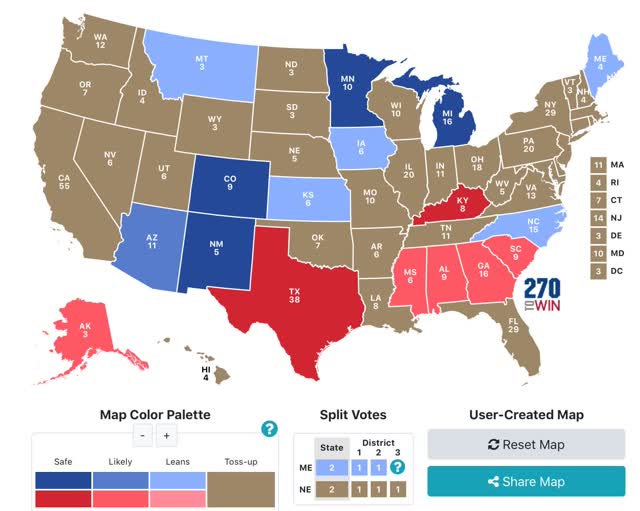

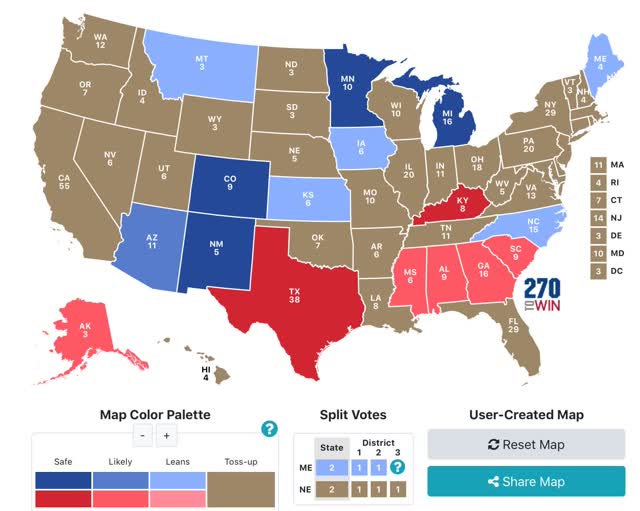

Now here is a color coded map based on all Senate polls in those States for the last 60 days (again, coding even very slight “leans” in the appropriate color to differentiate from non-polled States):

I want to emphasize several things about this second map. First of all, with the exception of Montana and Kansas, which are *extremely* tight, all of the other races have shown *consistent* leans in the same direction. As a result, I am not terribly sanguine about any Democrat’s chances in the Deep South, even though Georgia and South Carolina have been polling relatively close. It is also pretty clear that Democrats donating to the Texas and Kentucky races are throwing their money away. That same amount of money would go a long way in Maine, Iowa, Montana, and help in North Carolina as well.

- States where the race is closer than 3% are shown as toss-ups.

- States where the range is between 3% to 5% are light colors.

- States where the range is between 5% and 10% are medium colors.

- States where the candidate is leading by 10% plus are dark colors.

As I emphasized last week, polls are really just nowcasts, snapshots in time that will change as circumstances change.

To cut to the chase, there are no changes this week compared with last week. Biden is leading comfortably in the Electoral College vote, not even counting States that are only “leaning” in his direction:

But there has been a fair amount of polling in the past week or so. The below map shows only those States that have been polled in the last 10 days. The only change in the color coding is that any “lean” of even less than 1% is shown in the appropriate color (to differentiate polled from non-polled States):

As I’ve been anticipating, it looks like there is a small “reversion to the mean” particularly occurring in the States of the Confederacy, but also note Ohio, which was just polled for the first time in several months, and showed a slight Biden lean.

Next, last week I wrote that I would very much like to see more State polling in the red States, because there are GOP Senators who should be targeted that we don’t even know are vulnerable as of this point.

To demonstrate that, below are two maps. The first shows those Senate seats that are up for elections in 2020:

Now here is a color coded map based on all Senate polls in those States for the last 60 days (again, coding even very slight “leans” in the appropriate color to differentiate from non-polled States):

I want to emphasize several things about this second map. First of all, with the exception of Montana and Kansas, which are *extremely* tight, all of the other races have shown *consistent* leans in the same direction. As a result, I am not terribly sanguine about any Democrat’s chances in the Deep South, even though Georgia and South Carolina have been polling relatively close. It is also pretty clear that Democrats donating to the Texas and Kentucky races are throwing their money away. That same amount of money would go a long way in Maine, Iowa, Montana, and help in North Carolina as well.

But most importantly, note the almost complete lack of polling in the High Plains and Mountain West. These are small States in terms of population and cost of media markets, but their Senate votes count just as much as the largest States. Where there has been polling - Iowa, Montana, and Kansas — the Democratic candidates are extremely competitive.

So there is a crying need for more polling in these States, and also New Hampshire, and maybe even West Virginia. If there is going to be a “blue wave” Presidential election, we are needlessly flying blind as to potential inexpensive pick-ups in an expanded Senate map.

Subscribe to:

Comments (Atom)