- by New Deal democrat

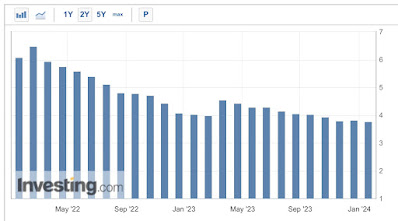

For this post, I’m going to show what the housing market looks like from most to least leading of the indicators. That shows that, although this morning’s release for housing permits and starts for December was generally positive, it is more likely that housing construction will decline rather than advance further in coming months.

Since interest rates lead housing construction, let’s start with the YoY change in mortgage rates (inverted, red) vs. the YoY change in housing permits (/10 for scale):

In December, mortgage rates were only about 0.4% higher than they were one year ago, suggesting that housing permits, which were actually 6% higher than in December 2022, will cool off in the coming months.

This shows up better when we compared the actual numbers. Mortgage rates rose significantly in October and November of both 2022 and 2023, only to decline in December of both years. In the first part of 2023, they remained lower than they had been in late 2022. With a lag, permits followed, turning down at the end of 2022 and then rising in the first half 2023 before leveling off in the second part of the year:

We are probably going to see a downturn in permits in the coming months, in reaction to the increase in mortgage rates during autumn.

The next most leading marker is that single family new home sales, although very noisy and heavily revised, tend to lead single family permits by several months. In reaction to the rise in interest rates in late 2023 discussed above, new home sales (blue) have already turned down (their 3 month average is down -7.5% from last spring’s peak), suggesting that single family permits (red), which made 1.5 year high in December) are going to follow:

Housing starts (light blue in the graph below) follow typically permits (blue) with a one to two month lag, and they are noisier:

Starts have trended sideways to slightly higher in the second part of 2023, but their noise makes a true trend almost impossible to see.

Finally, lagging all of the above is the actual economic impact of housing, units under construction. In contrast to conditions which have preceded recessions, these have turned down only slightly in the past year:

Because there has been a particular emphasis on multi-unit construction, here are single family (red), multi-unit (gold), and total units (blue) under construction for the past 5 years:

Single family housing under construction is down about -20%, at the lowest level since May 2021, while multi-unit construction has declined only -1% from its peak early last year. Total units, which typically have declined -10% or more before recessions, are only down -2%, nevertheless at their lowest level since April 2022.

To see where these trends are headed, here are permits for each:

All of the recent increase in permits has been for single family housing, which increased to its highest level since May 2022. The big increase in multi-unit permits has completely reverted to pre-pandemic levels, a -35% decline. While multi-unit permits increased slightly in December, they remain just slightly higher than their 3 year low set in November. Because multi-unit construction takes much longer than single family housing construction, the decline in apartment and condo construction is likely to slowly play out over this entire year.

To summarize: although there was a big decline in mortgage rates in December, the higher rates of the second half of 2023 have yet to work their way through housing construction. We can expect permits, starts, and units under construction to decline in the months ahead. Because manufacturing for the past year has been generally recessionary, how much housing construction declines will be very important for the economy in the latter part of this year. The course of housing thereafter depends on whether the decrease in mortgage rates since Thanksgiving is sustained or continues.