Until then ....

Regional and state unemployment rates were generally lower in November.

Thirty-six states and the District of Columbia recorded over-the-month unemployment rate decreases, 8 states registered rate increases, and 6 states had no rate change, the U.S. Bureau of Labor Statistics reported today. Over the year, jobless rates increased in all 50 states and the District of Columbia. The national unemployment rate edged down in November to 10.0 percent, 0.2 percentage point lower than October, but3.2 points higher than November 2008.

In November, nonfarm payroll employment increased in 19 states and decreased in 31 states and the District of Columbia. The largest over-the-month increase in employment occurred in Texas (+17,300), followed by Ohio (+5,400), Georgia (+4,800), and Arizona and Iowa (+4,300 each) Alaska experienced the largest over-the-month percentage increase in employment (+0.5 percent), followed by Iowa (+0.3 percent). The largest over-the-month decrease in employment occurred in Florida (-16,700), followed by Michigan (-14,000), California and Pennsylvania (-10,200 each), and New Jersey (-9,400). Hawaii (-1.0 percent) experienced the largest over-the-month percentage decrease in employment, followed by Nevada (-0.7 percent) and Maine, Mississippi, and Montana (-0.6 percent each). Over the year, nonfarm employment decreased in all 50 states and increased in the District of Columbia. The largest over-the-year percentage decreases occurred in Nevada (-6.1 percent), Wyoming (-6.0

percent), Michigan (-5.9 percent), Arizona (-5.6 percent), and Oregon

(-5.2 percent).

As savings rise and the market rallies, however, a new consumer is emerging, seeking a sensible middle ground between the gross excesses of the mid-2000s and the privations of the past year. He -- and more often, she -- is likely to find it in companies that offer great products, excellent service and outstanding value, which, by the way, doesn't always mean the lowest price.

The economy appears to have begun recovering after the worst recession in half a century. But businesses ranging from shoemakers to financial services to luxury hotels don't expect American consumers to return to their spendthrift ways anytime soon. They see consumers emerging from the punishing downturn with a new mind-set: careful, practical, more socially conscious and embarrassed by flashy shows of wealth.Much as the 1930s shaped the spending habits of an entire generation, many companies now anticipate a shift in consumer behavior that persists even after jobs and growth get back closer to normal.

"We seem to be at a cultural inflection point that we haven't seen since World War II," said Jim Taylor, vice chairman of market researcher the Harrison Group. Last month it surveyed 1,800 affluent Americans and found that 48% think they could suffer major financial losses in the future. "People are getting used to being careful, and I don't know how you undo that," Mr. Taylor said.

This ties in to a few interesting developments.

Total household debt outstanding is decreasing. Therefore

Debt service payments as a percentage of disposable income are decreasing. In addition

The financial services obligation ratio is also dropping. In addition,

The savings rate is increasing, indicating we're spending less.

So, we're paying down debt and becoming thriftier. We're becoming our parents.

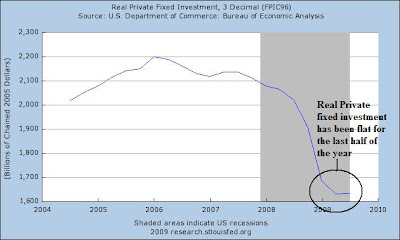

Information received since the Federal Open Market Committee met in November suggests that economic activity has continued to pick up and that the deterioration in the labor market is abating. The housing sector has shown some signs of improvement over recent months. Household spending appears to be expanding at a moderate rate, though it remains constrained by a weak labor market, modest income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment, though at a slower pace, and remain reluctant to add to payrolls; they continue to make progress in bringing inventory stocks into better alignment with sales. Financial market conditions have become more supportive of economic growth. Although economic activity is likely to remain weak for a time, the Committee anticipates that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a strengthening of economic growth and a gradual return to higher levels of resource utilization in a context of price stability.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

The Producer Price Index for Finished Goods rose 1.8 percent in November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This increase followed a 0.3-percent advance in October and a 0.6-percent decrease in September. In November, at the earlier stages of processing, prices received by manufacturers of intermediate goods climbed 1.4 percent, and the crude goods index rose 5.7 percent. On an unadjusted basis, prices for finished goods moved up 2.4 percent for the 12 months ended November 2009, their first 12-month increase since November 2008.

About three-fourths of the November advance in the finished goods index can be traced to higher prices for energy goods, which jumped 6.9 percent. The indexes for finished goods less foods and energy and for finished consumer foods also contributed to the finished goods increase, both rising 0.5 percent.

On a seasonally adjusted basis, the Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months the index increased 1.8 percent before seasonal adjustment, the first positive 12-month change since February 2009.

The seasonally adjusted increase in the all items index was due to a 4.1 percent increase in the energy index. The index for gasoline rose sharply and the indexes for electricity, fuel oil, and natural gas also increased, creating the fourth consecutive rise in the energy index and the largest increase since August. In contrast, the index for all items less food and energy was unchanged in November, after ten consecutive monthly increases. Declines in shelter indexes offset increases in the indexes for new and used motor vehicles, medical care, airline fares, and tobacco.

Let's look at the data from the report.

First, we've had increases in 8 of the past 12 months. That is actually good news because it indicates we're probably clear of a deflationary threat. In the long-run that is very good news.

Notice the year over year number is now back in positive territory. This is the same pattern the PPI followed and it is also good news largely because it means we're probably clear of a deflationary threat.

Click for a larger image.

The primary reason for this month's increase was energy prices -- just like PPI.

-----

NDD here, adding the following:

The same factors apply to the CPI as to the PPI. In short, it’s all about Oil – correlating with the run-up in Oil from $70 to $80/barrel.

Note that at the moment Oil is back down to $70/barrel which suggests that December may take back all of the November increase. In short, there are no real inflation concerns in the consumer number.

1.8% inflation with a ZIRP by the Fed = EZ money! And that means economic growth in the immediate future. If anything, the fact that YoY core inflation continues to be very low – only 1.7% again this month – is cause for concern in that there is very little cushion between here and institutionalized deflation (see Prof. Krugman re: this). The more present problem is that YoY PPI at 2.7% is higher than YoY CPI at 1.8%. If that is just a one month blip, it’s not a big deal. But if it continues, that means that producers are unable to pass on commodity price increases to already-strapped consumers, and that in turn is a recipe for yet another retrenchment in hiring and production.

Back over to Bonddad:

------

Sadly, he showed his true partisan colors yesterday on Bloomberg TV when he reiterated -- at least three times -- that the cause of our recent economic near-death experience was "the government forcing banks to make loans to people who never should have gotten them in the first place" (e.g. The CRA made me do it). That canard has been discredited so many times, for so long, by so many people -- including members of the Fed and bank execs themselves -- that I couldn't even believe Gartman was going to try to breathe life into it. But there he was.

Sorry, Dennis, I think many folks lost a great deal of respect for you yesterday. I know I did. Credible pundits should take better care to separate their politics from their economic analysis. The two don't belong together.

Cites:

Federal Reserve: "In the end, our analysis on balance runs counter to the contention that the CRA contributed in any substantive way to the current crisis."

Ken Lewis, BofA CEO: "But the charge that CRA lending was the primary or foundational cause of our housing crisis is not only unfair, it’s not true. [...] There’s no mandate to make risky loans, or to abandon sound lending principles. [...] Many reports and investigations, including a Fed report in 2000 and our own experience over the past 30 years, have found that CRA lending can be profitable, and need not be overly risky. The riskiest subprime lending of the past ten years didn’t have anything to do with CRA… in fact, 75% of high-priced loans made by mortgage companies and bank affiliates in recent years were not covered by CRA."

Literally dozens of others all over the web.

From Bonddad: This is one of the basic problems with the US: pure stupidity and a need to explain everything through a partisan lens. The causes of the financial wreckage of 2008 were numerous. In essence, to understand them you have to be aware of how multiple events can play out. This requires thinking beyond labels and talking points. That is not possible in today's political environment.

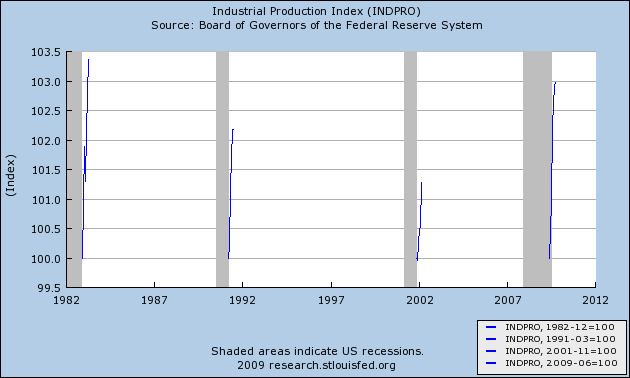

Industrial production increased 0.8 percent in November after having been unchanged in October.

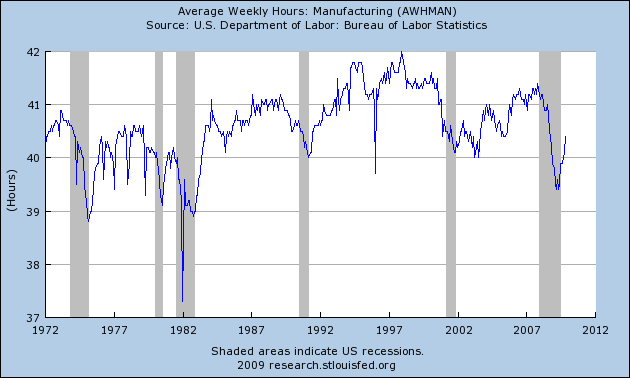

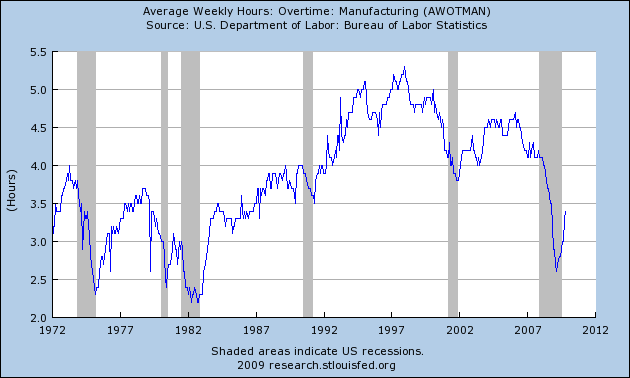

Manufacturing production advanced 1.1 percent, with broad-based gains among both durables and nondurables. The output of mines climbed 2.1 percent, but the index for utilities fell 1.8 percent, primarily as a result of lower output of gas utilities--temperatures in November were unseasonably mild and reduced the need for heating. At 99.4 percent of its 2002 average, total industrial production was 5.1 percent below its level of a year earlier. Capacity utilization for total industry moved up 0.7 percentage point to 71.3 percent, a rate 9.6 percentage points below its average for the period from 1972 through 2008.

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers leveled off in December, following four months of improvement. The general business conditions index fell 21 points, to 2.6. The indexes for new orders and shipments posted somewhat more moderate declines but also moved close to zero. Input prices picked up a bit, as the prices paid index rebounded to roughly its November level; however, the prices received index moved further into negative territory, suggesting that price increases are not being passed along. Current employment indexes slipped back into negative territory. Future indexes remained well above zero but signaled somewhat less widespread optimism than in recent months. Indexes for expected prices paid and received declined moderately but remained well above zero.

Paul A. Samuelson, whose analytical work laid the foundation for modern economics, died Sunday. He was 94. Actively publishing into the 2000s, Mr. Samuelson’s career in economics spanned eight decades. In 1970, he was the first American to win the Nobel Prize in economics, the second year the prize was offered.