- by New Deal democrat

No important economic news today, but it’s been a while since I took a look at the COVID-19 data, and there is an interesting trend, so let’s have at it!

But first, some bad news. The most reliable data for infections for the past year has been from Biobot, which tracked wastewater nationwide. Well, they lost their contract, which was won by a Google subsidiary called Verily. And Verily has all but rendered the data useless. In particular, they do not track any aggregate levels of COVID particles in wastewater regionally or nationwide. The sole option they provide is to show individual plants’ data. So there is no way to know what any regional or national trend is.

In short, all but totally worthless.

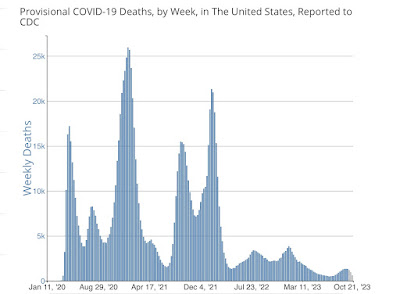

The CDC is still providing weekly updates on hospitalizations and deaths. And the data continues to show how COVID is much less virulent than it once was, whether because of mass vaccinations, near universal previous infections, and/or mutations in the virus itself.

As to hospitalizations, in the first year of the pandemic, weekly hospitalizations never declined below about 22,000:

But in the past year, in every period except last winter - between Thanksgiving and the end of Feburary - hospitalizations have *always* been under 22,000, hitting an all time low of about 6,000 this past summer:

Even now, hospitalizations are only about 16,000, about 75% of their level one year ago.

The news is even more promising when it comes to deaths.

For the last 18 months, deaths have been sharply lower than they were during the first 2 years of the pandemic:

During the first 2 years, with the exception of the brief respite during the summer of 2021, deaths never declined below 3,800 per week. But since then, with the exception of one week last January, deaths have never been *above* 3,800 per week.

And the news has continued to improve this year.

Because the virus displays some seasonality (probably having to do with large winter gatherings indoors), below I break down deaths in 6 and 12 month increments, to show how the death toll has been declining over time. The first number is the 6 month total (in thousands), the 2nd the 12 month total:

4/1/20-9/30/20: 211

10/1/20-3/31/21: 353 [564]

4/1/21-9/30/21: 166 [519]

10/1/21-3/31/22: 267 [433]

4/1/22-9/30/22: 62 [329]

10/1/22-3/31/23: 65 [127]

4/1/23-9/30/23: 23 [88]

As with economic data, the 12 month moving average takes away the seasonality issue. And we can see that the 12 month total has been relentlessly declining. Indeed, for the last 12 months it has equaled about an average annual flu season.

And here is the breakdown between warmer and colder seasons over time:

Colder: 353, 267, 65

Warmer: 211, 166, 62, 23

If this decline in virulence holds for this colder season as well, I would expect less than 50,000 deaths, and perhaps as low as about 30,000. As usual, these are mainly going to be among the elderly and the unvaccinated.

One fly in the ointment: it had occurred to me that some of these deaths might be among people who would otherwise have died from the flu, but that does not seem to be an important factor. In the 10 years before the pandemic, an average of 35,000 people a year died from the flu. In 2021-22, only 5,000 died. But in 2022-23, the preliminary estimate from the CDC - with a huge confidence band - is somewhere between 17,000 and 98,000.