- by New Deal democrat

No economic news today. Tomorrow the August CPI will be reported. Recall that in July there was no inflation whatsoever. In August last year prices increased 0.3%, so any number lower than that will lower YoY CPI from its July level of 8.5% (June’s 9.0% YoY inflation having been the peak).

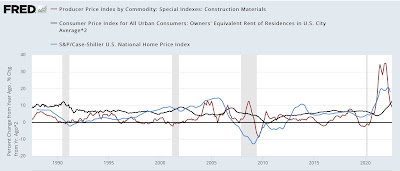

The big bugaboos for consumer inflation have been housing, vehicles, and gas. So let’s take a look at each.

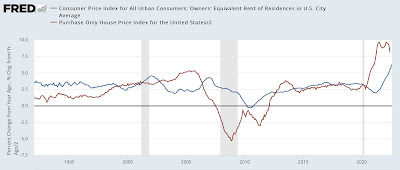

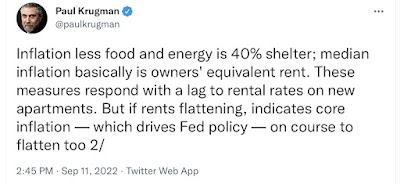

Yesterday, for the first time, Prof. Paul Krugman acknowledged something I’ve been pounding on for nearly a year:

I.e., the official measure of inflation, which drives Fed policy, lags the real world badly - by 12 to 18 months, by my best calculation.

Krugman made this observation by way of noting that monthly apartment rents, per Apartments.com, may be peaking:

The official CPI measurement of rents includes that for *all* apartments. But since leases typically last a year, the leading wedge of rents is for those apartments the leases for which renewed this month.

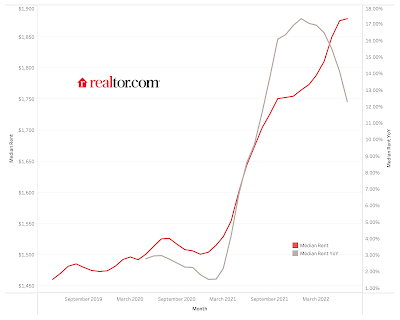

The best measure I’ve found is from ApartmentList. Here’s their cumulative and YoY measure as reported by realtor.com:

Note by my rule of thumb, that measures peak roughly when their YoY rate of increase decelerated by 50%, rents have not quite peaked yet.

A better view is their monthly % change measure:

Note that before the pandemic, the typical seasonal pattern was that the biggest increases were in the spring, with declines in the last 4 months of the year. Last month’s increase was significantly more than the August increases in 2018, 2019, and 2020.

For contrast, here are the FHFA and Case Shiller house price indexes measured YoY over the same period of time:

House prices started accelerating YoY well before apartment prices. Both apartment and house prices *may* have hit their YoY peaks simultaneously this past March. But there’s not enough of a history of the comparative data to make any further statements with confidence.

Because the CPI measures of rent lag, we will probably see continued significant increases tomorrow.

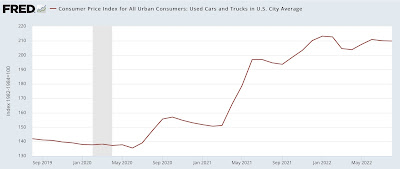

While there’s little information on new vehicles,

Wolf Street had a good article on used car prices, using data from Mannheim auto auctions. Here’s his graph of prices paid:

Note the peak in prices was 7 months ago.

Here’s the YoY graph:

The YoY peak was 9 months ago.

Now here is CPI for used vehicles, both in absolute terms (blue) and YoY (red, right scale):

This measure of CPI seems to track Mannheim’s data fairly well. Since prices declined about 5% in August, per Mannheim, I am looking for a similar decline in used vehicle prices in tomorrow’s CPI.

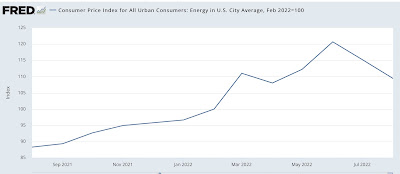

Finally, here’s the monthly change in gas prices from the E.I.A. (blue), /16 for scale, and adding .15%, which has been the long term average of “core” cpi growth monthly, compared with total CPI:

Gas prices declined even more in August than they did in July.

So we will probably see continued upward pressure on CPI from shelter prices tomorrow, offset by a softening in used car prices, and a decline in energy prices. Add this up and it would not be surprising at all to see an actual *decline* in CPI for August, which needless to say would bring down YoY CPI growth to something like 8%.

This, unfortunately, will not be enough to stop the Fed from another big rate hike later this month.