|

|

Paul Krugman |

|

|

|

Those on the reactionary side of the political spectrum are big proponents of equal opportunity-the outcome, whether you make a decent living, live high off the hog or suffer in poverty-is up to the individual.

In today’s U.S. economy, such reasoning is flawed, says economist Paul Krugman. Instead, the nation’s increasingly unequal distribution of wealth translates into unequal opportunity-a principle even conservatives should oppose. An array of forces-including growing imports, the falling real value of minimum wage and slower unionization-have contributed to this growing gap.

Krugman, a professor of Economics and International Affairs at Princeton University, delivered the keynote speech today at the

second briefing of the

Agenda for Shared Prosperity, a network of more than 50 progressive U.S. economists, policy analysts and academics sponsored by the Economic Policy Institute (

EPI). Today’s event, held on Capitol Hill in Washington, D.C., featured top-name leaders spearheading the fight for workers and their families. Although they spoke on a variety of topics, their comments shared a common theme: The American dream is slipping away for many hard-working families, and one of the key ways to restore that dream is by enabling workers who want to join unions to do so.

Krugman, also a columnist for The New York Times, said a powerful union movement bolstered the middle-class economy of the post-World War II decades but, in recent years, a political climate that encourages or at best winks at corporate union-busting has meant fewer workers who want to join unions can do so.

In fact, as professor Harley Shaiken writes in one of the four reports the Agenda for Shared Prosperity released today: “The yawning gap between robust demand to join unions and anemic membership numbers reflects the fact that for many Americans joining a union has become a risky proposition. Twenty-three thousand people a year are disciplined or fired for union activity resulting in a big chill on labor’s numbers and a ‘democracy deficit’ for the entire society.” Shaiken, a professor in the Graduate School of Education and Department of Geography at the University of California, Berkeley, writes in “

Unions, the Economy and Employee Free Choice”:

An effective way to address the “democracy deficit” is through the Employee Free Choice Act....It allows workers to form a union if a majority of people in a workplace sign up for one. In addition, it provides meaningful penalties for those who would violate workers’ rights and insures that if workers choose a union collective bargaining actually results. The act restores balance to a system that currently is driven by aggressive employers, anti-union consultants, coercion and fear.

Some 233 co-sponsors are backing the Employee Free Choice Act, introduced in the House earlier this month as H.R. 800, and working families and their unions are taking part in a week of action in

more than 100 cities thanking lawmakers who support the bill and urging others to sign on.

In a paper analyzing polling and survey data, economist Richard Freeman from Harvard University further made the case for the need to change the nation’s labor laws that currently are tilted in favor of Big Business. In his report, “Do Workers Still Want Unions? More than Ever,” Freeman concludes that:

In 2002 the proportion of workers who said they would vote for a union rose above the proportion that said they would vote against a union for the first time in any national survey: a majority of nonunion workers now desire union representation in their workplace.

America’s workers know that by joining unions, they can significantly improve their livelihoods, job security and future for their families. As Tom Kochan and Beth Shulman note, millions of America’s working families fail to have the necessary means for basic self-sufficiency—and it looks no better for the next generation. In their report, “A New Social Contract: Restoring Dignity and Balance to the Economy,” they write:

In 2000, the average high-school educated workers age 25–29 started out earning about $5,000 less real income and could expect slower growth in earnings than those who entered the labor force in 1970. Workers with some college started about $3,500 behind their 1970 counterparts.

Kochan is co-director of the Institute for Work and Employment Research at the Massachusetts Institute of Technology and Shulman authored

The Betrayal of Work: How Low-Wage Jobs Fail 30 Million Americans and Their Families. They find the decline in middle-class living standards, the elimination of institutions that support a growing middle class and the dramatic increase in income equality experienced in recent years is not the result of some invisible hand.

It is the direct result of policy choices that have undermined the bargaining power of every-day Americans. Instead of instituting policies in this global economy to ensure a broadly shared prosperity, we have made choices that benefit the few.

The implicit social contract that governed work for many years—the norm that hard work, loyalty, and good performance will be rewarded with fair and increasing wages, dignity, and security—has broken down and been replaced by a norm in which employers give primacy to stock price and short term gains at the expense of America’s workers.

As a result, the American Dream is slipping away from millions of Americans and their families. A majority of Americans now worry their children will not be able to improve on the standard of living they experienced growing up. If this is not the legacy we want to leave the next generation, then we need to start now to put in place forward-looking policies and labor market institutions to build a new social contract tailored to today’s workforce, families, and economy.

Throughout the year, the Agenda for Shared Prosperity will address the economic issues facing working families and offer solutions through reports on jobs, the economy, health care and more. In January, the Agenda for Shared Prosperity launch highlighted economist Jeff Faux’s “

Globalization that Works for Working Americans” and Jacob Hacker’s “

Health Care for America: A Proposal for Guaranteed, Affordable Health Care for All Americans Building on Medicare and Employment-Based Insurance.” In setting out a course of action for coming years, the Agenda for Shared Prosperity seeks to steer a stronger course for the nation’s economy—which some opinion-makers in the Democratic Party deny is headed in the wrong direction. As economist Tom Palley writes this week on

TomPaine.com:

This denial was recently on display in a report, "The New Rules Economy," issued by Third Way, an influential new Democrat think tank in Washington. The report denies America’s working families have been shortchanged. In doing so, it misrepresents economic reality, undercuts working families and gives comfort to supporters of corporate excess. That makes the Third Way the wrong way.

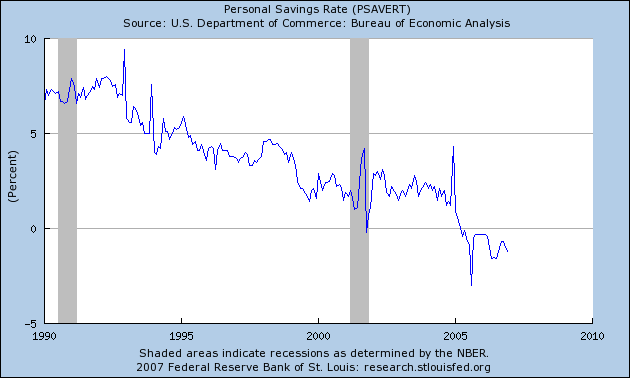

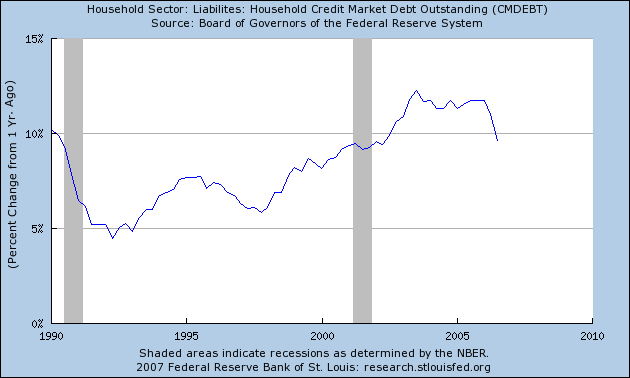

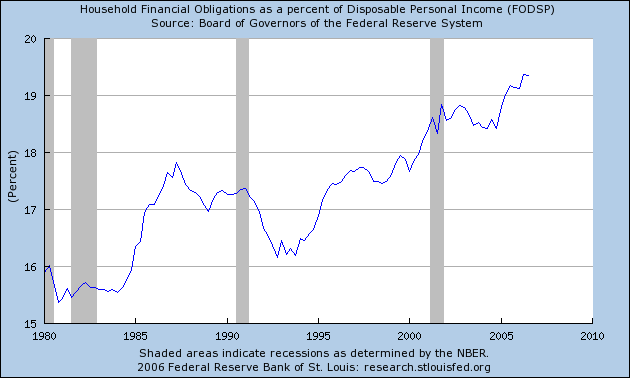

Palley goes on to point out how such groups as the Third Way deny that family income has stagnated and that there is no problem with excessive CEO pay, the massive trade deficit or household debt.

In another TomPaine article, Palley offers a “memo” to presidential contenders in which he suggests a road map for progressive Democrats to reverse the laissez-faire extremism of the past 30 years. Read it here.