- by New Deal democrat

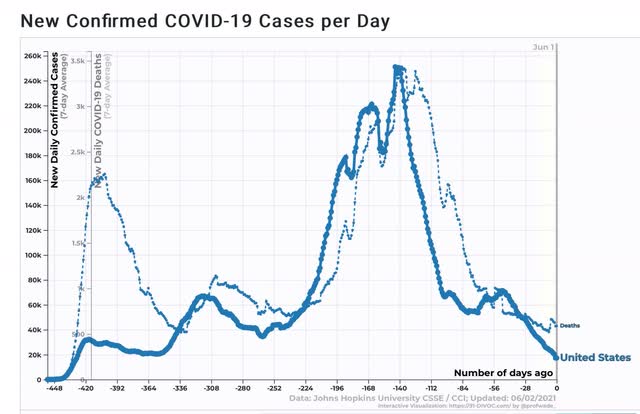

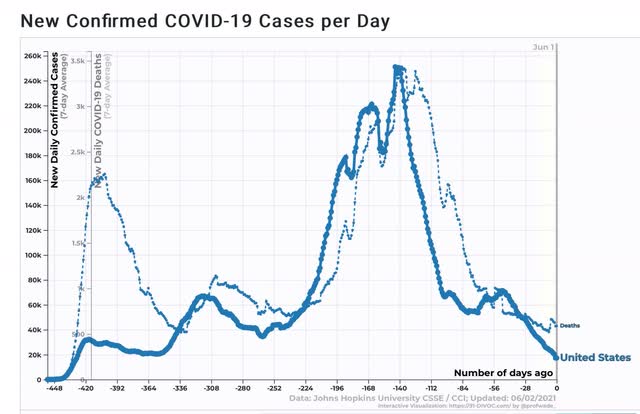

In the past week new COVID-19 cases declined almost 30%, by about 7,000 to 17,289/day; however, deaths actually increased by about 10% to an average of 589/day, mainly due to a data dump by California 5 and 6 days ago - thus I expect a new low in deaths within the next several days:

Total deaths are 595,213. Over 60% of all adults have received at least one dose, and over half are fully vaccinated. Slightly over half of the US population, including all children, has received at least one dose.

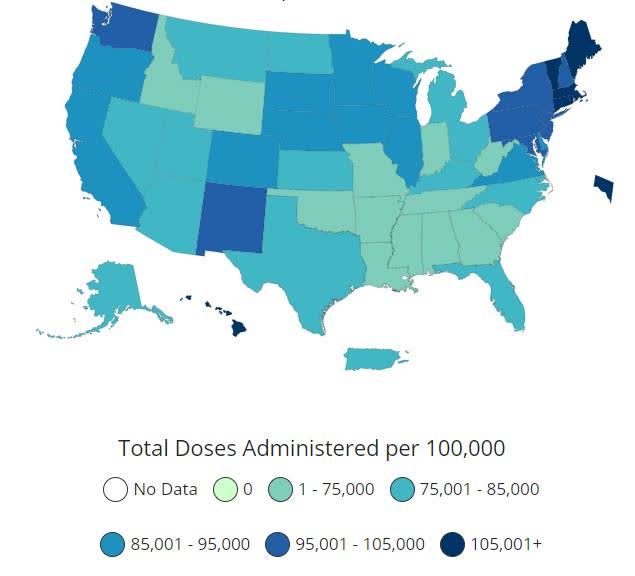

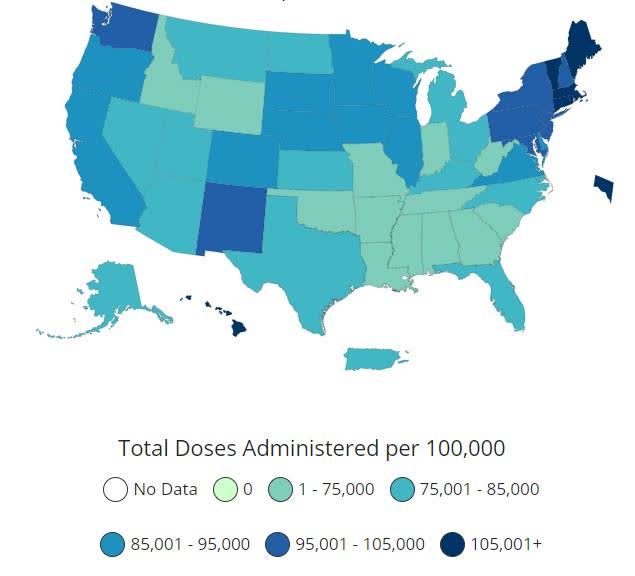

But the overall situation masks a large divergence between States where there have been the most vaccinations vs. States with the least. Here is the map of vaccination administration by State as of one week ago:

In the Northeast, only NY, at 67.9%, is slightly below 70% of all adults who have received at least one dose of vaccine. California also is over 70%.

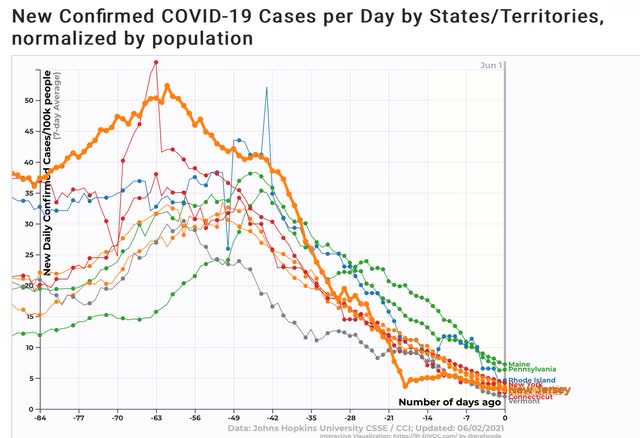

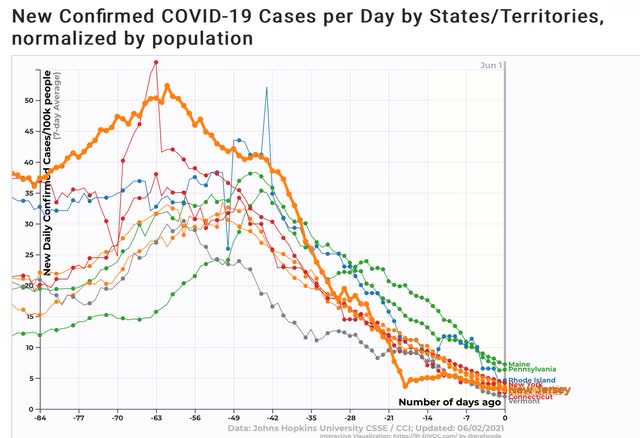

And here are the results: cases in the Northeastern States have rapidly declined to their best levels since the beginning of the pandemic. Only Maine and Pennsylvania, while still showing sharp declines, are lagging:

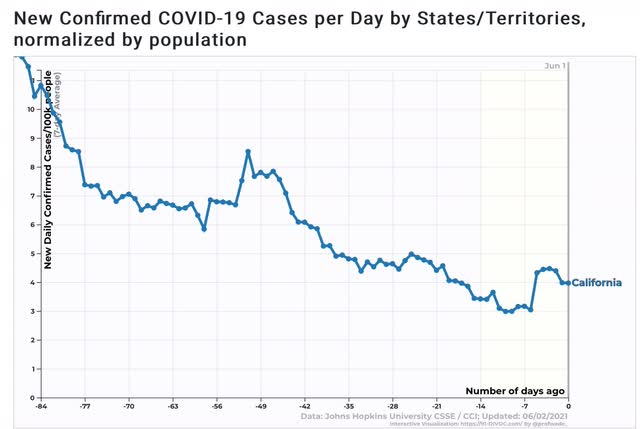

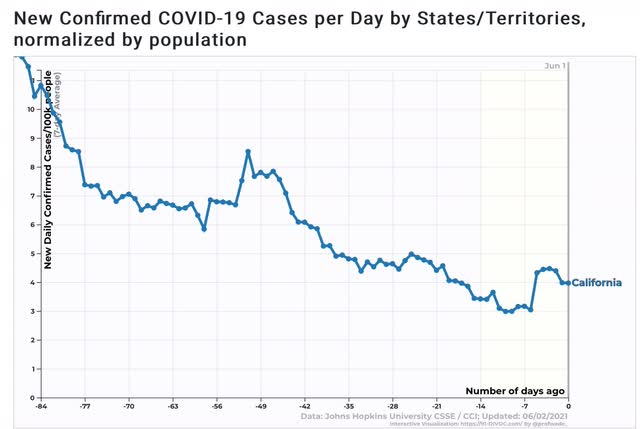

Meanwhile California has also seen over a 95% decline in cases since winter, when they averaged over 110 new cases per 100,000 population daily:

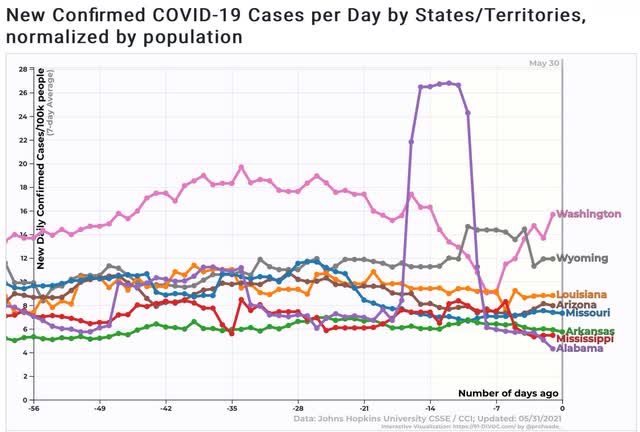

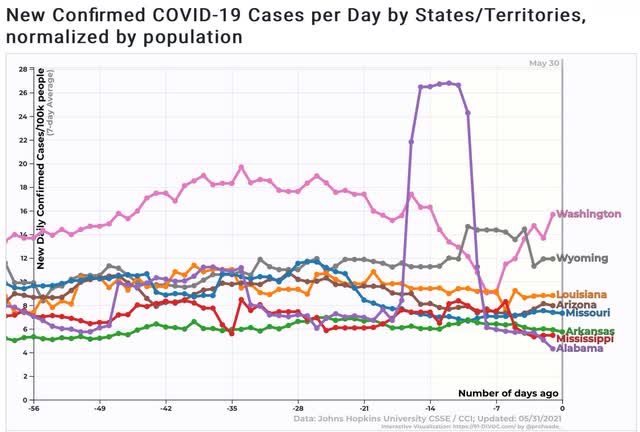

At the other end, there are 8 States which have seen *no* meaningful declines in cases over the past 8 weeks:

Four of them - WA, WY, LA, and AZ - are among the 10 worst States for new cases, which MO close behind. AR, MS, and AL are roughly in the middle of the pack. Note that with the exception of Washington State*, all of them are among those with the lowest rate of vaccinated population.

*A perusal of news sources in Washington State suggests that the recent increase in new cases is due to the admission of unvaccinated new residents to long term care facilities. When the disease is re-introduced into the facility, with close quarters and recirculated air among the most immune-compromised population, the disease spreads even among the vaccinated (although there is no indication of increased deaths among that group).

Basically, most of the US is at least very close to achieving herd immunity, while the disease continues to spread among those with recalcitrant populations, and if the new cases are all or virtually all among those who have voluntarily decided not to get vaccinated, then the disease is spreading among them at rates similar to last spring and summer, with little decline at all.