Here is the complete opening statementHere are the highlights.

Despite the downshift in growth, the demand for labor has remained solid, with more than 850,000 jobs having been added to payrolls thus far in 2007 and the unemployment rate having remained at 4-1/2 percent. The combination of moderate gains in output and solid advances in employment implies that recent increases in labor productivity have been modest by the standards of the past decade. The cooling of productivity growth in recent quarters is likely the result of cyclical or other temporary factors, but the underlying pace of productivity gains may also have slowed somewhat.

There is controversy about the labor picture. Some economists have argued the BLS' birth/death model has skewed recent numbers higher.

Here is a full explanation of the problem. While statistic issues are not my strong suit, the previous link provides a convincing argument that current employment numbers are too rosy.

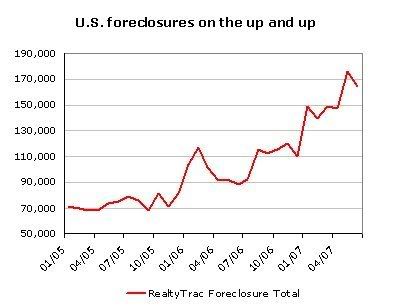

To a considerable degree, the slower pace of economic growth in recent quarters reflects the ongoing adjustment in the housing sector. Over the past year, home sales and construction have slowed substantially and house prices have decelerated. Although a leveling-off of home sales in the second half of 2006 suggested some tentative stabilization of housing demand, sales have softened further this year, leading the number of unsold new homes in builders’ inventories to rise further relative to the pace of new home sales. Accordingly, construction of new homes has sunk further, with starts of new single-family houses thus far this year running 10 percent below the pace in the second half of last year.

Notice that Bernanke is finally admitting the housing market is a bigger problem than currently thought and is largely responsible for the current economic downturn. However, it's also important to remember the Fed Chair is in a difficult position. He can't simply come out and say housing is dropping like a stone; part of his job is to offer assuring statements and a calm outlook. But considering the length of the housing downturn and the severity of the inventory overhang, I personally think Bernanke has understated the problem to a larger degree than prudent.

Real consumption expenditures appear to have slowed last quarter, following two quarters of rapid expansion. Consumption outlays are likely to continue growing at a moderate pace, aided by a strong labor market. Employment should continue to expand, though possibly at a somewhat slower pace than in recent years as a result of the recent moderation in the growth of output and ongoing demographic shifts that are expected to lead to a gradual decline in labor force participation. Real compensation appears to have risen over the past year, and barring further sharp increases in consumer energy costs, it should rise further as labor demand remains strong and productivity increases.

This statement slightly contradicts Bernanke's "the employment outlook is good" statement. If job growth were as robust as the numbers illustrate -- and if wage growth were as strong as indicated by the low unemployment rate-- then consumer spending would probably be stronger.

In the business sector, investment in equipment and software showed a modest gain in the first quarter. A similar outcome is likely for the second quarter, as weakness in the volatile transportation equipment category appears to have been offset by solid gains in other categories. Investment in nonresidential structures, after slowing sharply late last year, seems to have grown fairly vigorously in the first half of 2007. Like consumption spending, business fixed investment overall seems poised to rise at a moderate pace, bolstered by gains in sales and generally favorable financial conditions. Late last year and early this year, motor vehicle manufacturers and firms in several other industries found themselves with elevated inventories, which led them to reduce production to better align inventories with sales. Excess inventories now appear to have been substantially eliminated and should not prove a further restraint on growth.

Business investment will help, but not in as large a degree as we would like. In other words, the bullish argument's belief in a strong business sector may be overshooting the mark.

The global economy continues to be strong. Supported by solid economic growth abroad, U.S. exports should expand further in coming quarters. Nonetheless, our trade deficit--which was about 5-1/4 percent of nominal gross domestic product (GDP) in the first quarter--is likely to remain high.

Exports should grow, but not enough to tame the trade deficit.

So here's his conclusion:

Overall, the U.S. economy appears likely to expand at a moderate pace over the second half of 2007, with growth then strengthening a bit in 2008 to a rate close to the economy’s underlying trend.