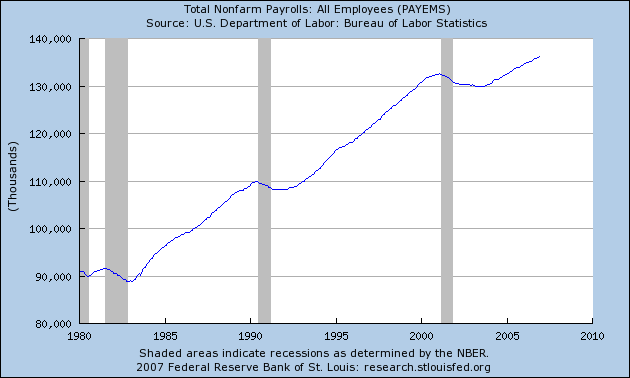

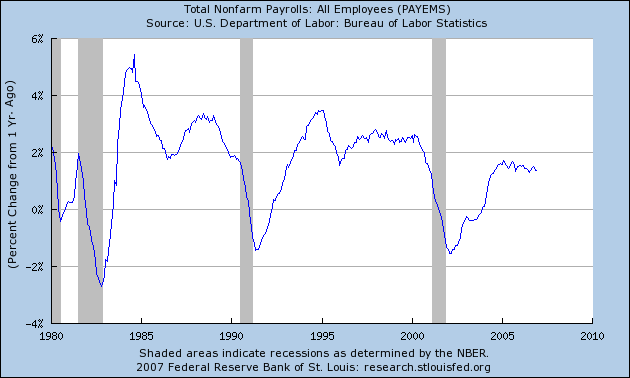

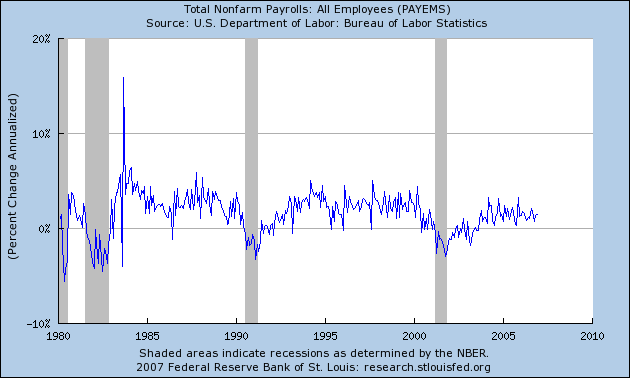

So, the latest jobs report released Friday by the U.S. Bureau of Labor Statistics (BLS) showed more job growth than analysts anticipated, and you practically could hear the champagne corks go off at the White House. The same report that found jobs increased by 167,000 in December also reported that average hourly earnings rose 4.2 percent in December.

Must mean America’s workers are sitting pretty, right?

Unfortunately for the economy and U.S. workers, such short-term trends are

misleading.

Looking at long-term wage growth, Jared Bernstein, senior economist for the nonprofit Economic Policy Institute (EPI),

puts it this way:

Real wages for most workers, after rising for the first few years of the 2000s, have fallen lately, and despite 14 percent higher productivity, a typical worker’s real weekly earnings are down 3 percent over this expansion. Median family income is down about $1,500 since 2000, and more than 5 million people have been added to the poverty rolls.

Wages and salaries today account for the smallest percentage of our gross domestic product on record, while corporate profits are at their highest level

since the 1960s.

In touting his economic policies in the months before the elections, Bush frequently referred to the 6.3 percent rise in the average net worth of an American family between 2001 and 2004, a statistic from the Federal Reserve Board’s Survey of Consumer Finances. But the law of averages here isn’t in favor of working families. For families at the bottom 40 percent of income, the median net worth

actually fell.

Another long-term trend is the separation of worker productivity from wage growth. Up to the early 1970s, the two grew together, with productivity 10 percent to 15 percent higher than wage growth. But since that time, workers have sped up their rates of productivity—but their employers have not similarly increased what they pay their employees. Wages now lag by more than 50 percent behind productivity.

Bob Herbert in his

New York Times column yesterday highlighted the perversity of a system in which employees work harder but see no correlative increase in their paychecks—not the best incentive for long-term productivity and certainly no benefit to workers. Herbert sums it up this way:

The productivity gains in the go-go decades that followed World War II were broadly shared, and the result was a dramatic, sustained increase in the quality of life for most Americans. Nowadays workers have to be more productive just to maintain their economic status quo. Productivity gains are no longer broadly shared. They’re barely shared at all.

Now, back to job growth. While the superficial BLS stats show the quantity of jobs created, behind that data a darker picture lurks—the quality of salary and benefit levels. What counts is not just the number of jobs created but how well those jobs provide a middle-class standard of living. (There’s a lot we can do about all this—and future posts will highlight elements of a populist economic agenda spearheaded by EPI that we in the progressive movement can rally behind in coming months.)

Jobs are increasing in sectors such as service and health care that, for the most part, offer low wages and unaffordable or no health care and pension plans. Meanwhile, jobs in industries such as manufacturing are in free fall: Between 2000 and 2003, annual manufacturing employment in the United States declined by nearly 3 million jobs and has been largely flat since then. The level of manufacturing employment in 2003 was 14.3 million, the

lowest since 1950. It’s easy to pooh-pooh manufacturing jobs as part of the “old economy,” but the fact is that manufacturing jobs provide solid salaries and health and retirement security rarely offered in the industries where we see rapid job growth.

And as Jacob Hacker has shown in

The Great Risk Shift, the unemployment rates we hear about omit what Hacker calls “shadow unemployment,” which includes the length of time workers now are unemployed. Writes Hacker:

Statistics on the long-term unemployed tell an equally worrisome story. Despite the sunny job statistics that most of us are familiar with, the share of the labor force experiencing unemployment for a half year or more—the standard definition of long-term unemployment—has in fact grown dramatically over the last generation. Indeed, compared with the late 1960s, the share of workers who experience long-term unemployment during the peak of the business cycle has more than tripled.

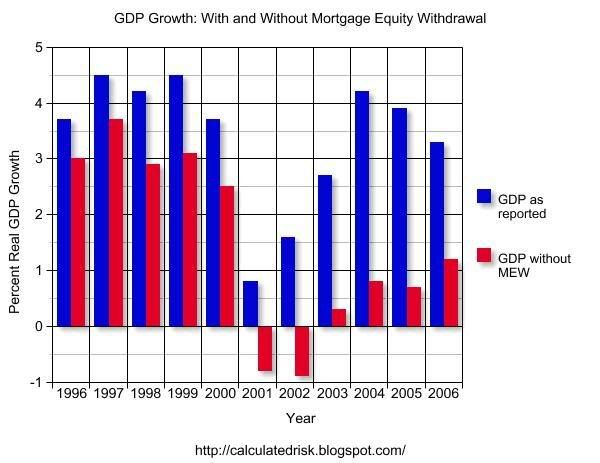

Short-term upticks won’t solve these long-term problems, and they won’t go very far to help working families dig out of debt and pay their mortgages on time. As Bonddad

reported in December:

The Mortgage Bankers Association, in its quarterly snapshot of the mortgage market released Wednesday, reported that the percentage of mortgage payments that were 30 or more days past due for all loans tracked jumped to 4.67 percent in the July-to-September quarter.

That marked a sharp rise from the second quarter’s delinquency rate of 4.39 percent and was the worst showing since the final quarter of last year, when delinquent payments climbed to a 2-1/2-year high in the aftermath of the devastating Gulf Coast hurricanes.

A recent

Center for American Progress report showed the nation’s middle class is in worse shape than ever. Some of the report’s findings:

- From 2001 to 2004, the proportion of middle-class families that has saved three months’ worth of income dropped to 18.3 percent from 28.8 percent.

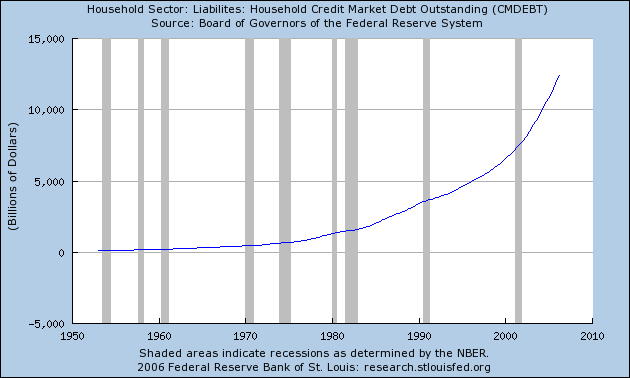

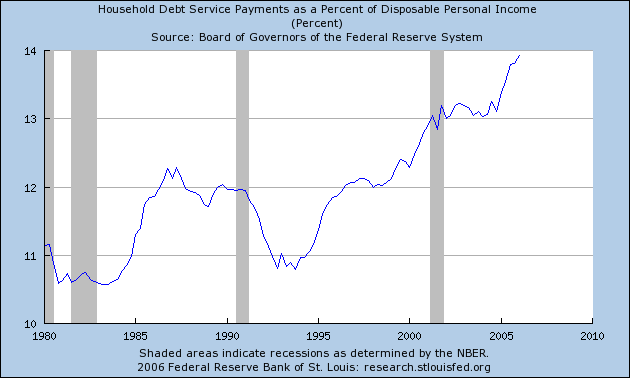

- To maintain day-to-day consumption, families have taken on a record amount of debt, equal to 126.4 percent of disposable income in the first quarter of 2006, according to the study.

In Election Day exit polling for the AFL-CIO, Peter D. Hart Research Associates found only 31 percent of voters felt they and their families could get ahead financially in the current economy—the rest report that they are just keeping up or falling behind. As pollster

Geoff Garin summarized:

Among the total electorate, 39 percent of voters said the economy was an extremely important issue for them in this election. These voters broke solidly for the Democrats—voting for a Democratic candidate in House races by a margin of 59 percent to 39 percent.

Or, as economist Paul Krugman

says:

The reason most Americans think the economy is fair to poor is simple: For most Americans, it really is fair to poor.

It’s been the pattern of the Bush administration to cherry-pick a few good stats to plump up its failed economic policies. But short-term data seldom work to describe long-term trends—and certainly don’t describe working families’ day-to-day reality of trying to pay the bills.