Saturday, January 26, 2019

Weekly Indicators for January 21 - 25 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

The short term and long term forecasts continued to diverge ever so slightly.

As always, clicking over and reading should be educational for you, and helps reward me a little bit for the work I do.

Friday, January 25, 2019

The first cracks in the dam?

- by New Deal democrat

My post describing the affect of the government shutdown on consumer sentiment, both historically and present, and the first possible crack in consumer spending, is up at Seeking Alpha.

As an aside, both Regional Fed new orders indexes (Richmond and Kansas City), which were soft last month, came in a little softer this month as well.

Thursday, January 24, 2019

Two economic notes on the shutdown

- by New Deal democrat

The government shutdown is the economic equivalent of sustaining -800,000, or -0.5%, layoffs. The last time we saw that was in the Panic of 2008.

So needless to say, it is very surprising that last week saw fewer official layoffs than at any time since November 1969. On a population-weighted basis, this is an all-time low. This entire behavior of first time jobless claims during this expansion speaks to employers only having hired new workers when there is compelling need. [Note that government workers are merely being “furloughed,” not laid off, so they are not showing up in these statistics.]

While this is undoubtedly good news, one of the two private sources of weekly consumer spending I follow reported only a +0.7% YoY increase in sales last week. Outside of the 2015-16 “shallow industrial recession,” this is the lowest for either of these series during the entire expansion.

I have a more detailed post about consumer spending pending at Seeking Alpha. Once it goes up, I’ll give you a link to hit here.

Wednesday, January 23, 2019

A yield curve paradox

- by New Deal democrat

I have a new post up at Seeking Alpha.

If the yield curve is close to infallible, with both minimal false negatives and minimal false positives, then what are we to make of a yield curve where one portion inverts, while another portion steadfastly does not invert?

Tuesday, January 22, 2019

At the end of 2018, housing lays an egg

- by New Deal democrat

Sorry for the lack of posting. Partly it reflects the normal monthly lull in data that occurs around this time, but it also reflects the suspension of some data series, like housing permits and starts, due to the government shutdown. Add to that some traveling and, well, there you have it.

Speaking of the shutdown, normally I don’t pay much attention to existing home sales, but with the lack of other housing data, this is the closest we have to a decent snapshot of the market during December.

This morning the NAR reported that

Existing-home sales ... decreased 6.4 percent from November to a seasonally adjusted rate of 4.99 million in December. Sales are now down 10.3 percent from a year ago (5.56 million in December 2017).

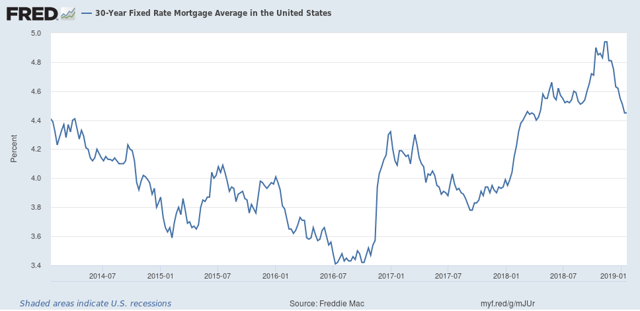

Lawrence Yun, NAR’s chief economist, sa[id] “The housing market is obviously very sensitive to mortgage rates. Softer sales in December reflected consumer search processes and contract signing activity in previous months when mortgage rates were higher than today. Now, with mortgage rates lower, some revival in home sales is expected going into spring.”

The median existing-home price for all housing types in December was $253,600, up 2.9 percent from December 2017 ($246,500).

I think Yun is correct here. This was the lowest number of existing sales in 3 years, and the lowest but one month in 4 years. Meanwhile, in the last 4 months of 2018, mortgage rates were at their highest in over 5 years:

while home prices have continued, by most surveys, to increase.

The good news in the report is that the YoY price increase was less than the increase in median household income as reported by Sentier Research for 2018, which makes houses slightly more affordable. And the decline in mortgage rates this month, if it is sustained, should help put a bottom under sales — a plus for the overall economy.

Subscribe to:

Comments (Atom)