On Saturday, the future Mrs. Bonddad will no longer be the future Mrs. Bonddad but will in fact be Mrs. Bonddad. Then we are going forward to do out part for the economy by having a wonderful honeymoon at an undisclosed location.

I will be returning on Monday May 19, same Bond time, same Bond channel.

Thursday, May 8, 2008

Will "Main Street Spoil the Recovery?"

From CNBC:

The article focuses on the tightening credit situation in the market (which I dealt with here.) But I want to focus on a basic problem of the market rallying in the current economic environment.

Here's the fundamental question: will the economy rebound in the 2H 2008, proving the market right?" I have doubts for the following reasons.

First, let's start with the following charts:

Job growth is still dropping from a year over year perspective, and

The unemployment rate is still increasing

Real disposable income is decreasing, which is

Lowering sentiment and

Confidence

Year over year spending did increase in the latest report. However, note the following regarding that upturn.

-- in the latest GDP report, both durable and nondurable goods purchases decreased. The reason for the increase was an unseasonably high increase in service purchases.

-- One month does not a trend make especially in light of the preceding trend.

Also remember that inflation is high right now:

High inflation crimps consumer spending.

This is not to say that people won't increase their spending. But in light of declining job prospects, record oil and food prices and a slowing economy, it just doesn't seem like the consumer spending will increase in a big way anytime soon.

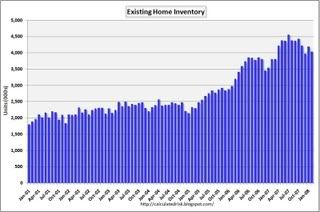

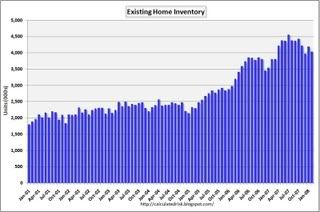

Then there is housing which started this mess. The inventory/demand situation is still horribly out-of-whack. From Calculated Risk, here is a chart of total existing homes on the market:

So -- we're at 4 million. And that number will increase because foreclosures are increasing in a big way -- they more than doubled in the first quarter. And it's not like we need all those homes -- not by a long shot. Home vacancies are now at a record.

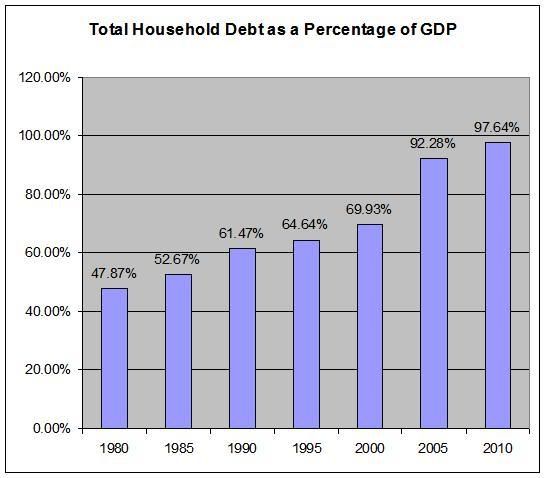

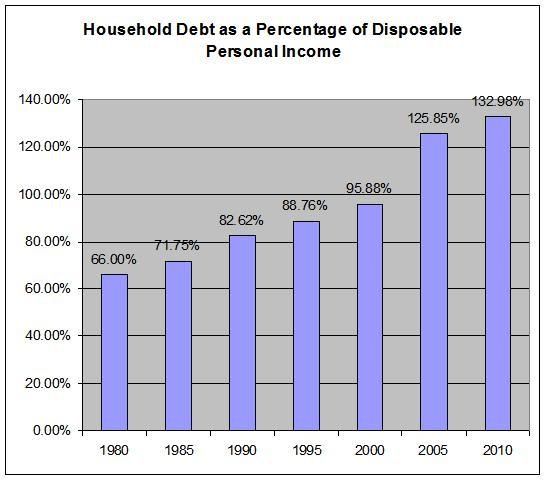

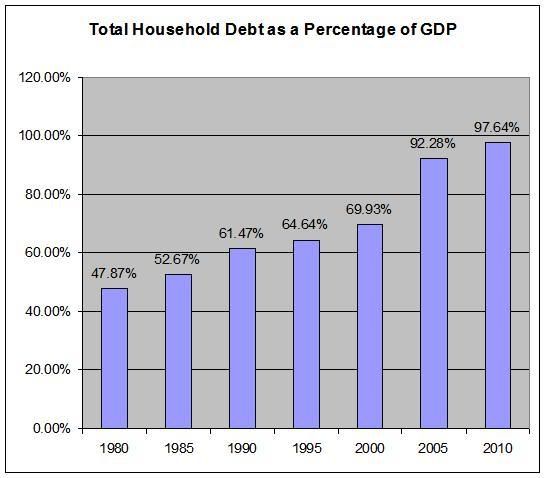

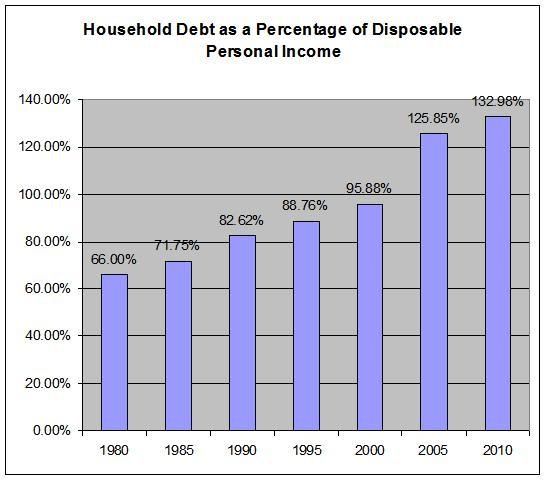

And who is going to buy these homes when credit conditions are tightening and consumers already have a record amount of debt?

So, according to the facts we have the following situation:

-- job growth is slowing

-- as is real income, which is

-- lowering consumer confidence and sentiment. In addition,

-- inflation is high, lowering spending.

-- Housing inventory is still high, and

-- rising foreclosures will increase that number.

-- Record levels of household debt and tightening lending standard will prevent a housing rebound.

Simply put, this is not a pretty picture for the second half of the year.

"Main Street has just entered the act. The peak of the pain is not visible yet," said Asha Bangalore, an economist with Northern Trust in Chicago.

The consumer strains are well-documented. Aside from the credit contraction, gasoline and grocery prices are on the rise, the housing market remains distressed, and consumer confidence is at recessionary levels. Tax rebate checks are in the mail, but that alone cannot compensate for the credit clamp-down and inflation pressure.

"Given that households are strapped financially, it is far-fetched even with the stimulus checks to expect a sharp increase in consumer spending," Bangalore said. "You have seen auto sales numbers for April, they posted a sharp drop."

.....

To say that Wall Street is expecting a second-half recovery would be an understatement. According to Thomson Reuters research, analysts are expecting fourth-quarter earnings growth of 62 percent for the S&P 500. Granted, that is a comparison with a disastrous fourth quarter of 2007, when earnings were down some 25 percent. In the current quarter, S&P 500 earnings are expected to be down 6 percent.

Not only is the market anticipating a swift recovery, but the earnings forecasts suggest that they think it will be lasting. For next year, analysts think earnings will be up 18 percent, twice the growth they are predicting for 2008.

They see particularly strong growth for consumer discretionary companies, beginning with the next quarter. Earnings for that sector are expected to jump by 41 percent in the fourth quarter, and 24 percent next year.

The article focuses on the tightening credit situation in the market (which I dealt with here.) But I want to focus on a basic problem of the market rallying in the current economic environment.

Here's the fundamental question: will the economy rebound in the 2H 2008, proving the market right?" I have doubts for the following reasons.

First, let's start with the following charts:

Job growth is still dropping from a year over year perspective, and

The unemployment rate is still increasing

Real disposable income is decreasing, which is

Lowering sentiment and

Confidence

Year over year spending did increase in the latest report. However, note the following regarding that upturn.

-- in the latest GDP report, both durable and nondurable goods purchases decreased. The reason for the increase was an unseasonably high increase in service purchases.

-- One month does not a trend make especially in light of the preceding trend.

Also remember that inflation is high right now:

High inflation crimps consumer spending.

This is not to say that people won't increase their spending. But in light of declining job prospects, record oil and food prices and a slowing economy, it just doesn't seem like the consumer spending will increase in a big way anytime soon.

Then there is housing which started this mess. The inventory/demand situation is still horribly out-of-whack. From Calculated Risk, here is a chart of total existing homes on the market:

So -- we're at 4 million. And that number will increase because foreclosures are increasing in a big way -- they more than doubled in the first quarter. And it's not like we need all those homes -- not by a long shot. Home vacancies are now at a record.

And who is going to buy these homes when credit conditions are tightening and consumers already have a record amount of debt?

So, according to the facts we have the following situation:

-- job growth is slowing

-- as is real income, which is

-- lowering consumer confidence and sentiment. In addition,

-- inflation is high, lowering spending.

-- Housing inventory is still high, and

-- rising foreclosures will increase that number.

-- Record levels of household debt and tightening lending standard will prevent a housing rebound.

Simply put, this is not a pretty picture for the second half of the year.

Thursday Oil Market Round-Up

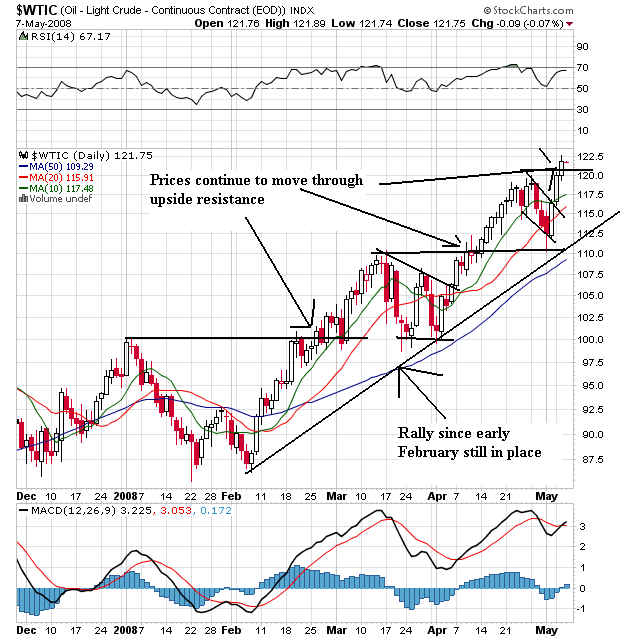

On the daily chart, notice the following:

-- The shorter SMAs are above the longer SMAs

-- Prices are above the SMAs

-- The trend that started in early February is still intact

-- Prices have continually moved through upside resistance

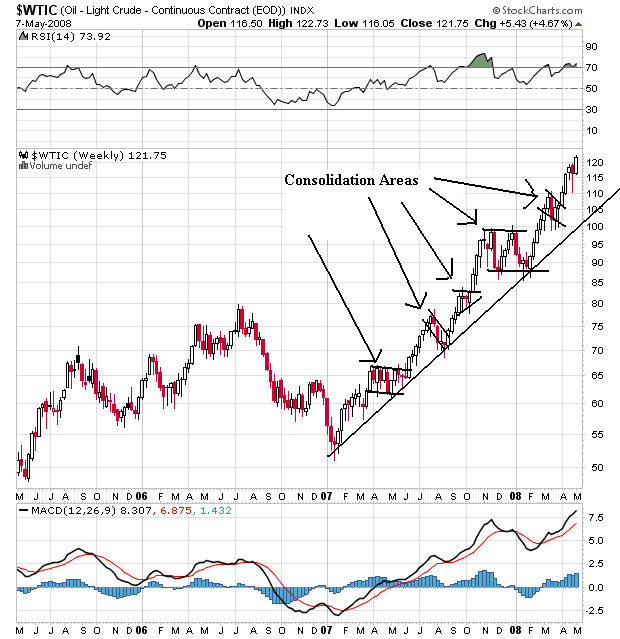

On the weekly chart, notice the following:

-- The uptrend that started in early 2007 is still intact

-- As prices have risen they have moved into 5 separate consolidation areas to absorb the gains.

After the Fed cut rates, oil dropped in response to a rising dollar:

Crude-oil futures fell for a third day Thursday as strength in the dollar reduced commodities' appeal as an investment alternative.

Natural gas futures also fell sharply after government data showed U.S. natural gas inventories rose more than expected last week.

Crude for June delivery dropped 94 cents, or 0.8%, to close at $112.52 a barrel on the New York Mercantile Exchange. It fell to an intraday low of $110 a barrel earlier. June natural gas futures fell 28.2 cents to end at $10.561 per million British thermal units.

Oil hit a new intra-day high on Monday:

Oil futures rose to an all-time high near $121 a barrel Tuesday in Asia, fueled by worries about threats to supply and a weakening of the U.S. dollar.

The surge in oil prices was also fueled by hopes that the U.S. economy will be spared a sharp downturn after the release of data Monday showing an unexpected expansion in the U.S. service sector in April, analysts said.

Light, sweet crude for June delivery rose to a record $120.93 a barrel in electronic trading on the New York Mercantile Exchange. The contract later retreated to $120.24 a barrel, up 27 cents from Monday's close. Crude futures settled on Monday at $119.97 a barrel, up $3.65 from Friday's close.

"The bulls are in control of the market," said Victor Shum, an energy analyst with Purvin & Gertz in Singapore. "The sentiment is that the oil pricing is likely going to stay quite strong, with a lot of volatility."

Monday's rise was based on the following geo-political hot spots:

Crude futures jumped $3.65, or 3.1%, to an all-time high $119.97 a barrel in New York as traders worried about developments in several key oil-producing countries: Diplomatic tensions between Iran and the West are rising again. Rebels have attacked Nigerian oil facilities in recent days. And Turkey recently conducted fresh strikes against the Kurdish minority in northern Iraq. Many analysts worry that long-simmering rivalry may see reprisals and continued violence this week.

While there are a lot of geo-political problems impacting oil, there is also the basic increase in demand:

Amid the occasional threats to crude supplies, global demand for oil continues to grow. While demand for oil and gasoline has been soft in the U.S., the Chinese and Indian economies are growing by double digits, boosting global demand for oil.

There is growing speculation that oil will continue on higher. Goldman was predicting $200/bbl oil in a recent report:

Crude oil may rise to between $150 and $200 a barrel within two years as growth in supply fails to keep pace with increased demand from developing nations, Goldman Sachs Group Inc. analysts led by Arjun N. Murti said in a report.

New York-based Murti first wrote of a ``super spike'' in March 2005, when he said oil prices could range between $50 and $105 a barrel through 2009. The price of crude traded in New York averaged $56.71 in 2005, $66.23 in 2006 and $72.36 in 2007. Oil rose to an intraday record of $122.49 today on speculation demand will rise during the peak U.S. summer driving season.

``The possibility of $150-$200 per barrel seems increasingly likely over the next six-24 months, though predicting the ultimate peak in oil prices as well as the remaining duration of the upcycle remains a major uncertainty,'' the Goldman analysts wrote in the report dated May 5.

There is also a growing realization that oil's upward climb may continue:

A growing number of oil-market watchers say voters riled by soaring fuel costs may face far worse this summer, as factors ranging from unrest in Nigeria to slumping production in Russia could shove benchmark oil prices over $150 a barrel.

.....

The world's diminished spare production capacity remains the strongest single catalyst for high prices, Mr. Yergin says. The world's safety cushion -- the amount of readily available oil that could be pumped in a moment of crisis -- is now around two million barrels a day, according to most estimates. That's just 2.3% of daily demand, and nearly all of the safety cushion is in one country, Saudi Arabia. Everyone else is pretty much pumping all they can, which makes the world vulnerable to political or other shocks.

And finally, gas prices are moving higher (again).

Once again, and for the sixth week in a row, the U.S. average retail price for regular gasoline moved higher, this time by one cent. As a result, the U.S. average price for regular gasoline set yet another all-time high of 361.3 cents per gallon. While the average price has gone up by 55.9 cents per gallon above the price a year ago, it has also shot up by nearly the same amount (exactly 56 cents) since December 31 of last year. On a regional basis, prices increased throughout the country with the exception of the Lower Atlantic portion of the East Coast where they went down a mere 0.6 cent. Elsewhere on the East Coast, prices increased by 2.5 cents per gallon in New England and 2.3 cents per gallon in the Central Atlantic while the average price for the entire East Coast region was 361 cents per gallon, a 0.9-cent increase. The average price in the Midwest was 357.9 cents per gallon, an increase of 1.1 cents. The increase in price for the Gulf Coast was smallest of any region, going up only two tenths of a cent to 350.7 cents per gallon. Despite an increase of 1.6 cents in the Rocky Mountain region, the price of 349.4 cents per gallon was the lowest for any region. The West Coast price went up by 1.4 cents to 380 cents per gallon, while the price in California increased by 1.1 cents to 390.3 cents per gallon.

Conclusion: there is no reason to think oil won't continue to move higher. The charts are incredibly bullish, demand is still strong, political tensions still exist (in a big way) and supply is tight.

Wednesday, May 7, 2008

Today's Markets

I'm out of pocket for the rest of the day -- lots of wedding stuff going on. I'll do a market wrap in the morning.

Fed Governor Concerned About Inflation

From Marketwatch.com:

Let's take a look at some of the inflation measures to see how they're doing:

Although it has stabilized, PPI is still at high levels.

CPI has also stabilized, although at high levels as well.

Import prices are spiking. So long as oil is in a rally, expect this trend to continue.

And now for the Shadow Stats alternate CPI measures, just to show you that yes, there is probably more inflation in the system than the Fed wants to admit.

So - who is right? I'm not a statistician so I can't speak to the validity or non-validity of any of these numbers. However, I can tell you there has been a tremendous amount of debate about the US CPI calculation which leads me to believe there is a problem somewhere. However, where it is and to what degree it is impacting the current situation I don't know.

I will add my own observations. I have noticed big food price increases over the last few years. Nothing concrete -- no "prices have increased by x%" -- but I know my food bill is going up and my eating habits have not changed. FWIW.

The latest comments form Federal Reserve Bank of Kansas City President Thomas Hoenig also will be scrutinized, as he said late Tuesday that rising inflationary pressures are "troublesome" and a "serious" matter, and now stand at "unacceptably high levels." Hoenig isn't a voting member of the FOMC.

Let's take a look at some of the inflation measures to see how they're doing:

Although it has stabilized, PPI is still at high levels.

CPI has also stabilized, although at high levels as well.

Import prices are spiking. So long as oil is in a rally, expect this trend to continue.

And now for the Shadow Stats alternate CPI measures, just to show you that yes, there is probably more inflation in the system than the Fed wants to admit.

So - who is right? I'm not a statistician so I can't speak to the validity or non-validity of any of these numbers. However, I can tell you there has been a tremendous amount of debate about the US CPI calculation which leads me to believe there is a problem somewhere. However, where it is and to what degree it is impacting the current situation I don't know.

I will add my own observations. I have noticed big food price increases over the last few years. Nothing concrete -- no "prices have increased by x%" -- but I know my food bill is going up and my eating habits have not changed. FWIW.

Wednesday Commodity Round-Up

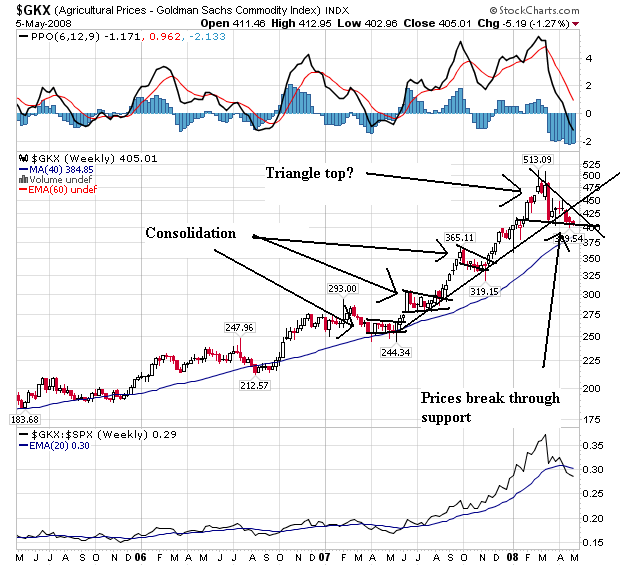

On the weekly agricultural prices chart, notice that prices have broken a year long upward sloping trend. Also note that prices are possibly forming a triangle top. Triangles are usually considered reversal patterns, but also note that prices have been forming consolidation patterns on the rally that has lasted the last year. That means this triangle could simply be another consolidation pattern on the way up.

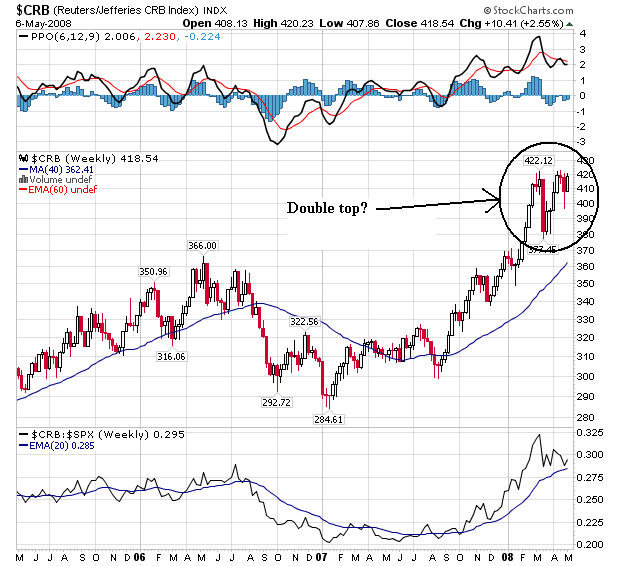

On the overall CRB index, notice we may be looking at an overall double top. Some of this will be determined by the dollar index which I will review on Friday.

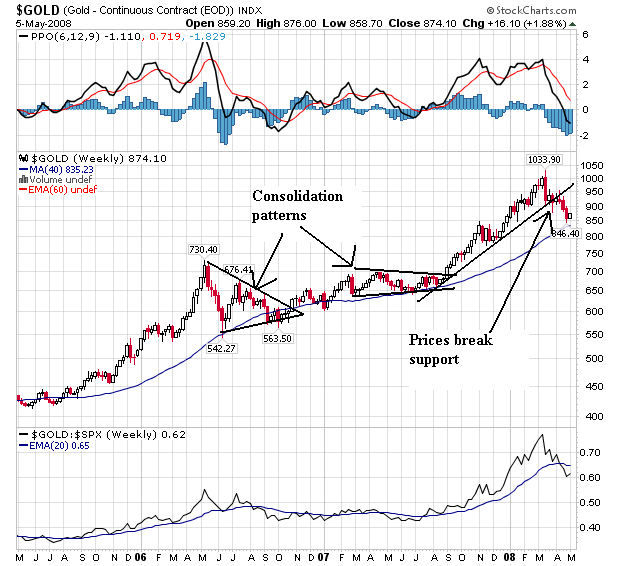

Gold has also broken a year-long uptrend.

Wheat has been under selling pressure because of the possibility of an increasing dollar. There is also news that farmers are increasing wheat crops:

Wheat fell below $8 a bushel for the first time in five months as investors speculated the U.S. will slow the pace of interest-rate cuts, boosting the dollar and reducing grain exports that surged as the currency weakened.

.....

Advance export sales of wheat in the marketing year that ends May 31 are 41 percent ahead of the year-ago period, U.S. Department of Agriculture data show. Actual shipments are up 46 percent, the USDA said in a report on April 24.

Still, analysts expect global production to rise as farmers plant more to capitalize on the higher prices. Farmers worldwide will harvest 645 million metric tons of the grain in the year that starts July 1, up 6.8 percent from the previous year, the International Grains Council said on April 24.

Producers in the U.S., the largest exporter of the grain, probably increased seeding in the marketing year that ends on May 31 by 5.6 percent to 63.8 million acres, the USDA said in a report last month.

``At this price level, growers are going to plant a lot of wheat,'' Holaday said.

Wheat is also dropping:

Consumer demand for rice may also slip, with some Asian consumers expected to adjust their diet to include more bread and less rice, Mr. Nelson said. Wheat, used to make bread flour, and rice are both major food grains.

Wheat is looking more affordable these days, as the price of the most-active CBOT July wheat contract has plunged to around $8 a bushel from $12 in March.

The world may see a record wheat crop this year after growers expanded plantings due to high prices. "Wheat is part of the diet in many of these countries," Mr. Nelson said. "To me, it seems like a part of the solution would be, as appropriate, that people could eat more bread."

On the daily chart of wheat, notice that prices are now near the lowest levels of the last 6 months.

On the weekly chart, notice that prices have broken through key support established in an almost year-long rally. That's a significant price break.

A rising dollar was having a negative impact on gold last Thursday:

"The return of dollar strength this morning has led to a swift reversal in direction with gold dropping back to $864, and given the pace of decline, suggests gold will remain at risk to further corrections in the coming sessions," said James Moore, an analyst at TheBullionDesk.com, in a research note.

Gold had finished Wednesday's regular trading session sharply lower, ending down $11.70 at $865.10. However, in electronic trading, gold rallied, boosted by the Federal Reserve's decision to cut the fed funds rate by 25 basis points to 2.0%.

"Despite the lack of a clear pause signal in yesterday's Fed announcement, the markets are treating May/June as the pivot point beyond which they can no longer reliably depend on ever cheaper dollars to fuel speculative binges in commodities," said Jon Nadler, senior analyst at Kitco Bullion Dealers.

On Thursday, the stronger dollar was also impacting the copper and wheat. IBD reported as much on Friday:

A resurgent dollar sent commodity markets reeling Thursday, as investors interpreted the latest economic data and monetary policy to mean interest rate cuts since September may be over.

Crude oil and gasoline fell as much as 3% each on the back of the dollar-related sell-off, as investors unloaded commodities denominated in the currency. Crude had hit record highs earlier this week, adjusting to the weak dollar and stronger rival currencies then.

Soybeans plunged 3% as well on Thursday, and grains like wheat and rice were under pressure as the dollar hit a five-week high vs. the euro.

In metals, gold sunk to a four-month low and copper plummeted 5% to a five-week low.

The Reuters-Jefferies CRB Index, which tracks 19 commodities futures, fell to a 3 1/2-week low.

And now because of food inflation concerns Congress is looking at the possibility of altering basic food policy in the US:

In Congress, some lawmakers are calling for changes in the nation's commitment to ethanol as the biofuel of choice to replace oil. "This is a classic case of the law of unintended consequences. Congress surely did not intend to raise food prices by incentivizing ethanol, but that's precisely what's happened," said Rep. Jeff Flake (R-Ariz.), who introduced legislation this week that would end federal support for ethanol.

After a huge run-up, the price of rice is retreating:

Chicago Board of Trade rice futures have likely seen a top for the year after global supply fears sparked a record-breaking rally, analysts said.

Nearby CBOT May rice has shed 17% since hitting its high of $24.6850 per hundredweight April 24. It settled Friday at $20.55. Most-active CBOT July rice has fallen more than 16% since reaching an all-time high of $25.07. The contract tumbled the daily, exchange-imposed limit for four consecutive days last week and closed Friday at $20.9450.

It seems as though all the bullish views about shrinking world supplies have been factored into the market, analysts said. Prices climbed recently as major producers like India and Vietnam curbed their export sales to protect domestic supplies, but there are now signs the tightness is easing, they said.

"I'm very much of the opinion that we've seen a top in the market," said Neauman Coleman, a principal at Neauman Coleman & Co., a brokerage and advisory firm in Brinkley, Ark. "From here, every time the market rallies, you're going to see an increase in folks who want to sell, particularly in the new crop months"

Above is a weekly chart of rice. Whenever prices move like this -- in a parabolic arc, the arc never lasts. Now the question becomes will prices maintain their downward trajectory or will they hover at high levels for the foreseeable future.

On the daily chart of rice notice the prices have broken through support established on the latest bull run.

However, with China still growing a high rates, it's possible that upward pressure on commodity prices won't slow down anytime soon:

In the first quarter, China's GDP expanded 10.6% vs. a year earlier, down from 11.4% in the last three months of 2007. China's inflation remains near decade highs, but slowing export gains make it less likely that Beijing will try to slam on the brakes, analysts say.

The Asian Development Bank forecasts that China's economy will grow 10% in 2008. The World Bank projects 9.4% growth. Much of the same is expected next year.

"China is the main source of increased demand for a lot of commodities, but the difference between 11.5% and 9.5% growth isn't that much," said David Wyss, Standard & Poor's chief economist.

More prosperous Chinese continue to buy bigger, gas-guzzling cars, driving up global oil demand. And China's rising energy and labor costs have been a factor in creeping U.S. inflation through the cost of imported goods.

"A slowdown in the Chinese economy would definitely take some pressure off of commodity prices, particularly crude oil, copper and steel," said Brian Bethune, chief U.S. economist at Global Insight.

The big news in commodities is some of the wind is leaving commodities' sales. We've seen some pretty important trend breaks in some big charts. This is very important from an inflation perspective. Commodities related inflation has been a big concern for some time.

Tuesday, May 6, 2008

Today's Markets

Fannie Mae reported a huge loss, cut its dividend and said it would raise more capital. Nonetheless, a federal regulator lowered Fannie's capital requirement from 20% to 15%. When you figure out the logic behind that move you can tell it to me. UBS reported a major loss. 70% of Americans thing we're in a recession. Maybe if they just thought happy thoughts everything would be alright. Oil rose again. Wachovia reported a loss twice as high as previously stated. Homebuilder DR Horton reported a major loss as well. All the more reason for the markets to rally.

The SPYs -- which had formed a pennant formation the last two trading days rallied today. But they are still below the levels set on Friday's opening. Prices need to move above 142 right now. They have plenty of momentum to do it.

The QQQQs are still firmly in their upward trend. But they could also be forming a double top with the first top occurring on early Friday and the second top occurring today.

The IWMs continued their jerky method of trading, with very little solid direction.

The SPYs -- which had formed a pennant formation the last two trading days rallied today. But they are still below the levels set on Friday's opening. Prices need to move above 142 right now. They have plenty of momentum to do it.

The QQQQs are still firmly in their upward trend. But they could also be forming a double top with the first top occurring on early Friday and the second top occurring today.

The IWMs continued their jerky method of trading, with very little solid direction.

Credit Tightening Across the Board

Yesterday the Federal Reserve issued its survey of lenders. The picture is not pretty:

Remember -- the US economy is credit dependent; without a steady supply of credit the economy will slow. That's a prime reason why the above news raises serious issues going forward. It brings into question the possibility of a 2H2008 rebound along with a bottoming in housing. In short -- it puts the entire economy into harms way.

About 55 percent of domestic banks—up from about 30 percent in the January survey—reported tightening lending standards on C&I loans to large and middle-market firms over the past three months. Significant majorities of respondents reported tightening price terms on C&I loans to these firms, and in particular, on net, about 70 percent of banks—up from about 45 percent in the January survey—indicated that they had increased spreads of loan rates over their cost of funds. In addition, smaller but significant net fractions of domestic banks reported tightening non-price-related terms on C&I loans to these firms over the past three months.

.....

About 60 percent of U.S. branches and agencies of foreign banks—a slightly smaller fraction than in January—noted that they had tightened lending standards on C&I loans over the past three months, and very large majorities also reported that they had tightened price terms on such loans. In particular, around 80 percent of foreign banks—about the same as in the January survey—reported increasing spreads of loan rates over their cost of funds. Finally, large fractions of foreign respondents reported tightening selected non-price-related terms over the past three months.

.....

About 80 percent of domestic banks and 55 percent of foreign banks—fractions similar to those in the January survey—reported tightening their lending standards on commercial real estate loans over the past three months. Concerning loan demand, about 35 percent of domestic banks and 45 percent of foreign institutions reported weaker demand, on net, for commercial real estate loans over the past three months.

.....

About 60 percent of domestic respondents—a somewhat larger fraction than in the January survey—indicated that they had tightened their lending standards on prime mortgages.2 Of the 37 banks that originated nontraditional residential mortgage loans, about 75 percent—a somewhat smaller fraction than in the January survey—reported a tightening of their lending standards on such loans over the past three months.3 Finally, 7 of the 9 banks that originated subprime mortgage loans—a somewhat higher proportion than in the January survey—indicated that they had tightened their lending standards on such loans.4

.....

About 50 percent of domestic respondents reported having tightened terms on existing HELOCs over the past six months. Nearly all respondents pointed to declines in the value of the collateral significantly below the appraised value for the purposes of the HELOCs as reasons for tightening terms on these lines. Large majorities of respondents also cited increased defaults of material obligations under loan agreements, as well as significant changes in borrowers’ financial circumstances, as additional reasons for tightening terms on the existing HELOCs.

.....

About 30 percent of domestic banks—up from around 10 percent in the January survey—reported that they had tightened their lending standards on credit card loans over the past three months. In addition, significant net fractions of respondents indicated that they had reduced the extent to which such loans were granted to customers who did not meet credit-scoring thresholds, reduced credit limits on credit card loans, and increased minimum required credit scores.

Remember -- the US economy is credit dependent; without a steady supply of credit the economy will slow. That's a prime reason why the above news raises serious issues going forward. It brings into question the possibility of a 2H2008 rebound along with a bottoming in housing. In short -- it puts the entire economy into harms way.

Wall Street Cutting Staff

From CNBC:

And on the front page of today's WSJ:

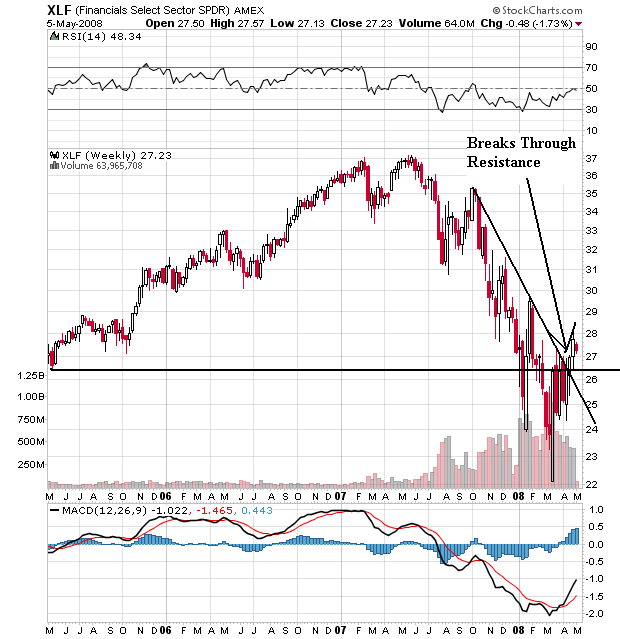

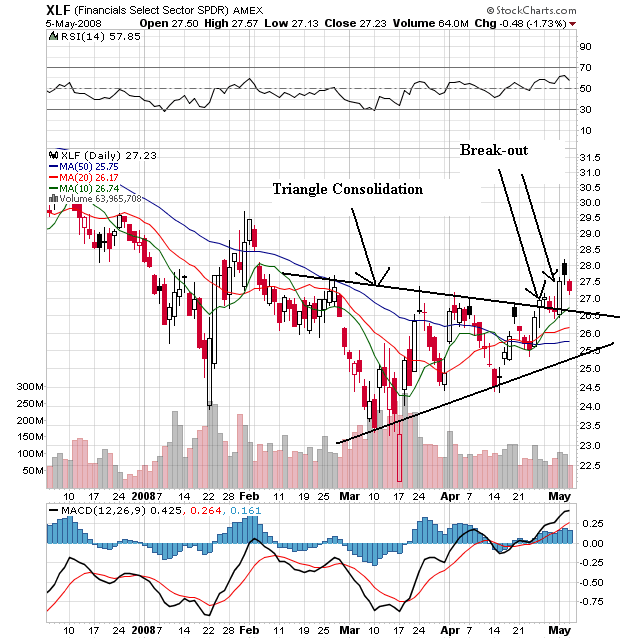

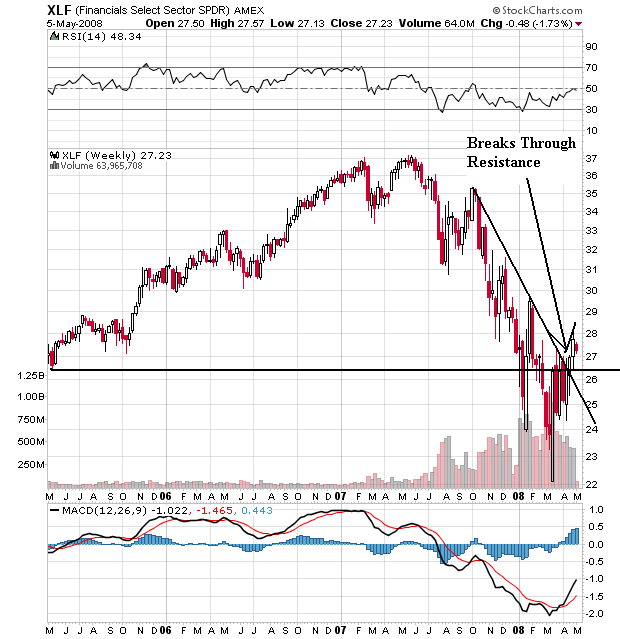

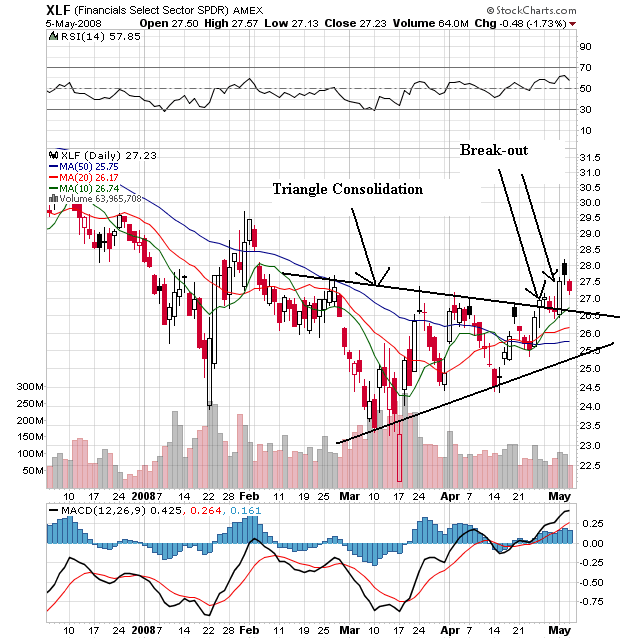

Let's take a look at the XLFs to see how they're doing.

Let's start with the weekly chart, because it shows an important reversal. Starting at the end of last summer, the financials sold-off big -- as in losing over 10 points. That's a big move. But take a look at the volume levels -- those indicate the market may have had a selling climax.

On the daily chart, notice the following:

-- Prices are rising from a triangle pattern. They broke through on decent volume.

-- Prices are above the SMAs

-- The shorter SMAs are higher than the longer SMAs

-- The 10 and 20 SMAs are rising.

Given the above lay-off news and the overall credit market situation, I can't see this rally being that strong. However, traders may be betting that the worst is actually over. I don't see it, but I've been wrong before.

Morgan Stanley is planning another round of layoffs in the coming days, finalizing a plan to slash another 5 percent from its securities-firm workforce, or 1,500 employees, CNBC has learned. And Lehman will announce another round of cuts in addition to those already begun as early as next week.

.....

JPMorgan is expected to cut more than half of Bear Stearns' 14,000 former employees, though CNBC has learned that JPMorgan has already offered jobs to around 4,000 former Bear workers. Senior people inside JPMorgan say the firm has no hard figure for the size of the layoffs.

Meanwhile, CNBC has learned that Lehman Brothers Holdings Inc next week also is expected to add to the 4,900 layoffs it has already announced.

And on the front page of today's WSJ:

UBS AG said Tuesday it would sell $15 billion in mortgage assets to BlackRock Inc. and slash 5,500 jobs by the middle of next year, moves meant to restructure the Swiss giant's troubled investment bank.

The Zurich-based bank will sell $15 billion -- with a nominal value of $22 billion -- in Alt-A and subprime assets to Blackrock, which will manage the holdings in a fund for distressed securities. Alt-A assets are considered slightly less risky than subprime loans.

The Zurich bank said it will ax 2,600 investment banking jobs, mainly in London and New York, after write-downs on dud mortgage securities totaling more than $37 billion. The remainder of the jobs will be cut through natural attrition across the bank's units, UBS said.

Let's take a look at the XLFs to see how they're doing.

Let's start with the weekly chart, because it shows an important reversal. Starting at the end of last summer, the financials sold-off big -- as in losing over 10 points. That's a big move. But take a look at the volume levels -- those indicate the market may have had a selling climax.

On the daily chart, notice the following:

-- Prices are rising from a triangle pattern. They broke through on decent volume.

-- Prices are above the SMAs

-- The shorter SMAs are higher than the longer SMAs

-- The 10 and 20 SMAs are rising.

Given the above lay-off news and the overall credit market situation, I can't see this rally being that strong. However, traders may be betting that the worst is actually over. I don't see it, but I've been wrong before.

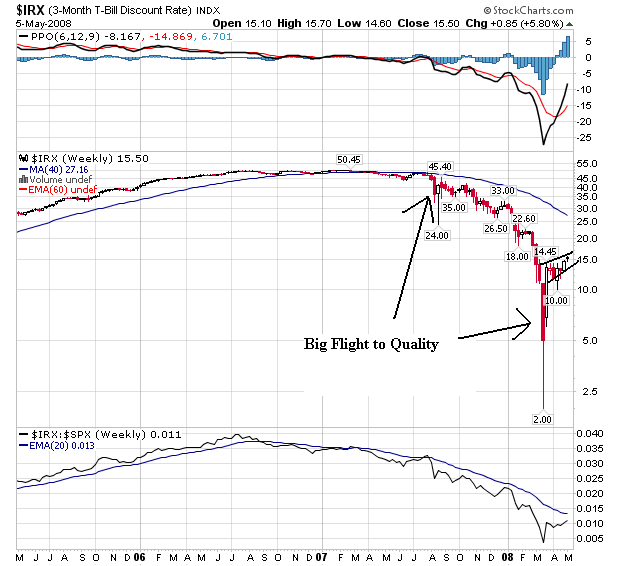

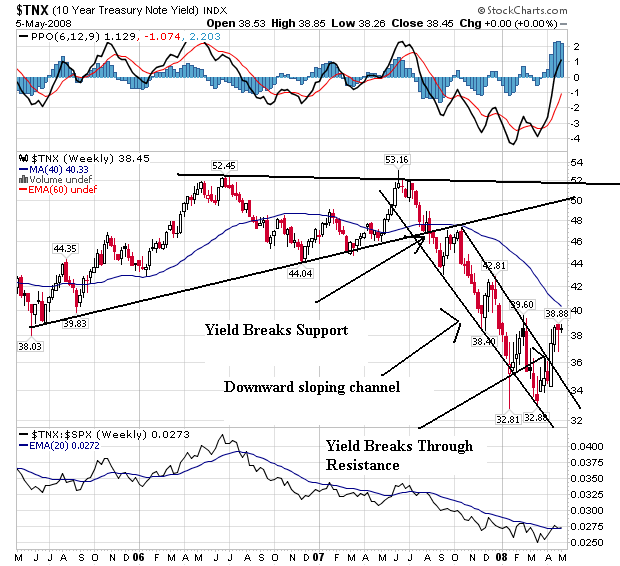

Treasury Tuesdays

Here are the charts

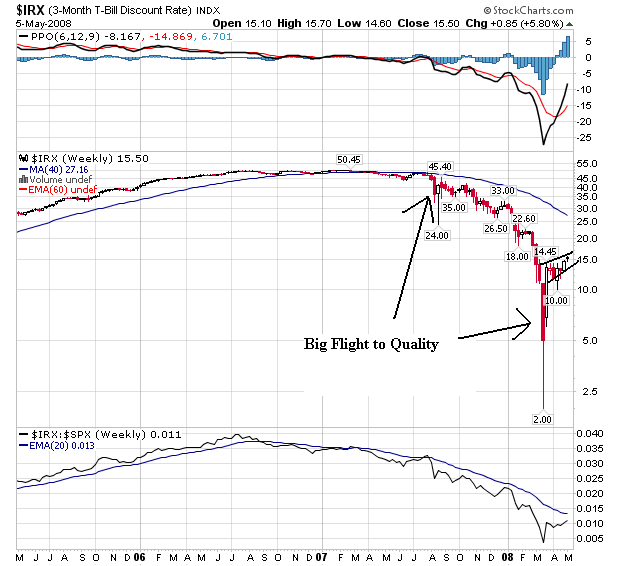

The long-term chart clearly shows the flight to safety that happened as the credit market tightened. Notice how yields dropped big time as this happened. Right now yields have formed a flag pattern as traders wait to see what the next move will be.

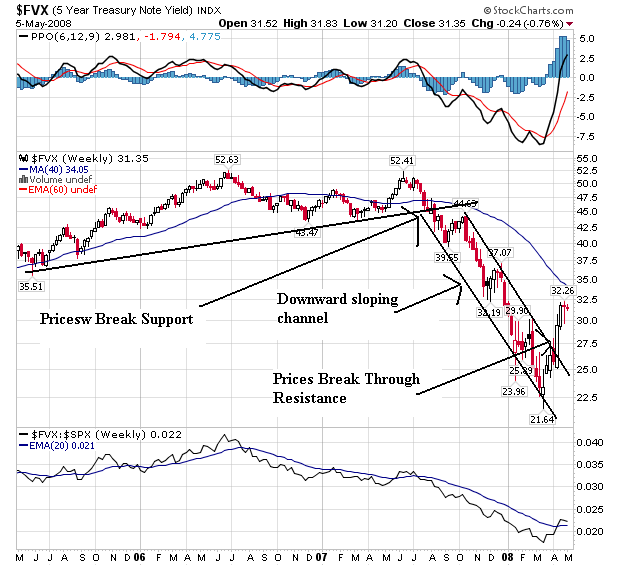

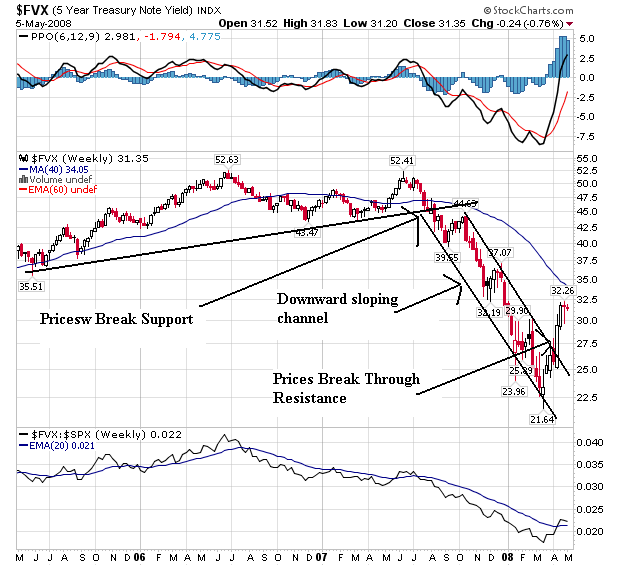

Notice the same thing with the 5-year yields -- they dropped as traders bought the Treasury market in a flight to safety. Also notice how yields have started to move higher.

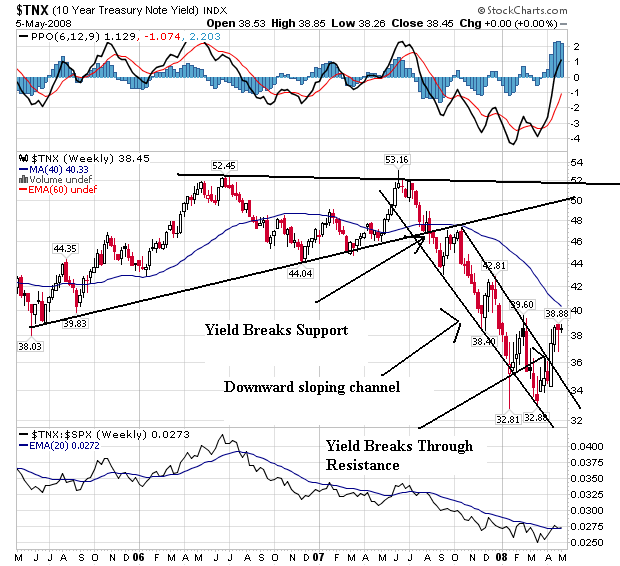

The 10-year Treasury also shows the flight to quality and the subsequent move away from the 10-year. More on this below.

Let's start with the good news. There is growing speculation that moving out of Treasuries and into higher-yielding, risker assets is the standard plan of managers:

Treasuries are also getting competition from a rush of new corporate issues:

This is a big reason why Treasury yields have moved higher over the last few weeks. Traders have sold Treasuries to move into higher yielding assets and equities. In other words, the flight to safety is starting to ease.

Also adding some upward pressure on yields is the Treasury is trying to figure out how to finance a growing deficit:

Remember -- the government is bleeding debt right now. And the latest "stimulus" plan will only make matters worse. Somebody will have to pay for this. And its looking like we're going to ask future generations to pay rather now. At some point, this increased borrowing will lead to higher rates. The question is simply when will that occur.

LIBOR is still an issue indicating that the credit markets are not well.

On Saturday, Barron's outlined the tools the Fed has used in its effort to lower LIBOR:

The long-term chart clearly shows the flight to safety that happened as the credit market tightened. Notice how yields dropped big time as this happened. Right now yields have formed a flag pattern as traders wait to see what the next move will be.

Notice the same thing with the 5-year yields -- they dropped as traders bought the Treasury market in a flight to safety. Also notice how yields have started to move higher.

The 10-year Treasury also shows the flight to quality and the subsequent move away from the 10-year. More on this below.

Let's start with the good news. There is growing speculation that moving out of Treasuries and into higher-yielding, risker assets is the standard plan of managers:

Emboldened by economic data signaling a strong likelihood the Federal Reserve will keep rates on hold for now, investors will continue to move into higher-yielding and riskier securities, including corporate and emerging-market debt. Global bond-fund managers may also consider selling short-dated Treasurys and buying government debt of similar maturities in Australia and New Zealand to pick up extra yield.

"That is where the opportunity is: putting on a bet that the fed-funds target rate is going to stay at 2% or lower for a much longer period of time," said James Kauffmann, head of fixed income for ING Investment Management in Atlanta, which oversees more than $40 billion of institutional and mutual-fund assets.

Friday's better-than-expected payrolls report supported the notion that the Fed can retire to the sidelines for now, and government bonds ended sharply lower across the board. But the shift in the market's rate outlook has been under way for several weeks, as the state of the economy has appeared less dire than had been feared. The Fed's liquidity-pumping measures -- which were tweaked again Friday -- have also helped reduce fears of a market meltdown.

Treasuries are also getting competition from a rush of new corporate issues:

On the corporate bond front, U.S. investment-grade companies are likely to issue another $80 billion to $100 billion in new debt in May after a surge of debt offerings in April, Bank of America said in a note released Thursday.

According to Thomson Reuters, companies with high-grade credit ratings issued $117 billion in bonds, the second best month ever. Some $40 billion bonds got underwritten during the week of April 25 alone.

This is a big reason why Treasury yields have moved higher over the last few weeks. Traders have sold Treasuries to move into higher yielding assets and equities. In other words, the flight to safety is starting to ease.

Also adding some upward pressure on yields is the Treasury is trying to figure out how to finance a growing deficit:

As the federal government rolls out its economic-stimulus plan, the Treasury market is eyeing the return of one-year bills and three-year notes to help offset the government's deteriorating fiscal outlook.

Changes to the maturities of debt sold by the government could be announced as early as Wednesday, when the Treasury presents its quarterly refunding program.

But given how low yields currently are on low-risk government debt, these two maturities might be a hard sell.

Yields on Treasurys with maturities of 10 years or less are below the current 4% inflation rate, and returns on government bonds are set to be negative in April for the first time this year.

Remember -- the government is bleeding debt right now. And the latest "stimulus" plan will only make matters worse. Somebody will have to pay for this. And its looking like we're going to ask future generations to pay rather now. At some point, this increased borrowing will lead to higher rates. The question is simply when will that occur.

LIBOR is still an issue indicating that the credit markets are not well.

A major source of stress has been the London interbank offered rate, or Libor, a benchmark for the rates banks pay on dollar loans in the offshore market. It remains unusually high compared with expected Federal Reserve interest rates, an indication that banks continue to hoard dollars.

Central banks have already taken steps to ease European banks' dollar-denominated funding needs, but the resurgent tension has policy makers discussing whether the current arrangements are enough.

There are disagreements about why the rate is rising. Fed officials attribute the recent Libor rise to European banks' needing to borrow in dollars, because the pressure tends to slacken around midday in the U.S. when the European day ends. U.S. banks have tended to retain their dollar holdings until the end of the day in New York, making it even harder for overseas banks to obtain dollars.

European officials aren't convinced demand from European banks for dollars is the source of the trouble. Since March 11, the amount on offer at ECB's swap line has been a relatively modest $30 billion. In each of three $15 billion auctions it has held since then, demand hasn't been overwhelming, suggesting to some European officials that European banks aren't desperate for dollars. The ECB also saw prior global central-bank maneuvers as partly a symbolic effort to try to calm markets.

On Saturday, Barron's outlined the tools the Fed has used in its effort to lower LIBOR:

Libor has remained stubbornly high, at 2.815% for the key three-month maturity. That's higher than it stood before the Fed's previous rate cut, to 2.25% from 3%, on March 18. In other words, the central bank's actions haven't affected much of the real world.

To counter that, the Fed announced it would boost several of its new policy instruments designed to funnel liquidity to the borrowers needing it most. Specifically, the Fed will expand its

Term Auction Facility by 50%, to $75 billion per auction, for a total $150 billion.

The Fed also said it would boost its swap lines to foreign central banks -- to $50 billion from $30 billion for the European Central Bank and to $12 billion, or doubled, for the Swiss National Bank -- to provide the wherewithal for those central banks to lend dollars to banks having difficulty borrowing.

In addition, the Fed said it would expand the collateral accepted at its Term Securities Lending Facility, which allows dealers to swap less-liquid securities for good-as-cash Treasuries, to include triple-A-rate asset-backed securities.

Monday, May 5, 2008

Today's Markets

The big news today was Microsoft pulling its bid for Yahoo. I should add that I often refer to Microsoft as the Satan just so everyone knows my bias. Oil hit a record as well before settling a bit lower. We learned that lenders are tightening lending standards and that the service sector expanded a bit. There were also conflicting stories on Sprint: either it would sell itself to Deutsch Telecom or it would split itself up.

On the SPYs chart, notice we the trend trading from Monday to mid-Thursday last week. Then the market shot higher at the beginning of trading on Thursday but has since been trending down. The downward trend has been orderly, indicating there is not a rush to the doors.

With the QQQQs, notice the 8 solid days of trading higher. Over the last two days we've had more consolidation.

The 10-day IWM chart is extremely messy. There are three separate flag formations, with price jumps to get to the different levels. But notice how incredibly uneven this part of the market is; trading is very jerky.

On the SPYs chart, notice we the trend trading from Monday to mid-Thursday last week. Then the market shot higher at the beginning of trading on Thursday but has since been trending down. The downward trend has been orderly, indicating there is not a rush to the doors.

With the QQQQs, notice the 8 solid days of trading higher. Over the last two days we've had more consolidation.

The 10-day IWM chart is extremely messy. There are three separate flag formations, with price jumps to get to the different levels. But notice how incredibly uneven this part of the market is; trading is very jerky.

Bank of America/Countrywide

From CBS Marketwatch:

My guess is Bank of America thought that in purchasing Countrywide they (B of A) would be increasing the size of its mortgage business after the current housing mess ends. My guess is B of A is starting to uncover some really ugly problems at Countrywide:

A contract of this size and magnitude will have a clause to the effect that any sign of criminal activity will break the deal. Even if the merger papers don't have that clause, there is an old adage that "you don't buy a lawsuit", meaning B of A could go to court and say, "You honor, there are just too many legal issues here."

My guess is we'll start to hear more of these rumblings over the next few weeks/months.

Shares of Countrywide Financial Corp. fell more than14% on Monday after an analyst called on Bank of America Corp. to scuttle plans to buy the nation's largest mortgage lender because of the falling value of its loan portfolio.

My guess is Bank of America thought that in purchasing Countrywide they (B of A) would be increasing the size of its mortgage business after the current housing mess ends. My guess is B of A is starting to uncover some really ugly problems at Countrywide:

FBI Director Robert Mueller said the agency's investigations into the subprime loan meltdown may uncover financial crimes committed by hedge funds and private equity firms.

Federal Bureau of Investigation agents have opened 19 criminal probes of companies in connection with the lending crisis, focusing on accounting fraud, insider trading and allegations of deceptive sales practices. Mueller, speaking today to an American Bar Association group in Washington, said he expects more to come as housing prices continue to fall.

``These investigations may well lead to other instances of fraud, from investment banks and private equity firms to hedge funds,'' Mueller said. ``We do not take these investigations lightly.''

The collapse in the credit markets has shaken Wall Street and forced people from their homes. Mueller told Congress yesterday that the FBI has seen a ``tremendous surge'' in fraud cases related to subprime loans, which are made to borrowers with poor credit.

Mueller didn't name any companies or hedge funds. A person familiar with the matter has said the FBI is probing Countrywide Financial Corp., the U.S.'s largest mortgage lender, for possible accounting fraud.

A contract of this size and magnitude will have a clause to the effect that any sign of criminal activity will break the deal. Even if the merger papers don't have that clause, there is an old adage that "you don't buy a lawsuit", meaning B of A could go to court and say, "You honor, there are just too many legal issues here."

My guess is we'll start to hear more of these rumblings over the next few weeks/months.

Feds Looking At Mortgage Fraud

From CNBC

First -- this should surprise no one. The latest expansion will go down in mortgage lender history as the best years ever. There was no oversight because no one had a vested interest in actually investigating the loans brokers and lenders were making. Brokers didn't hold the mortgages because they sold them to banks. Banks didn't hold mortgages because they sold them (but usually retained servicing fees). Hedge funds were "protected" through "diversification" (or was it "deworsification" from Peter Lynch's vocabulary?).

Secondly -- I am still waiting for the Congressional investigation. There are a ton of players who need to see the light of day. I'm think here of Countrywide and Washington Mutual, all of the ratings agencies, along with some of the larger investment banks. I want to know what they knew and when they knew it.

Third -- someone (or a group of people and/or companies) are going to get hammered over this. When the truth comes out my gut says it will be extremely ugly and painful for all involved.

A task force of federal, state and local agencies will look into potential crimes ranging from mortgage fraud by brokers to securities fraud, insider trading and accounting fraud, the Journal said.

The Federal Bureau of Investigation is already targeting major corporate insiders and criminal groups in its investigation of fraud in the mortgage lending industry. The FBI has said it is investigating 19 companies in mortgage cases.

The formation of the task force amplifies efforts already under way in Brooklyn, where prosecutors are investigating whether investment bank UBS AG improperly valued its mortgage-securities holdings, the report said.

Also being investigated are the circumstances surrounding the failure of two hedge funds at Bear Stearns, which collapsed last summer because of losses tied to mortgage-backed securities, the report said.

Separately, the New York Times said the FBI and the criminal division of the Internal Revenue Service had formed a task force to examine mortgages that were made with little or no proof of the earnings or assets of borrowers.

The group also includes federal prosecutors in New York, Los Angeles, Philadelphia, Dallas and Atlanta, the Times said, citing an unidentified official.

First -- this should surprise no one. The latest expansion will go down in mortgage lender history as the best years ever. There was no oversight because no one had a vested interest in actually investigating the loans brokers and lenders were making. Brokers didn't hold the mortgages because they sold them to banks. Banks didn't hold mortgages because they sold them (but usually retained servicing fees). Hedge funds were "protected" through "diversification" (or was it "deworsification" from Peter Lynch's vocabulary?).

Secondly -- I am still waiting for the Congressional investigation. There are a ton of players who need to see the light of day. I'm think here of Countrywide and Washington Mutual, all of the ratings agencies, along with some of the larger investment banks. I want to know what they knew and when they knew it.

Third -- someone (or a group of people and/or companies) are going to get hammered over this. When the truth comes out my gut says it will be extremely ugly and painful for all involved.

Sunday, May 4, 2008

Monday's Market Round-Up

We're in the middle of a rally.

On the SPYs chart, notice the following:

-- Prices have been moving higher since mid-March

-- The shorter SMAs (10, 20 and 50) are above the longer SMAs

-- All the shorter SMAs are moving higher

-- Prices are above the SMAs

On the QQQQ chart, note the following:

-- Prices have been moving higher since mid-March

-- All of the shorter SMAs are moving higher

-- The shorter SMAs are higher than the longer SMA

-- Prices are above all the SMAs

On the IWM charts, notice the following:

-- Prices are above the shorter SMAs

-- All the shorter SMAs are heading higher

-- The shorter SMAs are moving higher

-- Prices have moved through key resistance levels

The Transports have confirmed the rally:

-- Prices have moved through the 5-year trend line

-- Prices are above all the SMas

-- The shorter SMAs ahve moved through the longer SMAs

-- The shorter SMAs have moved through the 200 day SMA

Barron's Trader Column outlined the basic perception that traders have of the market:

The real question is will there be a recovery or will there be a protracted slowdown? The odds are about 50/50 for either.

On the pro-recovery side we have an aggressive Federal Reserve, which has cut rates big time. Lower rates should help to prevent a big system wide meltdown. But are they enough to get the economy back into the 3% or greater growth per quarter? I seriously doubt it. Housing is still a wreck. The credit crisis is also in full swing largely because LIBOR is seriously out of whack. From the consumer side we have job losses, declining income and weak consumer sentiment as three big inter-related problems. Consumers are also in debt up to their eyeballs preventing a big increase in consumer spending. And then there are gas prices which hurt sentiment and spending big time. In short, there are a host of reasons for the economy to not grow at full potential. I think the Fed may have prevented a full-blown recession, but there are a ton of problems out there not going away anytime soon.

The FOMC statement presented a pretty dire picture of the US economy:

Simply put, it doesn't gt much worse than that.

However, on Thursday the market rallied.

On Thursday there was also the better than expected news from the technology sector:

But Sun Micro showed a weaker tech sector:

Here's the short version: The market thinks the Fed has the situation in control. As a result, trader's are bidding up shares.

On the SPYs chart, notice the following:

-- Prices have been moving higher since mid-March

-- The shorter SMAs (10, 20 and 50) are above the longer SMAs

-- All the shorter SMAs are moving higher

-- Prices are above the SMAs

On the QQQQ chart, note the following:

-- Prices have been moving higher since mid-March

-- All of the shorter SMAs are moving higher

-- The shorter SMAs are higher than the longer SMA

-- Prices are above all the SMAs

On the IWM charts, notice the following:

-- Prices are above the shorter SMAs

-- All the shorter SMAs are heading higher

-- The shorter SMAs are moving higher

-- Prices have moved through key resistance levels

The Transports have confirmed the rally:

-- Prices have moved through the 5-year trend line

-- Prices are above all the SMas

-- The shorter SMAs ahve moved through the longer SMAs

-- The shorter SMAs have moved through the 200 day SMA

Barron's Trader Column outlined the basic perception that traders have of the market:

The recent barrage of monetary medicine -- including the seventh interest rate cut in eight months, administered last week -- has investors hopeful that a debilitating, protracted economic slump might have been averted. Still, most traders did not expect the government to report that the economy grew 0.6% in the first quarter. Pinch me please, Dr. Bernanke, but we're in a growing economy?

That unexpected -- though not unpleasant -- high was extended Friday by a report that showed employers cutting just 20,000 jobs in April. It was the fourth straight month of layoffs, but the toll was less than the 75,000 forecast, and investors tuning in for Recession '08, this season's most anticipated show, found themselves momentarily more befuddled than even Paula Abdul. Are we in a recession, were we ever in one and is it over yet?

The real question is will there be a recovery or will there be a protracted slowdown? The odds are about 50/50 for either.

Much will depend, of course, on rapidly increasing visions for a prompt economic recovery -- and how quickly companies can turn them into reality. Swiss Re's chief U.S. economist, Kurt Karl, thinks this downturn won't be severe but will likely be prolonged. Lower borrowing costs, tax rebates and the weak dollar "will keep the U.S. out of an acute recession," he says. "However, the full impact of the credit crisis, high oil prices and housing downturn has yet to be felt by consumers and businesses."

.....

"Wall Street believes that just because a systemic meltdown has been avoided, the crisis is over. It is not," says Charles Dumas, an economist with Lombard Street Research. Excessive private-sector debt will severely constrain domestic demand for years, and pre-emptive rate cuts "have sent oil and food prices sky-high, thus lowering real incomes and consumer confidence."

On the pro-recovery side we have an aggressive Federal Reserve, which has cut rates big time. Lower rates should help to prevent a big system wide meltdown. But are they enough to get the economy back into the 3% or greater growth per quarter? I seriously doubt it. Housing is still a wreck. The credit crisis is also in full swing largely because LIBOR is seriously out of whack. From the consumer side we have job losses, declining income and weak consumer sentiment as three big inter-related problems. Consumers are also in debt up to their eyeballs preventing a big increase in consumer spending. And then there are gas prices which hurt sentiment and spending big time. In short, there are a host of reasons for the economy to not grow at full potential. I think the Fed may have prevented a full-blown recession, but there are a ton of problems out there not going away anytime soon.

The FOMC statement presented a pretty dire picture of the US economy:

Recent information indicates that economic activity remains weak. Household and business spending has been subdued and labor markets have softened further. Financial markets remain under considerable stress, and tight credit conditions and the deepening housing contraction are likely to weigh on economic growth over the next few quarters.

Simply put, it doesn't gt much worse than that.

However, on Thursday the market rallied.

"The market is probably pleased that we may not see additional rate cuts going forward, since they've had the domino effect of pulling down the dollar and making oil prices higher," said Owen Fitzpatrick, head of the U.S. equity group at Deutsche Bank.

.....

The ability to borrow from the Fed is the catalyst that put the floor in for financial institutions, we're seeing financial institutions lend money, and some M&A deals announced," said Fitzpatrick.

And, recent capital offerings have succeeded in "allowing capital to flow back into financial stocks," the analyst said.

On Thursday there was also the better than expected news from the technology sector:

Symantec had the second-steepest rise in the S&P 500, gaining $2.12, or 12 percent, to $19.34. The world's biggest maker of security software said quarterly profit tripled, beating analysts' estimates, after businesses and consumers renewed subscriptions and bought more programs to protect information.

Intel added $1.03, or 4.6 percent, to $23.29. The world's largest chipmaker is stepping up production to meet higher-than- expected demand for Atom, a new processor for low-cost portable computers. Intel Chief Executive Officer Paul Otellini is using the processors to attract consumers who want stripped-down computers for word processing and surfing the Internet.

SanDisk gained $1.94, or 7.2 percent, to $29.03. The biggest maker of memory for digital cameras expects a sales boost from U.S. consumers spending their federal tax rebate checks, Chief Executive Officer Eli Harari said.

But Sun Micro showed a weaker tech sector:

Sun Microsystems Inc., citing impacts of the softening U.S. economy, posted a net loss on a slight decline in revenue for its third quarter and announced plans to cut up to 2,500 jobs.

But Sun was hit by a slowdown in tech spending in the U.S., said Sun Chief Executive Jonathan Schwartz in a conference call. "Our third quarter was a challenging one, in which U.S. macro factors impacted our overall performance," Mr. Schwartz said. In particular, Mr. Schwartz said the Santa Clara, Calif., technology company in March saw purchase decisions postponed because of economic uncertainty.

On Thursday, Mr. Lehman said the company will reduce its workforce by between 1,500 and 2,500 people, representing as much as 7.26% of its workforce, resulting in restructuring charges as high as $220 million.

Here's the short version: The market thinks the Fed has the situation in control. As a result, trader's are bidding up shares.

Subscribe to:

Comments (Atom)