- by New Deal democrat

Why do I blog? Why should you read me? In the last week I've thought a lot about political end economic turning points. For example, Obama is touting a "middle [class] out" economic strategy. He always gives great speeches, but he wouldn't have to be giving them now if he hadn't ceded the narrative to the Tea Party all throughout 2010, telling one Georgia Congressman at the time that there wouldn't be a repeat of 1994 because, "This time, you've got me."

The news of late has been totally "blah." Everything seems either totally stuck in the doldrums or just shambling forward. Unless Washington seriously rattles markets and the economy by refusing to pay bills that it has already incurred this autumn in what looks like Debt Ceiling Debacle 2 - a serious possibility - the news is likely to remain "blah" through the end of the year. Almost nobody is calling for, or saying we are already in, a recession. And the use of the term "recovery" in scare quotes, minus Atrios and a few Doomers, has almost completely disappeared. Almost everybody seems to have accepted the narrative that the economy is improving, as it has for 4 years, but way too slowly compared with what was needed for average Americans.

Meanwhile the stock market continues to make new highs. In the blogosphere, that means that economic sites are losing readership while investing sites are gaining as the public, as always, arrives late to the stock market rally party.

Which means it's a "blah" time for me as well. While I have a strong political viewpoint, my thoughts are usually expressed about 1000 times better by Digby, David Atkins, Charlie Pierce, Riverdaughter, and Armando a/k/a Big Tent Democrat. Simply put, my forte is identifying and calling economic and market turning points - and debunking the false hysteria in between.

In 1994, I was schooled. There was a huge back-up in interest rates, for a couple of days the long end of the bond market inverted, and consumer confidence plummeted. The overwhelming consensus of the pundits, and of individual investors, was bearish. I agreed, but it turned out it was the absolute bottom.

I only needed to learn once. I dug deeply into historical data. I saw why business infrastructure investment in software and computer hardware, touted by raging bull Joe Battapaglia, was driving the economy. I realized that as long as interest rates were declining over the longer term, and businesses continued to invest, the historic bull market was likely to continue. Further, whenever any one or two indicators would roll over, but the important ones remained intact, there would be a "V" market correction, Elaine Garzarelli would announce that a crash was imminent, and that would be the bottom. This was a historic secular bull move, and I figured every individual indicator would give a false positive at least once. At the top, everyone would be ignoring all the signals, all of the late Louis Rukeyser's elves would be bullish (or at least neutral), and then the bottom would fall out.

And that's exactly what happened. After Rukeyser booted Gail Dudak in 1999, all his elves were afraid of being bearish. Marty Zweig looked like he was in agony, continuing to say that he was neutral, while looking as if he wanted to grab Rukeyser by the lapels, shake him like a ragdoll, and scream, "Game over, man. Game over!!!" All of the other leading indicators started to turn. The advance/decline line from 1998 through 2000 looked absolutely horrible. In March 2000, I sat down with a friend over lunch, went through all of the indicators, virtually all of which had turned negative, and announced that the great bull market that had started in 1982 was over.

In 2005 when I started writing diaries at Daily Kos, I figured progressives could use neutral economic commentary, written by somebody with no product to sell. I am always worrying, I am always cautious, and my disposition is pessimistic, but usually with the caveat "not yet," because the long and short term data simply don't support that any Day of Reckoning is nigh.

I was almost positive that we were in a housing bubble, and called its turn in real time. In November 2006, I wrote that a recession would probably start within a year. As the data deteriorated, I wrote "Are Hard Times Near?" the thesis of which was that we were entering a period of prolonged, well, Hard Times as the strugle of the middle class to stay afloat by taking on ever greater debt, and refinancing at lower and lower interest rates, was probably coming to an end (as it turned out, there was one more chance, post 2008, to refinance). In 2007, I wrote of the similarities to 1929 in the broader economy.

Then the deluge hit. My focus turned to whether it would be a self-negatively-reinforcing deflationary spiral, or whether it would avoid going over the precipice. The first clue was when retail sales stopped falling - or fell at a very slow rate - beginning in December 2008. With gas at $1.40 a gallon, it looked like consumers might actually start to rebound in a few months. In January 2009, I started to write that the recession might bottom out in the summer, a conviction which increased as housing permits and starts stopped falling in the spring, and other leading indicators started to turn. Even the horrific monthly payroll declines started to be a little less horrific each month. By early May, Bonddad and I parted company with the dominant Doomish narrative on Daily Kos, and dared to say that conditions were on the cusp of improving.

They did. Since then I have remained positive, with greater or lesser caution at times, seeing off double dippers and triple dippers and Doomish dippers. The data simply hasn't supported a return to economic contraction. In 2009 I was mocking the Pied Piper of Doom. By the end of 2011, I was challenging ECRI. In mid-2011 I also foresaw the bottom in housing prices in early 2012, and in 2012 I took the contrary position to Barry Ritholtz's thesis that housing prices hadn't bottomed. In 2010 and 2011 I called the bottom of corrections in the stock market within one day.

So, writing economic or political polemics is simply not my strong point. Telling you the direction of the data, and whether or not we are at a turning point, is.

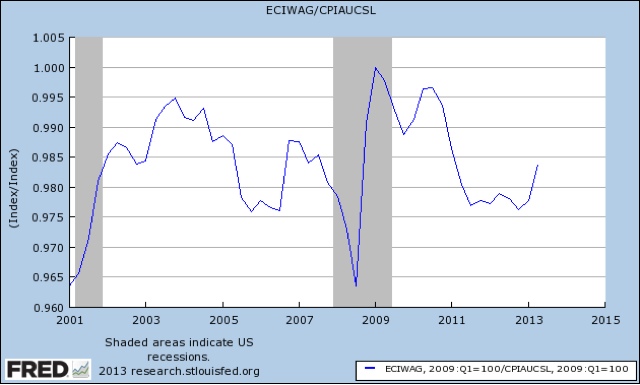

At the moment, the news is "blah." Washington could make it dramatic, in a very bad way, shortly, but there is simply no way to know how that will play out. Barring that sort of intervention in the economy, here's how I think the next recession begins. It will look very much like right now, with a significant increase in interest rates. Housing starts and permits will take a spill. Refinancing will die. Wages will fail to keep up with inflation. Corporate profits will suffer. Eventually consumers will cut back on buying cars, and then there will be a more general cutback in consumer spending. The short leading indicators will have joined the long leading indicators in rollilng over. At that point we will be right back where we were at the end of 2008, hoping we can avoid an outright wage deflationary spiral.

The recent retreat in several of the long leading indicators may or may not be the start of that process. Stay tuned.