- by New Deal democrat

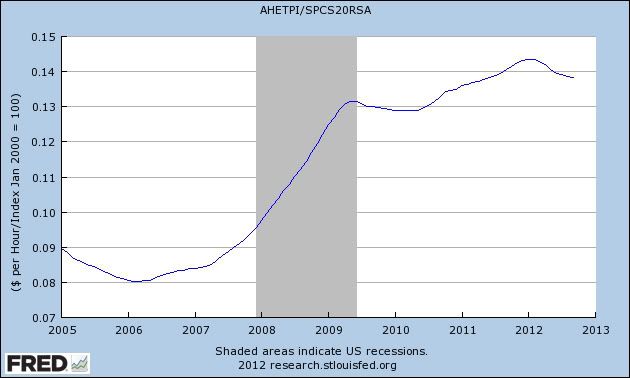

November monthly data reported this week came in surprisingly strong (or at least un-weak). 148,000 new jobs were created, and the unemployment rate fell to a new post-recession low of 7.7%. Auto sales also made a new 4 year high. Construction spending was up, showing the continued resurrection from the dead of the housing sector. ISM services improved, but ISM manufacturing went back into slight contraction. Unit labor costs for the 3rd quarter decreased. More ominously, in possibly the first sign that the "fiscal cliff" sausage-making is beginning to have a real impact similar to the debt ceiling decacle of summer 2011, Michigan consumer sentiment declined, mainly becuase expectations about the future plunged - just like in July 2011.

Woth the probable exception of initial jobless claims, the impact of Hurricane Sandy on most of the high frequency weekly indicators has abated. This makes watching this data of extra importance, since the level of any rebound will show up here well before December's monthly data is released in January.

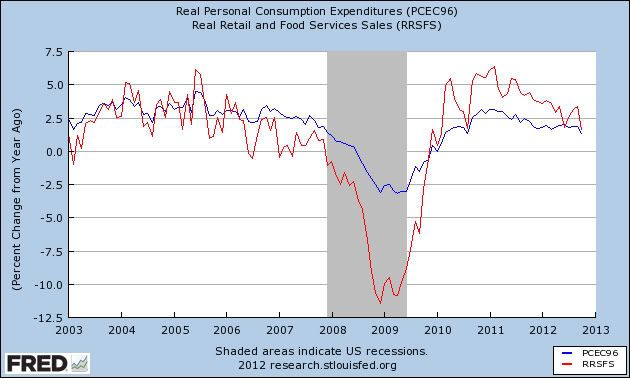

Same Store Sales and Gallup consumer spending continue to show a strong rebound:

The ICSC reported that same store sales for the week ending Novmeber 30 rose 3.1%w/w and were up +3.2% YoY. Johnson Redbook showed a 2.1% YoY gain. Johnson Redbook has consistently been lower than the other series for consumer spending. The 14 day average of Gallup daily consumer spending as of December 6 was $86, compared with $77 last year for this week last year. This is close to, if not

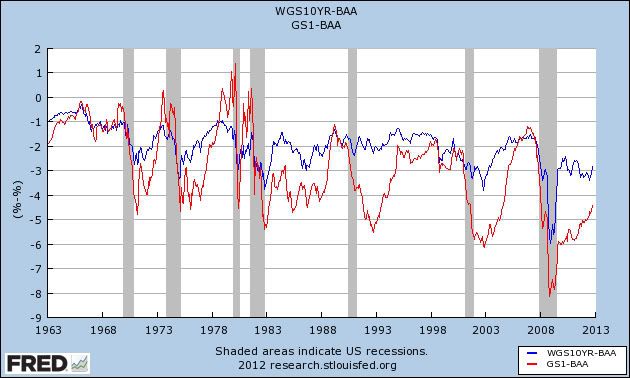

Bond yields were mixed but credit spreads retreated from their recent lows:

Weekly BAA commercial bond yields were unchanged this week at 4.56%. Yields on 10 year treasury bonds however fell -.04% to 1.63%. The credit spread between the two likewise increased by .04% to 2.93%. Spreads have increased in the last few weeks, but are well off their 52 week highs.

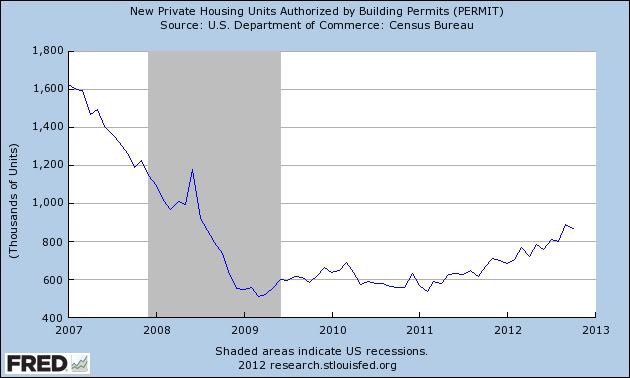

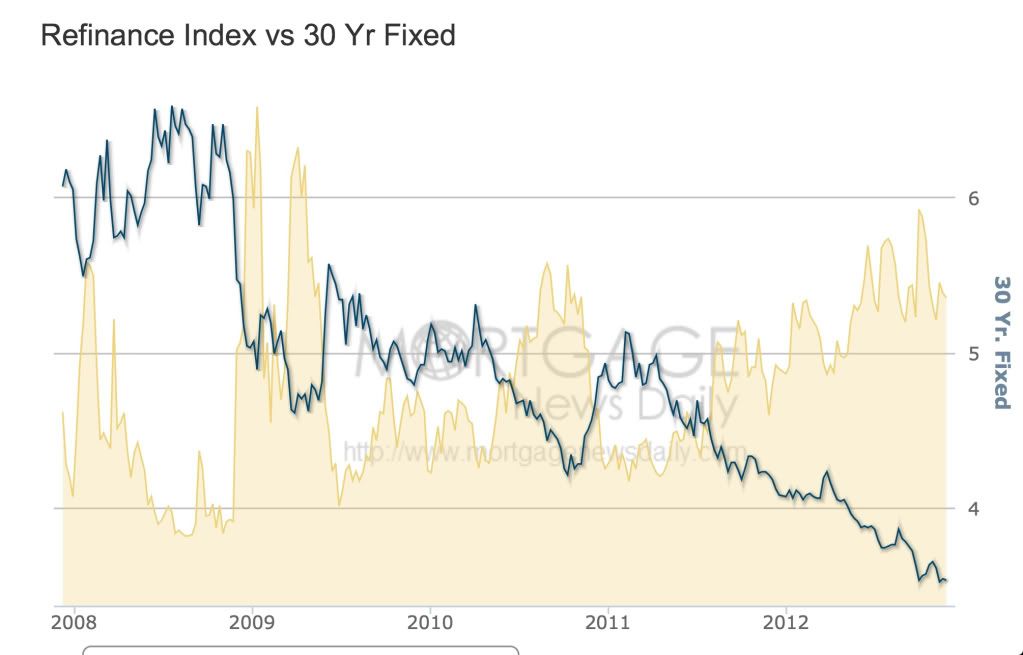

Housing reports were positive:

The Mortgage Bankers' Association reported that the seasonally adjusted Purchase Index rose 0.1% from the prior week, and declined -0.1% YoY (last year at this time they were near a 2 year high). These remain in the upper part of their 2+ year range. The Refinance Index increased 6.1% for the week, and is near its recent multi-year highs.

The Federal Reserve Bank's weekly H8 report of real estate loans this week increased +10 w/w to 3545. The YoY comparison also increased to +2.0% and is 2.1% above its bottom.

YoY weekly median asking house prices from 54 metropolitan areas at Housing Tracker increased +2.4% from a year ago. YoY asking prices have been positive for over an entire year.

Money supply has been mixed over the last few weeks, but remains generally positive:

M1 declined -1.7%% for the week, and also decreased -1.6% month over month. Its YoY growth rate declined further to +10.3% Real M1 also declined to +8.1% YoY. M2 increased +0.1% for the week, and was up +0.2% month over month. Its YoY growth rate fell to 7.1%, so Real M2 fell to 4.9% The growth rate for real money supply has been declined significantly, but is still positive.

Employment related indicators were quite positive as the effects of Sandy continue to abate:

The Department of Labor reported that Initial jobless claims fell from 393,000 to 370,000. The four week average rose by 2750 to 408,000. If this follows a similar pattern to that of Hurricane Katrina, claims will remain slightly elevated for a few more weeks. The 4 week average should decline sharply next week as the first post-Sandy shock leaves the average.

The American Staffing Association Index declined 5 to 91. This is normal Thanksgiving week seasonality. The general trend in this index remains similar to last year.

The Daily Treasury Statement showed that for the last 20 days ending on Thursday, $145.7 B was collected vs. $135.0 B for the comparable period in 2011, an increase of $10.7 B or +7.9%. Tax collections have continued to increase very well in the last month.

Rail traffic remained negative YoY, but still due to coal, and the diffusion index decreased again:

The American Association of Railroads reported that total rail traffic was down -8900 carloads YoY, or -1.6%. Non-intermodal rail carloads were again off considerably less than in recent weeks, only -6200 or -2.0%, and once again entirely due to coal hauling, which was off -18,100. Ex-coal carloads were up 9200. Negative comparisons declined once again from 8 to 6. For the first time all year, intermodal traffic was actually down -2600 or -1.1% YoY.

Finally, the price of oil rose slightly again while gasoline fell, but gasoline usage was positive:

Gasoline prices fell $.05 last week to $3.39. This is still higher than last year at this time. Oil prices per barrel declined from $88.28 to $85.93. Gasoline usage was down for one week at 8354 M gallons vs. 8574 M a year ago, or -2.6%. The 4 week average at 8647 M vs. 8640 M one year ago, was actually up a very slight +0.1% YoY.

Turning now to the high frequency indicators for the global economy:

The TED spread fell from 0.24 to 0.23, just .01 above its 52 week low. The one month LIBOR fell from 0.2146 to 0.2120, near its 3 year low.

The Baltic Dry Index fell 120 to 966, a 1 month low. The longer term declining trend in shipping rates for the last 3 years remains. The Harpex Shipping Index also fell 3 more to yet another new 52 week low of 360.

Finally, the JoC ECRI industrial commodities index rose from 121.47 to 122.24. It was again also positive YoY.

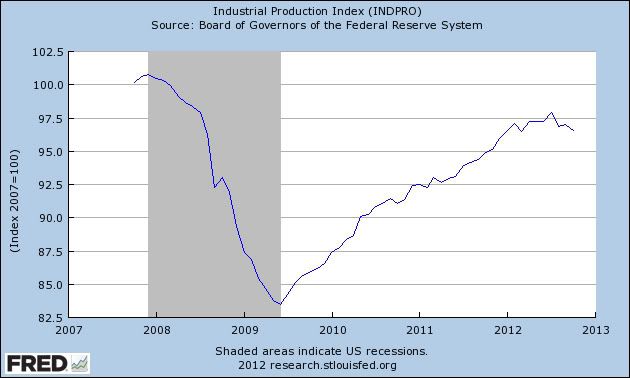

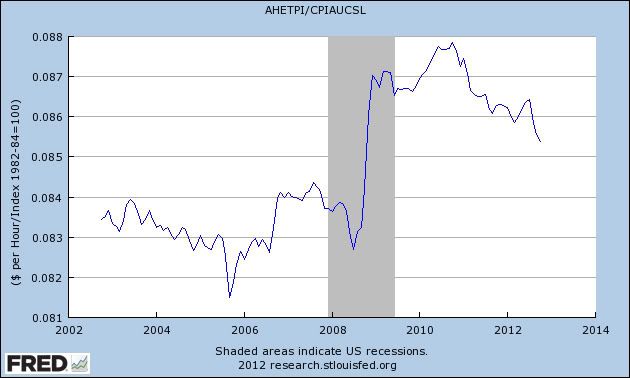

The old-fashioned type of economy is producing weak or contractionary data. This includes shipping, intermodal rail traffic, and manufacturing. Since manufacturing in particular generally leads, this is disconcerting. On the other hand, domestic rail ex-coal is positive and improving. Housing continues its resurgeance from a very low level. Consumer spending is going strong again. The service economy is expanding. Employment is positive. Gas prices are accomodative for now. Bank lending rates are positive. Once again the American consumer looks like a Superhero, trumping even the Superstorm.

Have a nice weekend.