- by New Deal democrat

I hear the WWE staged a helluva mud wrestling cage match last night!

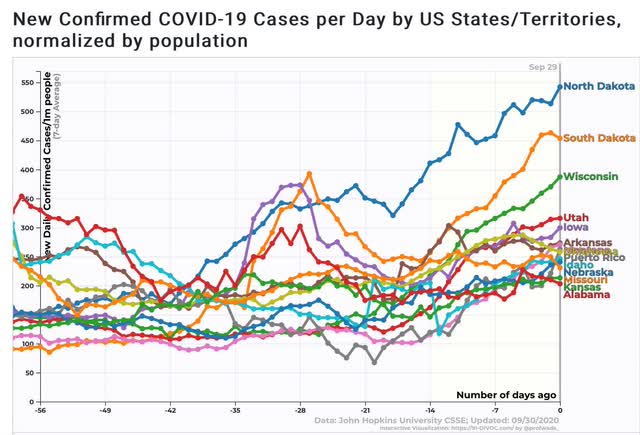

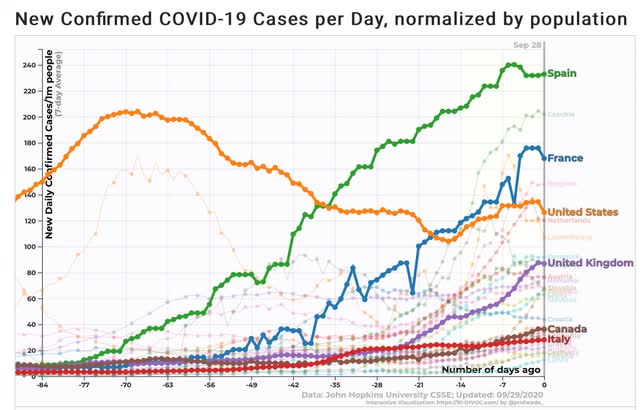

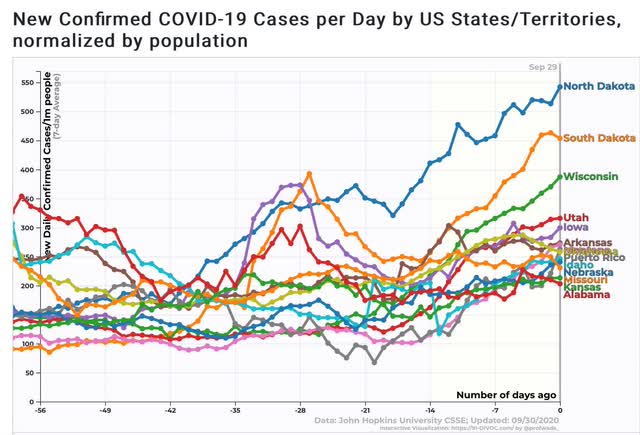

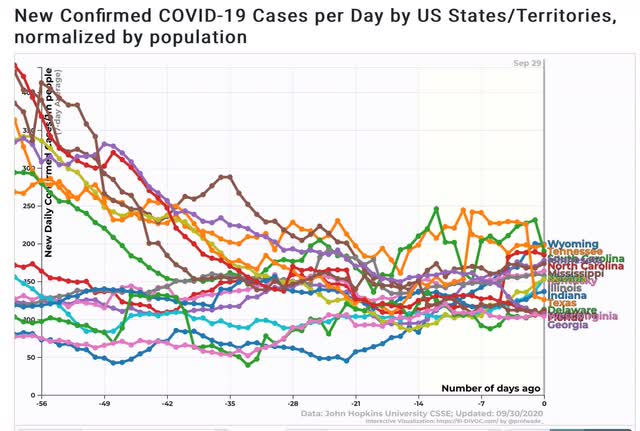

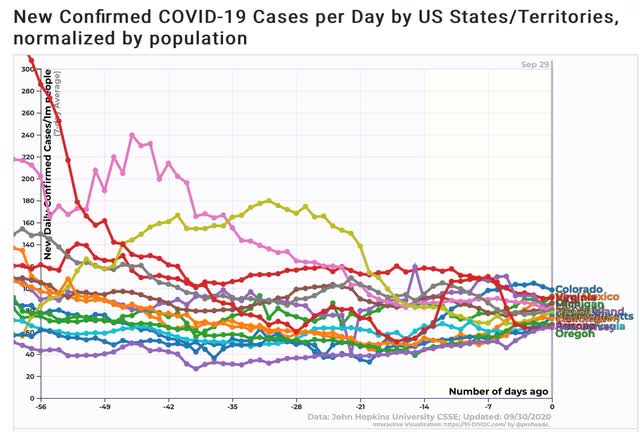

Since we won’t get any economic news until Every Statistic In The World is released tomorrow, in other, more uplifting news, let’s take the most updated look at coronavirus infections in the US.

Total US infections: 7,190,230

Average infections last 7 days: 42,045

Total US deaths: 205,986

Average deaths last 7 days: 743

Source: COVID Tracking Project

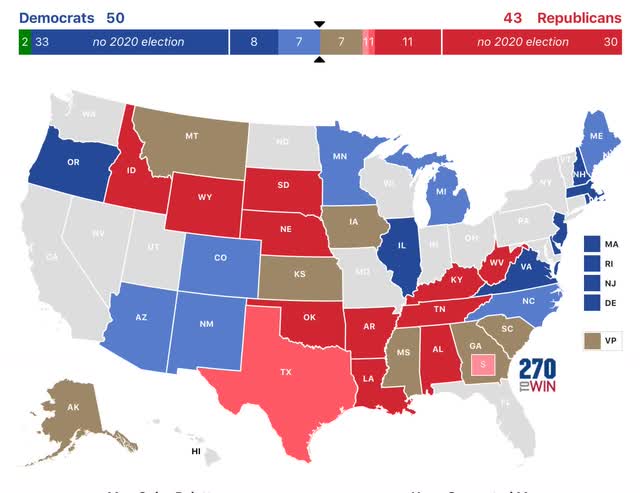

Deep Red (general alarm out-of-control fire): 200+ infections per million, 5+ deaths per million.

Red (3 alarm fire): 100-200 infections, 2-5 deaths

Orange (2 alarm fire): 60-100 infections, 1-2 deaths

Yellow (1 alarm fire):40-60 infections, 0.5-1 deaths

Blue (smoldering/1 alarm fire): 20-40 infections, 0.2-0.5 deaths

Green (embers): 0-20 infections, 0-0.2 deaths

Here’s how all 50 States, plus DC and Puerto Rico, fit into that paradigm, for infections only.

Deep Red (general alarm out-of-control fire): 200+ infections per million:

14 States (ND, SD, WI, UT, IA, AR, MT, OK, ID, NE, MO, KS, AL)+ Puerto Rico (up from 5 five weeks ago).

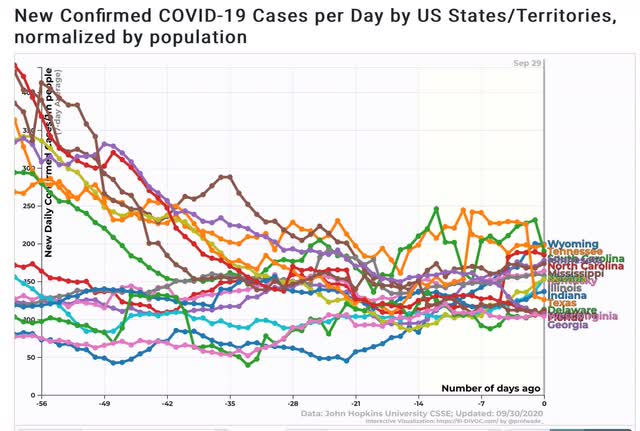

R ed (3 alarm fire): 100-200 infections per million:

17 States: (WY, TN, SC, NC, MN, MS, KY, IL, NV, AK, IN, TX, DE, FL, GA, LA, WV), (down from 19 five weeks ago)

17 States: (WY, TN, SC, NC, MN, MS, KY, IL, NV, AK, IN, TX, DE, FL, GA, LA, WV), (down from 19 five weeks ago)

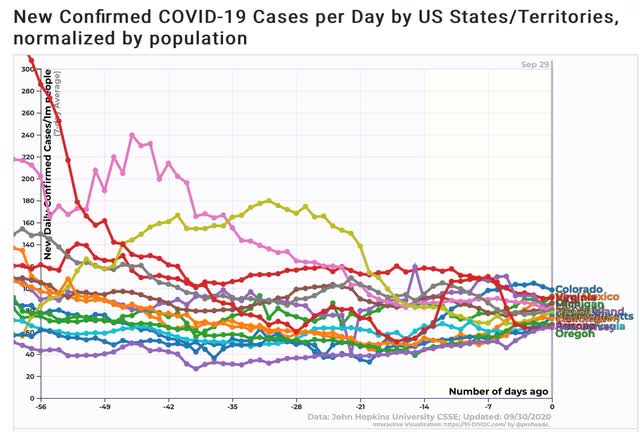

Orange (2 alarm fire): 60-100 infections per million:

15 States: (CO, NM. MI, VA, RI, OH, CA, MD, HI, PA, MA, WA, OR, AZ, NJ) (up from 10 five weeks ago)

15 States: (CO, NM. MI, VA, RI, OH, CA, MD, HI, PA, MA, WA, OR, AZ, NJ) (up from 10 five weeks ago)

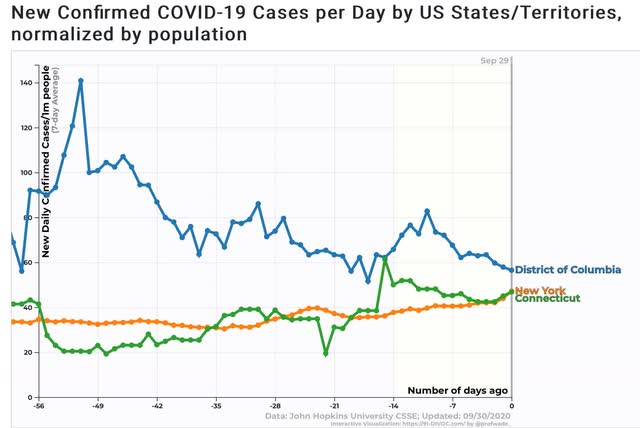

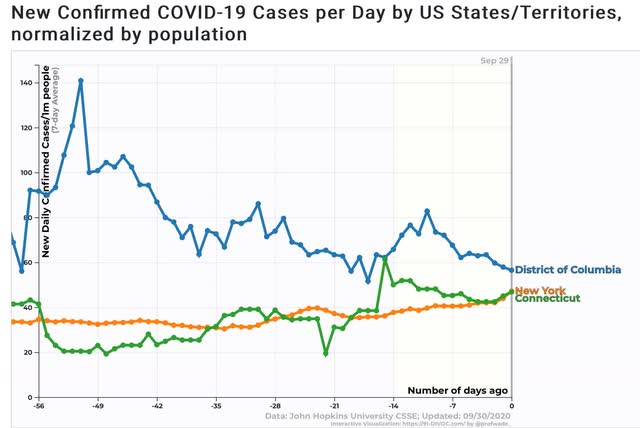

Yellow (1 alarm fire):40-60 infections per million:

2 States: (NY, CT) plus DC (down from 6 five weeks ago)

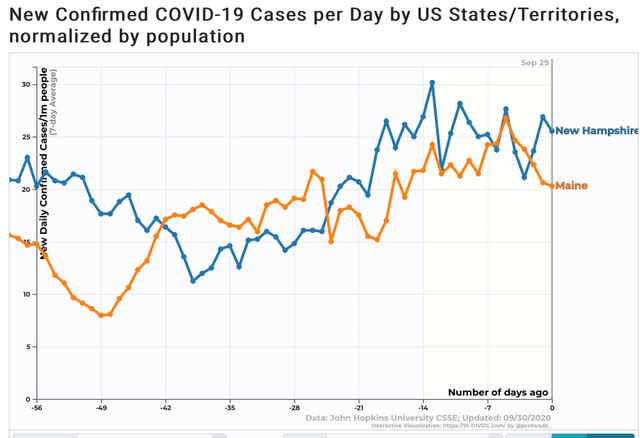

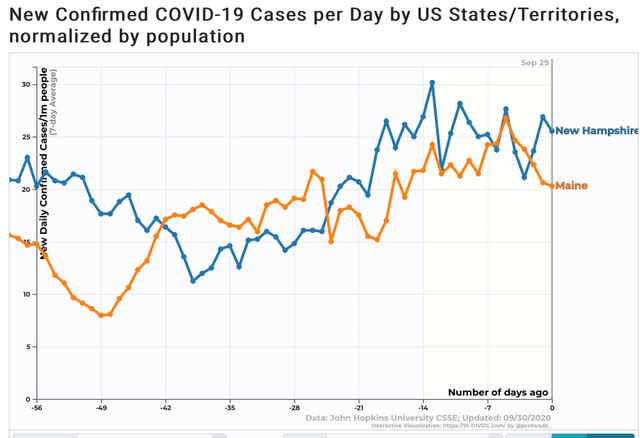

B lue (smoldering/1 alarm fire): 20-40 infections per million:

2 States: (NH, ME) (down from 3 five weeks ago)

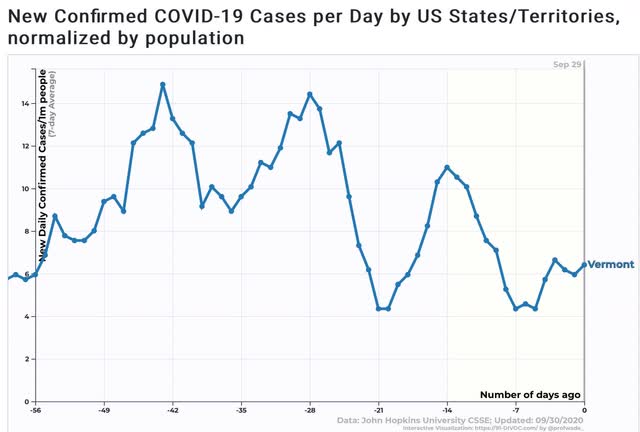

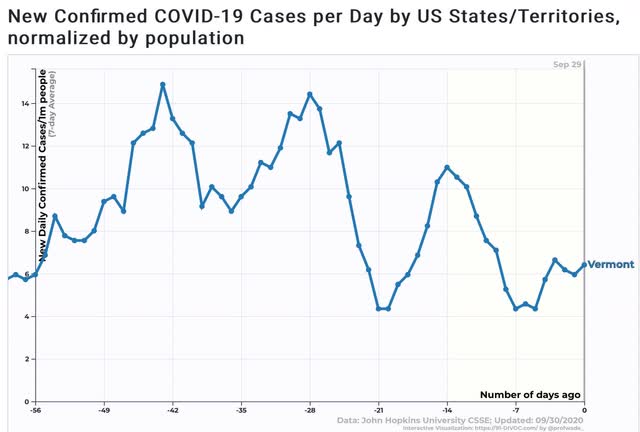

Green (embers): 0- 20 infections per million

1 State (VT) ( down from 3 five weeks ago)

In case it isn’t already clear, there are 31 jurisdictions that are Red or Deep Red now, vs. 24 five weeks ago. On the other hand, there are only 5 jurisdictions that are Yellow, Blue, or Green now vs. 12 five weeks ago.

This is the portrait of dismal societal failure. About the only good news is that a number of States that were previously out of control about a month ago panicked enough to take effective steps to rein in the pandemic at least somewhat.