he dollar fell versus the euro and pound after the Federal Reserve reduced its discount lending rate to prevent credit market losses from slowing the economy.

The dollar weakened against 15 of 16 major currencies as a reduction in borrowing costs dims the allure of U.S. assets. The decline today trimmed the dollar's weekly advance as investors had sought safety in the currency after a global rout of credit markets. U.S. and European stocks rallied.

``The Fed has taken the first step to calm down the market and restore investors' confidence,'' said Tom Fitzpatrick, global head of currency strategy at Citigroup Global Markets Inc. in New York. ``The dollar is getting a double-whammy. A reduction in interest rates makes it less attractive. The safe-haven flow into the dollar also flooded out.''

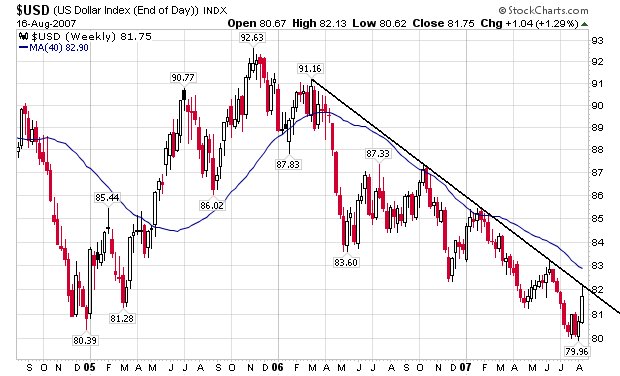

Here's a weekly chart of the dollar before today's action:

BTW: I have previously argued the dollar's value was a prime reason to not lower interest rates.