See you on Monday.

The actual returns to the Treasury from dividends banks pay on preferred shares issued through the program, in addition to the returns generated through warrant redemptions thus far, have been impressive. In fact, the total rate of return to the Treasury for all companies that have repaid TARP funds and redeemed their warrants associated with the program has been 10.22%, according to SNL data. The warrant redemptions have accounted for a large portion of that return, bringing in a 7.21% return to the Treasury. When looking at the return to the Treasury on an annualized basis, it becomes even larger, yielding 12.74% to the government on the 21 banks that cashed it out in full.

.....

The largest total returns to the Treasury have come from some of the largest recipients of TARP funds, namely Goldman Sachs Group Inc., Morgan Stanley and American Express Co., whose dividends on the government's preferred shares and the redemption of warrants tied to the program yielded returns to Uncle Sam of 14.18%, 12.68% and 12.23%, respectively, according to SNL data.

The Federal Deposit Insurance Corp. said it had 416 banks on its "problem list" at the end of June, equivalent to about 5% of the nation's banks, up from 305 at the end of March and 117 at the end of June 2008. Problem banks had a combined $299.8 billion of assets at the end of June, compared with $78.3 billion a year ago.

Landing on the FDIC's problem list means a bank is at a high risk of insolvency. State and federal regulators have already shut 81 banks this year.

"It's a continuation of the deterioration across the industry," said Gerard Cassidy, a bank analyst with RBC Capital Markets. "We think there are hundreds of failures to come."

The swelling of the problem list could be a harbinger of further industry consolidation, analysts said. Large, healthy banks, several of which have paid back their government-rescue funds, are "chomping at the bit" to buy failed lenders from the FDIC, and Thursday's report is likely to further whet their appetites, said Ed Najarian, head of bank research at International Strategy & Investment Group Inc. "They're looking at it as more opportunity to acquire banks."

The weekly chart shows a clear downtrend. The MACD is moving lower along with the RSI. Prices have been and continue to be in a downtrend. All the EMAs are moving lower, the shorter EMAs are below the longer EMAs and prices are below all the EMAs.

The weekly chart shows a clear downtrend. The MACD is moving lower along with the RSI. Prices have been and continue to be in a downtrend. All the EMAs are moving lower, the shorter EMAs are below the longer EMAs and prices are below all the EMAs.

Elections have consequences ....[A] new Administration in Washington populated by Economic Adults may ..[appreciate the]... pressing need for massive infrastructure investments that can lead to renewed bank lending and economic expansion on Main Street.

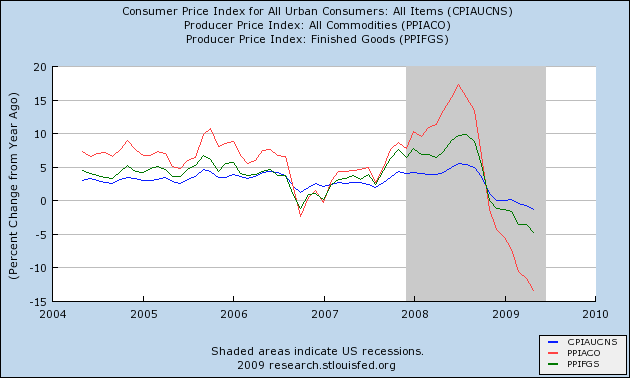

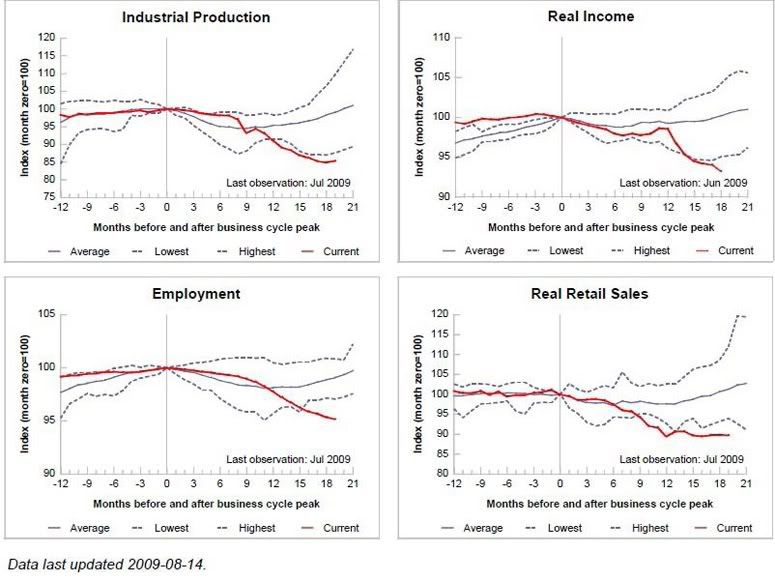

The temporal ordering of the spending weakness is: residential investment, consumer durables, consumer nondurables and consumer services before the recession, and then, once the recession officially commences, business spending on the short-lived assets, equipment and software, and, last, business spending on the long-lived assets, offices and factories. The ordering of the recovery is exactly the same.

First, the bullish side. Prices are rising and the EMA picture points to higher levels. The 10 and 20 week EMA are moving higher, the 10 week EMA has crossed over the 50 week EMA and the 20 appears ready to do so. Now the bearish side. The RSI printed a lower number on the second price top and the MACD's upward trajectory is less. The first point is very concerning as it indicates recent prices are less technically strong than earlier prices. The MACD issue is one of subjective interpretation. I would like that angle to be higher as prices move higher.

First, the bullish side. Prices are rising and the EMA picture points to higher levels. The 10 and 20 week EMA are moving higher, the 10 week EMA has crossed over the 50 week EMA and the 20 appears ready to do so. Now the bearish side. The RSI printed a lower number on the second price top and the MACD's upward trajectory is less. The first point is very concerning as it indicates recent prices are less technically strong than earlier prices. The MACD issue is one of subjective interpretation. I would like that angle to be higher as prices move higher.

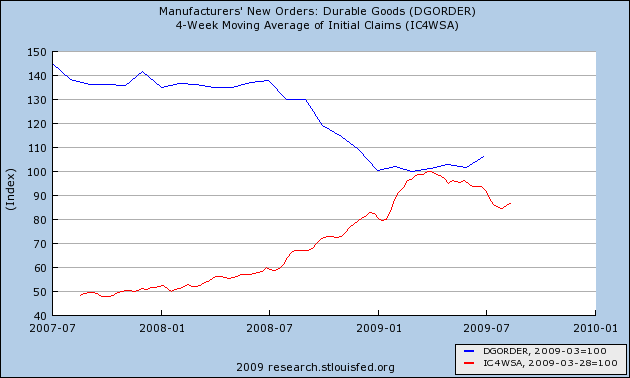

New orders for manufactured durable goods in July increased $7.8 billion or 4.9 percent to $168.4 billion, the U.S. Census Bureau announced today. This was the third increase in the last four months and the largest percent increase since July 2007. This followed a 1.3 percent June decrease. Excluding transportation, new orders increased 0.8 percent. Excluding defense, new orders increased 4.3 percent.

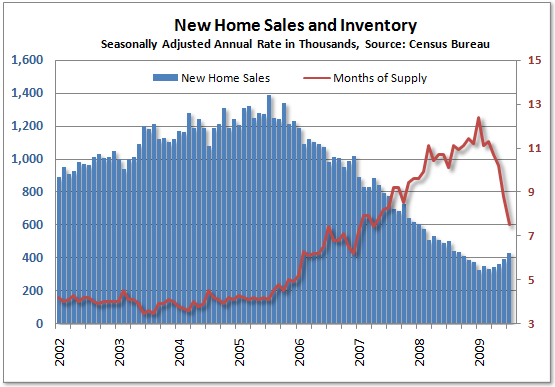

Purchases of new homes in the U.S. jumped more than forecast in July, adding to signs that the economy is rebounding from the worst recession since the 1930s.

Sales increased 9.6 percent, the most since February 2005, to a 433,000 annual pace, figures from the Commerce Department showed today in Washington. The number of houses on the market dropped to the lowest level in 16 years.

The gain in sales, together with rising purchases of existing homes and steadying prices, indicate the housing slump may be ending as Federal Reserve efforts to thaw credit and the Obama administration’s first-time homebuyer incentives lift demand. Job losses and mounting foreclosures mean any rebound in construction may be limited.

“We’re seeing a clear pickup in housing activity,” said Michael Moran, chief economist at Daiwa Securities America Inc. in New York. “The correction phase is essentially over and we expect continued improvement, though not a vigorous pickup.”

Wall Street and academic economists in recent weeks showed enthusiasm for giving Mr. Bernanke a second term, and some administration insiders felt similarly even though Mr. Bernanke was appointed by -- and served in the White House of -- President George W. Bush. Appointing a Democrat such as Janet Yellen, president of the Federal Reserve Bank of San Francisco, or Alan Blinder, former Fed vice chairman -- both former advisers to President Bill Clinton -- would have been popular with many Democrats. But a move by Mr. Obama to install his own person at the Fed might have have rattled markets and unsettled the foreign investors.

"I think this is a good thing for the markets," said Byron Wien, chief investment strategist at Blackstone Group. "Rather than going through a catechism of what Bernanke's done wrong, let's look at the net result. The economy is improving and the financial system is on the mend. It's a long way from perfect but it's also a long way from where it was a year ago."

Chinese companies have already played a leading role in pushing down the price of solar panels by almost half over the last year. Shi Zhengrong, the chief executive and founder of China’s biggest solar panel manufacturer, Suntech Power Holdings, said in an interview here that Suntech, to build market share, is selling solar panels on the American market for less than the cost of the materials, assembly and shipping.

Backed by lavish government support, the Chinese are preparing to build plants to assemble their products in the United States to bypass protectionist legislation. As Japanese automakers did decades ago, Chinese solar companies are encouraging their United States executives to join industry trade groups to tamp down anti-Chinese sentiment before it takes root.

Since March, Chinese governments at the national, provincial and even local level have been competing with one another to offer solar companies ever more generous subsidies, including free land, and cash for research and development. State-owned banks are flooding the industry with loans at considerably lower interest rates than available in Europe or the United States.

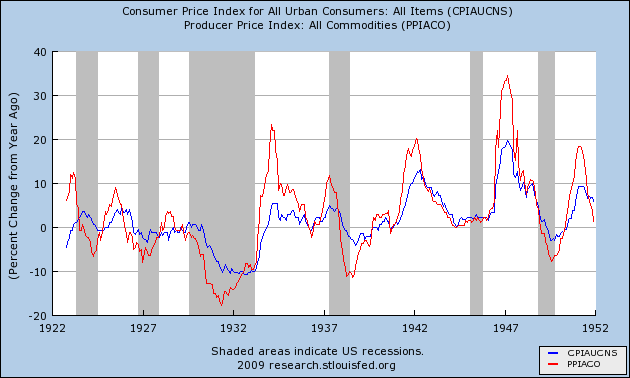

The economy was recovering briskly during Franklin D. Roosevelt's first term in the White House. The jobless rate, which had peaked at 25% in 1933, fell to 14% in 1937 -- not exactly cause for celebration but a relief nonetheless.

The comeback stalled in 1937. Banks, nervous about the fragile recovery, were holding huge amounts of cash in reserve at the Fed. Fearing an inflationary surge should the banks decide to lend that money out to businesses and individuals, the Fed -- which had made the mistake of tightening monetary policy soon after the 1929 stock-market crash -- miscalculated again. The Fed ratcheted up banks' reserve requirements three times, starting in 1936. The banks reacted by cutting lending even further.

"There's no doubt that [Fed Chairman Ben] Bernanke is heavily influenced by these two mistakes of the Fed during the Depression and is absolutely intent on not repeating them," says Alex J. Pollock of the American Enterprise Institute, a free-market think tank in Washington.

Compounding the Fed's errors, the federal government tightened fiscal policy. Congress approved a big bonus for World War I veterans in 1936, providing a spark of consumer spending. But lawmakers allowed the subsidy to lapse in 1937. At the same time, the government began collecting the first Social Security taxes, on top of income and capital-gains tax increases that Mr. Roosevelt approved in 1934-35.

Tightening the monetary and fiscal screws sent the economy into free fall again -- the second trough of the W. Unemployment shot up to 19%, prolonging the nation's suffering.