- by New Deal democrat

Over the weekend, in my high frequency “Weekly Indicators” post, I wrote that in the past month, the bulk of the short leading indicators had turned from being positive to negative. Which of course raises the question, should I go on recession watch?

To help resolve that, I took a look at the whole constellation of short leading indicators, including those that only come out once a month. To cut to the chase, the indicators that have reacted are the financial and interest rate sensitive ones. The “hard” indicators - and even a few of the “soft ones” - have not moved yet.

First, let me briefly update several of the high frequency indicators that have moved, starting with the “quick and dirty” forecast method including stock prices and jobless claims:

After turning negative YoY for several days last week, stocks have rebounded. Officially for my purposes they are a neutral indicator, because they made an all-time high as recently as late February. It will only be if they fail to surpass that high in the next month that they will turn negative.

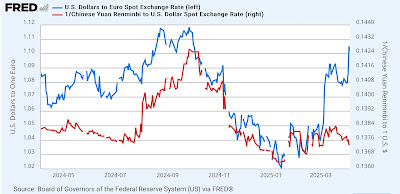

This is the US$, which I discussed yesterday, and made a new 52 week low intraweek last week:

Next is industrial commodities (basically, commodities minus oil):

This as well has made new 52 week lows in the past several weeks. This occurs either when supply increases (as it did in 2023) or demand is expected to contract, which is the most likely explanation at present.

As I wrote yesterday, the credit spread between Treasury’s and corporate bonds has also blown out:

Although I won’t bother with the graphs, several other short term leading indicators, including the average of the regional Fed manufacturing indexes and their new orders components, have been negative for awhile - which has also been the case for the ISM manufacturing index. And the aggregated St. Louis Financial Stress index sharply increased last week. But the similar Chicago Fed indexes show no sign of stress at all.

Where we haven’t seen a downturn is in manufacturers’ new orders for durable goods or for consumer goods (these are also “official” leading indicators in the index):

Note that these are only updated through February, and won’t be updated until later next week.

And recall that several leading indicators contained in the employment report, in the form of construction and goods-producing jobs generally, just made new peaks in March:

Finally, one last historical “official” short leading indicator that is very hard to reproduce now is net business formations vs. terminations. The Census Bureau does update formations monthly, but they are not seasonally adjusted and must be viewed YoY (particularly because of huge seasonal shifts during the Holiday season). These were just updated for March last week:

There’s no sign of stress at all in high propensity formations.

On the flip side, bankruptcy statistics do get updated every week, and will probably be updated later today. These have regular variations, peaking at the end of each month, as well as tailing off during the Holiday season. There is also a variation YoY depending on what day of the week a month begins and ends, so they are best averaged monthly:

It is not unusual for bankruptcies to increase during the course of an expansion, as the total number of businesses in the US increases with population and growth. The issue becomes when there is a significant acceleration of that trend. Averaging the four weeks in March through the beginning of April, there has been no such acceleration.

The bottom line as of now is that I would want to see some spreading out of weakness from the financial and interest rate data into the “hard” economic data before a “recession watch” would be warranted.