It's Saturday. Do anything except think about the markets or economics.

The subprime contagion has already forced several of the nation's largest home lenders into bankruptcy, but a banking attorney specializing in the mortgage industry says the carnage is far from over.

"This isn't the last of it," said Kal Das, head of the global bank and institutional finance and restructuring practice group at law firm Seward & Kissel, in a telephone interview. "Many more mortgage lenders will go down in the coming months."

U.S. retail sales increased a healthy 0.3% in August, but all the gains were for cars and trucks, the Commerce Department said Friday.

Excluding motor vehicles, sales fell a disappointing 0.4%, below expectations, and the biggest decline since last September.

Sales were slightly weaker than expected, but the upward revision to July's sales figures to 0.5% put the level of sales near expectations. Economists surveyed by MarketWatch had expected total sales to rise 0.6%, with a 0.2% increase in sales excluding autos. See Economic Calendar.

Sales were tepid outside of autos, although furniture and electronics sales showed some life. Sales at the malls, grocery stores, restaurants, and garden centers were weak.

Sales at U.S. retailers rose a smaller-than-expected 0.3% in August and they recorded the biggest decline in almost a year when car sales were stripped out, a government report showed on Friday.

Excluding motor vehicles and parts, retail sales fell 0.4% last month, the sharpest drop since September 2006, the Commerce Department said.

Analysts polled by Reuters were expecting sales to gain 0.4% and to rise 0.2% when cars and parts were stripped out.

Retail sales excluding cars, parts and gasoline, fell 0.1%, the steepest decline since April.

So-called core retail sales -- which exclude cars, gasoline and building materials -- were unchanged in August after a 0.8% gain in July.

In one of the highest-profile instances of a central bank coming directly to the rescue of a commercial bank in the current credit crisis, the Bank of England agreed to provide emergency funding to Northern Rock PLC, one of the United Kingdom's largest mortgage lenders.

...

The Bank of England's move -- the first time it has acted as a lender of last resort in this way since gaining independence on interest-rate policy in 1997 -- comes two days after its governor, Mervyn King, condemned some of the liquidity-providing measures other central banks have taken in the last month as needlessly encouraging risk-taking. In written testimony to the U.K. Parliament's Treasury Committee, Mr. King said the bank stood ready to take action in case of a severe shock to the banking system, but also warned that "if risk continues to be underpriced, the next period of turmoil will be on an even bigger scale."

Northern Rock Plc got emergency funding from the Bank of England, the biggest bailout of a British lender in 30 years, after a freeze in money markets left the mortgage provider unable to finance itself.

Northern Rock shares plunged as much as 26 percent to a six- year low after the company said today the central bank will provide an unspecified amount of credit. The Newcastle, England- based bank is the U.K.'s third-biggest lender by gross mortgages with loans worth 17.4 billion pounds ($35 billion) as of June 30.

The rescue stoked concern among investors and depositors that other financial firms that rely on short-term credit rather than deposits may be vulnerable. The Chancellor of the Exchequer Alistair Darling authorized the move, saying the Bank of England will step in as the lender of last resort ``where institutions face short-term liquidity difficulties.''

``This is a set of circumstances that I've not seen in 25 years,'' Chief Executive Officer Adam Applegarth said on a call with journalists. ``It's a substantial program, it is at a penalty rate. The facility will provide a solid ground base.''

European markets fell Friday, after Northern Rock, one of the United Kingdom's largest mortgage lenders, said it has agreed with the Bank of England to raise liquidity as needed through either secured borrowings or repurchase facilities.

The news rehashed fears that the fallout from the recent subprime and liquidity crisis is far from over. "There are only two important questions in our mind," said analysts at Credit Suisse in London. "What is a base valuation for Rock? And what does it mean for other banks?" (See related article.)

Kohlberg Kravis Roberts & Co.'s bankers have found buyers for the highest-yielding loans financing its purchase of U.K. pharmacist Alliance Boots in a sign demand for credit may be improving.

Deutsche Bank AG, JPMorgan Chase & Co. and UniCredit SpA, which last month abandoned selling 6 billion pounds ($12 billion) of mostly senior loans, probably will next week finish syndicating 750 million pounds of mezzanine debt that ranks last for repayment, two bankers involved said.

KKR's eight underwriters have been saddled with all of the 9 billion pounds of debt financing Europe's biggest leveraged buyout after investors rejected high-risk, high-yield loans. Banks in the U.S. are attempting to raise $16 billion of loans for KKR's acquisition of First Data Corp. in the biggest debt sale since rising U.S. mortgage defaults led to the highest borrowing costs for buyout firms in four years.

CALABASAS, Calif. (AP) -- Countrywide Financial Corp. boosted its borrowing capacity by $12 billion as the mortgage lender struggles to weather the slowdown in the housing market, the company said Thursday.

The move came after the largest U.S. home lender borrowed $11.5 billion and sold a $2 billion stake to Bank of America in recent weeks so it could keep operating its retail banking and mortgage businesses.

The decline in the U.S. commercial paper market slowed last week, prompting speculation that the worst of the short-term credit rout may be over.

U.S. stocks rose and Treasuries fell after the Federal Reserve reported short-term debt dropped by $8.2 billion, compared with a decline of $54.1 billion a week earlier. That coincided with Countrywide Financial Corp. obtaining new financing and banks finding buyers for loans to fund Kohlberg Kravis Roberts & Co.'s buyout of Alliance Boots.

Countrywide Financial Corp. boosted its borrowing capacity by $12 billion as the mortgage lender struggles to weather the slowdown in the housing market, the company said Thursday.

The move came after the largest U.S. home lender borrowed $11.5 billion and sold a $2 billion stake to Bank of America in recent weeks so it could keep operating its retail banking and mortgage businesses.

The decline in the U.S. commercial paper market slowed last week, prompting speculation that the worst of the short-term credit rout may be over.

U.S. stocks rose and Treasuries fell after the Federal Reserve reported short-term debt dropped by $8.2 billion, compared with a decline of $54.1 billion a week earlier. That coincided with Countrywide Financial Corp. obtaining new financing and banks finding buyers for loans to fund Kohlberg Kravis Roberts & Co.'s buyout of Alliance Boots.

Bonddad, permit me to offer an observation regarding the need for the transports to confirm the industrial's rise. That approach was valid for an extractive and manufacturing economy in which things get moved around.

In a service/information economy, wouldn't a better confirmation be found in an index focusing on telecommunications and maybe airlines? Those would represent the transport of electrons and people involved in passing information between operating nodes.

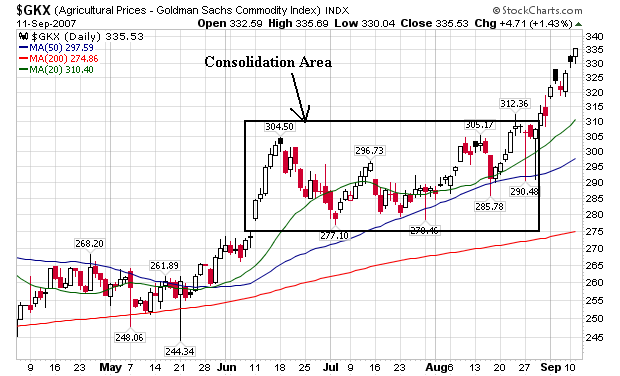

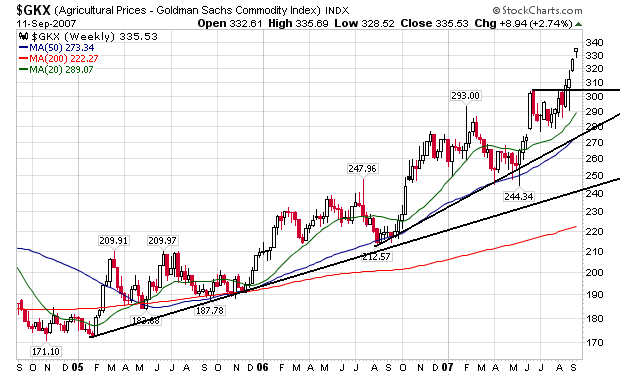

Wheat prices rose to a record, passing $9 a bushel in Asian trading, on concerns that declining global output will further shrink inventories at a 26-year low.

Reserves of the grain in Canada, the world's second-largest wheat exporter, plunged 29 percent at the end of July from a year earlier, Statistics Canada said yesterday. The U.S. may cut its forecast for the crop in Australia to 18 million tons, from 23 million metric tons in a report today.

Wheat prices have more than doubled in the past year, raising costs at companies such as Premier Foods Plc, the U.K.'s biggest maker of cakes, Nissin Food Products of Japan and Sara Lee Corp. The grain is used as livestock feed and to make cakes, noodles and bread, with one bushel enough to make 73 loaves.

``It is feeding through to the consumer, it's gone up high enough to do that,'' said Tobin Gorey, commodity strategist with Commonwealth Bank of Australia Ltd. in Sydney. ``The market is in a real frenzy. The news flow continues to be negative.''

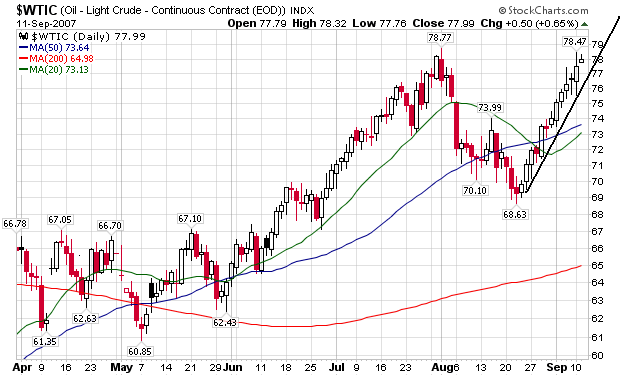

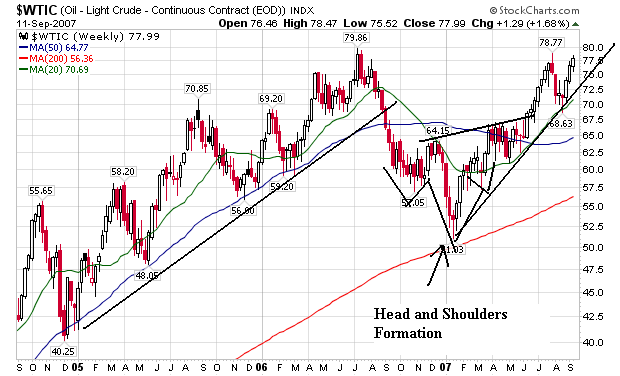

Crude-oil futures marked their highest closing level ever for a benchmark contract on the New York Mercantile Exchange Tuesday after some of the world's major oil producers decided to raise their daily output by 500,000 barrels per day, starting Nov. 1.

Traders had a difficult time digesting the news. Initial reports following the announcement from the Organization of the Petroleum Exporting Countries weren't clear as to whether the increase was to the cartel's official production quota or to its actual output, which has been estimated at about 1 million barrels above the quota.

But "what OPEC did was raise its production target from 25.8 million barrels per day to just over 27.2 million barrels per day -- an increase of about 1.4 million barrels per day," said Kevin Saville, a managing editor at Platts, who is on site at the meeting in Vienna.

Wall Street rose sharply Tuesday as investors grew more confident that the Federal Reserve will lower interest rates next week, even after its chairman gave no clues about the central bank's intentions. The Dow Jones industrials rose 180 points.

U.S. stocks rallied the most this month on growing evidence consumers are weathering an economic slowdown and bolstering profit growth.

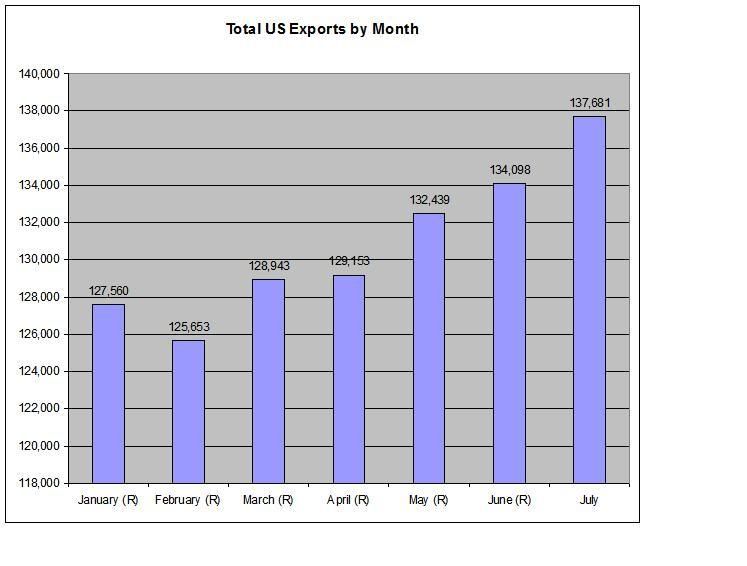

Exports increased 2.7% in nominal terms to $137.7 billion, while imports increased 1.8% to $196.9 billion. Much of the increase in imports was due to higher prices, especially for petroleum and food. The average price of imported crude petroleum was the second highest on record at $65.56 per barrel.

In inflation-adjusted terms, imports of goods rose 0.8%. Inflation-adjusted exports of goods rose 3.7%.

U.S. producers exported record values of capital goods, consumer goods, autos and foods. U.S. consumers imported record values of foods and feeds.

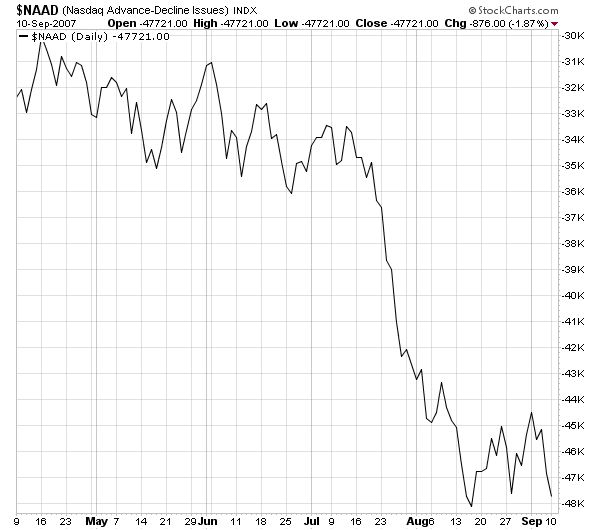

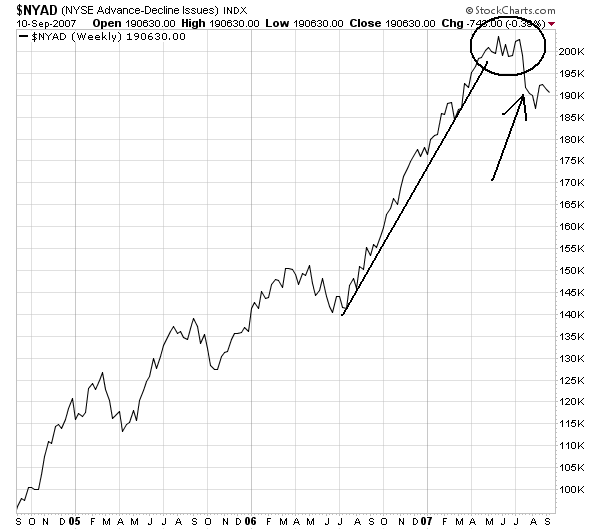

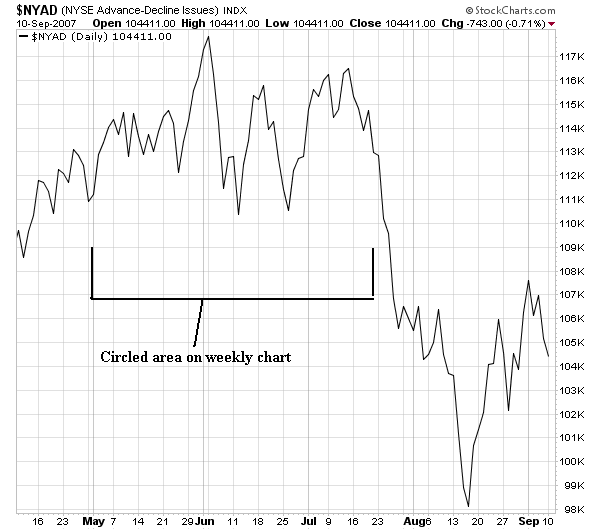

A technical indicator that plots changes in the value of the advance-decline index over a certain time period. Each point on the chart is calculated by taking the difference between the number of advancing/declining issues and adding the result to the previous period's value, as shown by the following formula:

A/D Line = (# of Advancing Stocks - # of Declining Stocks) + Previous Period's A/D Line Value

Investopedia Says... This indicator is used by many traders to confirm the strength of a current trend and its likelihood of reversing. If the markets are up but the A/D line is sloping downwards, it's usually a sign that the markets are losing their breadth and may be setting up to head in the other direction. If the slope of the A/D line is up and the market is trending upward then the market is said to be healthy.

San Francisco Federal Reserve Bank President Janet Yellen said on Monday that the current turmoil in financial markets has added "appreciably" to downside risks for the U.S. economy.

"Financial market turmoil seems likely to intensify the downturn in housing," and pose a risk to broader economy, especially consumer spending, Yellen said in a speech at the National Association of Business Economics annual meeting.

Here’s a quick run-down of all the recent Fed speeches:

* Hawk St. Louis Fed’s William Poole, Sept. 6: “The extent to which it’s affecting the broader economy…I don’t think we know yet. We shouldn’t take for granted the assumption that the economy is about to take a nose-dive.”

* Hawk Atlanta’s Dennis Lockhart, Sept. 6: “So far, I have not seen hard or soft data that provide conclusive signs that housing problems are spilling over into the broad economy…In my view current readings of inflation represent progress, but not victory. I would like to see inflation sustained at a somewhat lower rate—with emphasis on “sustained.”

* Hawk Philadelphia’s Charles Plosser, Sept. 8: “Going forward, until housing demand picks up and some of the inventory of unsold homes is worked off, residential construction will continue to be a drag on economic growth. I expect this drag to diminish gradually but continue until sometime next year. I believe the most likely outcome is that economic growth will return toward trend later in 2008.”

* Dove San Francisco’s President Janet Yellen, Sept. 10: “I see significant downward pressure based on recent data indicating further weakening in the housing sector and the tightening of financial markets… should the decline in house prices occur in the context of rising unemployment, the risks could be significant… signs of improvement in underlying inflationary pressures are evident in recent data… past experience does show that financial turbulence can be resolved more quickly than seems likely when we’re in the middle of it. Moreover, the effects of these disruptions can turn out to be surprisingly small.”

* Hawk/Dove Mr. Lockhart, Sept. 10: Friday’s employment figures “clearly have to be taken very seriously,” but added that he “would like to see inflation sustained at a somewhat lower rate.”

To recap — that’s three speeches on the side of hawkishness, one that sort of straddles the middle (Mr. Lockhart, today), and another that is mostly dovish, although not strongly so (Ms. Yellin, today), which suggests that market players betting on Fed rate cuts would probably want to lean to the quarter-point area.

Wall Street is getting no benefit from the biggest bond market rally in five years.

Lehman Brothers Holdings Inc. faces higher borrowing costs today than it did in June, even after the steepest quarterly drop in U.S. Treasury yields since 2002 pushed interest rates down for everyone from Procter & Gamble Co. to AT&T Inc. Investors are so leery of Bear Stearns Cos. that its 10-year bonds trade at a discount to Colombia, the South American nation that's barely investment grade. Goldman Sachs Group Inc. is being punished with a higher yield than Caterpillar Inc., the heavy-equipment maker.

Bond buyers view the nation's largest securities firms as no safer than taking a flier on subprime mortgages. That's a nightmare scenario for the industry's chief executive officers, who relied on cheap financing for leveraged buyouts, real estate lending and proprietary trading to produce record profits -- and paychecks of $40 million or more for themselves.

It is crunch time for many of the world's biggest banks grappling with one of the tightest credit markets of recent memory.

About $120 billion of commercial paper outside the U.S. is due for renewal in the next week, including $56.5 billion of asset-backed paper, which has met the stiffest resistance from investors. Issuers need to find buyers in order to roll over these short-term funding mechanisms or pay off the loans. So banks and other issuers are pulling out all stops to lure investors back. In the meantime, they are using short-term moves to raise cash to keep them going.

While there is little sign the market is opening up, a few rays of hope are emerging. In Australia, the central bank has broadened the definition of assets it would accept as collateral for short-term funding it supplies to domestic banks. In the U.S., money-market funds haven't suffered big redemptions and thus still have money to put to work. Investors in these funds also are willing to hold commercial paper for slightly longer time frames, suggesting some stability may be returning, though the funds may find their investors want a limited diet of short-term paper.