Saturday, July 6, 2019

Weekly Indicators for July 1 - 5 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha. Lower long term interest rates continue to improve the long range forecast, while the short term forecast has deteriorated.

As usual, clicking over and reading puts a penny or two in my pocket to help reward me for my efforts.

Friday, July 5, 2019

June jobs report: excellent establishment survey, mediocre household survey

- by New Deal democrat

HEADLINES:

- +224,000 jobs added

- U3 unemployment rate rose 0.1% from 3.6% to 3.7%

- U6 underemployment rate rose 0.1% from 7.1% to 7.2%

Leading employment indicators of a slowdown or recession

I am highlighting these because many leading indicators overall strongly suggest that an employment slowdown is coming. The following more leading numbers in the report tell us about where the economy is likely to be a few months from now. These were all positive this month.

- the average manufacturing workweek rose 0.1 from 40.6 hours to 40.7 hours. This is one of the 10 components of the LEI.

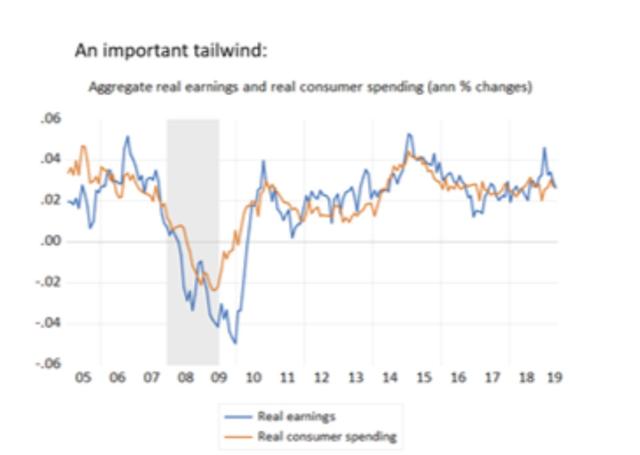

- Manufacturing jobs rose by 17,000. YoY manufacturing is up 167,000, a deceleration from last summer’s pace.

- construction jobs rose by 21,000. YoY construction jobs are up 204,000, also a deceleration from last summer. Residential construction jobs, which are even more leading, rose by 4600, the first monthly decline in the past three.

- temporary jobs rose by 4300.

- the number of people unemployed for 5 weeks or less declined by -186,000 from 2,147,000 to 1,961,000. The post-recession low was two months ago.

Wages and participation rates

Here are the headlines on wages and the broader measures of underemployment:

Here are the headlines on wages and the broader measures of underemployment:

- Not in Labor Force, but Want a Job Now: rose by 227,000 from 5.045 million to 5.322 million

- Part time for economic reasons: declined by -8,000 from 4.355 million to 4.347 million

- Employment/population ratio ages 25-54: unchanged at 79.7%. This remains a declined from the peak at the beginning of this year.

- Average Hourly Earnings for Production and Nonsupervisory Personnel: rose $.04 from $23.39 to $23.43, up +3.3% YoY. This is still a slight decline from the recent YoY% change peak. (Note: you may be reading different information about wages elsewhere. They are citing average wages for all private workers. I use wages for nonsupervisory personnel, to come closer to the situation for ordinary workers.)

Holding Trump accountable on manufacturing and mining jobs

Trump specifically campaigned on bringing back manufacturing and mining jobs. Is he keeping this promise?

Trump specifically campaigned on bringing back manufacturing and mining jobs. Is he keeping this promise?

- Manufacturing jobs rose an average of +14,000/month in the past year vs. the last seven years of Obama's presidency in which an average of +10,300 manufacturing jobs were added each month.

- Coal mining jobs were unchanged, an average of -100/month in the past year vs. the last seven years of Obama's presidency in which an average of -300 jobs were lost each month

Other important coincident indicators help us paint a more complete picture of the present:

- Overtime was unchanged at 3.4 hours.

- Professional and business employment (generally higher-paying jobs) rose by 51,000 and is up +1,482,000 YoY.

- the index of aggregate hours worked for non-managerial workers rose by 0.2%

- the index of aggregate payrolls for non-managerial workers rose by 0.5%

Other news included:

- the alternate jobs number contained in the more volatile household survey rose by 247,000 jobs. This represents an increase of 1,413,000 jobs YoY vs. 2,301,000 in the establishment survey. This survey, which has been negative three months this year, was a major disconnect from the establishment number. The household survey has a tendency to turn first, and this month it showed up in the establishment survey.

- Government jobs rose by 33,000.

- the overall employment to population ratio for all ages 16 and up was unchanged at 60.6% m/m and is up 0.2% YoY.

- The labor force participation rate rose 0.1% from 62.8% to 62.9% m/m and is unchanged YoY.

SUMMARY

Once again there is a divergence between the establishment report, which was excellent, and the household report, which was mediocre.

The best news was that all of the leading measures in the report were positive, taking back last month’s declines. Good professional and business jobs and government jobs rose strongly. Aggregate hours and payrolls also rose nicely. The only negative in the establishment survey was that revisions continued to be negative, which is thought to be something that happens at negative turning points.

While the monthly increase in jobs in the household report was also strongly positive, the YoY change continues to be lackluster, averaging about 125,000 jobs a month. Again, this is thought to be the kind of divergence that happens at negative turning points. Both the unemployment and underemployment rates rose. The participation’s rates and employment to population ratios were either flat monthly or flat YoY.

So, bottom line, this was mainly a very good report. Whether it signals that recent weakness was overblown, or whether it itself was a countertrend number, we will find out in the next month or two.

Wednesday, July 3, 2019

Initial claims on the cusp of turning neutral; expect a middling June jobs report

- by New Deal democrat

I have started to monitor initial jobless claims to see if there are any signs of stress.

My two thresholds are:

1. If the four week average on claims is more than 10% above its expansion low.

2. If the YoY% change in the monthly average turns higher.

Here’s this week’s update, plus implications for the impending June jobs report.

My two thresholds are:

1. If the four week average on claims is more than 10% above its expansion low.

2. If the YoY% change in the monthly average turns higher.

Here’s this week’s update, plus implications for the impending June jobs report.

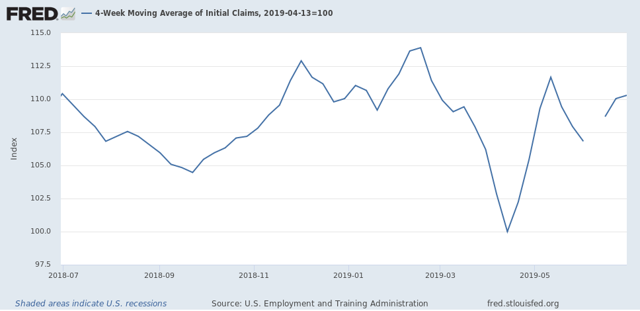

As of this week, the four week average is now 10.3% above its recent low:

Last June the monthly average was 222,000. This year it was 221,500:

That is merely -0.2% better than last year. In other words, had this week’s number been just 1,000 higher,that would have been enough to tip this indicator from positive to neutral.

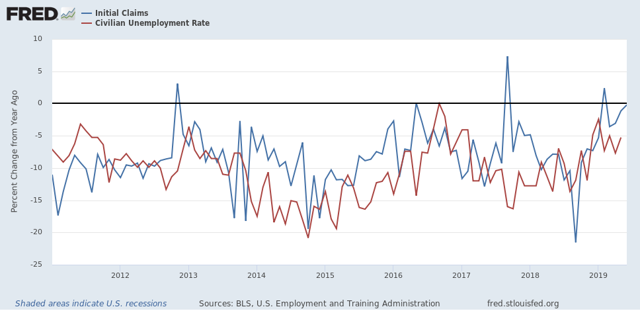

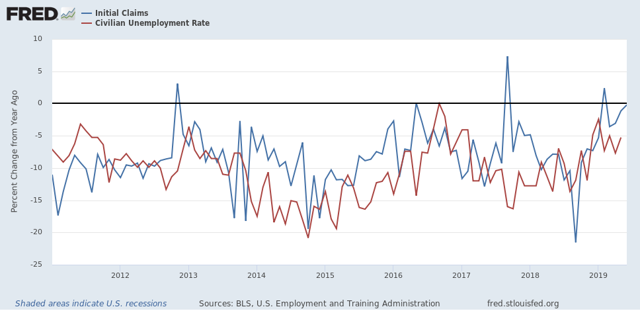

Now let’s turn to implications for Friday’s jobs report. Since initial jobless claims lead the unemployment rate, here is the long term view of both as YoY% changes going back 50 years:

Now here is the close-up on the past 8 years:

As you can see, there is no monthly correspondence, but there is a clear leading relationship. In both May and June, initial claims were barely below where they had been in May and June 2018. The corresponding unemployment rates were 3.8% and 4.0%, respectively. As a result, I am anticipating that the unemployment rate will rise to the 3.7% to 3.9% range.

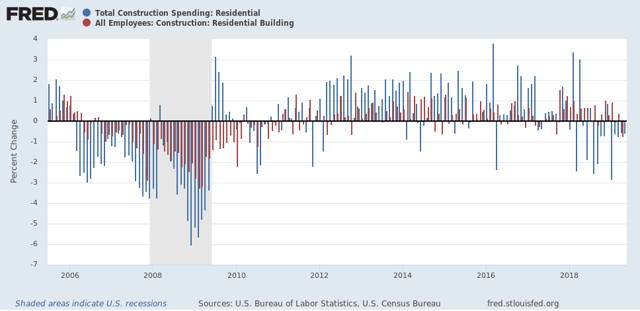

Another leading employment sector is residential construction employment. As the below graph shows, it follows residential construction spending on a YoY% basis:

Residential construction employment declined last month, and it is most likely that it will show another decline this month.

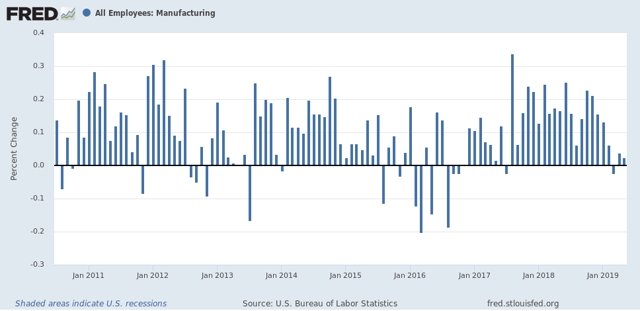

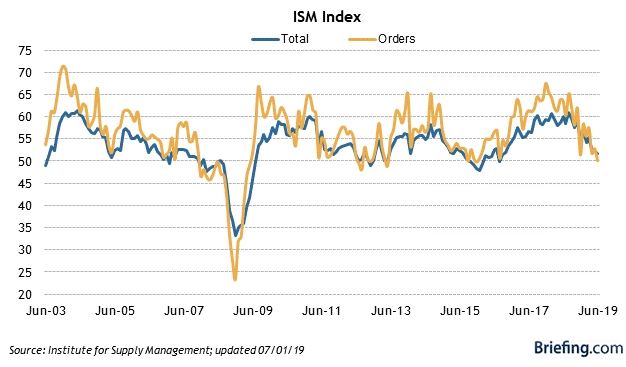

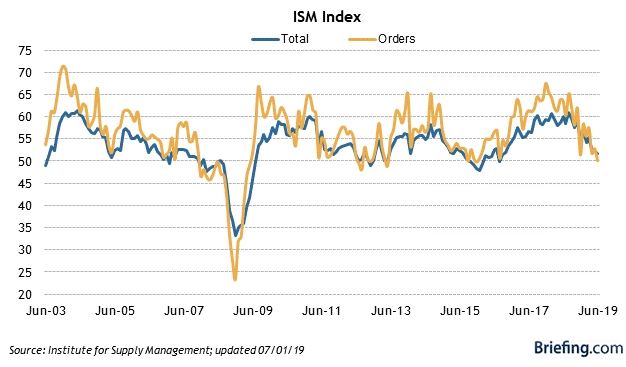

Additionally, the leading sector of manufacturing employment tends to follow the ISM manufacturing index with a lag of 3 to 9 months. Although FRED no long er carries the ISM data, it fell below 50 in both 2011 and 2015. As the below graph shows, manufacturing employment subsequently underwent monthly declines as well:

Thus I am expecting another lackluster month for this sector.

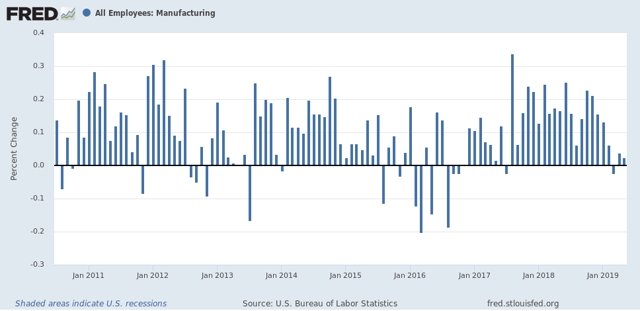

Finally, here is the YoY graph from the American Staffing Association of temporary employment:

This has stopped deteriorating on a YoY basis, and has made a little bit of improvement. Thus I expect a weakly positive number for this sector.

Keep in mind that there is, as I said above, no simple month-to-month correspondence in these numbers, although on a longer term time frame it is clear.

But put together initial claims, residential construction, ISM manufacturing, and temporary staffing, and this suggests to me a middling type of number, probably between 120,000 and 160,000.

We’ll see Friday.

Tuesday, July 2, 2019

In which I nitpick Prof. Jared Bernstein about a consumer “economic tailwind”

- by New Deal democrat

Last Friday, following the release of May’s personal income and spending report, Prof. Jared Bernstein, whom I follow religiously, wrote among other things about some economic headwinds and tailwinds, including the following:

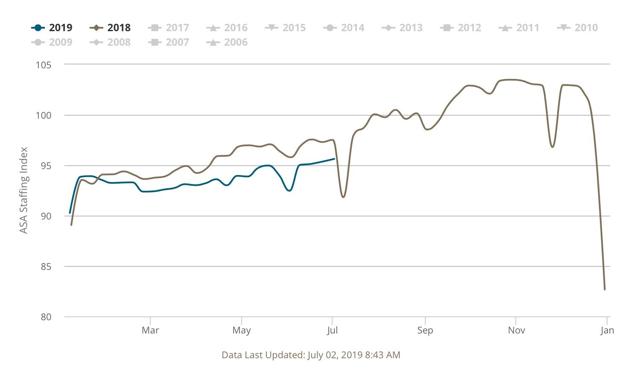

Finally, my personal favorite tailwind indicator [pointing to the below graph]: the close tracking between aggregate real earnings and consumer spending. The good news is they’re both clearly in expansion territory. The bad news is that they can both downshift within a few quarters:

Although he labels them differently, the first is one of my favorites as well: real aggregate payrolls of production and non-supervisory employees. The second is real personal consumption expenditures.

That piqued my interest, because over seven years ago I wrote that

real retail sales are much more volatile [than personal consumption expenditures]. And, . . . in a very specific and non-random way

early in economic expansions, YoY real retail sales growth far outstrips YoY PCE growth. As the economy wanes into contraction, YoY real retail sales grow less and ultimately contract more than YoY PCE's. You can see that by noting that retail sales minus PCE's are always negative BEFORE the economy ever tips into recession [graph omitted]. That's 11 of 11 times. Further, in 10 of those 11 times (1957 being the noteworthy exception), the number was not just negative, but was continuing to decline for a significant period before we tipped into recession.

So normal is this pattern that it is one of my “mid-cycle indicators.”

Okay, to the nitpick....

Prof. Bernstein’s post suggests that real personal consumption expenditures and real aggregate wages are coincident to one another. Since both are OK now, that’s a significant tailwind.

But what happens when we substitute real retail sales?

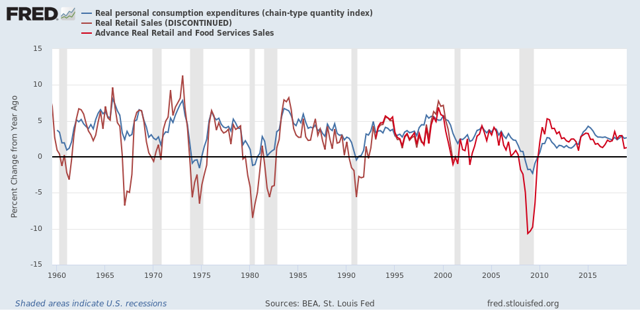

Let’s start with real personal consumption expenditures and real retail sales, going back 60 years (averaged quarterly to cut down on noise):

This graph confirms that (1) real retail sales more often than not slightly lead real personal consumption expenditures, and (2) real retail sales are much more volatile, especially to the downside, meaning they especially lead in the months leading up to a recession. Hence the “non-random way” in which the two measures differ.

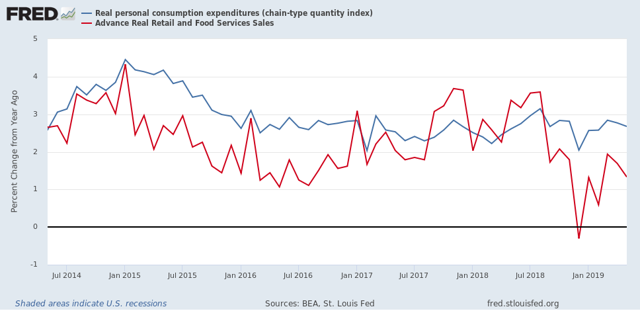

Here’s the monthly comparison over the past five years:

After a resurgence following the 2017 hurricanes, YoY growth in real retail sales has fallen well below that of real personal consumption expenditures, including one negative month during the government shutdown “mini-recession.”

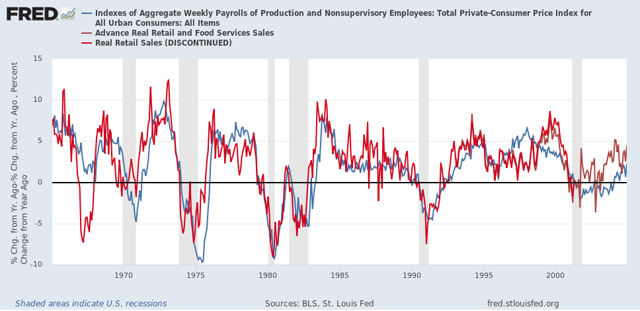

So, now let’s compare real aggregate payrolls to real retail sales. Here’s the long term look going back 55 years to the start of the series:

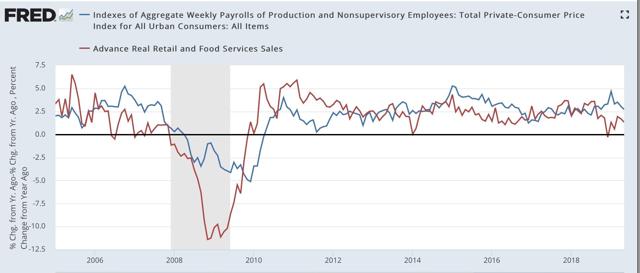

And here is the past 15 years (the same time frame as Prof. Bernstein’s graph):

With the exception of 1980, real retail sales have always improved first coming out of recessions. Further, more often than not (1969, 1981, 2000, 2007) real retail sales have also led real aggregate payrolls heading into recessions.

As shown in the last graph above, so far this year looks a lot like 2006. That doesn’t mean there can’t be a bounce, but what it does suggest is that consumer behavior isn’t nearly as much of a tailwind as Prof. Bernstein’s statement would make it appear.

Monday, July 1, 2019

As we start the second half of 2019 . . . (Updated: manufacturing almost exactly flat in June)

- by New Deal democrat

First of all, I forgot to post a link to my post at Seeking Alpha on how a near-term recession is not likely to be centered on either the consumer and financial sectors of the economy, which are doing OK at the moment, but the producer sector - manufacturing - which is getting pretty shaky. We’ll find out more later this morning when ISM manufacturing for June gets reported.

As usual, clicking over and reading puts a penny or two in my pocket to reward me for my efforts.

Now that we are in the second half of the year, I expect the slowdown that we’ve seen over the past few months to become more entrenched. I remain on “recession watch” because risks are elevated (see, for example, this post by Menzie Chinn), but despite the inverted yield curve, my base case remains slowdown only because the Fed can lower rates substantially without being worried about inflation. The main wild card is that Trump probably simply cannot control his urge to roil producers with chaotic tariff and trade policies.

UPDATE: The ISM manufacturing index remained slightly positive in June, at 51.7. The leading new orders subindex was precisely flat, at 50.0:

There is no manufacturing recession. There is the barest of manufacturing expansion.

Sunday, June 30, 2019

On Gerrymandering: “The United States shall guarantee to every State in this Union a Republican Form of Government”

Previously I have written that the Fourteenth Amendment specifically provides for a reduction in representation for any state that engages in voter suppression.

“[W]hen the right to vote at any election ... is denied to any ... citizens of the United States, or in any way abridged, except for participation in rebellion, or other crime, the basis of representation therein shall be reduced in the proportion [thereto]....”

In view of the GOP Supreme Court majority deciding that partisan gerrymandering is a “political question” beyond the purview of the courts, I want to take this matter further. Because if the Congress is willing to play hardball, it has a remedy.

In view of the GOP Supreme Court majority deciding that partisan gerrymandering is a “political question” beyond the purview of the courts, I want to take this matter further. Because if the Congress is willing to play hardball, it has a remedy.

Article 4, Section 4 of the US Constitution provides:

“The United States shall guarantee to every State in this Union a Republican Form of Government.”

Importantly, In Luther v. Borden (1849), the Supreme Court established the doctrine that questions arising under this section are political, not judicial, in character and that “it rests with Congress to decide what government is the established one in a State . . . as well as its republican character.”

In other words, it has already been established that what the guarantee of a “republican form of government is” is not for the Federal Courts, but for the Congress and the President to determine.

Do States have a “republican form of government” if a minority of the people are able to entrench themselves as a permanent legislative majority based on the outcome of just one election? Now that the Supreme Court has said that the Courts may not act, I think Congress has every right to declare that this is the case, both at the state and federal election levels, and to refuse to seat anybody winning such elections.

Here’s how I envision it could work. Congress would pass a “Republican Form of Government” law, whereby Congress could examine the State and Congressional districts of any State to determine if there was a partisan gerrymander that was an “abridgment” of the right to vote under Section 2 of the Fourteenth Amendment, and that if Congress so found, then it could determine that any such State was not permitting a “republican form of government.” Relying upon that finding, Congress could refuse to seat more than the proportional number of gerrymandered winners, or order new state elections in districts that were not gerrymandered. It would not have to wait for actual election results. It could notify the State in advance of the penalty if the State proceeds with such gerrymandered districts. Remember, since we now have Supreme Court precedent that “republican form of government” questions are political issues, as are matters of partisan gerrymandering, the door to this kind of Congressional action is wide open.

Such a law would also be in accordance with Article I, Section 5 of the United States Constitution which states that:

"Each House shall be the judge of the elections, returns and qualifications of its own members...."

This had been interpreted that members of the House of Representatives and of the Senate can refuse to recognize the election or appointment of a new representative or senator for any reason. It is particularly instructive that these issues arose often after the Civil War, as southern States sent Representatives where newly freed slaves were not allowed to vote. Even before the Fifteenth Amendment, the second section of the Fourteenth Amendment I have discussed was enacted as a remedy.

In my previous article, I used the example of North Carolina, where over 50% of the votes cast in 2018 were for Democrats, but Democrats were only elected in only 3 of the state’s 13 Congressional Districts. If North Carolina persisted in this gerrymander, then under a “Republican Form of Government” law, Congress could refuse to seat more than 3 GOP election winners. Congress could also similarly act on state legislative seats, or refuse to accept the North Carolina legislature as elected, as legitimate.

I realize this is a radical suggestion, but not to play hardball at this point is to accept that a minority may entrench itself in power forever without remedy. The GOP has been playing hardball for decades. It’s time for us to fight back.

Subscribe to:

Comments (Atom)