Saturday, December 20, 2014

Weekly Indicators for December 15 - 19 at XE.com

- by New Deal democrat

My Weekly Indicators post is up at XE.com.

The strong dichotomy between international and domestic US data continues.

US Equity Market Review For the Week of December 15-19: Searching For the Signal In the Noise

I think it's the secret desire of every technical analyst to always find order in the chaos. We secretly believe that if we look long enough and hard enough at a series of charts, a clear pattern and future course of action will emerge. There are times -- like the last couple of weeks -- where it has been damn hard to see what is happening. For example, take this 30-day, 5-minute chart of the SPYs:

There are two week-long rallies with a slight upward angle -- one at the end of November and one at the beginning of December. Both rallies hit resistance in the upper-206/lower207 area. Then a downward sloping channel emerges with increased volatility and wider price swings. Losses were consolidated at the beginning of last week until the Fed announcement when prices moved sharply higher. But the chart really doesn't give us any meaningful and understandable overall pattern to discern. Instead, it's a jumbled mess.

And that analysis falls in line with the latest economic analysis from the Fed's latest policy statement:

Information received since the Federal Open Market Committee met in October suggests that economic activity is expanding at a moderate pace. Labor market conditions improved further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately and business fixed investment is advancing, while the recovery in the housing sector remains slow. Inflation has continued to run below the Committee's longer-run objective, partly reflecting declines in energy prices. Market-based measures of inflation compensation have declined somewhat further; survey-based measures of longer-term inflation expectations have remained stable.

This is directly in line with the Conference Board's LEIs and CEIs:

The Conference Board Leading Economic Index® (LEI) for the U.S. increased 0.6 percent in November to 105.5 (2004 = 100), following a 0.6 percent increase in October, and a 0.8 percent increase in September.

“The increase in the LEI signals continued moderate growth through the winter season,” said Ken Goldstein, Economist at The Conference Board. “The biggest challenge has been, and remains, more income growth. However, with labor market conditions tightening, we are seeing the first signs of wage growth starting to pick up.”

“Widespread and persistent gains in the LEI point to strong underlying conditions in the U.S. economic expansion,” said Ataman Ozyildirim, Economist at The Conference Board. “The current situation, measured by the coincident economic index, has been improving steadily, with employment and industrial production making the largest contributions in November.”

The Conference Board Coincident Economic Index® (CEI) for the U.S. increased 0.4 percent in November to 110.7 (2004 = 100), following a 0.2 percent increase in October, and a 0.3 percent increase in September.

And finally, consider this chart from Scott Grannis showing the relationship between corporate profits and GDP:

Earnings are the mother's milk of the stock market. And right now, corporations are making a ton of money.

On the downside, the market is still expensive from a valuation perspective, so the upside is limited, barring further growth. But given the underlying economic fundamentals there is no reason to think growth won't continue. And that makes the last month of price action nothing more than statistical noise in the wider context of a growing economy.

There are two week-long rallies with a slight upward angle -- one at the end of November and one at the beginning of December. Both rallies hit resistance in the upper-206/lower207 area. Then a downward sloping channel emerges with increased volatility and wider price swings. Losses were consolidated at the beginning of last week until the Fed announcement when prices moved sharply higher. But the chart really doesn't give us any meaningful and understandable overall pattern to discern. Instead, it's a jumbled mess.

The daily SPY does still show an upward-sloping rally. But there are two problems with this, with the first being the sell-off that clearly broke through the support lines connecting the early February and mid-December lows. Martin Pring advises that a break doesn't change the trend if it is less than 2%-3%. But that's not the case here where the move was over 6%. And then there's the potential upward sloping wedge pattern forming, which is usually considered a topping pattern. The trend break and the wedge give a strong indication that the market is indeed topping.

But, when we pull the lens back further to a far longer time frame, we're still in a rally:

Looking at the 4-year weekly chart, we're still clearly moving higher. The price action that was so confusing above has been reduced to two bars, one red and one clear, indicating we had a brief sell-off followed by a rally. And that analysis falls in line with the latest economic analysis from the Fed's latest policy statement:

Information received since the Federal Open Market Committee met in October suggests that economic activity is expanding at a moderate pace. Labor market conditions improved further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately and business fixed investment is advancing, while the recovery in the housing sector remains slow. Inflation has continued to run below the Committee's longer-run objective, partly reflecting declines in energy prices. Market-based measures of inflation compensation have declined somewhat further; survey-based measures of longer-term inflation expectations have remained stable.

This is directly in line with the Conference Board's LEIs and CEIs:

The Conference Board Leading Economic Index® (LEI) for the U.S. increased 0.6 percent in November to 105.5 (2004 = 100), following a 0.6 percent increase in October, and a 0.8 percent increase in September.

“The increase in the LEI signals continued moderate growth through the winter season,” said Ken Goldstein, Economist at The Conference Board. “The biggest challenge has been, and remains, more income growth. However, with labor market conditions tightening, we are seeing the first signs of wage growth starting to pick up.”

“Widespread and persistent gains in the LEI point to strong underlying conditions in the U.S. economic expansion,” said Ataman Ozyildirim, Economist at The Conference Board. “The current situation, measured by the coincident economic index, has been improving steadily, with employment and industrial production making the largest contributions in November.”

The Conference Board Coincident Economic Index® (CEI) for the U.S. increased 0.4 percent in November to 110.7 (2004 = 100), following a 0.2 percent increase in October, and a 0.3 percent increase in September.

And finally, consider this chart from Scott Grannis showing the relationship between corporate profits and GDP:

Earnings are the mother's milk of the stock market. And right now, corporations are making a ton of money.

On the downside, the market is still expensive from a valuation perspective, so the upside is limited, barring further growth. But given the underlying economic fundamentals there is no reason to think growth won't continue. And that makes the last month of price action nothing more than statistical noise in the wider context of a growing economy.

Friday, December 19, 2014

Programming note

- by New Deal democrat

We're getting down to the end of the year. Next week we get reports on durable goods, personal income, and the final revision of Q3 GDP, and that about does it.

So over the next two weeks, I'll be grading my forecast for 2014 made at the end of last year, making a detailed forecast for 2015, and pointing out a few important relationships to watch. Also I'll be looking back at my 2014 housing forecast and compare it with the very different forecast made by Bill McBride, a/k/a Calculated Risk.

BTW, I'm sure you have noticed that the guy after whom this site is anmed has been more or less M.I.A. That's because he hasn't been posting links to most of his stuff, which you can find by clicking on this link to XE.com's market blog. Since we routinely get 2000+ page views over there (I got 7000+ for my Weekly Indicators piece last weekend), he's been spoiled.

I generally post stuff relevant to jobs and wages over here, with general data and forecasting commentary over there. I don't plan on changing that, and I've been encouraging Hale Stewart to post more "old-fashioned" Bonddad pieces here.

Thursday, December 18, 2014

The current economic tale told by real retail sales

- by New Deal democrat

I have a new post up at XE.com, describing how real retail sales have value as long leading, coincident, and mid-cycle indicator for the economy, and a short leading indicator for jobs.

It's a pretty useful metric. What's it showing now?

Wednesday, December 17, 2014

Americans finally think the economy has turned a corner

- by New Deal democrat

I have a new post up at XE.com. All sorts of gauges of consumer sentiment indicate that, courtesy of cheaper gasoline, and probably consistent job gains of over 200,000 a month, in the last few months American consumers are coming around to the opinion that the economy is actually doing OK.

Real aggregate and average wage measures set records in November

- by New Deal democrat

Courtesy of the huge decline in gas prices, in November consumer prices actually declined by -0.3%. Not only does that bring the YoY inflation rate down to +1.4%, but because of this deflation, at least two important measures of wages set records.

The most important record is that in real aggregate wages per capita. What this measures is how much in real, inflation-adjusted wages are being paid out for each person in the US population. This further tells us how much, in real terms, wage-earners in the aggregate have to spend on their families. Here's the graph:

This just set an all time record in this metric, which goes back 50 years.

Second, average real wages for all employees just set a post-recession record:

This series is less than 10 years old, so this is a record for the series.

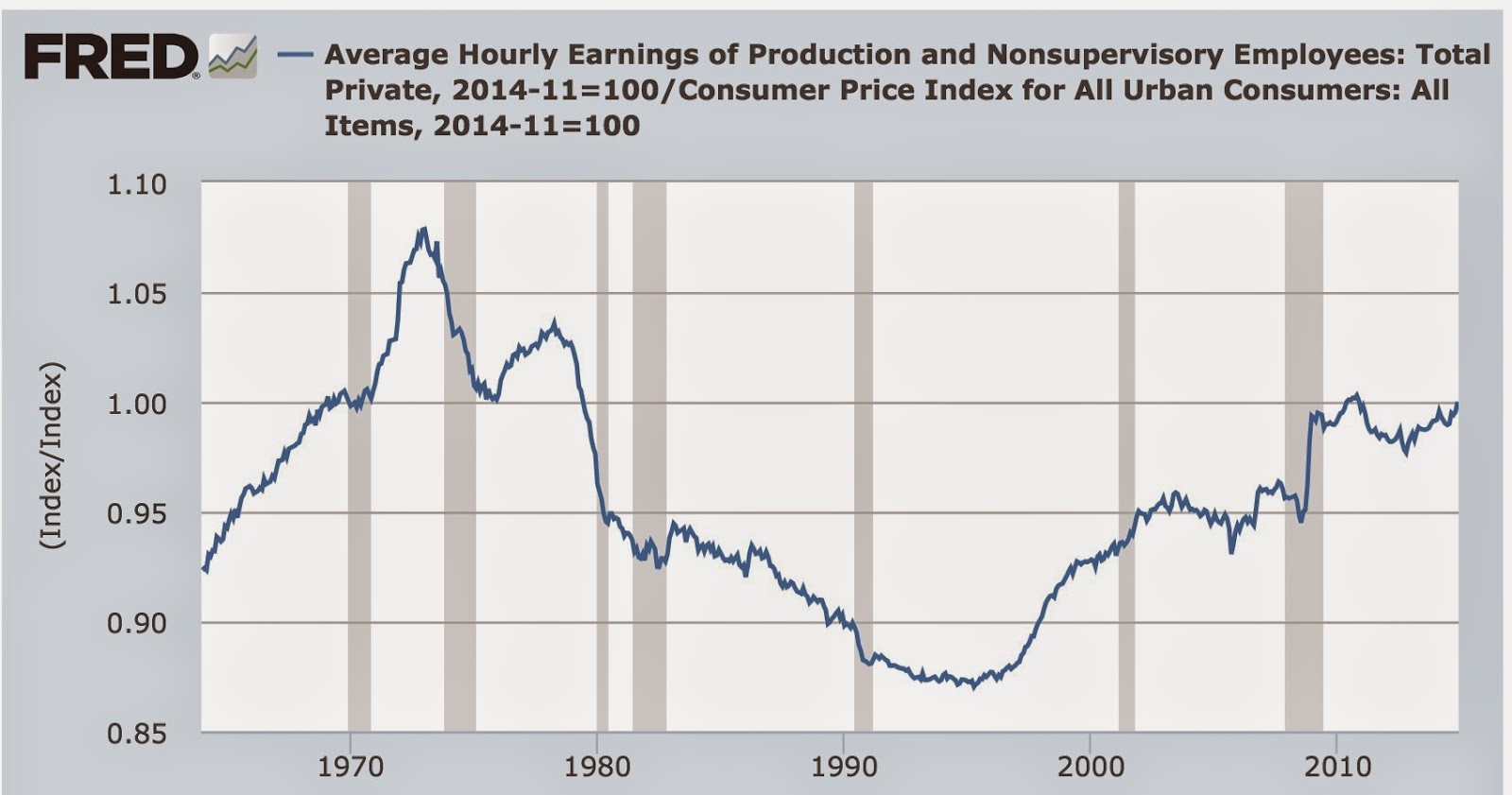

Finally, while it did not set a record, here is a look at real, inflation-adjusted wages for all nonsupervisory workers (a more representative series for middle and working class Americans):

As a result of the boot due to declining energy prices in November, this series is only 0.3% off from its October 2010 post-recession peak, and thus only 0.4% from a 35-year high, as shown in this graph showing the entire 50 years of this metric:

None of this should take away from the fact that workers have not been rewarded by owners for their increased productivity over the last 40 years. Because of this, in the larger view, wages are still stagnant. But this is real, solid progress, and it deserves mention. And it is all because of the breaking of the Oil choke collar.

Tuesday, December 16, 2014

The Oil Choke Collar: 2015 may be the acid test

- by New Deal democrat

It's nice to be proven right. Even more, it's nice to be proven right, for the right reason.

Back in 2011, I described what I called the "Oil choke collar," writing:

For the second time in two years, Oil's choke hold on the economy is asserting itself. Acceleration in recovery causes acceleration of demand, and acceleration of Oil prices - which causes the economy to stall. That choke hold won't go on forever, though. There are three forces that will combine to bring it to an end: alternate fuels, conservation, and exploration.

....[T]he Oil choke hold on the economy will not last forever. I claim no clairvoyance, but a good guess is that by 2013 or 2014, the combination of alternative fuels and technology, conservation, and exploration will relieve the current situation

(emphasis added)

In 2012 and 2013, gas prices made lower seasonal peaks, and lower seasonal troughs, than in 2011. They made a lower peak again this past spring. Periodically during that time (e.g.,here and here) I updated the data on alternative fuels, conservation, and exploration. Finally, a few months ago, I documented, as I consistently have since 2011, that the use of alternative fuels has been increasing - including in the vehicle fleet, that ridership on mass transit was still increasings, that demand of gas in the US was consistently declining from its 2006-07 peak, and that exploration was bringing on new supply. I concluded:

In short, there is a very good chance that at some point in the next few months - or even weeks - we will see a new 4 year low in gas prices in the US.

Of course, by November we did see that new 4 year low, and now we have even seen a 5 year low.

In short, 3 and a half years ago I made a specific forecast about oil prices. Not only was I right, and not only was I right about the time frame involved, but I was also right for the right reasons. Average vehicle fleet mileage rose. Use of mass transit rose. Use of alternative fuels, such as in natural gas powered vehicles, and solar power, rose. Demand for gasoline in the US fell. New oil supplies from deep water drilling and shale oil extraction, came on line.

In simplest terms, supply rose faster than demand, ultimately creating a surplus in prodcution. Indeed, depending on which source you read, demand is either expected to rise more slowly, or to actually fall. And because, as Bill McBride a/k/a Calculated Risk pointed out yesterday, because supply is inelastic over the short term, a small change in demand leads to a large change in price.

Now, on November 27, Saudi Arabia refused to cut production, triggering the most recent cliff-dive in oil prices. It is important to remember that, by that time, gas prices in the US has already fallen below $3 a gallon. Was there a political aspect to that? It's certainly possible, as Russia, Iran, and ISIS are among the biggest losers.

But - and somebody really needs to explain this to the Village Idiot over at Daily Kos - it is precisely because the Oil choke collar was already disengaging that such a move, if politically motivated, became possible. If demand were rising faster than supply, prices would be rising, not falling. There would be no way to "punish" players, since they would all be sharing in the profits windfall. It is only because there was now excess supply that the issue of who would take the hit from already-lower prices became an issue.

Further, unlike the Village Idiot, somebody who actually does know what he is talking about when it comes to the oil markets, Prof. James Hamilton of Econbrowser, has estimated that "In other words, of the observed 45% decline in the price of oil, 19 percentage points– more than 2/5– might be reflecting new indications of weakness in the global economy." In other words, the fall in the price of Oil is not just about politics.

All of which means that the year 2015 could prove to be the ultimate test of my "oil choke collar" thesis. One of my stock replies to those bemoaning relatively poor, below-trend, US GDP growth over the last few years has been, "Give me $2.50 a gallon gas instead of $3.50 a gallon gas, and I'll show you growth!" If oil prices have been acting like a governor, choking off growth in the US economy by approaching $4 whenever the economy appears poised to obtain "escape velocity," then particularly with the present positive configuration of both the long and short leading indicators, IF oil prices remain in a new, lower range in 2015, we finally ought to see above-trend US growth.

Monday, December 15, 2014

Gas prices now at 5 year low, nearing Y2K prices in real, wage-adjusted terms

- by New Deal democrat

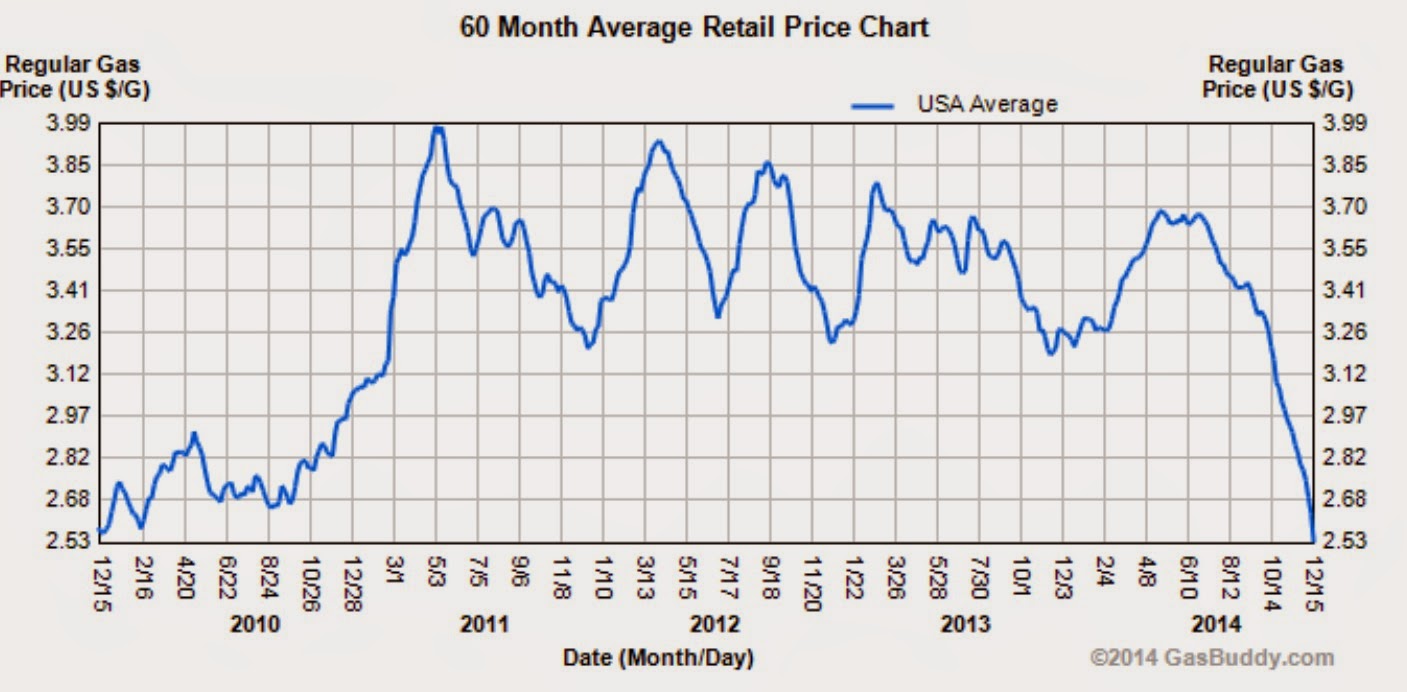

This is from GasBuddy:

Gas prices have fallen below $2.56 per gallon. This is the lowest they have been in 5 years.

Here is an update of the price of a gallon of gas as a share of the average hourly wage:

Note this is only through November. So far in December prices have plunge another 10%. "Real" gas prices could be at a 10 year low by the end of this month, and barely above their price at the turn of the Millennium.

There is evidence this is having a pronounced effect on living expenses on lower income households. More on that in a post later this week.

Note: As Jeff Miller points out, just as "the cure for high prices, is ... high prices," so low prices tend to "cure" themselves as well. I do not claim any profound knowledge as to how long these relatively low prices for gas will last. To the extent there is a political, rather than economic, reason for the Saudis in particular not to cut back on production, then as soon as the political goal has been achieved, prices might rise again quickly. On the other hand, to the extent the moves in price have an economic basis, then, just as it took from 2008 through 2014 for exploration, conservation, and alternative fuels to break through the "Oil choke collar," it may well take a similar amount of time for those forces to reverse.

Sunday, December 14, 2014

A thought for Sunday: one step from despair

- by New Deal democrat

[Who said: "I believe that our Great Maker is preparing the world, in His own good time, to become one nation, speaking one language, and when armies and navies will be no longer required" ? Hint: not a hippie. Answer at the bottom.]

This was a horrible week for what I once thought were American values.

First we find out that letter that state officials are submitting as official "comments" to federal legislation, were in fact dictated almost word-for-word by energy companies. Then we find out that the CIA enthusiastically embraced torture - not even to extract actionable information, but to make sure that nothing was left, or even to induce false information that could be used politically.

Finally a multi-billion dollar gift is delivered from Congress to Wall Street, repealing a provision of the Dodd-Frank Act that prohibited Wall Street banks from gambling on derivatives with their FDIC-insured deposits. On this last bit, fully 1/3 of all Democrats in the House voted in favor, Senate Democrats are expected to follow, and President Obama is expected to sign the bill into law.

Let's be clear about one thing: not a single word has been uttered by any lawmaker as to why this repealer is economically necessary. Wall Street banks are already making record profits. By definition we are not talking about a farmer, industrialist, or merchant hedging against adverse contingencies. This is strictly about gambling - with deposits that are backed up ultimately by the US taxpayer. It is also "moral hazard" at its absolute worst. Gains will be distributed as profits. Catastrophic losses will be bailed out. There is every incentive to swing for the fences.

And 1/3 of the supposed protectors of the middle/working class voted in favor?

But wait, we are told soberly by, among others, Barack Obama. Here's what the democrats got out of deal, according to Kevin Drum at Mother Jones:

In other words, the democrats got funding - for one year - for favored programs. The republicans permanently killed a provision keeping Wall Street from gambling with FDIC-insured deposits.In 20 years of being on the appropriations bill, I haven’t seen a better compromise in terms of Democratic priorities. Implementing the Affordable Care Act, there’s a lot more money for early-childhood development — the only priority that got cut was the EPA but we gave them more money than the administration asked for....There were 26 riders that were extreme and would have devastated the Environmental Protection Agency in terms of the Clean Water and Clean Air Act administration; all of those were dropped. There were only two that were kept and they wouldn’t have been implemented this fiscal year. So, we got virtually everything that the Democrats tried to get.The ... full-year appropriations legislation for most Government functions [ ] allows ... authorities and funding provided to enhance the U.S. Government’s response to the Ebola epidemic, and to implement the Administration’s strategy tocounter the Islamic State of Iraq and the Levant, as well as investments for the President’s early education agenda, Pell Grants, the bipartisan Manufacturing Institutes initiative, and extension of the Trade Adjustment Assistance program.

Imagine you want to throw a party for your graduating senior. You expect the party to get a little raucous, and you don't want trouble, so you go to your difficult neighbor and ask him to agree. He agrees, but only if you agree to deed over to him 5' of your yard. You got something temporary. He got something permanent. Sound like a deal? Well, that's akin to what those guardians of the little guy and gal just agreed to.

Mark my words, those same cuts will be demanded by the GOP next year. And the protection against gambling with FDIC insured deposits will still be gone, so another demand will be made of the democrats to save the cuts.

When it comes to American history, the scales fell from my eyes long ago. Andrew Jackson and Manifest Destiny virtually defined the 19th Century. If native tribes had to be slaughtered, well, too bad for them. The effort to expand slavery West and South (to Cuba, Mexico, and the Caribbean) were centerpieces of the Jacksonian dogma.

And torture? Been there, done that, in the Phillippine - American War of 1899 - 1902. Just an example:

To force information from a Filipino mayor believed to have been covertly helping insurgents, American soldiers resort to what they call the “water cure.” After tying the mayor’s hands behind his back and forcing him to lie beneath a large water tank, they pry his mouth open, hold it in place with a stick and then turn on the spigot. When his stomach is full to bursting, the soldiers begin pounding on it with their fists, stopping only after the water, now mixed with gastric juices, has poured from his mouth and nose. Then they turn on the spigot again.The disgust felt by many, such as Mark Twain, was unpersuasive.

In World War 2, many Americans at home wanted all Nazi and Japanese POW's killed. They were restrained by the military, which pointed out that American POWs were also being held by Germany and Japan.

But I digress. A couple of weeks ago, I wrote that the Presidency of George W. Bush might turn out to be as influential as that of Andrew Jackson. That torture - even if not effective - is viewed as a legitimate tool of government, that Wall Street should unquestioningly be given what it wants - are now topics of "legitimate" discussion, even "bipartisan" approval. The entire range of acceptable policies has been moved a full standard deviation to the right, and remained so during the presidency of the man who ran on "Hope" and "Change."

And the GOP hasn't officially taken control of the Senate yet.

I am one step from despair. But despair will never be an option.

You want hope? Here is the answer to the question I posed at the outset of this post. That sentence was uttered by President Ulysses S. Grant, the General who had saved the Union, in his second inaugural speech, 1873. There is no record of outrage from Washington insiders in response.

Subscribe to:

Comments (Atom)