1.) Expect a lot of volatility. The bottom line is we don't know when the credit markets will settle down. My guess is it's going to be a while. We simply don't know how much damage the subprime issue is going to do. The Financial Times said it best:

Investors are braced for a turbulent start to trading on Monday and this week’s data releases will take second place as fears over a liquidity crisis persist.

Last week saw a serious liquidity squeeze in money markets and short-term money rates rose higher as institutions’ willingness to lend evaporated.

The Financial Times also has a really good interactive graphic that shows how this mess has moved across the globe (thanks to the Big Picture for posting this). The bottom line is the problem is in the "getting worse" stage and probably will be for awhile.

2.) PPI comes out on Tuesday and CPI comes out on Wednesday. If these numbers are below consensus estimates, expect the markets to start arguing for a rate cut and for prices to rally. Given the dollar's current situation I don't see how the Fed can think about doing this. Also remember this part the Fed's statement from last week:

Although the downside risks to growth have increased somewhat, the Committee's predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the outlook for both inflation and economic growth, as implied by incoming information.

When the Fed made this statement, the credit markets were already frozen. Given the Fed's position in the economy, I have to think they knew about the Countrywide/WAMU announcements early in the week before both companies formally made the announcements. While the Fed added liquidity on Friday, I think that's about all they're going to do right now. Bernanke has continually stated he believes the US financial system is strong implying the US will be able to withstand the pressure the credit mess is currently creating. While I wouldn't be surprised to see the Fed add more liquidity, I'm not expecting them to cut rates.

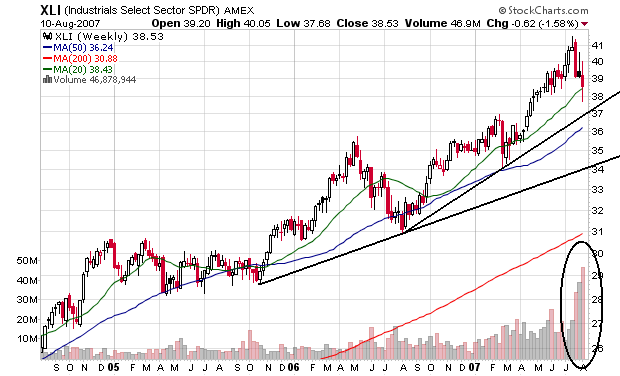

3.) The Empire State Index, Industrial Production and the Philly Fed Survey are also on tap this week. Exports have been one of the bright spots in the US economy over the last few months/quarters. If these reports show weakness expect added volatility. Here is a chart of the XLIs (Industrials) that I posted yesterday. While the chart isn't great, it's technically not in a horrible place. My guess is the losses over the last three weeks are advantageous profit taking rather than concern over the sector. However, if the previously mentioned numbers are weak this sector might take a hit.

4.) We're on a roller coaster folks. It's going to be crazy for awhile. Get out the antacid of your choice and keep it handy.