Saturday, February 22, 2020

Weekly Indicators for February 17 - 21 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

Aside from the sudden improvement in new manufacturing orders I wrote about earlier this week, the significant changes have moved from the short leading forecast to the coincident nowcast.

Clicking through and reading will give you the reason I say that, and as usual reward me a little bit for my efforts.

Friday, February 21, 2020

Production, transportation, and sales show a stalled economy

- by New Deal democrat

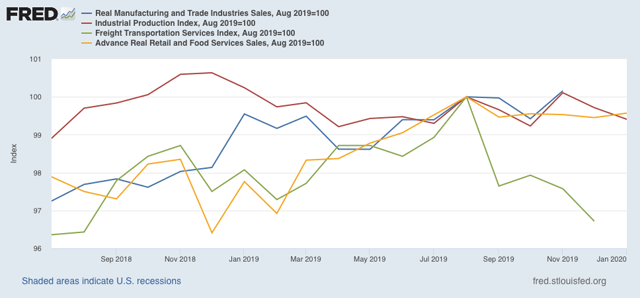

Below is a graph I put together in a discussion of transportation that I’ll probably post next week at Seeking Alpha.

The idea behind the graph is that (1) everything that is produced needs to be transported to market; i.e., the two metrics should move essentially in tandem (this is known as the “Dow theory” in financial markets); and (2) sales also ought to reflect - and slightly lead - what is being transported to market, since production is geared to match anticipated sales.

Anyway, here it is:

What we see is that production, transportation, and sales are all either flat or down since then. Although I didn’t include it, real personal income is only up +0.2% since then. Only jobs continue to show significant growth.

In short, since 6 months ago the economy has been in a very real slowdown, and in many respects has stalled.

Note that this is a nowcast, not a forecast, so you shouldn’t project this forward. But given how badly coronavirus is affecting China’s output, if the economy otherwise remains weak for the next several months, that might be enough to tip it into contraction.

Thursday, February 20, 2020

Housing analysis at Seeking Alpha; updated jobless claims

- by New Deal democrat

I have a more detailed analysis of yesterday’s very positive housing permits and starts data, and what it means for the economy for the rest of this year, over at Seeking Alpha. As usual, clicking over and reading helps reward me a little bit for my efforts.

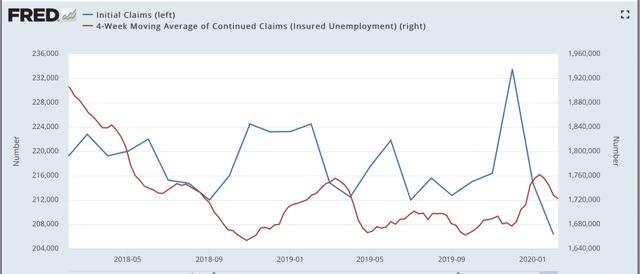

This morning’s weekly jobless claims report continues the recent string of very positive numbers. Here’s the updated graph of the monthly average of initial claims, plus the 4 week average of continuing claims:

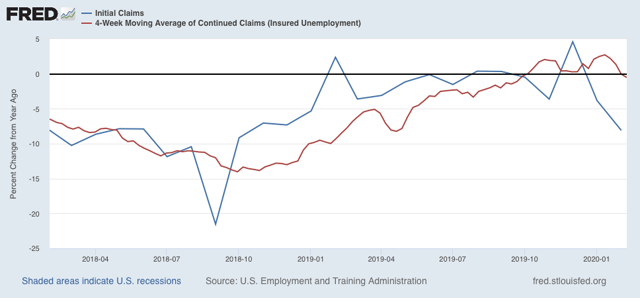

And here is the same information graphed YoY:

There isn’t going to be a recession so long as jobless claims stay close to their lowest levels and are lower YoY.

Wednesday, February 19, 2020

Housing continues to surge

- by New Deal democrat

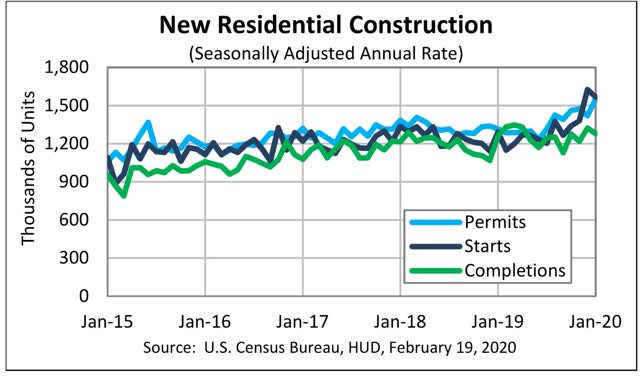

Low interest rates continue to fuel a strong upsurge in new housing construction.

I’ll put up a more detailed post later, but for now simply note that housing permits, both overall and for the less volatile single family housing component, made new expansion highs, at levels not seen since 2007. Housing starts backed off from December - but to only the second highest numbers of the entire expansion.

Here’s the graph from the Census Bureau:

This is extremely bullish for the economy at the end of this year and into next year.

Tuesday, February 18, 2020

Regional Fed Manufacturing Indexes Improving

- by New Deal democrat

It’s been a really slow newsweek so far, with no important data until tomorrow. Until then, here’s a note of interest.

This morning's Empire State Manufacturing Survey was the third regional report in a row (after Richmond and Dallas in the last week of January) to show a strong rebound in strength, as the new orders index jumped 15.5 to 22.1 (values over zero indicate improvement).

Here’s what the average of the five regions look like as of now (this is taken straight from my weekly update):

Regional Fed New Orders Indexes

(*indicates report this week)

- *Empire State up +15.5 to +22.1

- Philly up +7.1 to +18.2

- Richmond up +26 to +13

- Kansas City up +13 to -5

- Dallas up +16.0 to +17.6

- Month-over-month rolling average: up +3 to +13

The regional average had been only +3 only 3 weeks ago. A reading of +13 shows pretty strong growth on the order of what we saw in 2018.

Between coronavirus fears and always the possibility that Tariff Man launches new trade wars, I’m not making any promises about where this goes from here. But for now, a clear rebound in manufacturing.

Subscribe to:

Comments (Atom)