- by New Deal democrat

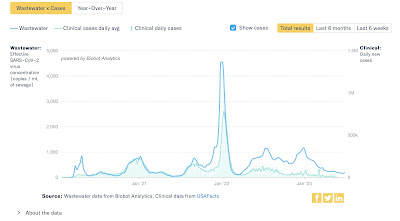

I haven’t done an update on the state of COVID since March or April. As we are halfway through the year, and just past the July 4 holiday get-togethers that sparked summer waves in the past, let’s take a look. Covid isn’t gone, but it is very much in a lull.

Almost all case tracking by governments is gone. But Biobot’s wastewater monitoring, which has been very reliable, continues. And it shows that COVID particles per milliliter in wastewater is down to levels only previously seen in April through mid-July 2021, and March 2022 (the data in 2020 is sparse, so I am discounting that):

There has been an uptick since June 21, but nothing significant yet.

Hospitalizations as of the last week reported, June 28, were just below 6300, or only 900 per day, an all time low:

Similarly, deaths for the week of June 3, the most recent week for which death reports have been fully updated, were just below 630, or only 90 per day, also an all time low:

Although I don’t have a graph right now, the demographics of serious illness and deaths have continued to focus on the most elderly, and the unvaccinated. At this point anyone under age 50 who is fully vaccinated has almost no risk.

The XBB variant and its progeny (including E.U.1.1. and F.E.1.1) continue to account for about 99% of all cases:

There is simply no sign of any new significantly different variant creating any kind of wave.

If we don’t see a significant rise in cases in the next 10 days, then we have successfully had our first July 4 since 2019 with no outbreak.

In summary: COVID isn’t gone, but right now it is pretty somnolent.