Investors are scooping up U.S. Treasury bills like few times in history as an expanding credit crunch makes it hard for companies to roll over short-term debt.

The yield on the three-month Treasury bill fell 0.54 percentage point yesterday to 4.09 percent, the lowest since 2005. It was the biggest single-day decline since Oct. 13, 1989, when the Dow Jones Industrial Average tumbled 6.9 percent, and exceeded the 0.39 percentage point drop in the aftermath of the Sept. 11, 2001, terrorist attacks.

Lenders are so concerned about the fallout from rising delinquencies on subprime mortgages that rates on commercial paper have shot up to 5.83 percent from 5.36 percent a month ago, data compiled by the Federal Reserve show. Commercial paper is debt due in nine months or less and is bought by money-market funds such as those managed by Boston-based Fidelity Management & Research and Vanguard Group Inc. in Valley Forge, Pennsylvania.

Money funds that had been buying corporate commercial paper ``have all switched to the safe side,'' said Glen Capelo, a trader at RBS Greenwich Capital in Greenwich, Connecticut, one of 21 firms known as primary dealers that trade directly with the Fed. ``I'm sure their managers have all given them a Treasury-only mandate, at least until the dust settles.''

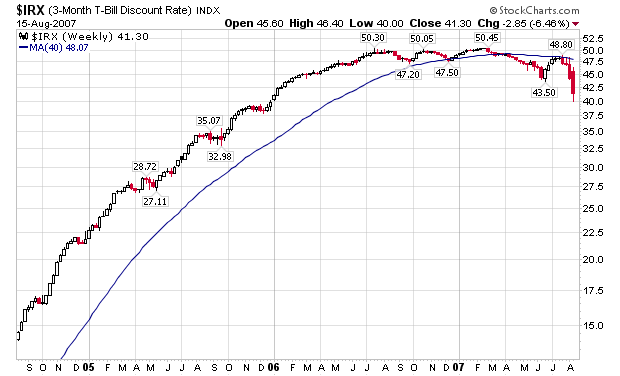

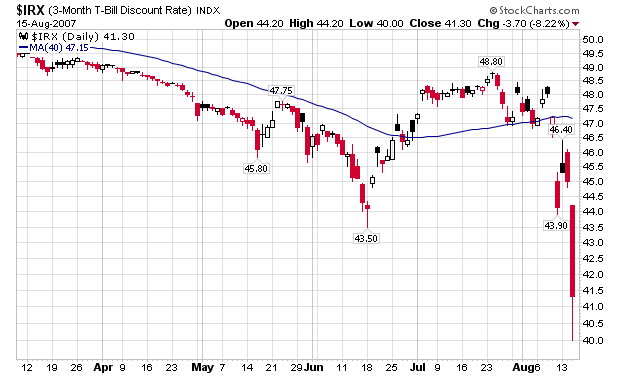

Here are two charts from Stockcharts.com which shows what is happening on the short end of the yield curve. Notice that:

-- this part of the curve does not move very much; it is usually very consistent.

-- this part of the curve has moved a ton over the last few weeks. This indicates how concerned institutions are about the credit situation

-- I have to wonder how much of the Fed's credit injection is moving into the short end of the curve.

-- If anything, this tells us there is a credit crunch going on right now -- and it's not getting better right now.

Here's the daily chart:

Here's the weekly chart: