Monthly data was mixed. New home sales were down slightly, but essentially have been flat all year. Durable goods orders were up by the most in 4 months, and new orders ex-defense - one of the 10 Leading Indicators - were up. This series continues to signal at least weak expansion. Final consumer confidence in July was largely unchanged from earlier in the month, but down sharply from the month before, and indeed was right back at readings not seen since the depth of the 2009 recession. The outlook for the future - another of the 10 Leading Indicators - was also sharply down. GDP for the second quarter was revised down to 1.0%, although the alternative measure of gross domestic income held up well.

The high frequency weekly indicators reflected that the emotional reaction in to the debt debacle, continuing uncertainty about the viability of the Euro, and the recent stock market plunge are on the verge of becoming self-reinforcing, and appear to be at a crossroads where any further deterioration will signal outright contraction.

This week let's begin by looking at the two items which had the biggest moves. Both continued the trend from last week and smell of panic:

Money supply -a leading indicator - continued to surge. M1 was down -0.5%, but increased 5.8% m/m, and 20.2% YoY, so Real M1 was up 16.6%. M2 increased 0.1% w/w, and also increased 2.6% m/m, and 10.1% YoY, so Real M2 was up 6.5%. The YoY increase in M1 in the last three weeks is the highest in history.

The Mortgage Bankers' Association reported that seasonally adjusted mortgage applications decreased another -5.7%, down a combined -15.8% in the last two weeks. The YoY comparison in purchase mortgages, which had been positive for two months, is suddenly strongly negative, down -7.3% YoY. Refinancing was also down -1.7% w/w and well below last year despite near record low interest rates.

Other series remained firmly in contraction this week:

The American Staffing Association Index remained at 87. This series' trend now looks just as it did in summer 2008, early in the last recession. The ASA's graph of this index shows how it has now decisively tipped out of improvement:

Oil finished at $85.30 a barrel on Friday. This is still about $10 below its recession-trigger level. Gas at the pump fell $.02 to $3.58 a gallon. Gasoline usage was -3.9% lower than a year ago, at 9009 M gallons vs. 9375 M a year ago. In the last few weeks, gasoline usage too has fallen to recessionary readings.

Weekly BAA commercial bond rates decreased .02% to 5.29%. Yields on 10 year treasury bonds much further, however, down .10% to 2.17%. This indicates continued fear of deflation, and also a continued significant increase in the relative distress in the corporate market. In the last two weeks, this credit spread has looked very much like an immediate precursor to recession.

Some employment related data has been improving in the last month, and several other series remained positive:

The BLS reported Initial jobless claims of 417,000. The four week average decreased to 407,500. The upturn was said to be due to that rare bird - an industrial strike (by Verizon workers). Jobless claims still remain below their recent range.

Adjusting +1.07% due to the 2011 tax compromise, the Daily Treasury Statement showed that for the first 19 days of August 2011, $120.8 B was collected vs. $118.6 B a year ago, for an increase of $2.2 B. For the last 20 days, $138.9 B was collected vs. $124.9 B a year ago, for an increase of $14.0 B, or 11.2%. With the exception of two weeks ago, withholding tax collections have rebounded strongly for the last 6 weeks.

The American Association of Railroads reported that total carloads increased 0.8% YoY, up 4400 carloads YoY to 539,200 for the week ending August 20. Intermodal traffic (a proxy for imports and exports) was up 2300 carloads, or 1.0% YoY. The remaining baseline plus cyclical traffic was up 3100 carloads, or 1.1% YoY%. Rail traffic has been oscillating between positive and negative YoY for the last 7 weeks. Using the breakdown of cyclical vs. baseline traffic that was graciously provided to me by Railfax, baseline traffic was down 3300 carloads, or -1.7% YoY, while cyclical traffic was up a strong 6400 carloads, or +6.0% YoY.

Retail same store sales continue to perform well. The ICSC reported that same store sales for the week of August 20 increased 3.0% YoY, and decreased -1.0% week over week. Shoppertrak reported a 5.0% YoY increase for the week ending August 20 and a WoW increase of 0.7%. This is the seventh week in a row of a strong rebound for the ICSC, joined for the fourth week by Shoppertrak.

Finally, continuing a real positive trend boding well for the longer term future, YoY weekly median asking house prices from 54 metropolitan areas at Housing Tracker showed that asking prices declined only -2.3% YoY. This is the smallest YoY decline since April 2007. The areas with double-digit YoY% declines remained at 6. The areas with YoY% increases in price increased by one more to 13. A few months ago only 3 or 4 areas had actual increases, and well over 10 had decreases. At the beginning of this year, only one metro area was showing a YoY increase. Now, 25% of all metropolitan areas tracked are showing YoY increases.

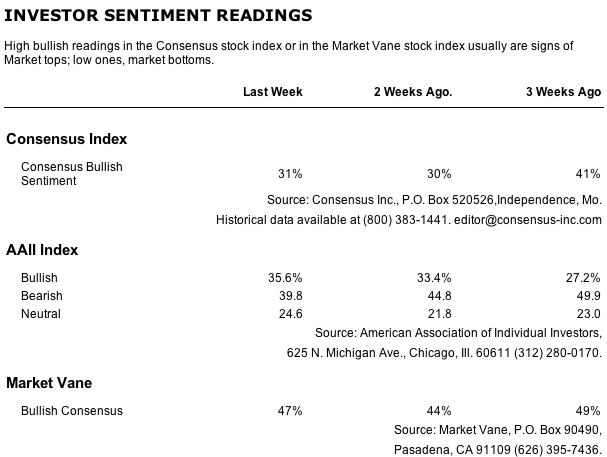

The continued plunge in purchase mortgage applications is especially concerning, as it shows consumers putting off big purchases due to being frozen in fear. (Incidentally, the decline in mortgage applications is probably why the ECRI index declined strongly again in the last week.) There is simply no other explanation for a 16% plunge in two weeks. That BAA bond spreads, consumer confidence about the future, and temporary staffing have joined gasoline usage in recessionary readings is also bad. At the same time, housing price stabilization, cyclical rail traffic, continued firm retail spending, and withholding taxes bode well, as does the surge in money supply for the longer term. We need to see consumer fear abate, and quickly, or the downturn will become self-reinforcing.