- by New Deal democrat

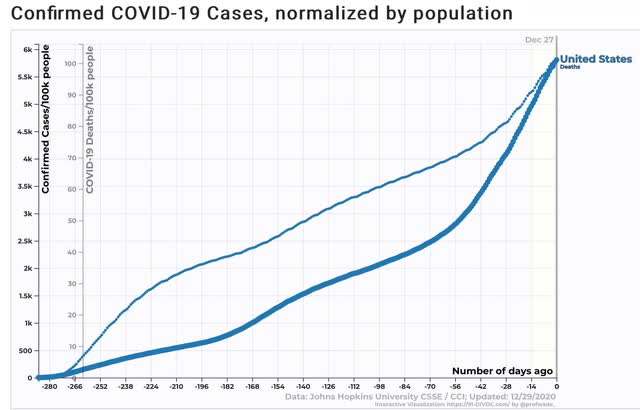

Total US confirmed cases: 19,132,726*

Average cases last 7 days: 184,005

Total US deaths: 333,118

Average deaths last 7 days: 2,207

Total vaccinated: 2,127,143 (per CDC via Bloomberg)

*Because many asymptomatic people probably never get tests, actual cases are probably more like 26 million, or about 8% of the US population

Source: COVID Tracking Project

The good news is, we finally have started the process of vaccination, and 1% of the population should be vaccinated by the end of this week. The bad news is, at the current rate, it would take over 4 years to vaccinate everyone in the US. I do expect this to ramp up, both as more States get more efficient at administering the vaccine, and because the Biden Administration will be much more activist and competent at ramping up production and improving the supply chain.

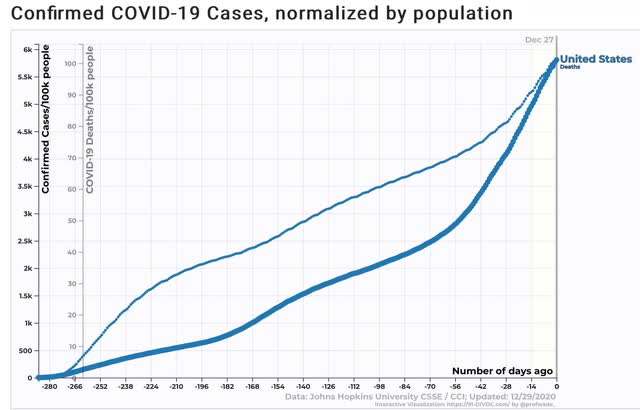

As we end 2020, let’s take a look at total infections and deaths per capita so far.

Here are infections and deaths for the US as a whole (note separate scales):

Roughly 1 in 16 Americans has had a *confirmed* infection; 1 in 1000 Americans has died from COVID this year.

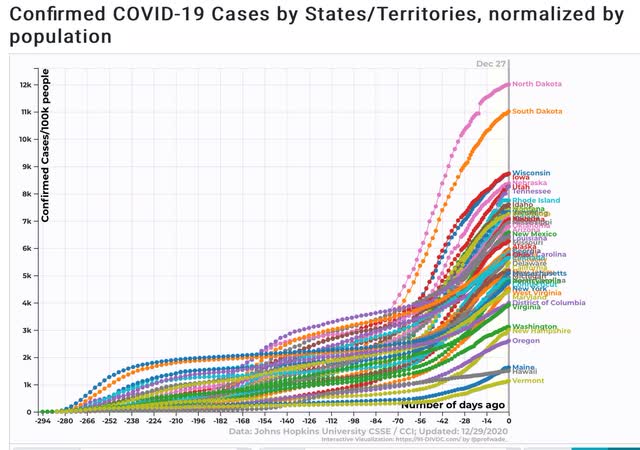

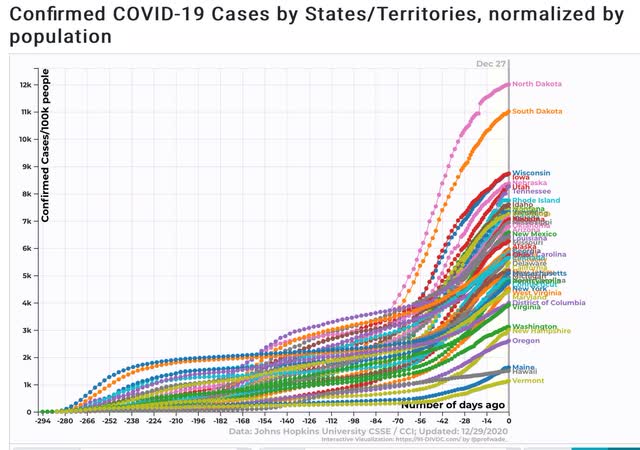

Here are total infections by State:

12% of North Dakotans and 11% of South Dakotans have had *confirmed* infections. Between 8% and 9% of the total population of Wisconsin, Iowa, Nebraska, Utah, and Tennessee have also had *confirmed* infections.

At the other end of the distribution, only about 1% to 2% of the populations of Maine, Hawaii, and Vermont have been infected. That is a success story.

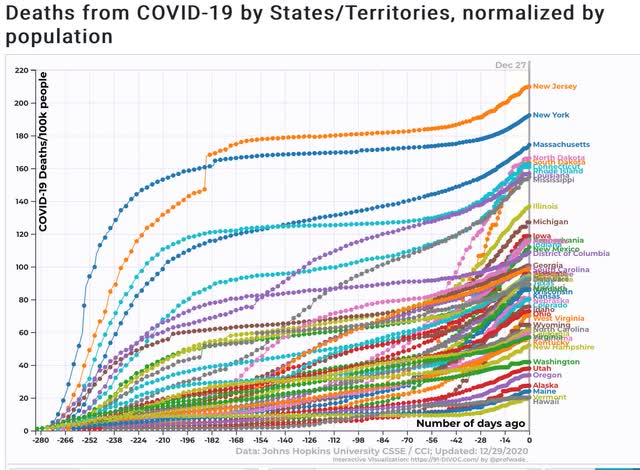

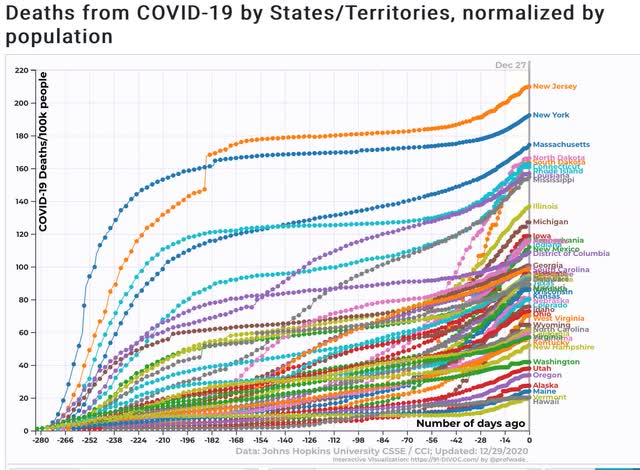

Here are total deaths by State:

New Jersey and New York, which had horrible outbreaks early, still lead the pack, with about 1 in every 500 residents having died of the disease this year. About one in 600-700 of the entire populations of Massachusetts, North and South Dakota, Connecticut, Rhode Island, Louisiana, and Mississippi have also died of the disease.

Maine, Vermont, Alaska, and Hawaii have the best record, with only 2 deaths per 10,000 population.

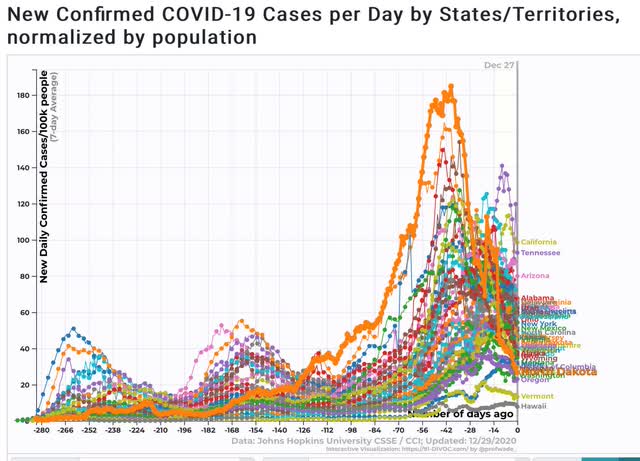

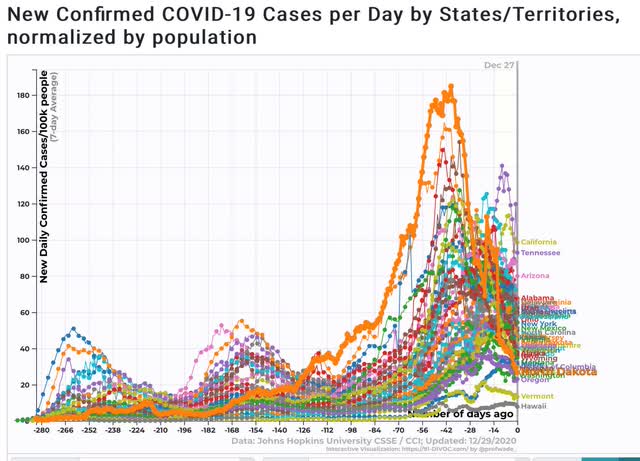

Looking at the 7 day average rate of infections shows that the wave that began in early November utterly dwarfs the two prior waves, with North Dakota having the worst result of any State:

Note that North Dakotans were apparently sufficiently terrified that their infection rate is now one of the 10 lowest in the entire country!

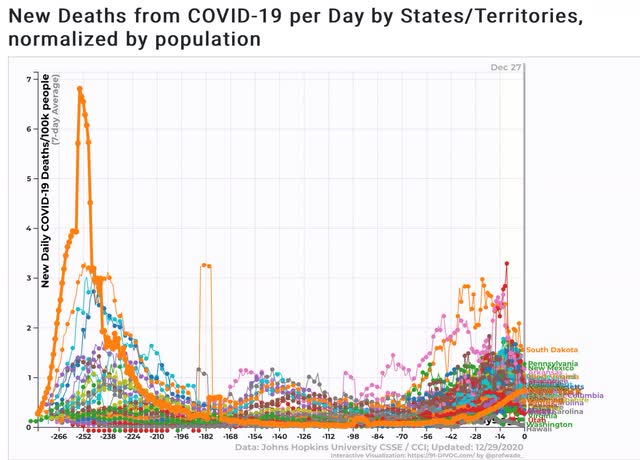

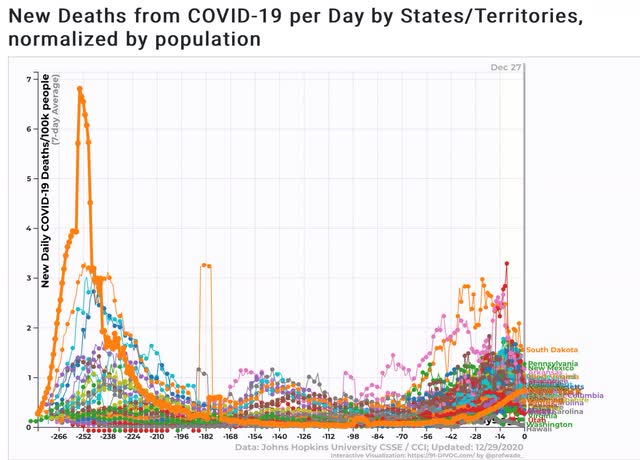

The 7 day average of deaths shows that the initial outbreak in the NYC metro area remains the most lethal:

Although Iowa and South Dakota’s recent spikes are in the same ballpark.

I expect the recent horrific rates of infections and deaths to continue throughout the winter, although there will be alternating waves of panic and complacency, depending on the recent experience of each State. Between vaccinations, warmer weather, and a competent new Administration in Washington I expect a real subsidence to finally begin by about late March or early April.