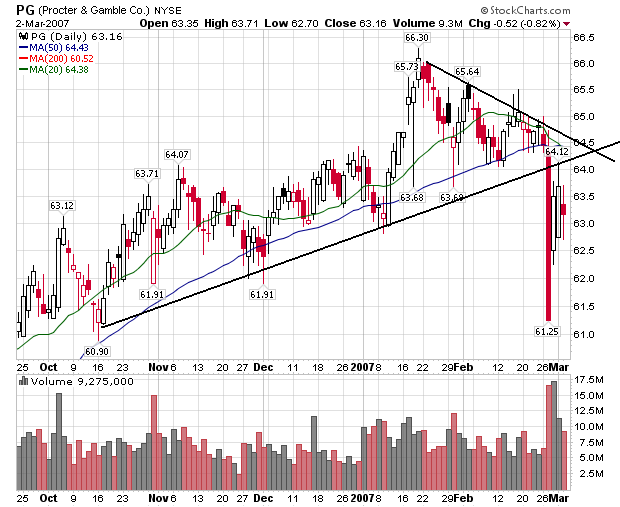

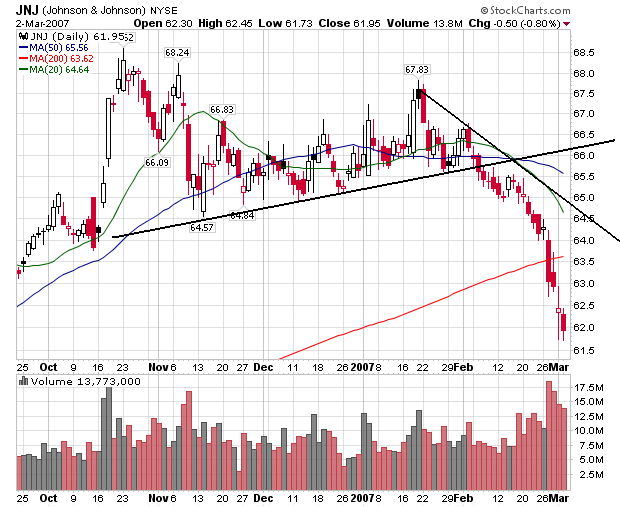

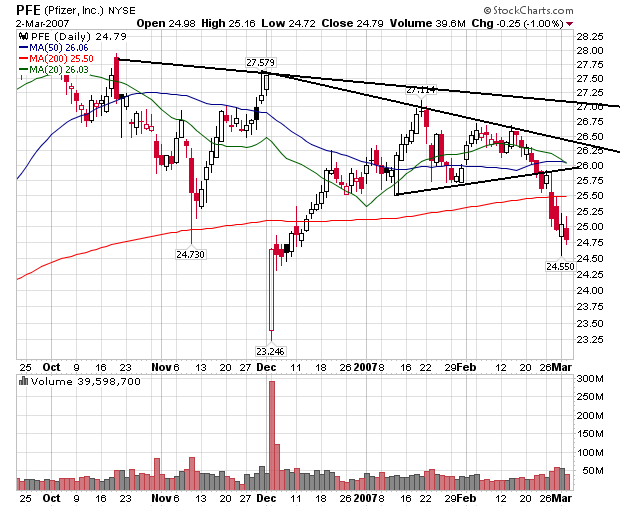

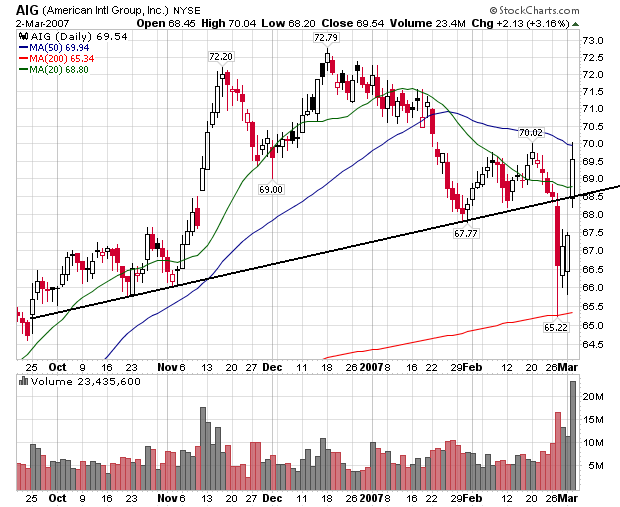

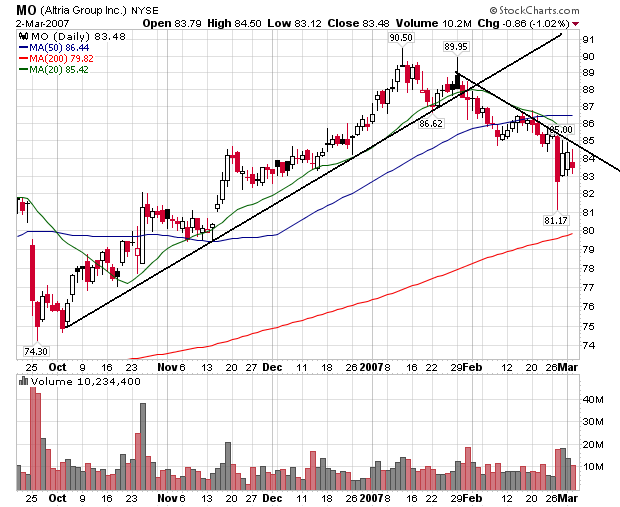

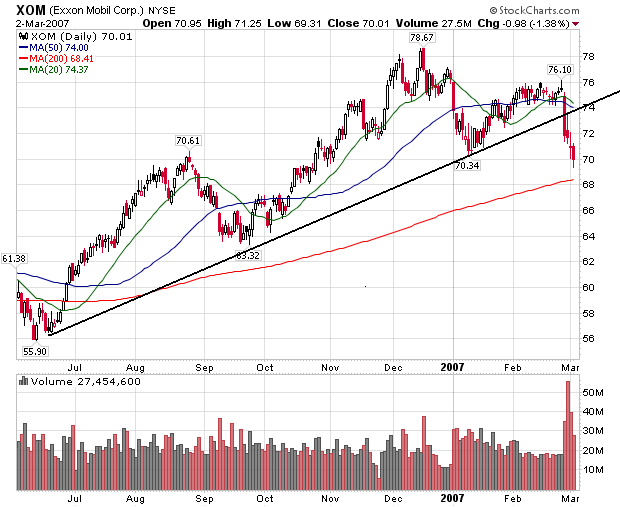

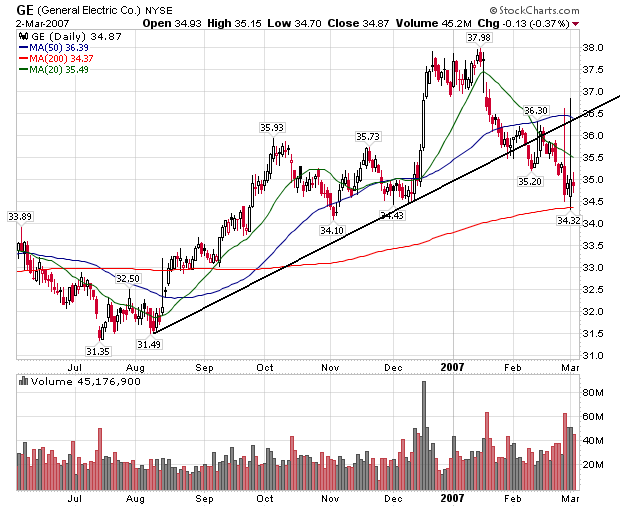

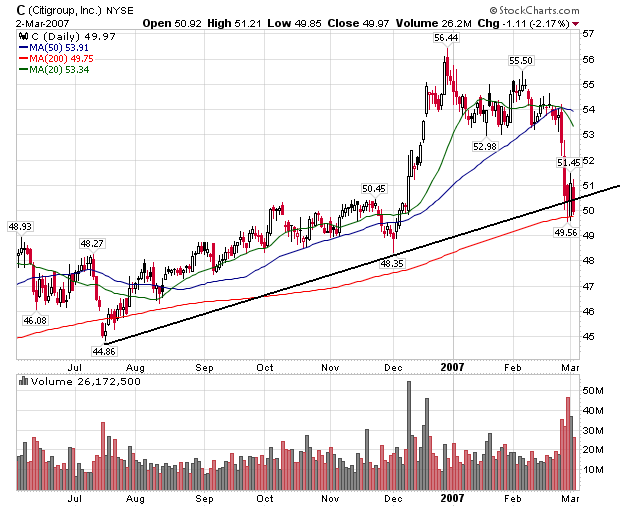

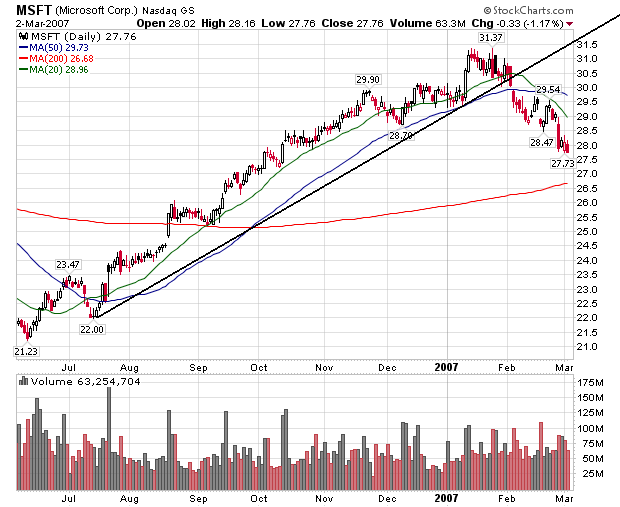

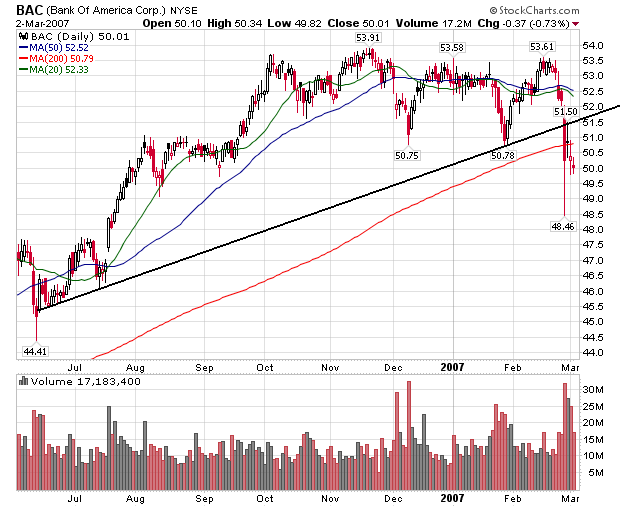

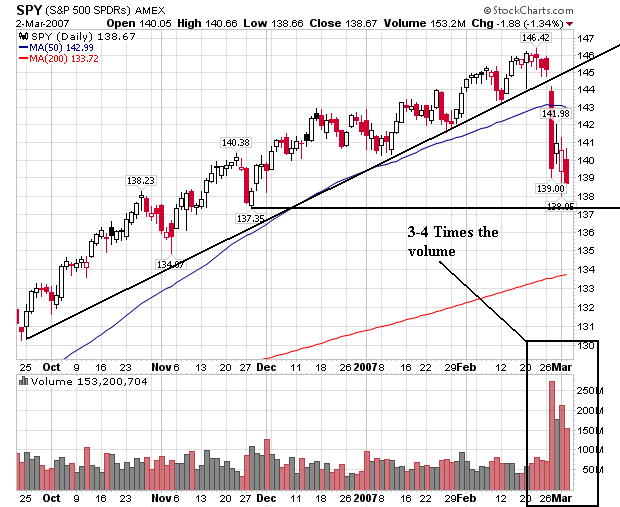

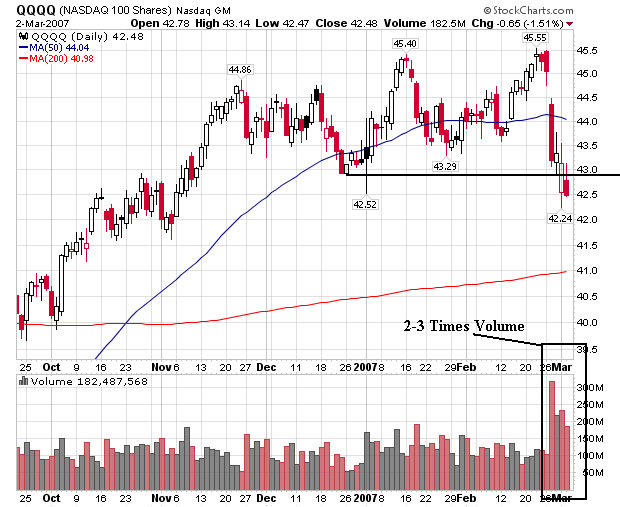

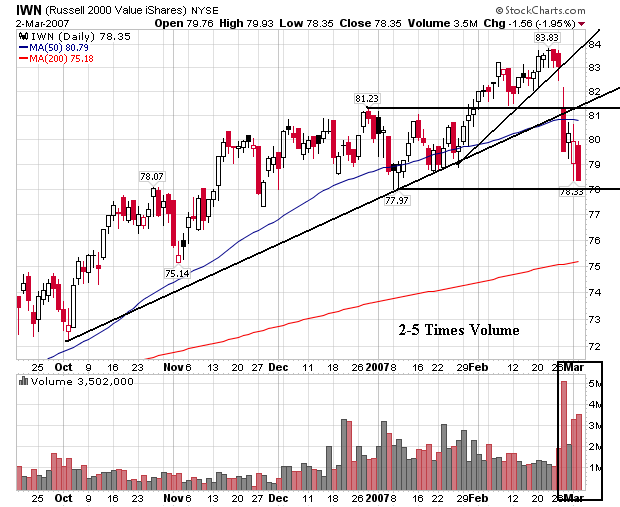

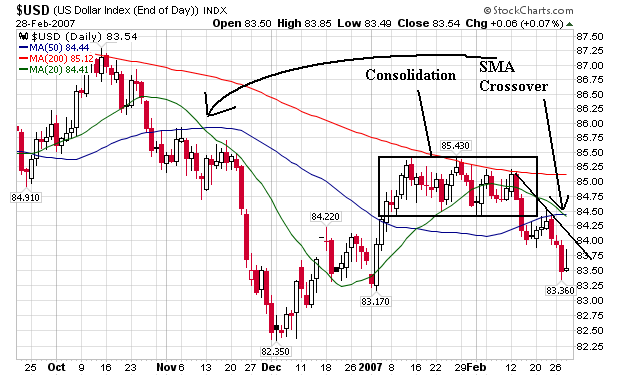

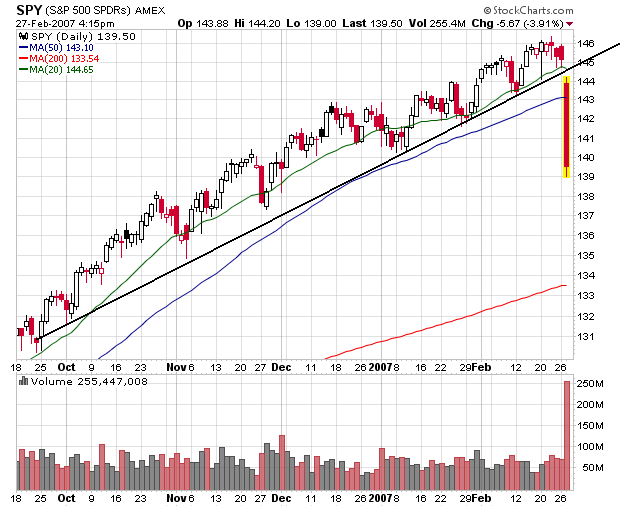

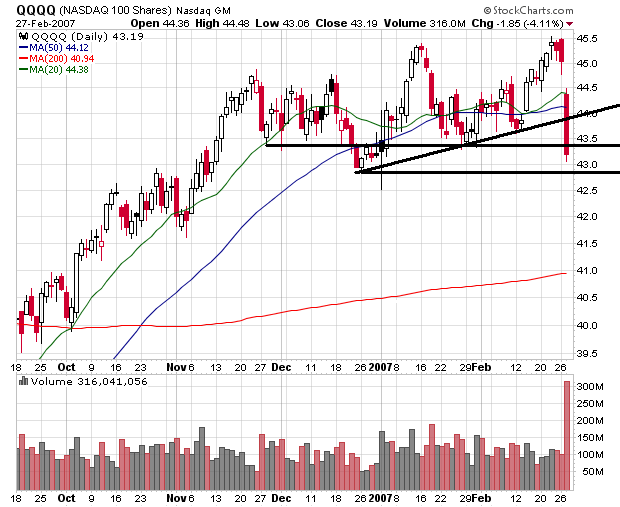

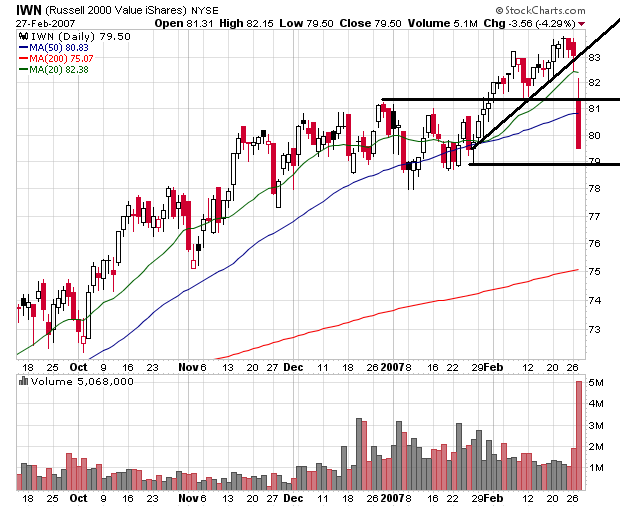

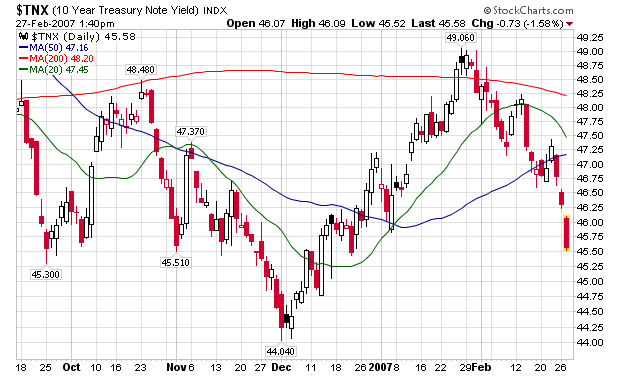

With the charts below, notice

1.) All the markets had a downward bias

2.) Traders dumped stock at the end of the day, indicating a lack of confidence about the overnight situation

3.) The increased volume at the end of the day.

"Non-manufacturing business activity increased for the 47th consecutive month in February," Nieves said. He added, "Business Activity and New Orders increased at a slower rate in February than in January. Employment increased at a faster rate than in January. The Prices Index decreased 1.4 percentage points this month to 53.8 percent. Nine non-manufacturing industries reported increased activity in February. Members' comments in February are mixed concerning current business conditions. The overall indication in February is continued economic growth in the non-manufacturing sector, but at a slower pace than in January."

Japan's Ministry of Finance reports Q4 (ended Dec.) capital spending increased 16.8%, beating the prior quarter's reading of 12.0% and analysts' estimates of 13.0% to 14.2% (Reuters). Up to a 1.0% revision to Q4 GDP is expected. Jesper Koll, chief economist at Merrill Lynch Japan, says annualized Q4 GDP will be revised to 5.1% from 4.8%, adding that "It is a trigger point for the Bank of Japan to normalize interest rates a little more aggressively." Bloomberg quotes Koll who also says, "The crisis of the 1990s is definitely over. Japan is in the process of building a strong platform for very strong, competitive economic growth." An economist at Nikko Citigroup however, says a revised GDP is not necessarily good due to concerns over rising inventories which "may prompt adjustments in production in coming months." The yen rose 1.7% today to ¥115.6/$1 as of the market's close in Tokyo. Japanese stocks meanwhile fell for a fifth straight day, as the Nikkei 225 lost 3.3% to 16,642.

Asian stocks dropped sharply across the region, with Japanese shares declining for the fifth session in a row, while Hong Kong retreated 4%.

Japan's Nikkei 225 Index fell 3.34% to 16642.25, extending a slide for a fifth day that was sparked by last week's plunge in Chinese and U.S. stock markets. Exporters were hit hardest on the yen's recent rally. Since climbing to its highest in nearly seven years last Monday, the index has slid 1573.10 points, or 8.64%, over the last five trading sessions.

Markets in Hong Kong, Australia, the Philippines, Malaysia, India and South Korea all fell sharply Monday, continuing their declines from last week, when a 9 percent plunge in Chinese stocks on Tuesday triggered cascading selloffs on Wall Street and other global markets.

European markets also opened lower Monday, with Britain's benchmark FTSE 100 down 1.5 percent in early trading, France's CAC 40 sliding 1.8 percent and Germany's DAX sinking 2.1 percent.

HSBC Holdings PLC, reporting its 2006 results, said the cost to cover bad debts soared 36% to $10.57 billion in 2006 because of the bank's ill-fated move to buy risky subprime loans from U.S. originators.

Overall, the London bank said net income rose 4.7% to $15.79 billion in 2006 from $15.08 billion. HSBC is the world's third-largest bank ranked by market value behind Citigroup Inc. and Bank of America Corp.

In 2005 and 2006, HSBC's U.S. business, HSBC Finance Corp., increased the number of subprime mortgage loans it bought from originators. But amid increasing interest rates and slowing housing price appreciation, borrowers defaulted at record rates, including in 2006 where loans were just months old. Last month, the bank replaced the top management of its U.S. operations and acknowledged that it had made mistakes in its mortgage strategy.

Federal bank regulators, worried about a surge in defaults on high-risk home mortgages, called on lenders to exercise caution in making subprime loans and strictly evaluate borrowers' ability to repay them.

The proposed guidance issued Friday by the Federal Reserve and the other four federal agencies that regulate banks, thrifts and credit unions, comes in an increasingly troubled market for subprime mortgage loans. Home-mortgage delinquencies and foreclosures are spiking, especially for people who took out subprime mortgages -- higher-interest loans for those with blemished credit records or low incomes who are considered higher risk -- during the sizzling housing boom that waned in the second half of 2005.

The regulators said the guidelines, if formally adopted by the agencies and followed by lending institutions, could result in fewer borrowers qualifying for subprime loans. The mortgage industry had hoped for less stringent guidelines.

John Robbins, chairman of the Mortgage Bankers Association, said the group was concerned that the guidelines "may restrict credit to many consumers in high-cost areas and deny credit to many deserving low-income, minority and first-time home buyers."

On Tuesday, Freddie Mac, the nation's second-largest financer of home loans, said it will stop buying those subprime mortgages that it deems most vulnerable to default or foreclosure.

Before Tuesday, every major stock market in the world -- and nearly all the smaller markets -- were near 52-week highs. Most markets also were near record levels, with the notable exceptions of the Nasdaq Composite and Standard & Poor's 500, a reflection of the absurd valuations they had reached in the tech boom of 2000.

.....

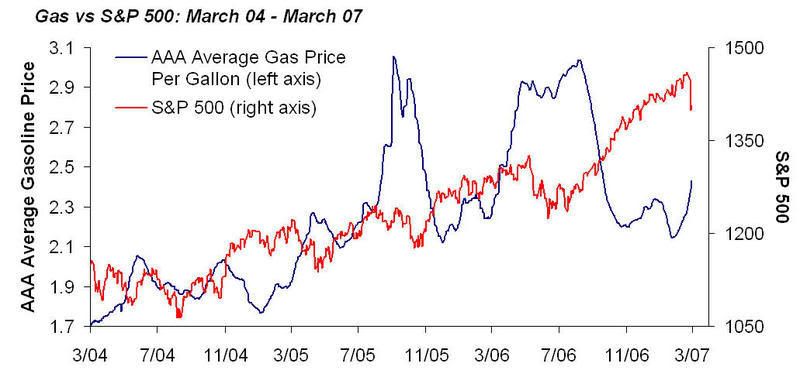

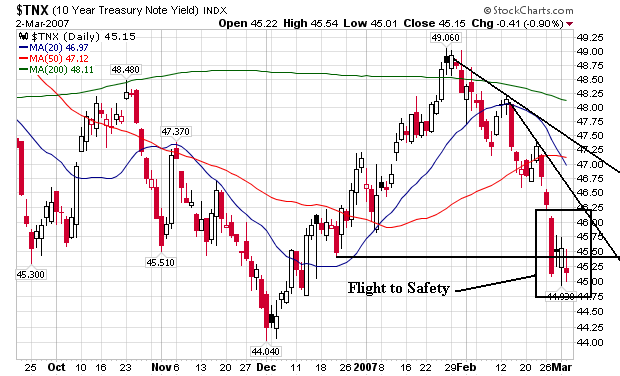

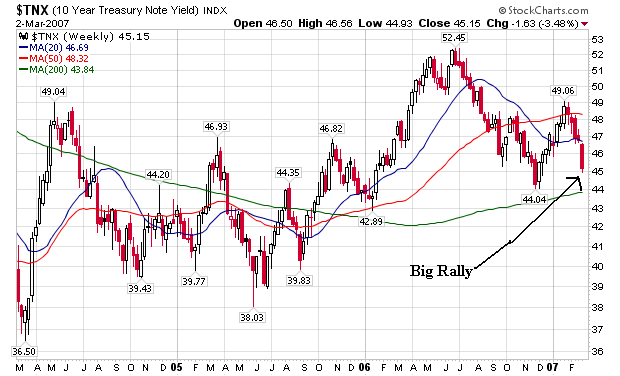

A bullish Wien thinks the S&P 500 could hit 1,600 by year end, a 15% gain. He says U.S. stocks look attractive with the S&P valued at 15 times projected 2007 operating earnings. The Dow Jones Industrial Average trades at 14.4 times estimated "07 profits. Both the Dow and the S&P 500 are in negative territory for the year, with the industrials off 2.8% and the S&P 500 down 2.2%. The so-called earnings yield on both the S&P 500 and the Dow is close to 7%, which compares favorably with the 4.5% yield on 10-year Treasuries. The earnings yield is the inverse of the market's price-earnings ratio.

Companies continue to lift dividends and repurchase record amounts of stock in order to reward shareholders -- and stay out of the sights of private-equity shops on the prowl for new leveraged buyouts.

.....

HISTORY SUGGESTS THAT STOCKS MAY DO WELL in the next two months. There have been 38 days since 1979 when the S&P 500 has suffered a single-session loss of 3% or more. The average gain in the ensuing 60 days has been 6.9%, with the index rising in 31 of the 38 cases, according to Citigroup research.

U.S. stocks dropped to a three-month low, completing their worst week since January 2003, after a decline in consumer confidence magnified the risk profit growth will be wiped out by a recession.

Subprime mortgage lender New Century Financial Corp. said Friday it won't be able to file its 2006 annual report on time, and plans to request an extension from the Securities and Exchange Commission.

In early February, New Century announced it would restate financial results for the quarters ending March 31, June 30 and Sept. 30, 2006, to correct accounting errors for losses to too to buy back bad loans.

The cratering of the subprime mortgage industry could present more than just a pothole for General Motors Corp.

The world's largest auto maker disclosed Thursday that it will need more time to file its 2006 annual report with the Securities and Exchange Commission, marking the second year in a row the company has postponed the key filing.

Many analysts attribute this year's delay to a substantial hit the Detroit-based automaker might take from the exposure its part-owned finance unit -- GMAC Financial Services -- has to the business of making mortgage loans to people with weak credit or heavy debt burdens.

Yesterday marked the release of February light vehicle sales figures and the results again showed a loss of market share among the 'Big 3' U.S. automakers, particularly to Japanese carmakers. Ford and DaimlerChrysler reported declines in sales, 13% and 7.7% respectively, versus a year ago's sales. Reversing its own downward trend, GM said its sales rose 3.4% from the year earlier period.

All three of Japan's 'Big 3' reported YoY sales increases, paced by Toyota at 12%, while Honda (3.2%) and Nissan (1.2%) also registered gains.

Despite an industry-wide YoY sales drop of 0.5%, the seasonally adjusted annual sales rate held steady at 16.6 million; Bloomberg consensus estimates were for an annual rate of 16.1 million sales.

The total market share of the U.S. 'Big 3' fell to 54% from 56.6% in February 2006. GM managed to increase its market share 1% to 24.6% total. Asian automakers up their share from 37% to 39.4%.

Personal income increased $108.1 billion, or 1.0 percent, and disposable personal income (DPI)increased $73.0 billion, or 0.8 percent, in January, according to the Bureau of Economic Analysis.

Personal consumption expenditures (PCE) increased $51.9 billion, or 0.5 percent. In December,personal income increased $55.7 billion, or 0.5 percent, DPI increased $46.0 billion, or 0.5 percent, and PCE increased $69.4 billion, or 0.7 percent, based on revised estimates.

Economic activity in the manufacturing sector expanded in February following a decline in January, while the overall economy grew for the 64th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Norbert J. Ore, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "February proved to be a good month in the manufacturing sector as New Orders, Production and Employment contributed to a solid growth scenario. The Inventories Index showed significant reduction in manufacturers' inventories for the second consecutive month, and the Backlog of Orders Index is growing once again. While the prices manufacturers pay reached their highest level in five months, concern about prices is still minimal due to the small number of commodities indicated as up in price. The trend in manufacturing, as well as the overall economy, is for slow but continuing growth."

In February, the ISM Prices Index registered 59 percent, indicating manufacturers are paying higher prices on average when compared to January. While 32 percent of respondents reported paying higher prices and 14 percent reported paying lower prices, 54 percent of supply executives reported paying the same prices as the preceding month. A Prices Index above 47.2 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) Index of Manufacturers Price

Construction spending in the U.S. fell by the most in three months in January, pulled lower by the biggest decline in homebuilding since July.

Spending on residential and non-residential projects dropped 0.8 percent after a revised 0.6 percent increase in December, the Commerce Department said today in Washington. The government previously estimated a drop in December spending.

Homebuilders are reluctant to start work on new projects as buyers cancel contracts and inventories of unsold homes swell. A report yesterday showing new-home sales fell by the most in 13 years suggests that construction will continue to falter, weighing on economic growth.

``Residential construction spending has been steadily declining since spring 2006, and we expect this trend to continue,'' Drew Matus, a senior economist at Lehman Brothers Holdings Inc. in New York, said before the report.

Ford Motor Co. said Wednesday that its restructuring plan would likely cost $11.18 billion, with more than half of the expenses devoted to programs for laid-off workers.

In a filing with the Securities and Exchange Commission, the No. 2 U.S. automaker estimated spending $5.96 billion on a jobs bank and other "personnel-reduction programs," $2.74 billion to scale back its pensions, $2.2 billion for fixed asset impairment charges and $281 million to idle plants.

Ford said in the filing that it had already accrued $9.9 billion in 2006 and the balance, mostly related to salaried personnel-reduction programs, would be accrued during the first three months of 2007.

The company also disclosed that it has pledged all its buildings, trademarks, intellectual property, shares in the main company, and shares in Volvo, Jaguar, Aston Martin, Ford Motor Credit Co. and other operations as collateral for a $23.4 billion line of credit to fund its restructuring plan and cover losses expected until 2009.

an automotive outlook report this week, IRN Inc., a Michigan market-research firm, predicted an economic slowdown in 2007 and says "sufficient evidence" supports a recession sometime this year. "Look for other analysts and the Big Three auto makers to make some significant reductions by the second quarter regarding their outlooks for 2007," it said.

"The automotive outlook is too high" on Wall Street, said Erich Merkle, IRN's forecasting director, in an interview. Citing a drop in housing starts and rising durable-goods inventories, he added, "I think that there are a lot of folks out there that have yet to account for the possibility of a significant slowdown in economic performance as 2007 unfolds."

IRN reduced its 2007 sales forecast in December to 16.1 million cars and trucks from 16.3 million. That number could go lower, Mr. Merkle said. Last year's sales totaled 16.6 million, according to Autodata Corp. Analysts and economists who forecast car sales are considering economic indicators, but most have stuck with their predictions.

At issue are mortgages made to people who fall in the gray area between "prime" (borrowers considered the best credit risks) and "subprime" (borrowers considered the greatest credit risks). A record $400 billion of these midlevel loans -- which are known in the industry as "Alt-A" mortgages -- were originated last year, up from $85 billion in 2003, according to Inside Mortgage Finance, a trade publication. Alt-A loans accounted for roughly 16% of mortgage originations last year and subprime loans an additional 24%.

The catch-all Alt-A category includes many of the innovative products that helped fuel the housing boom, such as mortgages that carry little, if any, documentation of income or assets, and so-called option adjustable-rate mortgages, which give borrowers multiple payment choices but can lead to a rising loan balance. Loans taken by investors buying homes they don't plan to occupy themselves can also fall into the Alt-A category.

Data from UBS AG show that the default rate for Alt-A mortgages has doubled in the past 14 months. "The credit deterioration has been almost parallel to what's been happening in the subprime market," says UBS mortgage analyst David Liu. The UBS report contrasts with testimony Federal Reserve Board Chairman Ben Bernanke gave to Congress yesterday. "Our assessment is that there's not much indication that subprime issues have spread into the broader mortgage market," Mr. Bernanke said.

To be sure, defaults have remained very low in the prime market -- and despite the uptick in bad loans, the problems in the Alt-A sector aren't as severe as those that have roiled the subprime market. Some 2.4% of Alt-A loans are at least 60 days past due, according to UBS, which looked at mortgages that were packaged into securities and sold to investors. That is well below the 10.5% delinquency rate for subprime mortgages. (During the housing boom, delinquencies were low for all types of loans because borrowers who wound up in trouble could refinance or sell.)

Thomas Gorman, a bankruptcy attorney in Alexandria, Va., says he is seeing more financially strapped borrowers who "probably bought more house than they could afford and then took on more credit-card debt" to furnish the house and pay for the move. When the housing market cooled, they were "caught in the middle," unable to sell their home or refinance and make their debt load more manageable.

New-home sales in the U.S. fell last month by the most in 13 years, pointing to more weakness in the real-estate market that limited economic growth last year.

The 16.6 percent decrease to an annual rate of 937,000 in January, less than any economist had forecast in a Bloomberg News survey, Commerce Department figures showed today. The pace of sales was the slowest since February 2003. A measure of housing inventory rose to the highest in three months.

The figures show home construction will remain a drag on the economy even with lower borrowing costs and more incentives from builders. More cuts in home prices may be needed to stir buyer interest as builders keep reporting increased rates of canceled orders.

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.2 percent in the fourth quarter of 2006, according to preliminary estimates released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 2.0 percent.

The GDP estimates released today are based on more complete source data than were available for the advance estimates issued last month. In the advance estimates, the increase in real GDP was 3.5 percent (see "Revisions" on page 3).

The increase in real GDP in the fourth quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, state and local government spending, and federal government spending that were partly offset by negative contributions from private inventory investment and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, decreased.

nvestors in Shanghai-listed stocks Wednesday bucked the very trend they'd begun a day earlier, bidding shares well into positive territory, even as other Asian benchmark indexes plunged for a second straight session.

Shanghai's Composite Index gained 3.94% to close at 2881.07, reversing a negative performance in the early part of the morning session. The Shanghai index, which tracks shares listed on the bigger of China's two stock markets, fell 8.8% Tuesday, triggering a global selloff that led to the biggest one-day losses in the U.S. since the wake of the Sept. 11, 2001, terrorist attacks.

The decline in Shanghai Tuesday followed concerns that the government may introduce additional macro-economic tightening measures to cool speculative activity. On Monday, the Shanghai benchmark ended at an all-time high.

In Tokyo, stocks plunged in the wake of the overnight dive on Wall Street, where the Dow Jones industrials fell more than 400 points. (See related article.)

The Nikkei 225 stock index fell 515.80 points, or 2.85%, to finish at 17604.12 on the Tokyo Stock Exchange. Around Asia, Hong Kong's Hang Seng Index ended down 2.46% at 19651.51. Australia's S&P/ASX 200 closed 2.69% lower at 5832.50. Shares of BHP Billiton fell 5.1%.

South Korea's Kospi Index ended down 2.56% to 1417.34. Singapore's Straits Times Index finished down 3.72% to 3111.94 and New Zealand's NZSX-50 ended 1.5% lower to 4037.12. Markets in Taiwan were closed for a public holiday.

Japan's Nikkei 225 index tumbled more than 700 points at Wednesday's open in Tokyo, falling below 18000 for the first time in nearly a week, as investors sold stocks across the board in the wake of steep losses on Wall Street.

The Shanghai Composite Index, which surged an astonishing 127% in 2006 and is up 13% over the last six sessions, plunged 8.8% -- the biggest one-day decline in 10 years. Worries the Chinese government may step up its efforts to curb speculative buying interest have been attributed to the consolidation that has aggravated ongoing concerns about overbought conditions and talks of a correction.

China's stocks tumbled the most in 10 years on concern that a government crackdown on investments with borrowed money will end a rally that drove benchmarks to records.

...

The Shanghai and Shenzhen 300 Index slid 250.18, or 9.2 percent, to 2457.49. The measure, which jumped 13 percent in the past six sessions, closed at a record yesterday.

Today's rout wiped out $107.8 billion from a stock market that doubled in the past year as 249 of the key index's 300 shares plunged by the 10 percent limit. The 300 index is valued at 38 times earnings, compared with 16 times for the Morgan Stanley Capital International Emerging Markets Index.

The State Council, China's highest ruling body, has approved a special task force to clamp down on illegal share offerings and other banned activities in the market, the government said. The group will provide advice on regulations and policy explanations of the securities market, according to a statement published Feb. 25 on the central government's Web site.

Orders for durable goods decreased by 7.8% last month to a seasonally adjusted $203.90 billion, the Commerce Department said Tuesday. Durables rose 2.8% in December, revised from a previously estimated 2.9% increase.

A key barometer of business-equipment spending -- orders for nondefense capital goods excluding aircraft -- fell by 6.0%, after increasing 3.6% in December. Shipments for nondefense capital goods excluding aircraft decreased by 2.7%, after dropping by 0.8% in December; the shipments are used in calculating gross domestic product.

The 7.8% decrease in overall durable goods orders surprised Wall Street. The median estimate of 21 economists surveyed by Dow Jones Newswires had durables just 3.2% lower in the first month of 2007.

The manufacturing sector weakened in 2006. The economy had cooled and receding demand caused inventories at companies to pile up. Firms had to adjust inventory levels and depleting supplies meant fewer orders and cuts in production of goods. The auto business was hit particularly hard. The Federal Reserve recently reported industrial production made a surprising drop in January, falling by 0.5%.

Sales of previously owned homes in the U.S. rose more than forecast in January to a seven-month high as lower prices and warm weather brought out more buyers.

Purchases increased 3 percent last month to an annual rate of 6.46 million, up from a 6.27 million December rate that was higher than previously reported, the National Association of Realtors said today in Washington. Sales fell 4.3 percent compared with a year earlier.

The report suggests that housing, recovering from its worst slump in 15 years, may be less of a burden on growth this year, economists said. Cheaper homes and low borrowing costs are spurring sales, while a plunge in January housing starts reported this month shows builders are trying to reduce a glut of unsold properties.

Durable-goods orders fell 7.8 percent in January, reflecting the biggest slide in business equipment demand in three years, the Commerce Department said in Washington. At the same time, the Conference Board's consumer-optimism index unexpectedly increased to the highest level in more than five years, and the National Association of Realtors said existing- home sales rose more than forecast.

Durable-goods orders excluding transportation equipment dropped 3.1 percent, the most since July 2005. Excluding military equipment, orders fell a record 7.8 percent last month, while inventories of all durables rose 0.3 percent.

Reluctance to Invest

The figures suggest reluctance among companies to invest carried into 2007 after spending on equipment such as computers, machines and communications gear fell by the most in four years in the fourth quarter. Bloated stockpiles at auto dealers and construction-equipment makers may restrain production early this year, Bernanke told Congress this month.

Shanghai's benchmark stock index plunged nearly 9% on Tuesday, its biggest drop in more than 10 years, as investors unloaded shares to lock in profits after recent gains. Asian-Pacific markets ended mostly lower.

The Shanghai Composite Index tumbled 8.8% to close at 2771.79, its biggest single-day decline since it fell 9.4% on Feb. 18, 1997, just after the death of Communist Party elder Deng Xiaoping. The Shanghai index had gained 1.4% on Monday to 3040.60, extending a spate of record high closes.

Shares in airlines, steelmakers and financial issues led declines, and Chinese traders said profit-taking was sparked by concerns additional macro-tightening policies could be introduced following the annual session of the China's National People's Congress that gets underway March 5.

And RealtyTrac reported last week that the number of homes entering the foreclosure process increased by 19% in January, compared with December's numbers. Compared with January 2006, the number of homes in the process is up 25%. In 2006, a total of 1.2 million homes entered the foreclosure process, 42% more than 2005.

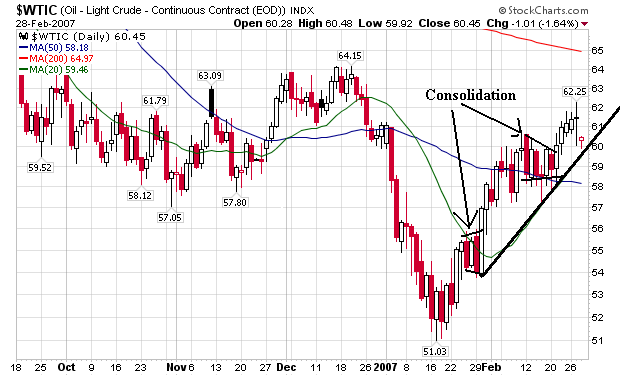

Some analysts see a growing upward momentum for oil and note the latest data from the New York Mercantile Exchange points to an increase in investment by large funds.

"It is the first time this year that the large speculative funds are showing a net long position in crude oil," said Olivier Jakob, an analyst at Swiss-based Petromatrix.

Oil prices have swung between a high of $78.40 last July, when fighting flared in Lebanon, and a 20-month low of $49.90 in January when an expected influx of fund money failed to materialise, disappointing oil investors.

A steady recovery in prices since late January has been supported by gradually tightening supplies -- OPEC has twice cut output since November -- and by concerns over a possible disruption of Iran's oil supplies.

Fears about defaults are slowing the gusher of investor funds going to riskier segments of the mortgage market. That means less money available for "subprime" loans to riskier borrowers, forcing lenders to focus more on borrowers who can afford down payments and have well documented finances. With fewer lower-income Americans able to buy homes, downward pressure on prices will probably increase.

These pressures have intensified in recent days. The cost of insuring mortgage-bond holders against default risk, as measured by the so-called ABX index, has soared, deepening the concerns of investors in collateralized debt obligations, among the biggest holders of riskier mortgage bonds. Managers of some CDOs are delaying new offerings to "wait for the dust to settle," a process that could take weeks or months, says Chris Flanagan, head of CDO research at J.P. Morgan Chase & Co.

"CDO managers and hedge funds still want to do CDOs, but the conditions are much, much tougher," David Liu, a mortgage analyst with UBS AG, adds.

"It's tightening up a lot," said Eddie Carmona, branch manager at Homewood Mortgage in Carrollton, Texas, a mortgage broker that handles subprime borrowers.

Carmona said down payment requirements are the biggest change he's seen.

"Before, you didn't have to bring a down payment," Carmona said.

Other changes:

Higher credit scores. Previously, borrowers with a FICO credit score as low as 570 (out of 850) could qualify for a single loan financing 100 percent of their home purchase, Carmona said.

"Now, across the board, it's jumped up to a 600 FICO score for an 80/20 loan," Carmona said, in which a second loan has to be taken out to finance the remaining 20 percent of the home value.

Rising interest rates. Rates on subprime mortgages have risen about a full percentage point since September, Carmona said, while regular mortgage rates have been relatively steady.

More stringent savings requirements. "They want to see borrowers have at least three months of reserves in their account in case of an emergency," Carmona said.

Lowe's Cos., the nation's second biggest home improvement store chain, said Friday that its fourth-quarter profit fell 11.5 percent due to a slowing home improvement market amid a continued slump in the housing sector.

The Mooresville, N.C.-based retailer said it earned $613 million, or 40 cents a share, for the three months ended Feb. 2, down from $693 million, or 43 cents a share, a year earlier.

Revenue fell to $10.4 billion from $10.8 billion a year earlier. Same-store sales, or sales in stores open at least one year, a key measure of industry performance, fell 5.3 percent.

Analysts surveyed by Thomson Financial had been looking for net income of 37 cents a share on revenue of $10.36 billion. The estimate for earnings typically excludes one-time items.

On Tuesday, rival Home Depot Inc., the nation's largest home improvement store chain, said its fourth-quarter income dropped 28 percent. Its same-store sales dropped 6.6 percent.

"Sales continued to be pressured by a slowing housing market, tough comparisons to last year's hurricane recovery and rebuilding efforts and significant deflation in lumber and plywood prices," Robert A. Niblock, Lowe's chairman and chief executive said in a statement accompanying the results.

Core CPI is now running at a 2.7% annual pace through last month. That's up from 2.6% for 2006 and close to the peak of recent years (2.9%) set last September. The rising pace of core inflation is a problem because the Fed is widely reported to have a target of 1-2% for core. By that standard, the central bank is behind the monetary eight ball.

The Fed, in sum, has more work to do to bring core CPI down, or at least convince the market that core CPI is no longer rising. There's reason to wonder how this task will play out. As we reported on Monday, the pace of growth is rising for M2 money supply. Coincidence? For the moment, we prefer to err on the side of caution and answer "no."