Banks raising nearly $40 billion in buyout-related debt for Chrysler Group and the United Kingdom's Alliance Boots PLC are being forced to sweeten terms for investors and face delays in their sales, in another sign of turbulence in global debt markets.

Chrysler is being taken over by Cerberus Capital Management, a New York hedge fund, and is raising $20 billion in loans as it separates from DaimlerChrysler AG. Alliance Boots, a chain of U.K. drug stores and a wholesale pharmaceutical-distribution firm, is being taken over by Kohlberg Kravis Roberts & Co. and is raising the U.S. dollar equivalent of $18.4 billion.

In both cases, bankers are shopping interest payments to investors that are around a half percentage point more than originally planned. And in both cases, they're putting off plans to close the deals in the next few days. The Alliance fund raising might be delayed by months, people familiar with the situation said. The Chrysler debt sale is expected to close next week.

This is far from the end of the world for the M&A market. Credit terms have been incredibly lax for the last few years. A better description of events would be a "return to prudent lending standards".

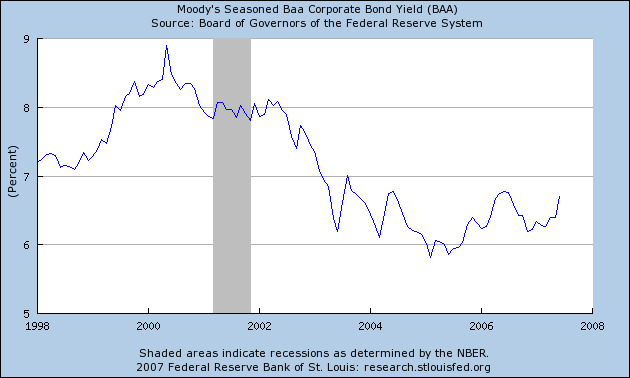

As an example, here is a chart of the daily baa yield for the last 10 years. While rates have increased, they are still below the levels at the end of the 1990s.